- Home

- »

- Healthcare IT

- »

-

U.S. Biosimulation Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Biosimulation Market Size, Share & Trends Report]()

U.S. Biosimulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Software, Services), By Application, By Therapeutic Area, By Deployment Model, By Pricing Model, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-674-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Biosimulation Market Size & Trends

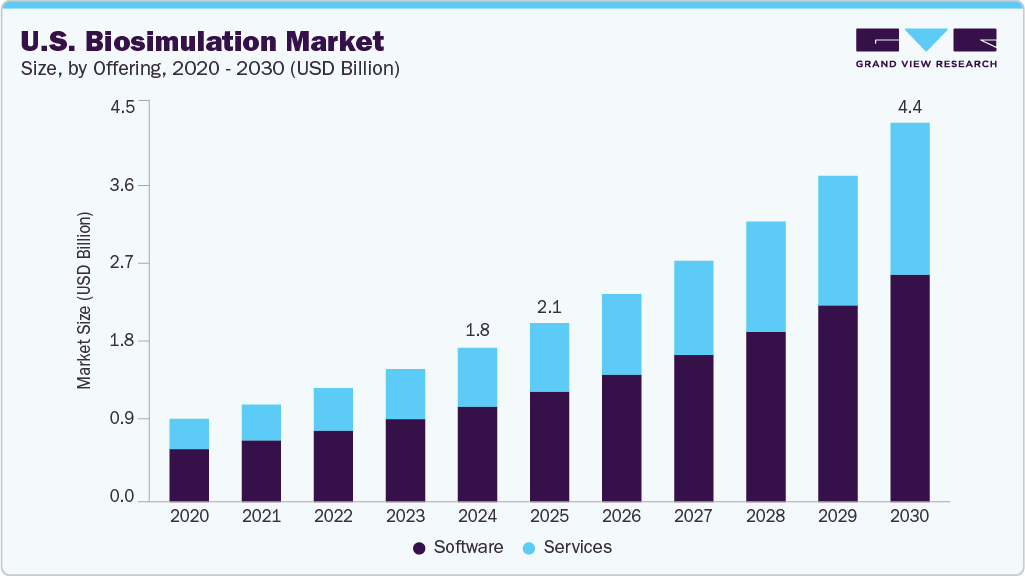

The U.S. biosimulation market size was estimated at USD 1.78 billion in 2024 and is projected to grow at a CAGR of 16.2% from 2025 to 2030. This growth is primarily driven by the increasing adoption of in silico modeling and simulation tools to reduce drug development costs and timelines. With the average cost of bringing a new drug to market continuing to rise, pharmaceutical and biotech companies are leveraging biosimulation to optimize clinical trial designs, predict drug interactions, and identify potential safety concerns early in the R&D process. The growing emphasis on precision medicine and the need for patient-specific dosing strategies further boost the demand for pharmacometrics and physiologically based pharmacokinetic (PBPK) modeling.

As the healthcare industry moves toward more tailored treatment strategies, a growing demand exists for tools that accurately model patient-specific therapy responses. Biosimulation enables researchers to develop detailed models accounting for genetic variations among individuals, helping predict how different patients respond to particular drugs or treatment plans. This approach improves treatment effectiveness while reducing adverse effects by customizing therapies to each patient’s unique profile. The expanding field of pharmacogenomics highlights the critical need for advanced biosimulation tools capable of incorporating genetic data into predictive models within the U.S. healthcare landscape.

Advancements in AI and ML are significantly enhancing the capabilities of biosimulation tools. These technologies allow for more accurate and efficient simulations of biological processes, enabling researchers to predict drug interactions and outcomes precisely. Integrating AI and ML into biosimulation platforms facilitates the development of personalized medicine approaches, where treatments are tailored to individual patient profiles. This technological synergy is driving the adoption of biosimulation in drug development processes across the U.S.

Moreover, favorable regulatory support from the U.S. FDA, which increasingly accepts biosimulation data as part of regulatory submissions, enhances market growth. The rise of biologics and complex therapies, such as gene and cell therapies, has also contributed to the market expansion, as these treatments often require advanced modeling approaches to evaluate efficacy and safety. Moreover, the integration of artificial intelligence and machine learning into biosimulation platforms is enhancing model accuracy and scalability, making these tools more accessible and valuable across the drug development lifecycle.

The COVID-19 pandemic impacted the U.S. market, accelerating the demand for biosimulation software and services to support vaccine candidates' rapid development and testing. For instance, in August 2020, Certara, a player in the U.S. biosimulation sector, partnered with several pharmaceutical companies to develop a new biosimulation tool to streamline vaccine candidate development across diverse patient populations using virtual patients and clinical trials. This innovation aimed to provide critical insights before initiating real-world studies, enhancing the efficiency and effectiveness of vaccine development. This new capability was integrated into Certara's Quantitative Systems Pharmacology (QSP) platform, highlighting the growing importance of biosimulation in pandemic response efforts within the U.S. healthcare system.

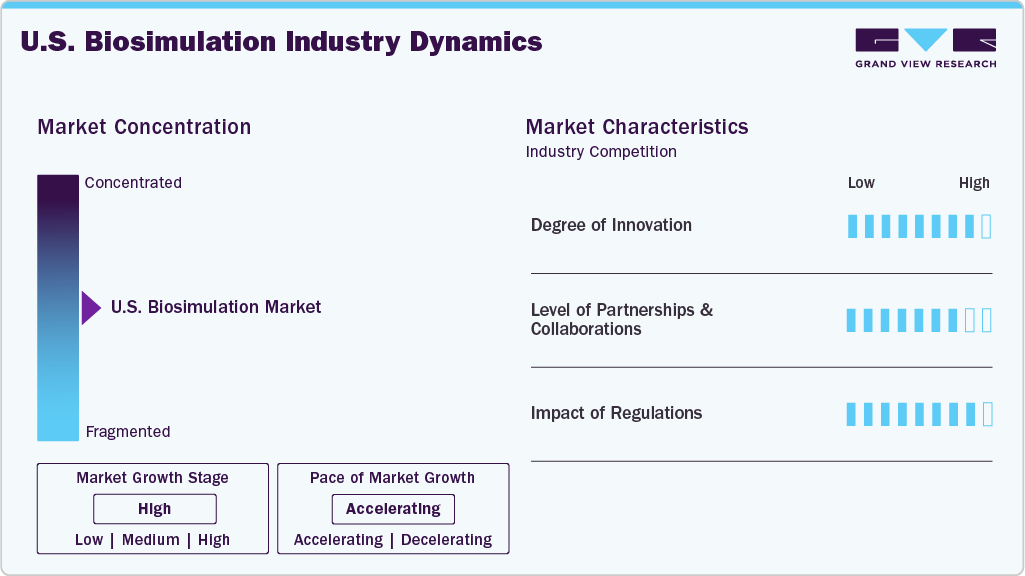

Market Concentration & Characteristics

The U.S. market exhibits high innovation driven by AI, ML, and computational biology advancements. Companies such as Certara and Simulations Plus are at the forefront, integrating AI and ML into their biosimulation platforms to enhance predictive accuracy and efficiency in drug development. For instance, in May 2024, Simulations Plus launched GastroPlus X (GPX), an advanced physiologically based pharmacokinetic (PBPK) platform incorporating machine learning to streamline workflows and improve drug absorption predictions.

“Our development process included significant external user testing, and we sought partners’ feedback throughout the entire development cycle. This resulted in a completely redesigned, intuitive, flexible platform that follows our customers’ research and thought processes instead of requiring them to fit their processes to the software.”

- Neil Miller, Vice President of Simulation Sciences at Simulations Plus.

The market demonstrates a high level of partnerships and collaborations, particularly between industry leaders and academic or research institutions. For instance, in December 2023, Certara acquired Applied BioMath, a mathematical modeling and biosimulation platform developer, to industrialize quantitative systems pharmacology (QSP) biosimulation methods, enhancing the accessibility and availability of QSP approaches across the industry. These collaborations signify a concerted effort to advance biosimulation capabilities and expand their application in drug development.

Health authorities such as the U.S. Food and Drug Administration (FDA) provide regulatory oversight for the market. The FDA has established strict guidelines to ensure biosimulation's safe and practical application in drug discovery and development. These regulations are designed to maintain high patient safety and scientific integrity standards. As technological advancements continue to reshape the biosimulation landscape, the FDA updates its regulatory framework to reflect emerging scientific methods and innovations, ensuring that biosimulation tools remain aligned with current research and industry needs.

Offering Insights

The software segment held the largest revenue share of 62.00% in 2024 due to its critical role in modeling complex biological processes and predicting drug behavior. Key drivers include increasing demand for early-stage drug development tools, technological advancements in AI-integrated platforms, and rising adoption by pharmaceutical companies. For instance, in August 2024, Certara launched Phoenix version 8.5, software for pharmacokinetic/pharmacodynamic (PK/PD) and toxicokinetic modeling.

“Certara develops software solutions that transform research data into trustworthy insights for scientists and regulators with the goal of bringing new medicines to market faster. The latest version of Phoenix includes new capabilities requested by existing clients and their IT business partners that streamline the comprehensive PK/PD data workflow.”

- Max Kanevsky, Chief Technology Officer at Certara

Services are expected to grow at the fastest CAGR of 17.2% during the forecast period. This growth is driven by the growing complexity of drug development processes, where biosimulation services are expected to play an essential role. The advancement is due to the development of more targeted and accurate combination therapies, increasing the need for simulation support.

Application Insights

Drug discovery & development segment held the largest market share in 2024, driven by the increasing number of drug development processes. The Pharmaceutical Research and Manufacturers of America (PhRMA) reported that over 8,000 drugs are developing phase. Biosimulation software plays a critical role in this process by enabling researchers to build comprehensive models of biological systems. The increasing use of biosimulation in areas such as pharmacogenomics and pharmacogenetics is significantly contributing to the growth of this segment.

Disease modeling is anticipated to grow fastest during the forecast period. The rising global incidence of infectious diseases has created a strong need for advanced modeling frameworks to forecast outbreaks and evaluate their effects on healthcare systems. In addition, incorporating big data analytics and artificial intelligence into disease modeling has driven growth, allowing for more precise predictions and real-time insights.

Therapeutic Area Insights

Oncology segment held the largest revenue share in 2024. In oncology, biosimulation is vital in analyzing tumor behavior, treatment responses, and individual patient factors that affect cancer outcomes. By integrating diverse data sources such as genomic profiles, clinical trial results, and pharmacokinetic information, researchers can build sophisticated models to forecast tumor reactions to different therapies. For instance, in September 2024, Cellworks Group, Inc. announced progress in its biosimulation technology that enhances the prediction of immunotherapy effectiveness in non-small cell lung cancer (NSCLC) patients. By combining genomic and transcriptomic data with personalized modeling of the tumor microenvironment, this approach offers more accurate outcome predictions than traditional biomarkers such as PD-L1 and TMB.

Infectious diseases segment is anticipated to grow at the fastest CAGR during the forecast period. Biosimulation models incorporate a wide range of biological data, such as pathogen behavior, host immune responses, and treatment outcomes, enabling researchers and healthcare professionals to anticipate the progression of infectious diseases and evaluate responses to various therapies. In addition, these models are valuable for examining how drug resistance affects treatment effectiveness by simulating scenarios in which pathogens develop resistance mechanisms.

Deployment Model Insights

Cloud-based segment dominated the market with the largest revenue share and is expected to grow at the fastest CAGR over the forecast period. This growth is driven by the cloud platform's flexibility, scalability, and cost-efficiency compared to traditional on-premises solutions. Cloud-based biosimulation enables companies to scale computational power quickly, streamline collaboration across geographically dispersed teams, and accelerate drug development timelines. As pharmaceutical companies adopt cloud technology, this segment's rapid expansion is set to continue.

Hybrid model segment is expected to grow significantly over the forecast period. This approach appeals to companies needing to protect sensitive data while leveraging the flexibility of cloud computing. Drivers include increasing data privacy concerns, regulatory compliance, and the demand for efficient resource management. For instance, pharmaceutical firms use hybrid models to run sensitive simulations on local servers while utilizing the cloud for large-scale data processing. This balance enables faster drug development and improved collaboration, making the hybrid model an attractive and growing deployment option in the U.S. market.

Pricing Model Insights

License-based model held the largest revenue share in 2024. This model offers users access to sophisticated tools without substantial infrastructure or development costs. Its adaptable and scalable nature enables companies to choose from various licensing options, including single-user, multi-user, or enterprise-wide licenses tailored to their requirements and financial capacity. These advantages are expected to support the segment’s growth over the forecast period.

The subscription-based pricing model is anticipated to grow at the fastest CAGR over the forecast period. A subscription model allows organizations to control their budgets and optimize resource allocation. In addition, this model drives collaboration among researchers and institutions by making advanced biosimulation tools more accessible and reducing entry barriers.

End-use Insights

Life science companies accounted for the largest revenue share in 2024. Companies are integrating biosimulation software as an essential drug development and research tool. This software allows them to build detailed models of biological systems that simulate drug effects on different physiological processes. In addition, biosimulation software is vital for supporting regulatory submissions and ensuring compliance within the pharmaceutical industry.

The academic and research institutes’ segment is expected to grow at the fastest during the forecast period. Biosimulation models enable the simulation of biological systems to forecast their behavior in different scenarios. This software helps researchers develop virtual models of intricate biological processes, including drug interactions, metabolic pathways, and cellular responses.

Key U.S. Biosimulation Company Insights

Major companies in the U.S. market are implementing various strategies to enhance their market presence and broaden the availability of their products and services. Expansion efforts and strategic partnerships are key drivers fueling growth within the market.

Key U.S. Biosimulation Companies:

- Certara, USA.

- Dassault Systèmes

- Advanced Chemistry Development

- Simulation Plus

- Schrodinger, Inc.

- Chemical Computing Group ULC

- Physiomics Plc

- Rosa & Co. LLC

- BioSimulation Consulting Inc.

- Genedata AG

- Instem Group of Companies

- PPD, Inc.

- Yokogawa Insilico Biotechnology GmbH

Recent Developments

- In October 2024, Certara acquired ChemAxon, a leading provider of cheminformatics software. This acquisition helped Certara enhance its drug discovery and development capabilities by integrating ChemAxon's advanced molecular modeling and data analysis tools.

“Combining Chemaxon’s expertise with Certara’s biosimulation capabilities provides life sciences companies with unique solutions to enhance productivity and increase their scientific innovation success rates,”

-William Feehery, Certara’s CEO.

- In September 2024, Certara partnered with Ichnos Glenmark Innovation (IGI) to optimize the dosing strategy for a potential first-in-class cancer drug. This collaboration leverages Certara's modeling and simulation expertise to enhance the drug's development process, aiming to improve patient outcomes and streamline clinical trials.

“We were honored to work with IGI to develop a comprehensive biosimulation approach that allowed the team to successfully test ISB 2001 in virtual trials, Our unique expertise and experience using virtual patients plus mechanistic modeling solutions allowed us to accelerate the speed at which ISB 2001 gets to patients. Virtual patient technology is the future of optimizing dosing for human patients.”

- Senior Vice President and Head of Applied Biosimulation, Certara.

U.S. Biosimulation Market Report Scope

Report Attribute

Details

Revenue Forecast in 2025

USD 2.06 billion

Revenue Forecast in 2030

USD 4.37 billion

Growth rate

CAGR of 16.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Offering, application, therapeutic area, deployment model, pricing model, end-use

Key companies profiled

Certara, USA.; Dassault Systèmes; Advanced Chemistry Development; Simulation Plus; Schrodinger Inc.; Chemical Computing Group ULC; Physiomics Plc; Rosa & Co. LLC; BioSimulation Consulting Inc.; Genedata AG; Instem Group of Companies; PPD, Inc.; Yokogawa Insilico Biotechnology GmbH

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biosimulation Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biosimulation market report based on offering, application, therapeutic area, deployment model, pricing model, and end-use.

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Molecular Modeling & Simulation Software

-

Clinical Trial Design Software

-

PK/PD Modeling and Simulation Software

-

Pbpk Modeling and Simulation Software

-

Toxicity Prediction Software

-

Other Software

-

-

Services

-

Contract Services

-

Consulting

-

Other (Implementation, Training, & Support)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Development

-

Disease Modeling

-

Other (Precision Medicine, Toxicology)

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Disease

-

Infectious Disease

-

Neurological Disorders

-

Others

-

-

Deployment Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premise

-

Hybrid Model

-

-

Pricing Model Outlook (Revenue, USD Million, 2018 - 2030)

-

License-based Model

-

Subscription-based Model

-

Service-based Model

-

Pay Per Use Model

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Life Sciences Companies

-

Academic Research Institutions

-

Others (CROs/CDMOs, Regulatory Authorities)

-

Frequently Asked Questions About This Report

b. The global U.S. biosimulation market size was estimated at USD 1.78 billion in 2024 and is expected to reach USD 2.06 billion in 2025.

b. The global U.S. biosimulation market is expected to grow at a compound annual growth rate of 16.2% from 2025 to 2030 to reach USD 4.37 billion by 2030.

b. The software segment held the largest revenue share of 62.00% in 2024. This is attributable to increasing demand for early-stage drug development tools, technological advancements in AI-integrated platforms, and rising adoption by pharmaceutical companies.

b. Some key players operating in the U.S. biosimulation market include Certara, USA., Dassault Systèmes, Advanced Chemistry Development, Simulation Plus Schrodinger, Inc., Chemical Computing Group ULC, Physiomics Plc, Rosa & Co. LLC, BioSimulation Consulting Inc., Genedata AG, Instem Group of Companies, PPD, Inc., Yokogawa Insilico Biotechnology GmbH

b. Key factors that are driving the market growth include increasing adoption of in silico modeling and simulation tools to reduce drug development costs and timelines, and advancements in AI and ML are significantly enhancing the capabilities of biosimulation tools.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.