- Home

- »

- Biotechnology

- »

-

U.S. Biotechnology Market Size, Industry Report, 2030GVR Report cover

![U.S. Biotechnology Market Size, Share & Trends Report]()

U.S. Biotechnology Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Nanobiotechnology, Tissue Engineering and Regeneration), By Application (Health, Food & Agriculture), And Segment Forecasts

- Report ID: GVR-4-68040-242-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Biotechnology Market Size & Trends

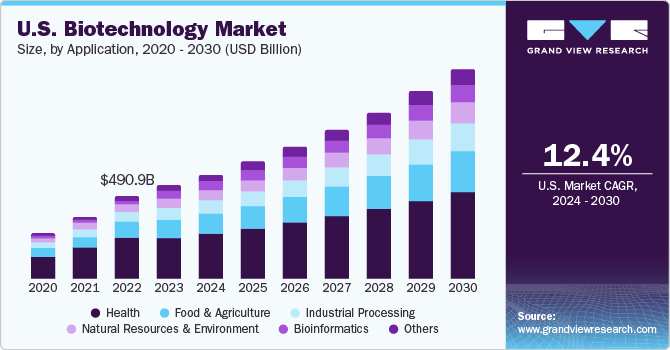

The U.S. biotechnology market size was estimated at USD 552.40 billion in 2023 and is expected to grow at a CAGR of 12.4% from 2024 to 2030. Government support plays a major role in propelling market growth, focusing on modernizing regulatory frameworks, enhancing approval processes and reimbursement policies, and standardizing clinical studies. The National Science Foundation (NSF) and Synthetic Biology Engineering Research Center (SynBERC) are responsible for conducting regular evaluations of synthetic biology. Biotechnology applications are experiencing a surge in market revenue thanks to the growth of personalized medicine and the development of orphan drug formulations. This has resulted in the emergence of many new and innovative biotech firms, contributing to the industry's expansion.

The U.S. accounted for over 35.6% of the global biotechnology market 2023. The increasing demand for agricultural products like wheat, rice, and beans, driven by population growth, highlights the importance of biotechnology-based solutions. Scientists focus on advanced agricultural technologies through extensive research and development (R&D) to address challenges such as pest attacks, limited land availability, and water scarcity. Moreover, investments in agriculture R&D, exemplified by companies like Loopworm and initiatives like the USD 101 million investment by Unilever and others in regenerative agriculture, propel market growth. Supportive government guidelines, particularly in synthetic biology, and the decreasing costs of DNA sequencing are also significant drivers of the biotechnology market's expansion.

The market has seen a positive influence from the COVID-19 pandemic, as it has spurred an increase in opportunities and advancements in developing and producing vaccines for the virus. Moreover, the success of mRNA vaccines and expedited approval processes have resulted in a spike in vaccine-related revenues, demonstrated by a collective revenue of approximately USD 31 billion in 2021 from vaccines by Moderna, Pfizer/BioNTech, and Johnson & Johnson. In addition, the growing demand for biotechnology tools in agricultural applications, such as micro-propagation, molecular breeding, tissue culturing, traditional plant breeding, and the creation of genetically modified crops, among others, has further propelled the market's growth.

In addition, an increasing tendency is observed toward accepting genetically modified crops and seeds that can endure insect-resistant herbicides. This trend is playing a significant role in the expansion of the market. A robust clinical trial pipeline and funding availability in tissue engineering and regeneration technologies further fuel the market growth. Moreover, the increasing need for effective clinical interventions to address chronic conditions like cancer, diabetes, age-related macular degeneration, and various forms of arthritis is expected to propel market growth. Leading companies are actively exploring and advancing pipeline products targeting conditions such as diabetes, neurological disorders including Parkinson's and Alzheimer's diseases, different types of cancers, and cardiovascular ailments. Notably, data from clinicaltrials.gov in January 2021 revealed 126 agents undergoing clinical trials for Alzheimer's disease treatment, with 28 treatments in phase III trials.

Fermentation technology is on the rise in the life sciences and healthcare industries, positively impacting market expansion. The development of simplified and vortex bioreactors and other improvements to traditional bioreactors has driven advancements in fermentation technology and increased its popularity. Additionally, vortex bioreactors have been upgraded for more efficient wastewater treatment. These advancements in fermentation technology are expected to fuel market growth.

In recent years, there has been a noticeable increase in the use of biotechnological methods such as stem cell technology, DNA fingerprinting, and genetic engineering. The growth in the market for stem cell technologies can be attributed to advancements in stem cell therapeutics, rising demand for biologics, and an increased emphasis on creating personalized medicines. DNA fingerprinting is becoming more prevalent in forensic science, and it's also being used to investigate familial relationships in animal populations and measure inbreeding levels. In a similar vein, the use of genetic engineering and cloning techniques is expanding in animal breeding and the production of complex biological substances.

Market Characteristics & Concentration

U.S. biotechnology industry is in a stage of significant growth, and the pace of industry is accelerating. This industry is marked by a strong influence of innovation, driven by fast-paced progress in areas such as genomics, molecular biology, cellular and tissue engineering, bioimaging, and new methods of drug discovery and delivery. These advancements are expected to create opportunities for improving diagnostic capabilities and expanding treatment options. Companies constantly goes through initiatives like mergers and acquisitions, geographic expansions, and new product or technology launch to keep themselves ahead in the market.

Industry players in biotechnology industry continuously goes through innovations across diverse fields, including medicine, energy, and materials science, leveraging biological processes to address complex challenges and drive technological advancements. For instance, in July 2020 Qosina announced the launch of Entegris' Aramus 2D bag chambers. These are high-performance fluid storage along with transfer bag chambers built of gamma-stable fluoropolymer that offers excellent purity, great compatibility, and increased safety for sensitive process fluids & high-value final products.

Companies in the industry are using these strategies to enhance their production abilities and expand the geographical distribution of their products. The industry is marked by a significant number of mergers and acquisitions (M&A) carried out by the top players. For instance, in October 2023, Amgen declared that it had finalized its purchase of Horizon Therapeutics plc. Horizon Therapeutics is a biopharmaceutical firm that specializes in the development and commercialization of treatments for rare genetic and autoimmune diseases.

The FDA, EPA, and USDA are responsible for implementing regulations in the biotechnology sector. The focus of these regulations is to ensure that the industry operates in compliance with the rules set by these governing bodies. The Department of Agriculture (USDA), the Environmental Protection Agency (EPA), and the Food and Drug Administration (FDA) work together to enforce regulations for the biotechnology industry. FDA evaluates and approves biopharmaceuticals and genetically modified organisms to ensure their safety and efficacy. The EPA oversees biotechnology products that could impact the environment, while the USDA monitors biotech crops to ensure food safety and proper cultivation practices. These agencies collaborate to establish rigorous standards and conduct thorough assessments to control and monitor the various aspects of the biotechnology industry.

Industry’s companies utilize this approach to enhance their product range and provide their customers with advanced and innovative products. For example, in October 2023, the FDA approved Novartis AG's Cosentyx, which became the first new biologic treatment available for patients with Hidradenitis Suppurativa, filling a significant gap in medical alternatives.

To increase the availability of their products and expand their reach in diverse geographic areas, key players in the industry adopt geographic/regional expansion strategies. In October 2021, Lonza announced its plans to expand development services for mammalian processes in Singapore. The aim of the expansion is to enhance cell culture, analytical, and purification services at the facility.

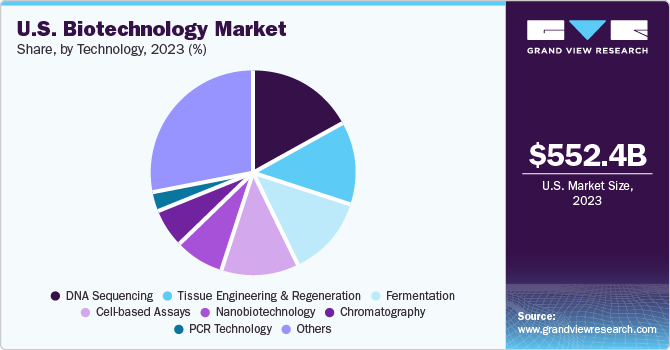

Technology Insights

DNA sequencing dominated this market and held the highest revenue market share of 17.52% in 2023, which can be attributed to declining sequencing costs and rising penetration of advanced DNA sequencing techniques. This technology is key in creating personalized cancer treatments by pinpointing mutations. Widely embraced in research, DNA sequencing efficiently compares large DNA segments across species. Advancements in sequencing systems are enhancing speed and cost-effectiveness, offering substantial potential in healthcare applications. Government support, exemplified by grants like the USD 10.7 million NIH award in May 2021 for Alzheimer's disease research, is fueling the expansion of sequencing for disease insights.

The others’ segment is anticipated to grow at the fastest CAGR of 28.0% during the forecast period. This segment includes fermentation in food and environmental applications, driven by the rising use of microorganisms in the food industry and to address environmental challenges like climate change. Intechopen highlighted in February 2023 that employing microorganisms in food processing can boost efficiency, save time and energy, and establish a more consistent processing system commercially. With the modern lifestyle's demands, there is a growing reliance on processed foods, leading to an increased demand for such products. Fermentation in food processing leverages microorganisms' growth and metabolic activity to stabilize and transform food materials by converting organic acids or carbon dioxide and carbohydrates to alcohols under anaerobic conditions using bacteria, yeasts, or a combination of them. This is anticipated to fuel market growth.

Application Insights

The health segment dominated the market and accounted for the largest revenue market share of 44.3% in 2023. The use of biotechnology in healthcare is transforming the industry. Innovations in genomics, molecular biology, cellular and tissue engineering, bio-imaging, new drug discovery, and delivery methods offer promising possibilities for enhancing diagnostic capabilities and broadening treatment options. The segment's growth is expected to be driven by an increasing disease burden, the rising availability of agri-biotech and bio-services, and technological advancements in the bio-industrial sector. Furthermore, significant progress in Artificial Intelligence (AI), machine learning (ML), and big data is also fueling the segment's growth and boosting its adoption food and beverage industries.

Bioinformatics is expected to witness the fastest growth, with a CAGR of 17.1% during the forecast period. The bioinformatics industry has seen rapid global expansion, driven by various fields like physics, mathematics, and pharmaceuticals, and the emergence of new biotechnology fields like proteomics and genomics. The surge in data from increased biotechnology R&D has broadened bioinformatics’ scope. It’s now widely used for bioresource conservation & management, biology prospecting, product & process evaluation, and managing complex data for national programs. Cloud computing has become integral to bioinformatics, providing scalable computing & storage, data sharing, and on-demand resource access. The rise of biomedical cloud platforms catering to specific research community needs is a notable trend, expected to boost bioinformatics tool adoption in life sciences.

Key U.S. Biotechnology Company Insights

The biotechnology sector is witnessing a trend where companies form alliances through various strategic initiatives such as business collaborations, partnerships, and development agreements. The primary motivation behind these initiatives is the collective development of innovative therapeutics for improved results and cost reduction. The market's growth is largely due to the launch of new and innovative products, contracts, acquisitions, technological advancements, and wide-ranging applicability. For instance, in January 2021, Sartorius Stedim Biotech acquired the chromatography process equipment division of Novasep. This division's chromatography products portfolio includes resin-based batch systems and advanced chromatography systems for various applications, including oligonucleotides, small molecules, insulin, and peptides.

Key U.S. Biotechnology Companies:

- AstraZeneca

- Gilead Sciences, Inc.

- Bristol-Myers Squibb

- Sanofi

- Biogen

- Abbott Laboratories

- Pfizer, Inc.

- Amgen Inc.

- Novo Nordisk A/S

- Merck KGaA

- Johnson & Johnson Services, Inc.

- Novartis AG

- F. Hoffmann-La Roche Ltd.

- Lonza

Recent Developments

-

In October 2023, Amgen announced that it had completed its acquisition of Horizon Therapeutics plc. Horizon Therapeutics is a biopharmaceutical company focused on developing and commercializing therapies for rare genetic and autoimmune diseases.

-

In October 2023, Gilead Science's subsidiary, Kite and Epicrispr Biotechnologies, announced a research collaboration and licensing agreement to utilize Epic Bio's gene regulation platform in developing advanced cancer cell therapies.

-

In September 2023, Biogen announced that the U.S. Food and Drug Administration (FDA) had approved CONFIDENCE (tocilizumab-above) in its intravenous form, representing a biosimilar monoclonal antibody concerning ACTEMRA.

U.S. Biotechnology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 552.40 billion

Revenue forecast in 2030

USD 1.25 trillion

Growth rate

CAGR of 12.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion/trillion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application

Country scope

U.S.

Key companies profiled

AstraZeneca; Gilead Sciences, Inc.; Bristol-Myers Squibb; Sanofi; Biogen; Abbott Laboratories; Pfizer, Inc.; Amgen Inc.; Novo Nordisk A/S; Merck KGaA; Johnson & Johnson Services, Inc.; Novartis AG; F. Hoffmann-La Roche Ltd.; Lonza

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biotechnology Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biotechnology market based on technology, and application:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Nanobiotechnology

-

Tissue Engineering and Regeneration

-

DNA Sequencing

-

Cell-based Assays

-

Fermentation

-

PCR Technology

-

Chromatography

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Health

-

Food & Agriculture

-

Natural Resources & Environment

-

Industrial Processing

-

Bioinformatics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. biotechnology market size was estimated at USD 552.40 billion in 2023.

b. The U.S. biotechnology market is expected to grow at a compound annual growth rate (CAGR) of 12.4% from 2024 to 2030 to reach USD 1.25 trillion by 2030.

b. The health segment dominated the market and accounted for the largest revenue market share of 44.3% in 2023. The use of biotechnology in healthcare is transforming the industry.

b. Some prominent players in the U.S. biotechnology market include AstraZeneca, Gilead Sciences, Inc., Bristol-Myers Squibb, Sanofi, Biogen, Abbott Laboratories, Pfizer, Inc. among others.

b. Government support plays a major role in propelling market growth, focusing on modernizing regulatory frameworks, enhancing approval processes and reimbursement policies, and standardizing clinical studies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.