- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Cigar And Cigarillos Market Size, Industry Report, 2033GVR Report cover

![U.S. Cigar And Cigarillos Market Size, Share & Trends Report]()

U.S. Cigar And Cigarillos Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Mass, Premium), By Flavor (Unflavored, Flavor), By Distribution Channel (Offline, Online), And Segment Forecasts

- Report ID: GVR-4-68040-727-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cigar & Cigarillos Market Summary

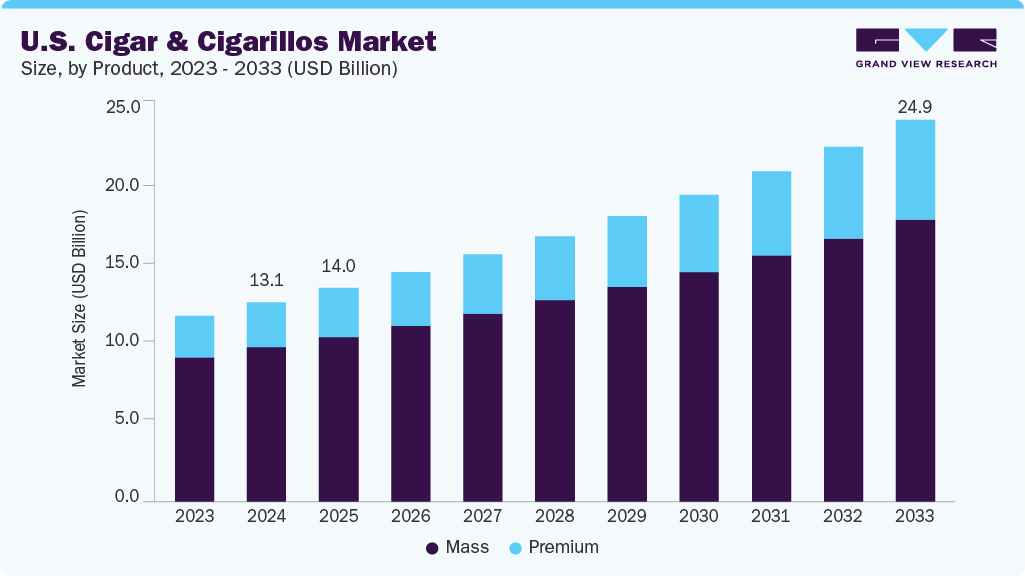

The U.S. cigar and cigarillos market size was estimated at USD 13.07 billion in 2024 and is projected to reach USD 24.97 billion in 2033, growing at a CAGR of 7.5% from 2025 to 2033. The major driving factor for the growth of the market includes the rising popularity of cigar lounges and parlors, particularly in urban cities such as Chicago and Los Angeles, which are fostering a culture around cigar smoking.

Key Market Trends & Insights

- The U.S. cigar and cigarillos market was valued at USD 13.07 billion in 2024.

- The U.S. cigar and cigarillos market is growing at a 7.5% CAGR over the forecast period.

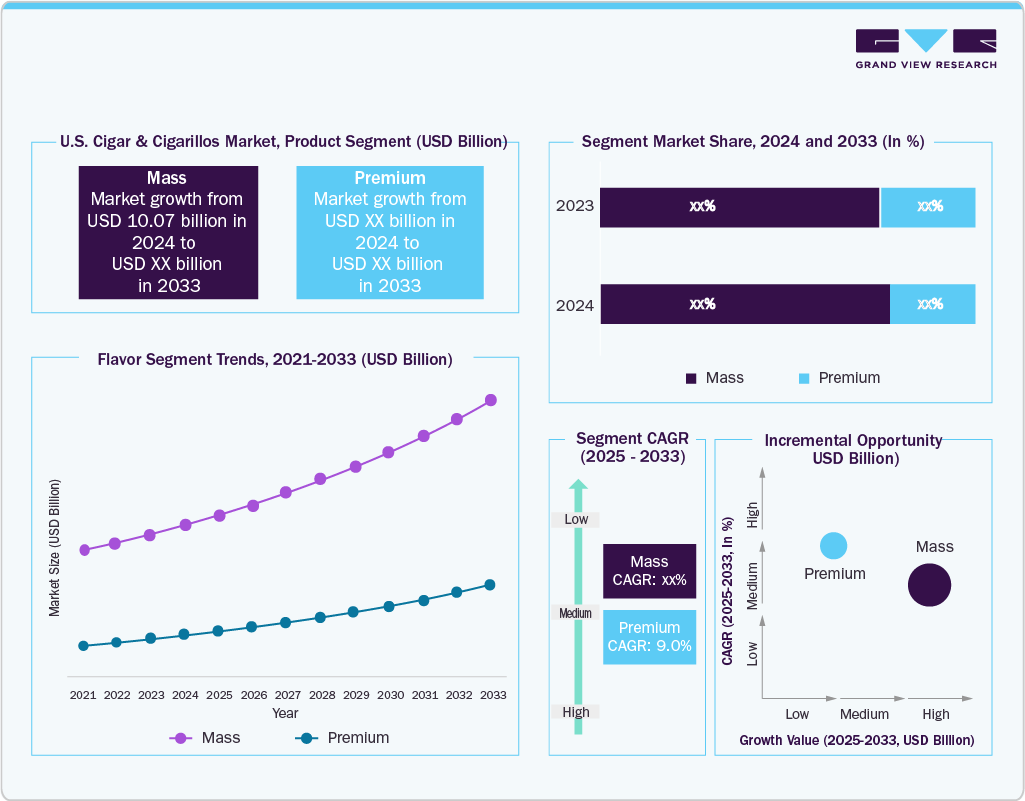

- By product, the mass segment accounted for a share of 77.1% in the U.S. cigar & cigarillos market in 2024.

- By flavor, the flavored segment dominated the U.S. cigar & cigarillos market, accounting for a share of 53.5% in 2024.

- By distribution channel, the online segment is growing at a significant CAGR of 8.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 13.07 Billion

- 2033 Projected Market Size: USD 24.97 Billion

- CAGR (2025-2033): 7.5%

- Miami, Tampa, Las Vegas, and New Orleans are popular destinations for cigar smoking in the U.S.

This trend is contributing to an increase in demand for both cigars and cigarillos, as these venues offer a social space for enthusiasts to enjoy their products in a communal setting. In addition, the growing establishment of cigar lounges across the U.S. is expected to further boost the consumption of cigars. According to After Burners Cigar Lounge, LLC in 2023, there are about 7,684 legally registered and licensed cigar lounge/smoke shop businesses scattered across the U.S.; thus, the growing number of cigar lounges across the U.S. is a major driving factor for the growth of the market during the forecast period.

The increasing consumer demand for premium and luxury tobacco products, especially from millennials in the U.S., is a major driving factor for the growth of the market. Cigar and cigarillos are often associated with a higher social status and a symbol of wealth, leading to their popularity among affluent consumers. This trend is particularly strong in the U.S., where there is increased demand for premium tobacco products. The changing lifestyle in the U.S. is increasing the consumption of tobacco products, which in turn is fueling the market's growth. Flavored products have gained popularity, particularly among younger consumers drawn to the variety of flavors available, such as fruit, chocolate, and alcohol-infused options. This has led to an expansion of the product range, catering to diverse consumer preferences. Thus, increasing consumption of flavored cigars is aiding in the growth of the market during the forecast period.

Moreover, legislation by government bodies, such as the passing of bills aimed at expanding the number of smoking lounges, will create lucrative opportunities for the luxury cigar market, which in turn expands the growth of the cigars and cigarillos market in the U.S. For instance, Assembly Bill 451, introduced in the Wisconsin State Assembly in October 2023, signals the potential opening of new cigar bars, marking the first such opportunity since 2009. Assembly Bill 451, which has received support from the Premium Cigar Association (PCA), has been forwarded to the State Affairs Committee for further consideration. This proposed change in the law will allow more establishments to offer cigar-smoking experiences and broaden the options for cigar enthusiasts. Thus, with the growth of cigar lounges, cigar enthusiasts likely to have greater access to dedicated spaces for an enhanced smoking experience. This may attract existing and potential cigar aficionados, making luxury cigars more readily available to a broader consumer base.

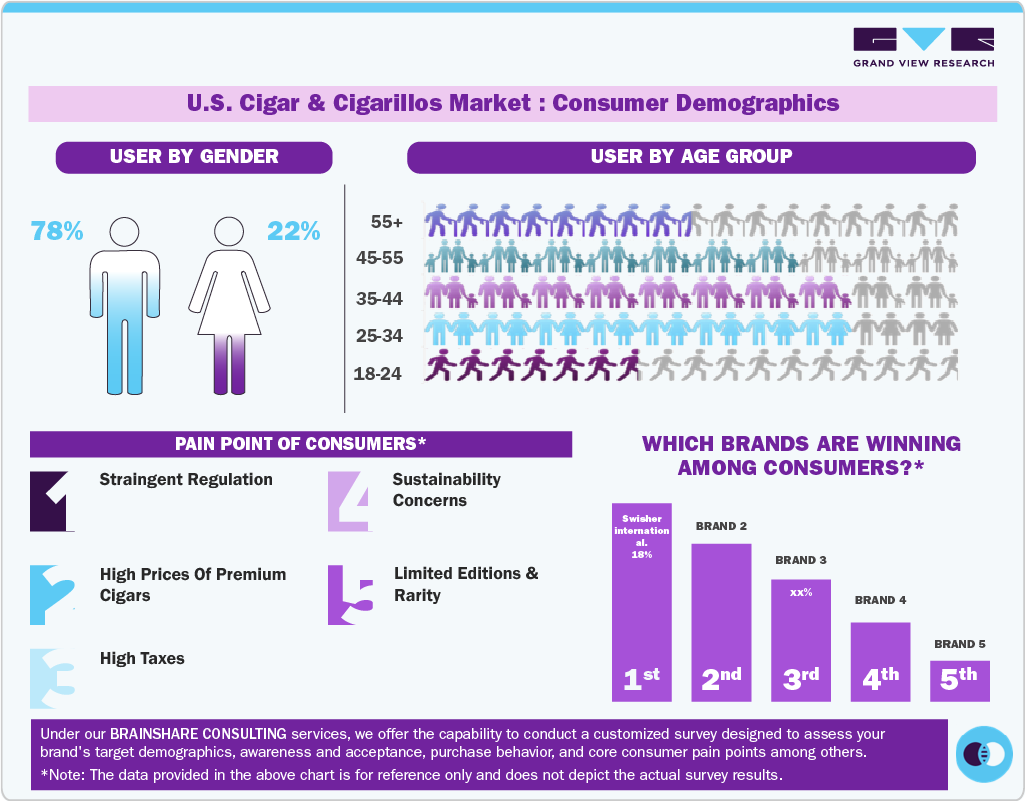

Consumer Insights for the U.S. Cigar and Cigarillos Market

Cigar consumers in the U.S. are increasingly inclined towards consuming organic tobacco, which has been steadily growing in recent years as consumers become more health-conscious and environmentally aware. Some consumers in the cigar market are increasingly interested in cigars produced using sustainable and ethical practices. They may seek out brands that prioritize responsible sourcing and manufacturing.

Consumption habits in the U.S. are heavily tied to social and cultural experiences. The core decision revolves around the quality and flavor of the cigar & cigarillos. Enthusiasts seek cigars & cigarillos with unique flavor profiles, excellent construction, and consistent quality. For instance, Swisher Sweets is well-known for its wide variety of flavored cigarillos, which are affordable and accessible. The company offers options infused with fruit flavors, making them popular among casual smokers. Individual preferences for cigar size, shape, strength, and flavor significantly influence purchase choices. What one person enjoys might not be enjoyable for another.

Flavor is a major determinant in consumer preferences for cigars, such as trends observed in e-cigarette consumption. According to the National Library of Medicine, consumers often prefer specific flavors, which can drive their purchasing choices. For instance, sweeter flavors tend to have higher appeal, while others may prefer more traditional tobacco flavors.

Product Insights

The mass cigar and cigarillos segment accounted for a share of 77.1% in 2024, owing to factors such as affordability and the variety of flavors available, which are attracting many young millennials. Moreover, the high availability of mass cigars in different flavors, such as mint, chocolate, menthol, and vanilla, is also a major driving factor for the growth of the segment. These flavors not only enhance the smoking experience by masking the harshness of tobacco but also make the products more enticing to novice users who might be trying tobacco for the first time. The sweet and aromatic flavors can reduce the barrier to entry for young consumers, who the strong taste of traditional tobacco products might otherwise put off.

The premium cigar and cigarillos segment is expected to expand at the fastest CAGR of 9.0% during the forecast period. The growth in the premium category is attributed to the increasing demand for luxury cigars among premium smokers and millennials. The rising use of tobacco among millennials, along with the emergence of numerous high-end cigar lounges globally, has increased the demand for luxury cigars. The growth of private clubs, cigar lounges, and the online retail sector is driving the popularity of luxury cigars. Cigar retailers have witnessed a substantial surge in their sales. This growth can be attributed to various factors, including an increasing consumer interest in premium cigars, a favorable economic climate, and potential changes in smoking habits. Moreover, the growing import of premium cigars on account of increasing demand for premium types of cigars is a major driving factor for the growth of the market. For instance, according to a report published by the Cigar Association of America, the U.S. imported an estimated 467.6 million premium cigars in 2023, which is a 0.7 percent increase from the previous year.

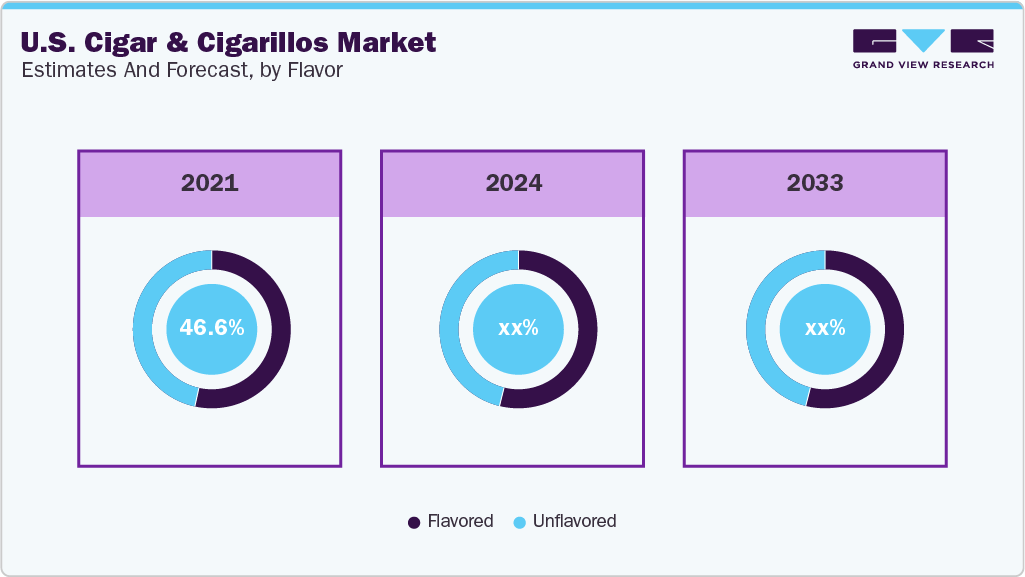

Flavor Insights

The sale of flavored cigar and cigarillos in the U.S. accounted for a revenue share of 53.5% in 2024. The growing introduction of diverse and appealing flavor options to cater to a wide range of customers in the U.S. is a major driving factor for the market's growth. Manufacturers are infusing cigars and cigarillos with a range of flavors, from traditional notes such as vanilla and chocolate to more exotic options such as fruit and spices. This factor is aiding the market's growth during the forecast period. The high availability of flavored cigars and cigarillos, available in a variety of fruit, spice, and alcohol-inspired flavors, has witnessed increased traction due to their novelty and taste. This has led to an expansion in the product portfolio of many manufacturers, who are keen to capture this segment by offering a wide range of flavored options.

The unflavored cigar and cigarillos segment is expected to expand at a CAGR of 7.3% during the forecast period. Key factors driving the sales of unflavored cigars & cigarillos include consumer preferences, regulatory environments, and changing market dynamics. The major driver for the increasing demand for unflavored cigars includes increasing consumption of natural and authentic tobacco. As consumers become increasingly health-conscious and wary of the additives and flavors used in various tobacco products, there has been a shift toward products perceived as less adulterated. Tobacco-flavored cigars and cigarillos without added flavors appeal to those who prioritize pure tobacco taste, often associated with higher quality or a more traditional smoking experience.

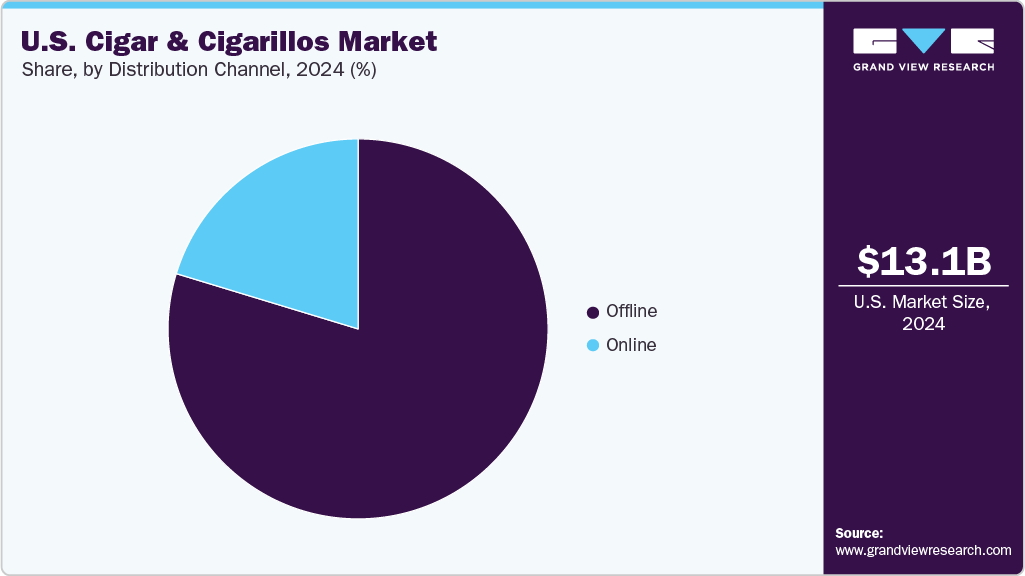

Distribution Channel Insights

The sale of cigar and cigarillos through the offline channel accounted for a share of 79.7% in 2024. The high availability of an extensive range of choices of cigars and cigarillos through offline sales channels is a major driving factor for the growth of the segment. The increased adoption of e-commerce channels for online shopping is attributed to their convenience. Cigar and cigarillo companies with an offline presence provide customers with the luxury to choose from a variety of standard to premium brands. Due to its seamless shopping experience, which satisfies modern consumers' preference for efficiency and convenience, it increases customer satisfaction and loyalty, which is a major driving factor for the growth of the segment during the forecast period.

The sale of cigar and cigarillos through online channels is expected to expand at a CAGR of 8.9% from 2025 to 2033. The expansion of the online distribution channel in the cigar and cigarillos market can be attributed to several driving factors. Consumers in the U.S. are opting for online platforms for cigar shopping due to factors such as convenience. These platforms provide a hassle-free shopping experience, allowing customers to explore, choose, and purchase cigars and cigarillos from the comfort of their own homes.

Other prominent features of the high adoption of the online sales channel include extensive product descriptions, customer feedback, and educational content that allow customers to make well-informed decisions while buying cigars and cigarillos. This transparency and easy access to information enrich the online shopping experience, assisting customers in choosing cigars that perfectly match their tastes and meet their expectations.

Key U.S. Cigar And Cigarillos Company Insights

The U.S. cigar and cigarillos market is characterized by the existence of global brands as well as local cigar brands, which has resulted in a high intensity of competitive rivalry. The U.S. is also experiencing an upsurge in demand from teenagers or young smokers, which is coupled with changing lifestyles and increasing cigar clubs and lounges, which are assisting these key market participants in generating greater demand for their vast product portfolios.

Key U.S. Cigar And Cigarillos Companies:

- Altria Group Inc.

- British American Tobacco

- C. Fuente Holdings, Inc.

- Gurkha Cigars

- JT International SA

- Oettinger Davidoff AG

- Imperial Brands plc (Habanos S.A.)

- Burger Holding AG

- Scandinavian Tobacco Group A/S

- Swisher International Inc.

Recent Developments

-

In August 2024, Gurkha Cigar Group introduced an exclusive cigar called Fantasma, specifically for Specs, a Texas-based retailer. This limited-edition release features a unique blend of Nicaraguan and Dominican tobaccos, wrapped in a dark, oily San Andrés wrapper. The Fantasma is presented in a coffin-style box, with only 500 boxes available, each containing 10 cigars. This launch reflects Gurkha's commitment to offering premium and distinctive products tailored for select partners, enhancing the experience for cigar enthusiasts.

-

In April 2024, Gurkha Cigar Group launched a collection of six premium cigars for the travel retail market. The collection comprises the Gurkha Beauty, Cellar Reserve (15 Year), Cellar Reserve Edición Especial (18 Year), Cellar Reserve (15 Year) 10th Anniversary, Cellar Reserve 21 Year, and Gurkha 35th Anniversary, along with a stainless-steel cutter. The specialty box features copper-gold foil designs and Gurkha's iconic soldier figure with crossed swords. The box showcases the cigars through a window and is the perfect gift for travelers. This limited-edition product follows the success of a similar offer released in the U.S. during the 2023 holiday season and marks Gurkha's increasing focus on the travel retail market.

U.S. Cigar And Cigarillos Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.02 billion

Revenue Forecast in 2033

USD 24.97 billion

Growth rate

CAGR of 7.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

product, flavor, distribution channel

Key companies profiled

Altria Group Inc.; British American Tobacco; C. Fuente Holdings; Inc.; Gurkha Cigars; JT International SA; Oettinger Davidoff AG; Imperial Brands plc (Habanos S.A.); Burger Holding AG; Scandinavian Tobacco Group A/S; Swisher International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cigar And Cigarillos Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. cigar & cigarillos market report based on product, flavor, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Mass

-

Premium

-

-

Flavor Outlook (Revenue, USD Million, 2021 - 2033)

-

Unflavored

-

Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. cigar and cigarillos market size was estimated at USD 13.07 billion in 2024 and is expected to reach USD 14.0 billion in 2025.

b. The U.S. cigar and cigarillos market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2033 to reach USD 24.97 billion by 2033.

b. Mass cigar and cigarillos accounted for the largest revenue share of 77.1% in 2024. Their popularity is driven by affordability, wide availability, and appeal to price-sensitive consumers seeking accessible alternatives to premium cigars.

b. Some key players operating in the U.S. cigar and cigarillos market include Altria Group Inc.; British American Tobacco; C. Fuente Holdings, Inc.; Gurkha Cigars; JT International SA; Oettinger Davidoff AG; Imperial Brands plc (Habanos S.A.); Burger Holding AG; Scandinavian Tobacco Group A/S; Swisher International Inc.

b. The major driving factor for the growth of the market includes the rising popularity of cigar lounges and parlors, particularly in urban cities such as Chicago and Los Angeles, which are fostering a culture around cigar smoking.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.