- Home

- »

- Medical Devices

- »

-

U.S. Breast Reconstruction Market, Industry Report, 2030GVR Report cover

![U.S. Breast Reconstruction Market Size, Share & Trends Report]()

U.S. Breast Reconstruction Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Implants, Tissue Expander, Acellular Dermal Matrix), By Shape (Round, Anatomical), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-523-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Breast Reconstruction Market Trends

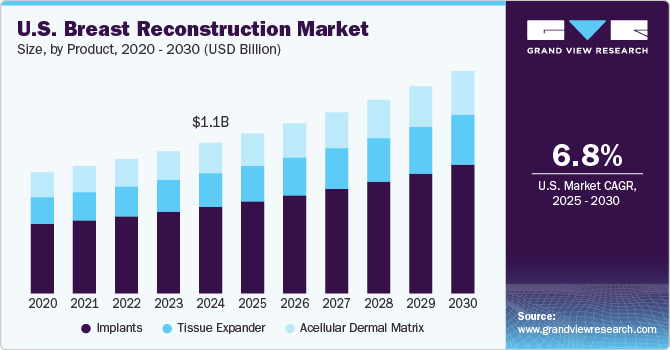

The U.S. breast reconstruction market size was estimated at USD 1.12 billion in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2030. This growth can be attributed to the increasing number of breast cancer survivors seeking reconstruction, growing awareness about breast cancer treatments, advancements in surgical techniques, and rising demand for aesthetic improvements. In addition, the availability of insurance coverage for reconstruction procedures and the increasing adoption of minimally invasive methods contribute to the market growth. As more women undergo mastectomies and look for options to restore breast appearance, the demand for these procedures continues to rise.

The increasing prevalence of breast cancer is anticipated to drive market growth. For instance, as per a report by American Cancer Society, Inc., in 2025, an estimated 316,950 women in the U.S. will be diagnosed with invasive breast cancer. As the number of breast cancer cases increases, more women seek reconstruction procedures to restore their breast shape and appearance after surgery. This growing demand for post-mastectomy reconstruction drives the market, as patients look for options to regain confidence and improve their quality of life after cancer treatment.

Moreover, many organizations sponsor numerous awareness campaigns. For instance, in January 2025, The Breast Reconstruction Awareness (BRA) campaign, a joint effort by the American Society of Plastic Surgeons (ASPS) and The Plastic Surgery Foundation (The PSF), aims to empower women facing breast cancer to make informed decisions about reconstruction. BRA educates women, their families, caregivers, and the media about breast reconstruction options, emphasizing that this aspect of breast cancer care continues to be relevant and important until a woman is fully informed.

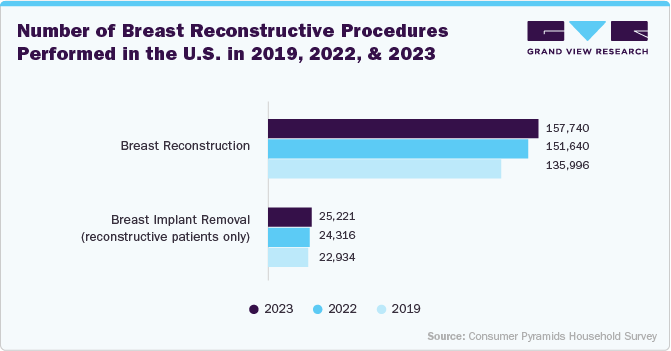

The growing adoption of breast reconstructive procedures coupled with rising awareness among women about breast reconstruction procedures for beauty enhancement is another major driver of the U.S. breast reconstruction market. This surgery is most commonly adopted by women to enhance breast size for reconstruction applications following mastectomy, which is expected to drive market growth over the forecast period.

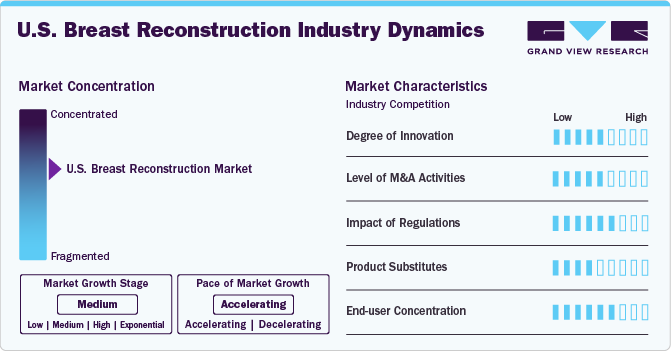

Market Concentration & Characteristics

The degree of innovation in the U.S. breast reconstruction market is high, with continuous advancements in surgical methods, implant materials, and technologies. New options like 3D-printed implants, tissue engineering, and minimally invasive procedures are improving the safety, effectiveness, and aesthetic outcomes of breast reconstruction. These innovations aim to provide more personalized, natural-looking results and reduce patients' recovery times.

Regulations play a significant role in the U.S. breast reconstruction market, with the FDA ensuring that all products, like implants and surgical devices, meet strict safety and quality standards. Manufacturers must undergo rigorous testing and comply with regulations before their products can be used in surgeries. While this process can slow down the approval of new products, it helps maintain high safety standards and ensures patient protection during breast reconstruction procedures.

The level of mergers and acquisitions (M&A) in the U.S. breast reconstruction market is growing. Larger companies are acquiring smaller firms with innovative products or specialized technologies, helping them expand their offerings and strengthen their market position. This trend supports increased research and development, leading to better products and wider availability for patients seeking breast reconstruction options.

In the U.S. breast reconstruction market, there are few substitutes for surgical procedures like implants or tissue flaps. While alternatives like external prosthetics exist, they do not provide the long-term, natural-looking results that reconstruction surgeries offer. As a result, breast reconstruction remains the preferred option for women seeking a permanent solution after mastectomy.

The end-user concentration in the U.S. breast reconstruction market is diverse, with hospitals and surgical centers being the main buyers due to the high volume of surgeries they perform. Other important users include outpatient clinics and specialty medical centers. These facilities depend on advanced breast reconstruction techniques and products to provide effective care for patients after mastectomy.

Product Insights

The implants segment dominated the market in 2024. This dominance is because they offer a widely accepted, effective, and minimally invasive solution for restoring breast shape after mastectomy. They are preferred due to their ability to provide natural-looking results, shorter recovery times, and lower risk compared to other options like tissue flaps. The availability of different types of implants, such as silicone and saline, further contributes to their popularity, making them the go-to choice for many patients and surgeons.

The tissue expander segment is expected to witness the fastest growth in the U.S. breast reconstruction market. This can be attributed to its ability to gradually stretch the skin and create space for permanent implants. This technique is popular because it offers a more flexible, controlled approach to breast reconstruction, allowing for better results, especially in cases where there is limited skin or tissue after a mastectomy. As patients and surgeons seek less invasive, more customizable options, tissue expanders are becoming an increasingly preferred choice in the market.

Shape Insights

The round shape segment dominated the market in 2024. This dominance is because they offer a fuller, more symmetrical appearance, which many patients prefer. They are also easier to place during surgery and provide more predictable results, making them a popular choice for both surgeons and patients. Their versatile shape suits a wide range of body types, contributing to their dominance in the market compared to other shapes like anatomical. According to a research article published in the Journal of Plastic, Reconstructive & Aesthetic Surgery in 2023, where plastic surgeons were interviewed, around 20% of round-shaped breast implants are preferred for breast reconstruction by plastic surgeons. This is expected to boost demand for these breast implants

The anatomical shape segment is expected to witness the fastest growth in the U.S. breast reconstruction market due to its more natural, teardrop-like appearance, which closely resembles the natural shape of a woman’s breast. Many patients prefer this shape for a more aesthetically pleasing and subtle result. As demand for more personalized and realistic outcomes grows, anatomical implants are gaining popularity, especially for women looking for a more natural look after reconstruction.

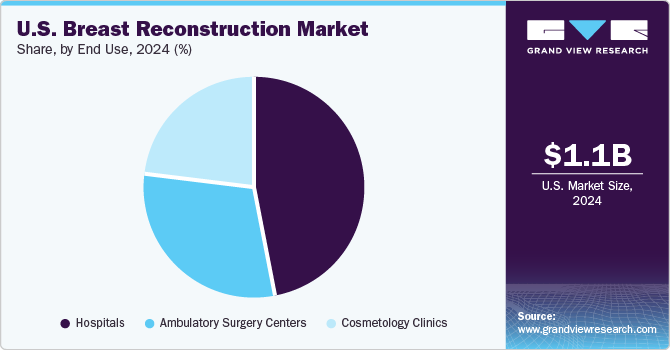

End Use Insights

The hospitals segment dominated the market in 2024. Hospitals perform the highest number of mastectomy and reconstruction surgeries. They have the resources, specialized staff, and advanced technology needed for these complex procedures. As a result, hospitals are the primary settings for breast reconstruction, attracting a large number of patients who need both medical care and surgical expertise in one place. According to the ASPS Procedural Statistics Release, in 2023, around 57% of reconstructive procedures were performed in hospitals. Therefore, owing to the above-mentioned factors, the hospitals segment is expected to hold the largest share of the end use segment over the forecast period.

The Ambulatory Surgery Centers (ASCs) segment is expected to grow at the fastest CAGR over the forecast period. Compared to hospitals, ASCs provide patients with several benefits, such as faster recovery time and same-day discharge. As surgical techniques become more advanced, most reconstructive procedures can now be performed at ASCs. They are also less expensive than inpatient surgeries. As ASCs are cost-effective, they provide significant cost savings to patients. Due to these factors, the number of ASCs has been rapidly growing.

Key U.S. Breast Reconstruction Company Insights

Key market players are adopting various strategies such as product launches, approvals and others to increase their market presence and get competitive advantage over other market players. These advancements in U.S. breast reconstruction market are anticipated to boost market growth over the forecast period.

Key U.S. Breast Reconstruction Companies:

- Mentor Medical Systems (Johnson & Johnson)

- Allergan, Inc. (AbbVie)

- Sientra, Inc. (Acquired by Tiger Aesthetics Medical, LLC)

- Ideal Implant, Inc. (Bimini Health Tech.)

- Establishment Labs

- RTI Surgical

- Integra LifeSciences Corporation

Recent Developments

-

In January 2024, Establishment Labs announced the commercial launch of Motiva Implants in China and the completion of the first procedure with Motiva Flora SmoothSilk Tissue Expander in the U.S. Establishment Labs' strategic moves in China and the U.S. demonstrate their commitment to expanding their market presence and offering advanced breast implant technologies.

-

In November 2023, RTI Surgical received FDA IDE approval for the clinical investigation of Cortiva allograft dermis in breast reconstruction. This technique involves placing a breast implant and using additional materials to create the desired breast shape and size. Cortiva allograft dermis supports the implant and improves tissue integration. RTI Surgical, in consultation with the FDA, designed a comprehensive clinical study to assess the safety and effectiveness of Cortiva allograft dermis in breast reconstruction.

-

In June 2023, Sientra, Inc. announced that AlloX2 Pro Tissue Expander received U.S. FDA 510k clearance. The innovative AlloX2 tissue expander's proprietary dual port technology was built upon, and the AlloX2 Pro expands on it by removing 95% of the metal typically found in tissue expander ports. Due to this innovation, the AlloX2 Pro was the only tissue expander approved in the U.S. suitable for exposure to MRI, a crucial screening method for patients undergoing breast reconstruction

U.S. Breast Reconstruction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.19 billion

Revenue forecast in 2030

USD 1.65 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

product, shape, end use

Key companies profiled

Mentor Medical Systems (Johnson & Johnson); Allergan, Inc. (AbbVie); Sientra, Inc. (Acquired by Tiger Aesthetics Medical, LLC); Ideal Implant, Inc. (Bimini Health Tech.); Establishment Labs; RTI Surgical; Integra LifeSciences Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Breast Reconstruction Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. breast reconstruction market report based on product, shape, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Silicone Breasts Implants

-

Saline Breasts Implants

-

-

Tissue Expander

-

Saline Expander

-

Air Tissue Expander

-

-

Acellular Dermal Matrix

-

-

Shape Outlook (Revenue, USD Million, 2018 - 2030)

-

Round

-

Anatomical

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cosmetology Clinics

-

Ambulatory Surgery Centers

-

Frequently Asked Questions About This Report

b. The U.S. breast reconstruction market size was estimated at USD 1.12 billion in 2024 and is expected to reach USD 1.19 billion in 2025.

b. The U.S. breast reconstruction market is expected to witness a compound annual growth rate of 6.83% from 2025 to 2030 to reach USD 1.65 billion by 2030.

b. Implants segment dominated the U.S. breast reconstruction market with a share of 57.54% in 2024. This is attributable to their ability to provide natural-looking results, shorter recovery times, and lower risk compared to other options like tissue flaps.

b. Some key players operating in the U.S. breast reconstruction market include Mentor Medical Systems (Johnson & Johnson); Allergan, Inc. (AbbVie); Sientra, Inc. (Acquired by Tiger Aesthetics Medical, LLC); Ideal Implant, Inc. (Bimini Health Tech.); Establishment Labs; RTI Surgical; Integra LifeSciences Corporation.

b. Key factors that are driving the market growth include the increasing number of breast cancer survivors seeking reconstruction, growing awareness about breast cancer treatments, advancements in surgical techniques, and rising demand for aesthetic improvements

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.