- Home

- »

- Power Generation & Storage

- »

-

U.S. Battery Energy Storage System Market Report, 2030GVR Report cover

![U.S. Battery Energy Storage System Market Size, Share & Trends Report]()

U.S. Battery Energy Storage System Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Transportation, Grid Storage, UPS), By Product (Flywheel Battery, Lead Acid Battery), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-619-6

- Number of Report Pages: 76

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

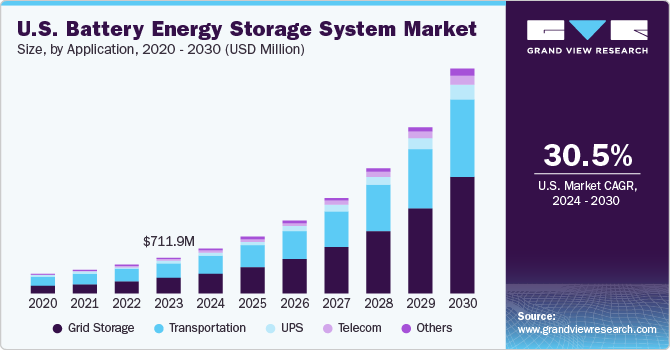

The U.S. battery energy storage system market size was estimated at USD 711.9 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 30.5% from 2024 to 2030. Growing use of battery storage systems in industries to support equipment with critical power supply in case of an emergency including grid failure and trips is expected to drive the U.S. battery energy storage system industry. The rising need for uninterruptible power supply in data centers and telecommunications to enhance business productivity is expected to drive market growth over the forecast period.

In the U.S. market, the value chain is characterized by equipment suppliers, battery energy storage manufacturers, and end-use markets. Battery energy storage system utilizes batteries, module packs, connectors, cables, and bus bars as a part of the manufacturing process. Batteries form a major key component of battery energy storage systems.

Large-scale renewable energy installation in the U.S. economy will lead to enhanced deployment of battery energy storage systems in order to prevent intermittent power supply from renewable sources. Stringent government regulations regarding environmental protection have resulted in increased use of solar and wind energy, which needs to be converted and stored in off-grid power storage systems.

These batteries find their application in areas including emergency power supply systems, battery systems for wind power output fluctuation management, and stand-alone PV systems. Advantageous features such as favorable cost, performance ratio, easy charging, and easy recyclability work in favor of these batteries, which is further expected to drive the market.

Continuous innovation in energy storage technology is driving the market. Industrial leaders such as U.S.-based Company Power Electronics, are innovating dual solar-inverter-plus-storage products, along with expansion of its solar charging offering. Demand for alternatives to Lithium-ion technology such as zinc technology is growing, especially in areas that are fire-sensitive where lithium-ion batteries are still seen as somewhat risky.

Battery energy storage systems are anticipated to have high growth and high penetration on account of easy charging properties coupled with re-energization of electrolyte liquid resulting in low wastage. Moreover, increasing applications in backup power, portable power, and stationary applications are further expected to surge market growth.

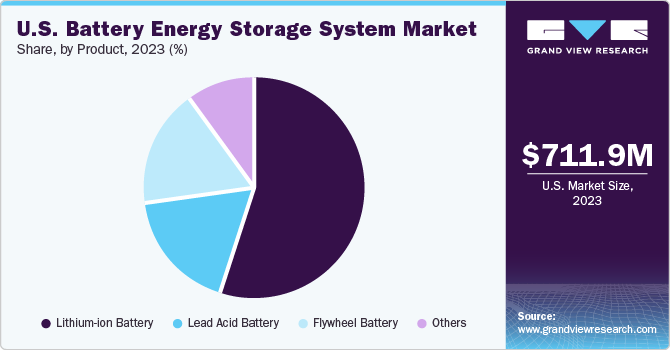

Product Insights

Based on product, the lithium-ion battery segment accounted for a revenue of 54.9% in 2023. Lithium-ion battery storage systems are used in numerous areas including communication base stations, commercial and industrial buildings, grid frequency modulation, household energy storage, and smooth output of renewable energy. Rising demand for electricity along with the shift from conventional fuel to renewable energy is anticipated to fuel the product segment growth during the forecast period.

The lead acid battery product segment occupied a significant revenue share of 18.57% in 2023. Lead acid battery advantages such as low-cost, simple manufacturing process, durability, dependability, low maintenance costs, and high discharge rate capability are expected to increase its demand over Li-ion and NiCd batteries. In addition, the abundant availability of lead acid batteries in various sizes and specifications is expected to sustain demand for these batteries over the forecast period.

The flywheel battery product segment is expected to witness a significant CAGR of 34.1% over the forecast period. The segment is growing in accordance with the growing energy storage demand in the U.S. Market players are focusing on flywheel systems owing to their long life and higher efficiency as compared to other batteries.

In August 2019, VYCON Inc. added a new product VDC-XXT flywheel model to its existing family of products. The product can be paired with three-phase UPS, and it utilizes the patented technology of the company. This product will help the client to reduce its initial cost, and also it lowers ongoing energy and operational costs over the life of the product installed.

The others segment include products such as redox flow batteries, alkaline batteries, silver oxide batteries, zinc carbon batteries, iron batteries, and pure lead batteries. Exide Technologies; GS Yuasa Corporation; Eveready Industries India Ltd.; EnerSys; Duracell, Inc.; BYD Co., Ltd.; and Panasonic Corporation are major players that have extensive battery product portfolios. Alkaline batteries and button silver oxide batteries are used in watches, calculators, and medical devices and instruments.

Market Dynamics

Worldwide registration of electric vehicles is anticipated to increase significantly over the forecast period. Rising availability of charging outlets and financial incentives have emerged as crucial factors for the development of the market, boosted by the lower running cost of EVs as compared to that of conventional ICE-operated vehicles. EVs form the foundation for sustainable transport systems in the future along with the optimization of urban & suburban infrastructures. However, global deployment of all types of EVs is necessary to achieve sustainability targets set by regulatory authorities. The Paris Declaration on “Electro-Mobility and Climate Change and Call to Action” proposed a target of deploying 100 million electric cars and 400 million electric 2- and 3-wheelers by 2030.

The primary flaw in renewable energy systems is a gap between the demand for resources and their availability. Thermal storage systems allow bridging of this gap by stocking up energy. However, it cannot be stored for long owing to the inability of these systems to hold the energy for over a half-year cycle. Stored heat then gets dissipated due to the inefficiency of technology. Stored energy in battery energy storage systems reduces with time owing to heat loss as the systems used presently are still in their developmental stage. Seasonal storage using CAES and flywheel requires massive surface areas. If stored heat is not utilized within a certain span of time, there are chances of it dispersing into the atmosphere. Lack of long-term storage options and the inefficiency of current technology are factors projected to restrain the market over the forecast period.

Application Insights

Based on application, the grid storage segment accounted for the largest revenue share of more than 44.0% in 2023. This is attributed to the increasing need for reliable energy storage solutions to support the integration of renewable energy sources. Grid storage systems play a critical role in stabilizing the grid by storing excess renewable energy during peak generation and supplying it during periods of high demand. This capability enhances grid reliability and resiliency, making it a key driver of market growth.

The telecom segment was valued at USD 24.2 million in 2023. Telecom companies have been establishing contracts with battery energy storage systems manufacturers in order to facilitate a cost-effective and continuous supply of power. Increasing telecom subscriptions in the economy have led to growth in telecom tower installations, thereby increasing the need to use battery energy storage systems.

The UPS application segment is anticipated to witness a CAGR of 31.1% from 2024 to 2030. The growing IT industry has led to increased utilization of UPS systems in order to protect computer networks and ensure continuous service. The rising number of power outages and voltage fluctuations have necessitated the adoption of UPS systems in commercial and industrial buildings, which is likely to propel demand over the forecast period.

The others segment is expected to witness a significant CAGR of 29.2% over the forecast period. Other applications majorly include forklift trucks which are utilized for material handling. The U.S. has witnessed a rapid increase in demand for forklifts over the past years. Low charge time, runtime, and low cycle life of lead-acid batteries have led to replacement of these batteries with lithium-ion battery-based energy storage systems.

Key Companies & Market Share Insights

The market is consolidated in nature and is dominated by numerous key players. Key companies are adopting various organic and inorganic growth strategies with an aim to enhance their product offerings in order to gain market share. Battery manufacturers supply batteries both through direct supply and third-party supply agreements to battery energy storage system manufacturers. Manufacturers assemble different batteries depending on the requirements of end-use industries. With increasing requirements for efficient grid management, constant load management, and continuous power supply, the market is expected to witness significant growth over the forecast period.

Key U.S. Battery Energy Storage System Companies:

- General Electric

- Hitachi Ltd.

- GS YuasaBeckett Energy Systems

- Exide Technologies

- Samsung SDI

- Enersys

- AES Energy Storage

- Imergy Power Systems Inc.

- Altair Nanotechnologies Inc.

U.S. Battery Energy Storage System Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.4 billion

Growth rate

CAGR of 30.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Application, product

Country scope

U.S.

Key companies profiled

General Electric; Hitachi Ltd.; GS YuasaBeckett Energy Systems; Exide Technologies; Samsung SDI; Enersys; AES Energy Storage; Imergy Power Systems Inc.; Altair Nanotechnologies Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Battery Energy Storage System Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. battery energy storage system market report based on application, and product:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Grid Storage

-

UPS

-

Telecom

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flywheel Battery

-

Lead Acid Battery

-

Lithium-ion Battery

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. battery energy storage system market size was estimated at USD 711.9 million in 2023 and is expected to reach USD 884.9 million in 2024.

b. The U.S. battery energy storage system market is expected to witness a compound annual growth rate of 30.5% from 2024 to 2030 to reach USD 4.4 billion by 2030.

b. Grid Storage application segment accounted for the largest revenue share of 44.47% of the U.S. market in 2023. This is attributed to the increasing need for reliable energy storage solutions to support the integration of renewable energy sources.

b. Some key players operating in the U.S. battery energy storage system market include Exide Technologies, GS Yuasa Corporation, Eveready Industries India Ltd., EnerSys, Duracell, Inc., BYD Co., Ltd., and Panasonic Corporation.

b. Key factors that are driving the market growth growing use of battery storage systems in industries to support equipment with critical power supply in case of an emergency including grid failure and trips is expected to drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.