- Home

- »

- Clinical Diagnostics

- »

-

U.S. Biological Safety Testing Products And Services Market, 2033GVR Report cover

![U.S. Biological Safety Testing Products And Services Market Size, Share & Trends Report]()

U.S. Biological Safety Testing Products And Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Reagent & Kits, Services, Instruments), By Application (Stem Cell, Vaccines & Therapeutics, Gene Therapy), By Test Type, And Segment Forecasts

- Report ID: GVR-4-68040-619-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

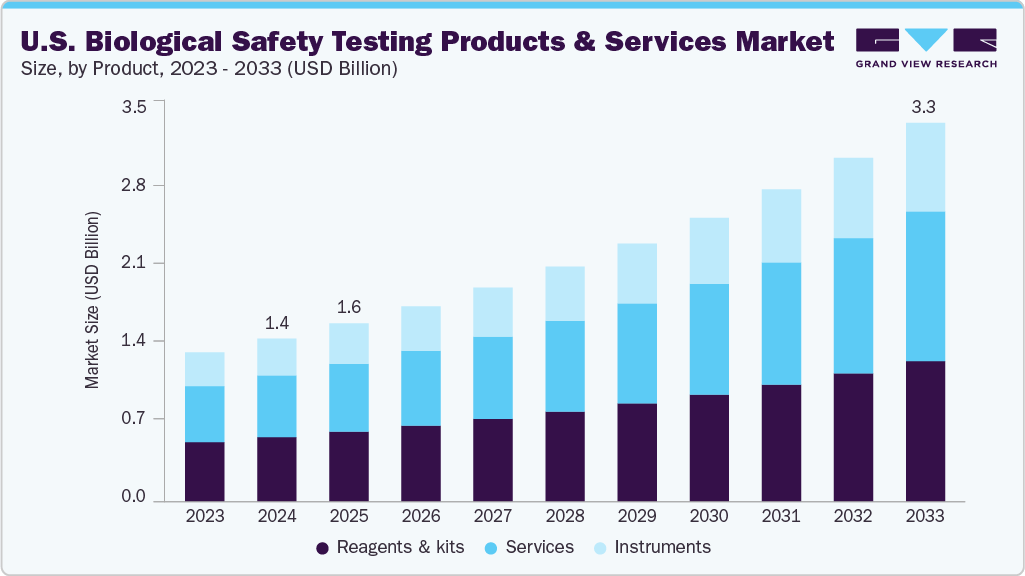

The U.S. biological safety testing products and services market size was estimated at USD 1.44 billion in 2024 and is expected to grow at a CAGR of 9.88% from 2025 to 2033. The rapid growth of the biopharmaceutical and biotechnology industries in the U.S. is one of the foremost drivers of the biological safety testing market. With increasing R&D investment in biologics, biosimilars, gene therapies, and regenerative medicines, there is heightened demand for validated, precise biosafety testing. These therapies, being complex and sensitive, require robust safety protocols to meet regulatory and clinical expectations.

The surge in novel therapeutic candidates has led to an expansion in testing volumes and a need for new assay types, accelerating the development of cutting-edge biosafety platforms. The strategic push toward personalized medicine, combined with an aging population and increasing prevalence of chronic diseases, further amplifies this need. Merck's October 2024 launch of a USD 305 million biosafety testing and cell bank facility in Maryland illustrates how major players are responding to this demand. The site integrates testing with analytical development and manufacturing, streamlining workflows. Its proprietary Blazar CHO AOF panel, which reduces testing timelines by more than half, exemplifies the emphasis on speed and reliability in biosafety services. Such investments signify the foundational role of biological safety in securing the therapeutic pipeline and enabling rapid market entry for high-value biologics.

Expansion of the Market Players

Companies

Year

Month

Details

Samsung Biologics

2025

January

Samsung Biologics announced the launch of dedicated ADC services at their new facility. This expansion supports the development and manufacturing of ADC therapies from late discovery to conjugation stage.

Merck KGaA

2024

October

Merck has inaugurated a new USD 328.28 million biosafety testing facility in Rockville, Maryland, U.S. This facility supports critical biosafety testing and analytical development, which are essential for the successful development and commercialization of both traditional and innovative drug modalities. The demand for these services is experiencing strong double-digit growth.

SGS Société Générale de Surveillance SA

2024

October

SGS expanded its biopharmaceutical testing services at its 60,000 sq. ft. center of excellence. The facility now offers enhanced capabilities including early cell bank safety assessment, product characterization, method development/validation, raw material testing, and support for final product release.

Regulatory oversight in the U.S. is a key force shaping the biological safety testing market. agencies like the U.S. Food and Drug Administration (FDA) and the U.S. Pharmacopeia (USP) enforce rigorous safety testing mandates for biologics throughout their development and manufacturing lifecycle. These include sterility, endotoxin, bioburden, and mycoplasma tests, among others. Regulatory expectations are especially strict for products such as monoclonal antibodies, vaccines, and gene therapies, where contamination risks can compromise safety and efficacy. As a result, pharmaceutical companies and contract research organizations (CROs) are compelled to implement high-quality, validated biosafety procedures to secure approvals and minimize risks.

Non-compliance can result in clinical holds, product recalls, or market withdrawal, increasing the strategic importance of robust safety frameworks. Thermo Fisher Scientific’s February 2024 enhancement of its GMP lab in Middleton, Wisconsin-adding rapid qPCR-based mycoplasma testing-demonstrates industry alignment with these expectations. The new method delivers results in just five days, enabling manufacturers to meet FDA timelines without compromising quality. As biologic modalities become more complex and distributed, regulatory harmonization efforts will continue to drive innovations and investments in safety infrastructure, ensuring that U.S.-based firms remain compliant while accelerating therapeutic delivery.

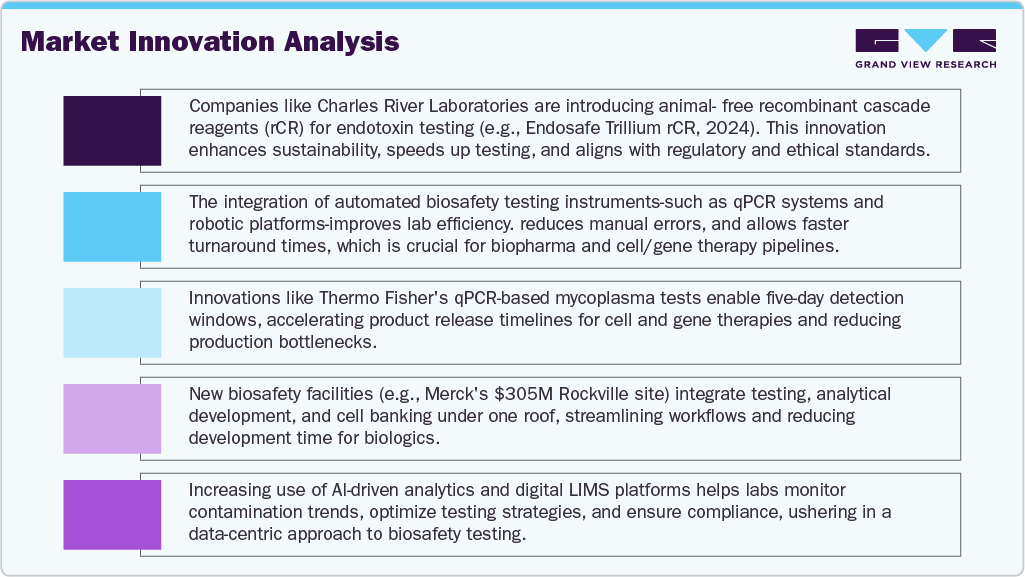

Innovations such as qPCR, next-generation sequencing (NGS), biosensors, and automation are transforming traditional testing models. These technologies enable earlier detection of microbial or viral contaminants, significantly reducing the time and cost associated with batch release and product development. Automated and integrated platforms are also enhancing throughput, a crucial capability as testing demand increases with larger therapeutic pipelines. Companies are not only modernizing existing facilities but also building new centers equipped with digital and robotic systems to support high-volume testing with minimal human error. SGS North America’s July 2024 expansion of its Center of Excellence in Lincolnshire, Illinois, exemplifies this trend. The 60,000 sq. ft. upgrade added new instrumentation to support biosimilar and novel biologic testing across all drug development stage. These integrated systems offer end-to-end analytical support, enhancing traceability and data integrity-two core requirements in regulated environments. Looking ahead, technology convergence with AI and machine learning may enable predictive biosafety analytics, ushering in a new era of proactive contamination risk management. The increasing availability of such sophisticated tools cements the U.S.'s position as a global leader in biosafety innovation.

Market Concentration & Characteristics

Degree of Innovation: The U.S. market shows a high degree of innovation, driven by the need for faster, more sensitive, and automated biosafety testing. Technologies such as qPCR, next-generation sequencing (NGS), and rapid microbial methods are modernizing workflows, improving accuracy, and reducing turnaround times-key for biologics, cell therapies, and vaccines facing tight development and regulatory timelines.

Level of M&A: The biological safety testing sector in the U.S. is witnessing moderate to high merger and acquisition activity. Leading players are acquiring specialized CROs and tech-driven firms to expand testing portfolios and geographic reach. These consolidations aim to streamline services, enhance capacity, and respond to growing demand for integrated safety solutions across complex biologic development pipelines.

Impact of Regulation: Regulation heavily influences the U.S. market. FDA and USP guidelines mandate strict biosafety compliance, especially for biologics and gene therapies. New policies emphasizing quality, validation, and data integrity drive constant updates in protocols. While regulations increase operational complexity, they also ensure market stability and push innovation in testing methods and infrastructure.

Product Expansion: Product expansion is strong, with companies introducing advanced test panels, automation platforms, and combined service models. Firms such as Thermo Fisher and Merck are launching rapid assays and integrated platforms, addressing unmet needs in cell and gene therapy manufacturing. Expansion supports faster approvals, improves test sensitivity, and meets the growing volume of complex biologic products.

Product Substitution: Product substitution is limited due to regulatory rigidity and specificity of test requirements. While some traditional assays are being replaced by faster molecular methods (e.g., qPCR over culture-based mycoplasma tests), full substitution is constrained by validation demands. Innovations must undergo rigorous trials to replace incumbent solutions, slowing down the pace of substitution despite technological advancements.

Product Insights

On the basis of product, the reagents & kits segment dominated the U.S. biological safety testing products and services with a share of 39.56% in 2024, driven by their essential role in performing a wide range of biosafety assays, including sterility, endotoxin, mycoplasma, and bioburden tests. These components are integral to ensuring accuracy, repeatability, and regulatory compliance of laboratory results. The surge in biologic drug development, including vaccines, monoclonal antibodies, and cell and gene therapies, has significantly increased demand for high-quality, validated testing kits. Furthermore, the rise of automated and high-throughput platforms has amplified the need for compatible, reliable reagents to streamline workflows and reduce human error. Leading manufacturers are focusing on launching ready-to-use GMP-compliant kits that improve efficiency and turnaround times. In addition, recurring purchases of consumables such as reagents contribute to consistent revenue streams, making this segment financially attractive. As biosafety standards tighten, the demand for advanced, sensitive reagents and kits is expected to remain strong across the U.S. market.

Instrument is expected to grow with the fastest growth rate over the forecast period, fueled by the rising demand for automated, high throughput testing systems that enhance accuracy and efficiency. As biologics and cell and gene therapies become more prevalent, laboratories require advanced instrumentation to manage complex assays such as mycoplasma detection, sterility testing, and viral clearance. Modern instruments reduce manual workload and ensure consistency in test results, making them essential in GMP-regulated environments. Integration with digital platforms and data management systems also enables real-time monitoring, audit trails, and regulatory compliance. For instance, systems supporting qPCR, next-generation sequencing (NGS), and flow cytometry are seeing rising adoption.

Application Insights

On the basis of application, the vaccine and therapeutic segment held the largest revenue share of 25.19% of the U.S. biological safety testing products and services in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This dominance is attributed to the surge in demand for novel vaccines and biologic therapeutics, especially in response to emerging infectious diseases, chronic illnesses, and pandemic preparedness. The development and commercialization of mRNA vaccines, monoclonal antibodies, and advanced therapeutics require rigorous biosafety validation at every stage from preclinical testing to batch release. Regulatory agencies such as the FDA mandate comprehensive testing to ensure product sterility, absence of contaminants, and viral safety. In addition, growing investments in vaccine research by both the public and private sectors, coupled with continuous advancements in vaccine technology, are fueling the need for specialized biosafety services. As the pipeline for biologics and vaccines expands, this segment is expected to remain the most lucrative and rapidly evolving.

Meanwhile, the blood & blood-based products application segment is witnessing steady growth in the U.S. biological safety testing products and services market. This expansion is driven by the increasing use of plasma-derived therapies, blood transfusions, and advanced cell-based treatments, all of which require rigorous safety testing to prevent contamination and ensure product integrity. Regulatory mandates by the FDA, including viral inactivation and pathogen screening, necessitate extensive biosafety protocols. With the rising incidence of chronic diseases, surgical procedures, and emergency care cases, the demand for safe, screened blood products continues to grow. In addition, innovation in blood-based biologics and immunotherapies further supports the need for advanced biosafety testing tools, contributing to the segment’s sustained market momentum.

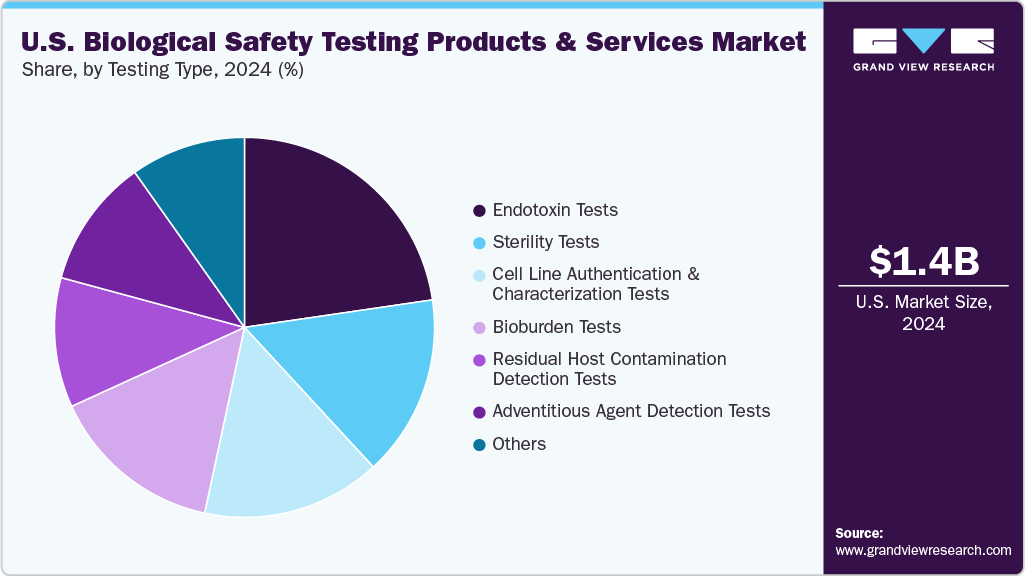

Test Type Insights

On the basis of test type, endotoxin tests market is segmented held the largest revenue share of 22.69% in 2024, driven by increasing demand for rapid, reliable quality control in biologics production. In January 2024, Charles River Laboratories advanced its portfolio with the launch of the Endosafe Trillium rCR cartridge. This innovative solution combines the proven Endosafe cartridge technology with a recombinant cascade reagent (rCR), offering a fully animal-free, efficient, and sustainable testing alternative. The Trillium rCR enhances speed and accuracy in endotoxin detection while aligning with regulatory expectations and Charles River’s 4Rs sustainability initiative-Replacement, Reduction, Refinement, and Responsibility further strengthening its market position.

The bioburden test market is projected to experience the fastest compound annual growth rate (CAGR) over the forecast period, propelled by stringent regulatory standards and the expanding landscape of cell and gene therapies, biologics, and medical devices. As regulatory agencies such as the FDA place increased emphasis on contamination control, bioburden testing has become essential for ensuring product sterility and validating manufacturing processes. This type of testing measures the microbial load on raw materials, components, and final products prior to sterilization, playing a vital role in risk assessment and quality assurance. In high-stakes applications such as advanced therapeutics and implantable devices, even minimal contamination can compromise patient safety, necessitating precise microbial quantification. Advances in testing technologies, including automated colony counters and rapid microbial detection systems, are further supporting segment growth by reducing turnaround times and improving accuracy. As the U.S. continues to lead in innovative biologic development and manufacturing, demand for robust bioburden testing solutions is expected to rise sharply.

Key U.S. Biological Safety Products And Services Company Insights

Leading players are focusing on expanding their product and service portfolios to increase revenue. Market players, such as Charles River Laboratories, BSL Bioservice, Merck KGaA, Samsung Biologics, Sartorius AG, Eurofins Scientific, SGS Société Générale de Surveillance SA, Thermo Fisher Scientific Inc., BIOMÉRIEUX. In January 2025, Samsung Biologics is constructing its fifth biomanufacturing plant in Songdo, South Korea, expected to be operational by April 2025. This will increase their total biomanufacturing capacity to 784,000 liters. These strategies to increase their production capabilities & strengthen their geographic presence.

Key U.S. Biological Safety Testing Products And Services Companies:

- Charles River Laboratories

- BSL Bioservice

- Merck KGaA

- Samsung Biologics

- Sartorius AG

- Eurofins Scientific

- SGS Société Générale de Surveillance SA

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- Lonza

Recent Developments

-

In April 2025, Eurofins Scientific, Eurofins expanded its U.S. portfolio by introducing a new ethylene oxide (EtO) sterilization solution, enhancing its capabilities in providing safe and effective sterilization for medical devices.

-

In January 2025, Samsung Biologics is constructing its fifth biomanufacturing plant in Songdo, South Korea, expected to be operational by April 2025. This will increase their total biomanufacturing capacity to 784,000 liters.

-

In May 2025, Thermo Fisher introduced the Thermo Scientific 1500 Series Class II, Type A2 Biological Safety Cabinet (BSC), engineered to deliver reliable protection, enhanced user comfort through ergonomic design, and ease of operation. This versatile solution is tailored to meet the demands of routine laboratory work across academic, pharmaceutical, and biotechnology environments.

U.S. Biological Safety Testing Products And Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.58 billion

Revenue forecast in 2033

USD 3.35 billion

Growth rate

CAGR of 9.88% from 2025 to 2033

Actual years

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, test type

Key companies profiled

Charles River Laboratories; BSL Bioservice; Merck KGaA; Samsung Biologics; Sartorius AG; Eurofins Scientific; SGS Société Générale de Surveillance SA; Thermo Fisher Scientific Inc.; BIOMÉRIEUX

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biological Safety Testing Products And Services Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. biological safety testing products and services market report on the basis of product, application, and test type:

-

Product and Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Reagents & Kits

-

Instruments

-

Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Vaccines & Therapeutics

-

Vaccines

-

Monoclonal Antibodies

-

Recombinant Protein

-

-

Blood & Blood-based Products

-

Gene Therapy

-

Tissue & Tissue-based Products

-

Stem Cell

-

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Endotoxin Tests

-

Sterility Tests

-

Cell Line Authentication & Characterization Tests

-

Bioburden Tests

-

Adventitious Agent Detection Tests

-

Residual Host Contamination Detection Tests

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. biological safety testing products and services market size was estimated at USD 1.44 billion in 2024 and is expected to reach USD 3.35 billion in 2025.

b. The global U.S. biological safety testing products and services market is expected to grow at a compound annual growth rate of 9.88% from 2025 to 2033 to reach USD 3.35 billion by 2033.

b. The reagents & kits segment dominated the U.S. biological safety testing products and services with a share of 39.56% in 2024, driven by their essential role in performing a wide range of biosafety assays, including sterility, endotoxin, mycoplasma, and bioburden tests.

b. Some key players operating in the U.S. biological safety testing products and services market include Charles River Laboratories, BSL Bioservice, Merck KGaA, Samsung Biologics, Sartorius AG, Eurofins Scientific, SGS Société Générale de Surveillance SA, Thermo Fisher Scientific Inc., BIOMÉRIEUX.

b. Key factors that are driving the market growth include the rapid growth of the biopharmaceutical and biotechnology industries. With increasing R&D investment in biologics, biosimilars, gene therapies, and regenerative medicines, there is heightened demand for validated, precise biosafety testing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.