- Home

- »

- Medical Devices

- »

-

U.S. Breast MRI Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Breast MRI Market Size, Share & Trends Report]()

U.S. Breast MRI Market (2025 - 2033) Size, Share & Trends Analysis By Product (Systems, Coils, Software), By Imaging Technique/Contrast Use (CE-MRI, Ab-MRI), By Condition (Malignant, Benign), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-656-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Breast MRI Market Summary

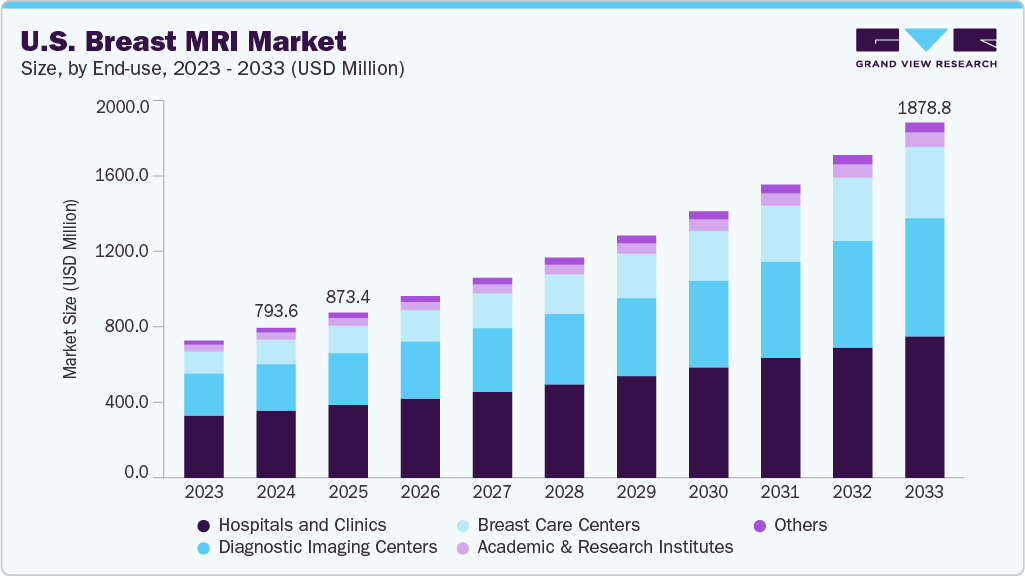

The U.S. breast MRI market size was estimated at USD 793.61 million in 2024 and is projected to reach USD 1,878.8 million by 2033, growing at a CAGR of 10.05% from 2025 to 2033. The demand for breast MRI in the U.S. is increasing due to the rising prevalence of breast cancer and the growing demand for medical imaging, along with growing clinical trials and continuous technological advancements in magnetic resonance imaging.

Key Market Trends & Insights

- Based on product, the systems segment led the market with the largest revenue share of 77.76% in 2024.

- Based on imaging technique/contrast use, the non-contrast / Abbreviated Breast MRI (Ab-MRI) segment is anticipated to grow fastest over the forecast period.

- By condition, the malignant segment is anticipated to grow with the highest CAGR from 2025 to 2033.

- By end-use, the hospital segment dominated the market in 2024, capturing the largest share of 44.80%.

Market Size & Forecast

- 2024 Market Size: USD 793.61 Million

- 2033 Projected Market Size: USD 1,878.8 Million

- CAGR (2025-2033): 10.05%

The growing prevalence of breast cancer and other breast-related abnormalities is expected to drive market expansion significantly. According to data published by the National Breast Cancer Foundation, Inc. in June 2025, approximately 1 in 8 women in the U.S. will be diagnosed with breast cancer during their lifetime. In addition, projections from the International Agency for Research on Cancer estimate a 27.8% increase in breast cancer incidence in the U.S. between 2022 and 2050, with cases expected to reach approximately 350,693 by 2050. This substantial rise in cancer cases is anticipated to fuel the demand for breast magnetic resonance imaging procedures across the country.

Furthermore, the increasing number of clinical trials evaluating advanced magnetic resonance imaging modalities for cancer detection and developing innovative imaging solutions is expected to contribute significantly to market growth. These trials are crucial in improving diagnostic accuracy, enhancing early detection, and validating new technologies.

Table 1 Ongoing and Recently Conducted Clinical Trials for Breast Cancer MRI in the U.S.

Study Title

Intervention/Treatment

Sponsor

Completion Date

Enrollment

Quantitative MRI Assessment of Breast Cancer Therapy Response

Procedure: Diffusion Weighted Imaging

Procedure: Dynamic Contrast-Enhanced Magnetic Resonance Imaging

William Beaumont Hospitals

2027-05-31

135

To compare magnetic resonance imaging (MRI) with more well-established diagnostic imaging techniques to determine which method best finds and defines breast cancer.

Procedure: MRI

Stanford University

2027-05

445

Development and Testing of an Accurate, Rapid, and Inexpensive MRI Protocol for Breast Cancer Screening - A Pilot Study

Diagnostic Test: MRI Abbreviated Scan

Diagnostic Test: Abbreviated MRI Scan

University of Chicago

2024-09-14

200

TMEM-MRI: A Pilot Feasibility Study of Magnetic Resonance Imaging for Imaging of TMEM (Tumor Microenvironment of Metastasis) in Patients With Operable Breast Cancer

Device: TMEM-MRI

Procedure: FNA

Montefiore Medical Center

2026-12

75

Source: ClinicalTrials.gov

Such ongoing trials evaluating various MRI modalities for breast cancer are anticipated to create significant growth opportunities for industry stakeholders. These studies advance the understanding of imaging technologies and pave the way for developing more precise, cost-effective, and patient-friendly diagnostic solutions, ultimately enhancing clinical outcomes and market potential.

In addition, favorable reimbursement and regulatory policies are critical to expanding access to MRI across the U.S. population. The Centers for Medicare & Medicaid Services (CMS) covers various imaging modalities, including breast magnetic resonance imaging, particularly for high-risk individuals and those requiring further diagnostic evaluation. Such support reduces the financial burden on patients, encourages early detection, and promotes broader adoption of advanced imaging technologies nationwide.

Table 2 Coding information along with the CPT codes and description for different breast MRI are mentioned in below table:

Code

Description

77046

MAGNETIC RESONANCE IMAGING, BREAST, WITHOUT CONTRAST MATERIAL; UNILATERAL

77047

MAGNETIC RESONANCE IMAGING, BREAST, WITHOUT CONTRAST MATERIAL; BILATERAL

77048

MAGNETIC RESONANCE IMAGING, BREAST, WITHOUT AND WITH CONTRAST MATERIAL(S), INCLUDING COMPUTER-AIDED DETECTION (CAD REAL-TIME LESION DETECTION, CHARACTERIZATION AND PHARMACOKINETIC ANALYSIS), WHEN PERFORMED; UNILATERAL

77049

MAGNETIC RESONANCE IMAGING, BREAST, WITHOUT AND WITH CONTRAST MATERIAL(S), INCLUDING COMPUTER-AIDED DETECTION (CAD REAL-TIME LESION DETECTION, CHARACTERIZATION AND PHARMACOKINETIC ANALYSIS), WHEN PERFORMED; BILATERAL

C8903

MAGNETIC RESONANCE IMAGING WITH CONTRAST, BREAST; UNILATERAL

C8905

MAGNETIC RESONANCE IMAGING WITHOUT CONTRAST, FOLLOWED BY WITH CONTRAST, BREAST; UNILATERAL

C8906

MAGNETIC RESONANCE IMAGING WITH CONTRAST, BREAST; BILATERAL

C8908

MAGNETIC RESONANCE IMAGING WITHOUT CONTRAST, FOLLOWED BY WITH CONTRAST, BREAST; BILATERAL

Source: Centers for Medicare & Medicaid Services

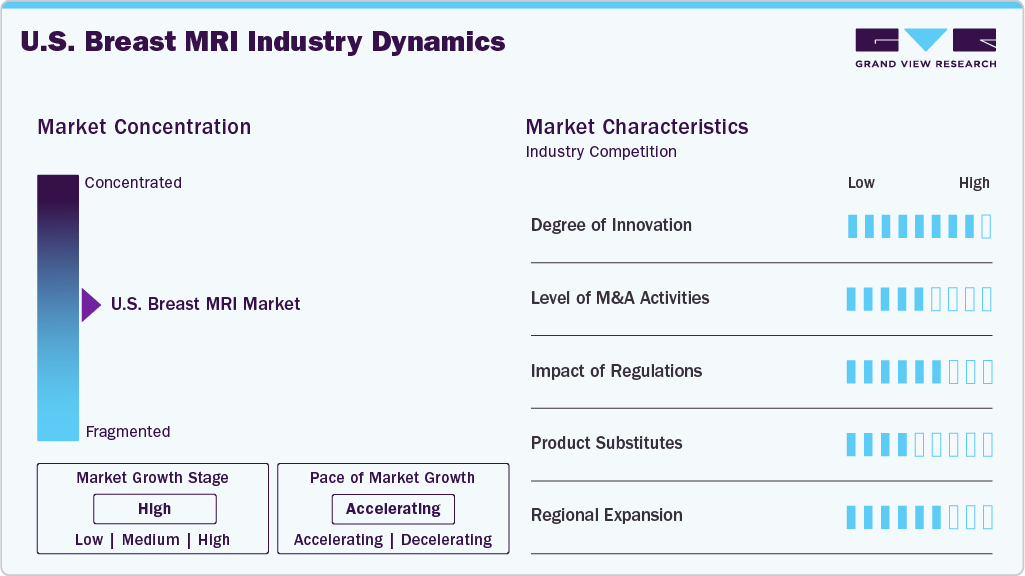

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The U.S. breast MRI industry is characterized by high growth due to the rising burden of breast cancer and the increasing adoption of medical imaging.

The growing research activities and clinical trials for breast MRI support the increasing innovation in the U.S. breast MRI industry. Different types of MRIs are being adopted to evaluate and diagnose breast cancer. For instance, in October 2022, Intermountain Healthcare launched an abbreviated MRI to screen women at higher risk of developing cancer. Such launches of novel MRIs are anticipated to drive innovation in the market.

In the U.S., breast MRI procedures are regulated by the Food and Drug Administration (FDA) to ensure safety, accuracy, and clinical efficacy. Under strict guidelines, the FDA approves breast magnetic resonance imaging systems and contrast agents while monitoring imaging protocols and device performance. These regulatory frameworks and CMS reimbursement policies help promote widespread clinical use and innovation in magnetic resonance imaging, ultimately supporting early diagnosis and improved patient care outcomes.

Mergers and acquisitions are actively leveraged in the U.S. breast MRI industry as a strategic approach to broadening product portfolios, driving innovation, and enhancing market positioning. Companies are incorporating advanced imaging technologies through these strategies, strengthening their research and development capabilities and enabling comprehensive cancer diagnosis and treatment solutions.

Key product substitutes in the U.S. breast MRI industry include digital mammography (2D and 3D), ultrasound, and contrast-enhanced mammography (CEM). These alternatives vary in diagnostic accuracy, cost, and availability. While breast magnetic resonance imaging offers superior sensitivity, especially for high-risk patients, these substitutes are often used in routine screening or when magnetic resonance imaging is not accessible or cost-effective.

Key Opinion Leaders

Company Name

KOLs

Growth Opportunities

Intermountain Healthcare

"Scans from an MRI are more sensitive and can detect certain cancers earlier than a normal mammogram. Studies have also shown that the sensitivity of a mammogram is about 70-85 percent, while an MRI is about 95-98 percent. That sensitivity is especially important for women with dense breast tissue because it can be harder for a mammogram to pick up tumors early because of the extra tissue."

- Abbreviated MRI adoption

Charlotte Radiology Breast Services

“Having this new, more advanced diagnostic imaging capability will allow us to capture even higher-quality images of breast tissue with greater efficiency, accuracy, and consistency. We will have the ability to detect even the smallest of cancers with precision as early as possible. The earlier we find breast cancer, the sooner it can be treated, the better the survival outcome for our patients.”

- Increasing adoption of breast MRI

Source: Grand View Research Analysis

Product Insights

The systems segment dominated the U.S. market, accounting for 77.76% of total revenue in 2024. This segment dominance can be attributed to the growing adoption of magnetic resonance imaging modality for breast cancer management. Several healthcare facilities and radiology institutions are adopting MRIs. For instance, in April 2021, Charlotte Radiology introduced the Siemens Vida 3T MRI, a state-of-the-art system exclusively for breast imaging. Offering double the strength of conventional 1.5T MRIs, it delivers faster exams with higher resolution. This system also supports advanced imaging sequences, especially for high-risk patients. Charlotte Radiology annually provides screening and diagnostic breast imaging services for over 100,000 patients. Thus, adopting magnetic resonance imaging systems in settings where patient inflow is high is anticipated to propel the segment growth.

The coils segment is projected to be the fastest-growing market, driven by the rising demand for high-resolution imaging and improved diagnostic accuracy. Advanced coils enhance image quality and support faster scan times, making them essential in clinical settings. Increasing adoption of specialized coils for breast imaging is fueling this segment’s rapid growth.

Imaging Technique/Contrast Use Insights

In 2024, the Contrast-Enhanced MRI (CE-MRI) segment held the largest revenue market share, primarily driven by the approval and availability of advanced contrast agents. For example, in September 2022, the FDA approved Gadopiclenol for use in magnetic resonance imaging procedures. Such regulatory approvals are expected to further support the segment’s growth by enhancing diagnostic precision and clinical adoption.

The Non-Contrast/Abbreviated Breast MRI (Ab-MRI) segment is expected to grow fastest from 2025 to 2033. This growth is largely driven by advancements in magnetic resonance imaging techniques that eliminate the need for contrast agents. For example, in October 2022, researchers at the University of Chicago Medical Center developed a novel method called High Spectral and Spatial Resolution Imaging (HiSS), which detects cancer with reliability comparable to traditional contrast-enhanced techniques. Such innovations are accelerating the adoption of non-contrast magnetic resonance imaging approaches, supporting broader use in routine screening and improving accessibility for patients who may not tolerate contrast media.

“Breast cancer screening without injection of contrast media would reduce costs, increase compliance with screening, and make it possible to perform MRI screening outside of hospitals, for example, in local malls and doctor’s offices, “said Gregory Karczmar, PhD, professor of radiology and co-leader of the Center’s Advancing Imaging Program.

End-use Insights

The hospital segment dominated the market in 2024, capturing the largest share of 44.80%. The largest share is attributed to the widespread availability of advanced imaging infrastructure, skilled radiologists, and the ability to handle a high volume of patients. Hospitals are primary centers for both routine diagnostics and complex breast cancer evaluations, making them key adopters of breast MRI systems for accurate detection, staging, and treatment planning.

The breast care centers segment is projected to register the highest CAGR from 2025 to 2033. The increasing focus on specialized, patient-centered care and the rising demand for dedicated breast imaging services drive this growth. These centers often offer advanced technologies, including breast magnetic resonance imaging, tailored for early detection, diagnosis, and monitoring of conditions, making them a preferred choice for patients and referring physicians.

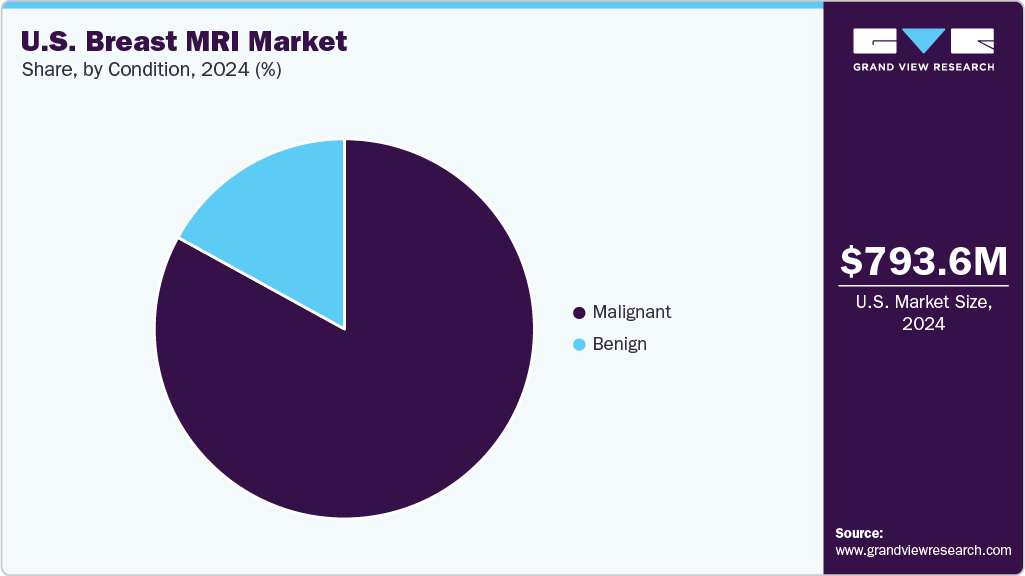

Condition Insights

In 2024, the malignant segment accounted for the largest revenue market share. It is also anticipated to grow fastest over the forecast period. This dominance is primarily driven by the high prevalence of breast cancer and the critical role of magnetic resonance imaging in detecting, staging, and monitoring malignant tumors. Breast magnetic resonance imaging is widely used for evaluating tumor extent, assessing treatment response, and guiding surgical planning, making it an essential tool in managing malignant conditions.

The benign segment is projected to experience significant growth from 2025 to 2033. This growth is driven by the increasing use of magnetic resonance imaging to evaluate non-cancerous conditions. MRI's high sensitivity aids in accurate differentiation, reducing unnecessary biopsies and improving patient management in cases of ambiguous or complex findings.

Key U.S. Breast MRI Company Insights

GE Healthcare, Siemens Medical Solutions USA, Inc., Koninklijke Philips N.V., CANON MEDICAL SYSTEMS USA, INC., FUJIFILM, United Imaging Healthcare Co., Ltd., AURORA HEALTHCARE US CORP, Quality Electrodynamics (QED), MR Instruments, Inc., iCAD, Inc., Subtle Medical, Inc., and Arterys (Tempus) are some of the major market players. Companies are expanding their portfolios of U.S. breast MRI and acquiring other smaller players to meet the growing demand. In addition, growing clinical trials are driving market growth.

Key U.S. Breast MRI Companies:

- GE HealthCare

- Siemens Medical Solutions USA, Inc.

- Koninklijke Philips N.V.

- Canon Medical Systems USA, Inc.

- FUJIFILM Healthcare

- United Imaging Healthcare Co., Ltd.

- AURORA HEALTHCARE US CORP

- Quality Electrodynamics (QED)

- MR Instruments, Inc.

- iCAD, Inc

- Subtle Medical, Inc.

- Arterys (Tempus)

Recent Developments

-

In December 2024, GE HealthCare unveiled research on an advanced 3D MRI foundation model that integrates with clinical reporting standards like BI-RADS. This model leverages the detailed anatomical and pathological insights from 3D MRIs to improve the consistency, objectivity, and efficiency of breast cancer diagnosis and risk stratification by better characterizing breast lesions such as shape, size, and margins.

-

In October 2024, Fujifilm introduced the Version 10 (v10) suite of innovations for the ECHELON Synergy 1.5T MRI system. This system has advanced technologies, including Synergy Vision with StillShot, Synergy DLR Clear, and automated scanning process enhancements. Deep Learning improved AutoPose for breast application is integrated with ECHELON Synergy’s v10.

U.S. Breast MRI Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 873.4 million

Revenue forecast in 2033

USD 1,878.8 million

Growth rate

CAGR of 10.05% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, imaging technique/contrast use, condition, end-use

Country scope

U.S.

Key companies profiled

GE Healthcare; Siemens Medical Solutions USA, Inc.; Koninklijke Philips N.V.; Canon Medical Systems USA, Inc.; FUJIFILM Healthcare; United Imaging Healthcare Co., Ltd.; AURORA HEALTHCARE US CORP; Quality Electrodynamics (QED); MR Instruments, Inc.; iCAD, Inc.; Subtle Medical, Inc.; Arterys (Tempus)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Breast MRI Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. breast MRI market report based on product, imaging technique/contrast use, condition, and end-use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Systems

-

By MRI System Type

-

Closed MRI Systems

-

Open MRI Systems

-

-

By Field Strength

-

1.5 Tesla (1.5T)

-

3 Tesla (3T)

-

7 Tesla (7T)

-

-

By Dimensional Modality

-

3D Breast MRI

-

4D Breast MRI

-

-

-

Coils

-

By Coil Configuration

-

Unilateral Breast Coils

-

Bilateral Breast Coils

-

-

By Channel Count

-

8-Channel Breast Coils

-

16-Channel (or Higher) Breast Coils

-

-

By Functionality

-

Diagnostic-Only Coils

-

Biopsy-Compatible Breast Coils

-

-

-

Software

-

-

Imaging Technique / Contrast Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Contrast-Enhanced MRI (CE-MRI)

-

Non-Contrast / Abbreviated Breast MRI (Ab-MRI)

-

-

Condition Outlook (Revenue, USD Million, 2021 - 2033)

-

Malignant

-

Benign

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals and Clinics

-

Diagnostic Imaging Centers

-

Breast Care Centers

-

Academic & Research Institutes

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. breast MRI market size was estimated at USD 793.6 million in 2024.

b. The U.S. breast MRI market is expected to grow at a compound annual growth rate of 10.05% from 2025 to 2033 to reach USD 1,878.8 million by 2033.

b. The systems segment dominated the U.S. breast MRI market, accounting for 77.76% of total revenue in 2024. This segment dominance can be attributed to the growing adoption of MRI modality for breast cancer management.

b. Some key players operating in the U.S. breast MRI market include GE Healthcare, Siemens Medical Solutions USA, Inc., Koninklijke Philips N.V., CANON MEDICAL SYSTEMS USA, INC., FUJIFILM, United Imaging Healthcare Co., Ltd., AURORA HEALTHCARE US CORP, Quality Electrodynamics (QED), MR Instruments, Inc., iCAD, Inc, Subtle Medical, Inc., and Arterys (Tempus).

b. Key factors driving the market growth include the rising prevalence of breast cancer and the growing demand for medical imaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.