- Home

- »

- Automotive & Transportation

- »

-

U.S. Automotive Battery Aftermarket Size Report, 2030GVR Report cover

![U.S. Automotive Battery Aftermarket Size, Share & Trends Report]()

U.S. Automotive Battery Aftermarket Size, Share & Trends Analysis Report By Battery Type (Lithium-ion, Lead Acid, Nickel-based, Sodium-ion, Others), By Vehicle Type, By Distribution Channel, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-738-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

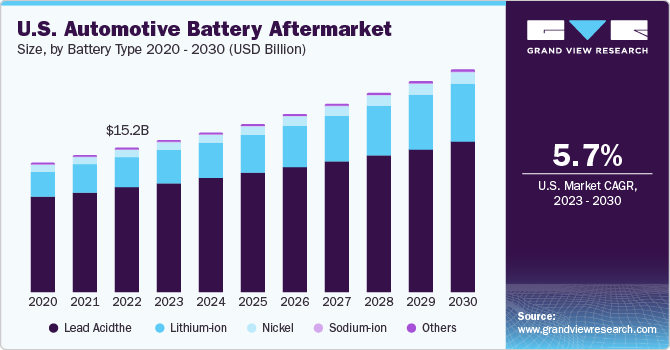

The U.S. automotive battery aftermarket size was valued at USD 15.18 billion in 2022 and is expected to grow at a CAGR of 5.7% from 2023 to 2030. The market is driven by stringent government regulations and emission norms governing the auto industry. Regional regulatory authorities such as the U.S. Environmental Protection Agency (EPA) and other federal and international agencies are implementing stringent government regulations. For instance, the U.S. EPA implemented regulations related to the storage of used lead-acid batteries to avoid pollution. In addition, lithium batteries must adhere to guidelines levied by the International Air Transport Association (IATA) for transportation purposes.

Implementing policies such as the Kyoto Protocol to reduce Greenhouse Gas (GHG) emissions is expected to increase the adoption of hybrid electric vehicles (HEVs) over the forecast period. Moreover, stringent regulations related to carbon emissions have increased demand for start-stop battery technology. In addition, a rise in incentives from the U.S. government for manufacturing HEVs is boosting market growth. For instance, the U.S. American Recovery and Reinvestment Act funds private and government entities to develop HEVs.

Increasing fuel prices and growing environmental concerns in developed countries have also effectively raised interest in the potential of electric vehicles to replace conventional fuel-based vehicles globally. This optimistic scenario for HEVs will positively impact market growth over the next few years.

Technological advancements have also triggered business changes, owing to which OEMs and suppliers focus on collaborations within the industry and with technology companies. These collaborations are expected to be pivotal in the market's future development. They allow different entities to work together to draft standards for emerging technologies, such as battery charging infrastructure for electric vehicles.

Battery Type Insights

On the basis of battery type, the market has been segmented into lithium-ion, lead acid, nickel-based, sodium-ion, and others. The lead acid segment accounted for the largest revenue share of 72.9% in 2022. Lead acid batteries are expected to witness a significant rise in demand chiefly due to their recyclable nature. Lead as an element is toxic and should not be disposed of. Therefore, it is recycled and reused to produce new batteries. Lead acid batteries are most suitable for recycling as 70.0% of their weight contains reusable lead. This segment is anticipated to observe steady growth over the forecast period.

U.S. battery recycling companies collect used batteries from consumers for recycling and reuse. These are first broken into pieces, lead heavy materials and plastics are separated from the broken pieces. The plastic waste is properly washed and sent to a plastic recycler, where the pieces are melted. The extrusion process then gives the molten plastic shape and is sent to battery manufacturers for further processing. Lead oxide, lead grids, and lead parts are cleaned properly and melted in smelting furnaces.

The sodium-ion segment is expected to grow at the fastest CAGR of 18.3% during the forecast period. Due to their abundant and low-cost raw material supply, sodium-ion batteries have gained attention as a potential alternative to traditional lithium-ion batteries. The growing focus on reducing carbon emissions and transitioning towards cleaner transportation has spurred interest in sodium-ion batteries as a promising technology.

Vehicle Type Insights

Based on vehicle type, the U.S. automotive battery aftermarket has been segmented into passenger vehicle, electric vehicle, commercial vehicle, and others. The passenger vehicles segment captured the largest revenue share of over 56.5% in 2022. The growing number of passenger vehicles on the road is leading to a higher demand for automotive batteries, as these vehicles require periodic battery replacements due to wear and tear. As the average age of vehicles increases, there is a greater likelihood of battery failure, prompting vehicle owners to seek replacement batteries, driving the growth of the aftermarket segment.

The electric vehicle segment is expected to grow at the fastest CAGR of 9.4% during the forecast period. Significant rise in advancements in battery technology over the years has increased the use of various battery-operated devices across the U.S. HEVs, for instance, are equipped with a number of features that consume a substantial amount of battery power. These include GPS navigation systems, power windows, air-conditioning systems, and display systems that denote battery charge levels.

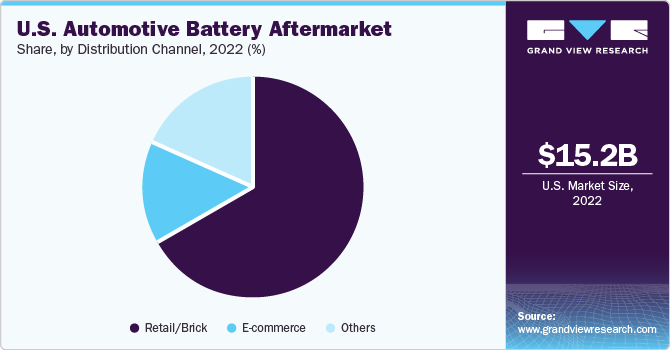

Distribution Channel Insights

Based on the distribution channel, the market is segmented into retail/brick, e-commerce, and others. The retail/brick segment accounted for the largest revenue share of 57.7% in 2022. The U.S. automotive industry has witnessed steady growth in vehicle ownership, resulting in a larger customer base for automotive battery replacements. As vehicles age and their original batteries reach the end of their lifespan, there is a rising demand for aftermarket automotive batteries.

The e-commerce segment is estimated to register the fastest CAGR of 9.3% over the forecast period. The e-commerce sector in the country features established e-retail companies such as Amazon.com and e-Bay. The rising penetration of e-commerce in the supply chain will enhance the market's growth prospects over the forecast period.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in September 2022, Yuasa Battery, Inc. launched YBX automotive and marine batteries to the North American battery market. Yuasa Battery Inc.'s new YBX brand features next-generation battery innovation developed in collaboration with top vehicle manufacturers, and it delivers charged and ready for installation. Yuasa's YBX batteries have been optimized for partial charge efficiency and built with lower self-discharge rates for expanded lifespans with advanced technology cars in consideration.

Key U.S. Automotive Battery Aftermarket Companies:

- A123 Systems, LLC

- East Penn Manufacturing Company

- Aptiv

- Exide Technologies

- Johnson Controls

- NEC Corporation

- Samsung SDI Co., Ltd

- Tesla

- Interstate Batteries

Recent Developments

-

In June 2023, OneD Battery Sciences and Customcells partnered to enhance, produce, and supply prototype battery cells for electric vehicles (BEVs) to a leading global automotive manufacturer. The primary objective of OneD Battery Sciences is to reduce costs associated with EV batteries by leveraging their SINANODE technology. Incorporating silicon into battery anodes is crucial as it offers significant potential, enabling them to store ten times more ions per unit weight than graphite.

-

In June 2023, Toyota Motor Corporation announced its plan to invest USD 2.1 billion in its North Carolina EV battery factory to increase the production of SUVs. This investment in North Carolina is vital to Toyota's strategy to achieve carbon neutrality. The company aims for 70% of its U.S. sales to be comprised of electric vehicles, including fully electric models and hybrid, by 2030. Additionally, Toyota aims to introduce electrified versions of all Toyota and Lexus models sold worldwide by 2025.

-

In September 2022, Webasto Charging Systems, Inc., a subsidiary of the Webasto Group, launched Webasto Go. This Level 2 EV charger, developed, tested, and manufactured by Webasto, is accessible to electric vehicle owners in the U.S. and Canada. Additionally, future expansions are planned to make the charger available worldwide.

U.S. Automotive Battery Aftermarket Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 23.60 billion

Growth Rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Volume in million units, revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Battery type, vehicle type, distribution channel

Key companies profiled

A123 Systems, LLC, East Penn Manufacturing Company, Aptiv, Exide Technologies, Johnson Controls, NEC Corporation, Samsung SDI Co., Ltd, Tesla, Interstate Batteries

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Automotive Battery Aftermarket Report Segmentation

This report forecasts revenue growth at country and state levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. automotive battery aftermarket report on the basis of battery type, vehicle type, and distribution channel:

-

Battery type Outlook (Volume in Million Units, Revenue in USD Billion, 2017 - 2030)

-

Lithium-ion

-

Lead Acid

-

Nickel-based

-

Sodium-ion

-

Others

-

-

Vehicle type Outlook ((Volume, Million Units; Revenue, USD Billion, 2017 - 2030)

-

Passenger Vehicle

-

Electric Vehicle

-

Commercial Vehicle

-

Others

-

-

Distribution Channel Outlook ((Volume, Million Units; Revenue, USD Billion, 2017 - 2030)

-

Retail/Brick

-

E-commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. automotive battery aftermarket size was estimated at USD 15.18 billion in 2022 and is expected to reach USD 15.99 billion in 2023.

b. The U.S. automotive battery aftermarket is expected to grow at a compound annual growth rate of 5.7 % from 2023 to 2030 to reach USD 23.60 billion by 2030.

b. Passenger vehicles dominated the U.S. automotive battery aftermarket with a share of 56.5% in 2022. This is attributable to the significant rise in advancements in battery technology.

b. Some key players operating in the U.S. automotive battery aftermarket include A123 Systems, LLC; East Penn Manufacturing Company; EnerSys; Delphi Technologies; Exide Technologies; Johnson Controls; NEC Corporation; Samsung SDI Co., Ltd.

b. Key factors that are driving the market growth include increasing the sale of electric vehicles, digitalization of automotive repair and maintenance services, and recyclability of lead-acid.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."