- Home

- »

- Medical Devices

- »

-

U.S. Clear Aligners Market Size, Share, Trends, Report, 2030GVR Report cover

![U.S. Clear Aligners Market Size, Share & Trends Report]()

U.S. Clear Aligners Market (2024 - 2030) Size, Share & Trends Analysis Report By Age (Adults, Teens), By End-use (Hospitals, Standalone Practices), By Dentist Type (General Dentists, Orthodontics), By Duration, By Material, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-200-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

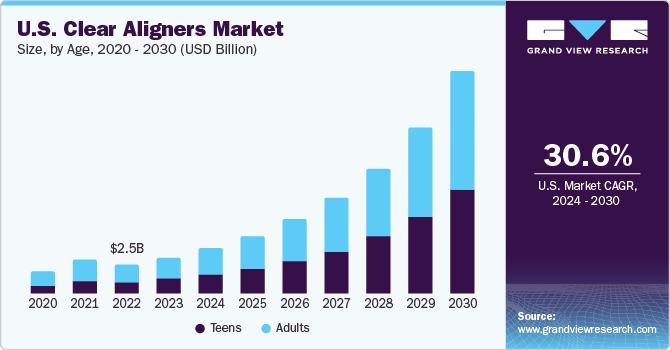

The U.S. clear aligners market size was valued at USD 2.49 billion in 2023 and is expected to grow at compound annual growth rate (CAGR) of 30.6% from 2024 to 2030. The market is expected to witness a lucrative growth rate owing to the increasing prevalence of malocclusions, and a robust presence of advanced infrastructure & technology, such as CAD/CAM software solutions & digital radiography. Increasing customization of dental procedures with the integration of advanced technologies, such as digital impression systems can efficiently treat mild to moderate misalignment conditions.

The increasing cases of dental flaws and malocclusions paired with the effectiveness of clear aligner system in treating these dental conditions are some of the significant factors boosting the market growth. According to the WHO, malocclusion is the third most dominant dental disorder, after dental caries and periodontal disease. Malocclusion causes misalignment in teeth that can cause severe oral health problems over a prolonged period. This health condition is genetic and often causes tooth overcrowding and abnormal bite patterns.

According to the American Association of Orthodontics, over 4 million people in the U.S. use dental braces and over 25% people of this population are above the age of 18 years. Clear aligners have increasingly gained acceptance as an enhanced alternative to conventional teeth straightening tools, as they are convenient and esthetically appealing to wear. Earlier, clear aligners were deployed to treat only trivial oral problems; however, with advancements in technology, they are being adopted in treating more severe issues. Class I & II cases of misalignment can now be treated by clear aligners, which is widely accepted by numerous patients across the U.S.

Market Concentration & Characteristics

The prevalence of oral disorders is surging rapidly and with this surge, the need for advancements in orthodontics is also increasing. Digital computer imaging and 3D technology to create an accurate fit are being increasingly used in orthodontic practices. 3D impression scanners, Nickel and Copper-Titanium Wires, digital scanning technology additive fabrication, CAD/CAM appliances, incognito lingual braces, temporary anchorage devices, and clear aligners are among the latest advancements leading to delivery of more efficient, customized, predictable, and effective orthodontic treatments.

The U.S. clear aligners market is characterized by a high level of M&A activities undertaken by leading players. This is due to factors including the increasing focus on enhancing companies' products & services portfolio, the need to consolidate in a rapidly growing market, and the increasing strategic importance of aesthetic treatments. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in January 2024, Align Technology acquired Cubicure GmbH. This acquisition aimed to support Align's strategic innovation roadmap and reinforce the Align Digital Platform.

Implementation of Affordable Care Act in the U.S. and subsequent increase of excise tax on specific medical devices manufactures in the country have significantly impacted the profitability and revenue of small and medium industry players. Additionally, several organizations including the World Dental Federation are implementing awareness programs to encourage good oral health.

A major trend in the clear aligner market is launching new and innovative products or software technology, which can make it easy for orthodontists to track the alignment changes. For Instance, in November 2021, SDC announced the U.S. launch of SmileOS, a treatment planning software that allows affiliated doctors of the company to treat more patients accurately. SmileOS helps predict tooth movements and supports various treatment options.

Companies such as Align Technology, Inc., SDC, and Dentsply Sirona have a strong presence in the North American markets and have established many manufacturing facilities in the region. However, these companies are also focusing on market expansion in European and Asian countries. For instance, Align Technology, Inc., which is a major player in the U.S. market, is increasingly focusing on expansions into the international markets by making its products available in more countries.

Age Insights

Adults dominated the market with a revenue share of 60.2% in 2023. During COVID-19 times adult population had to attend web meetings, which highlighted the importance of dental aesthetics resulting in high penetration of clear aligners among the target population. In the orthodontics segment, aligners are one of the fastest-growing dental treatments. Patients regard aligners as a comfortable, convenient, and discreet solution.

The teens segment is expected to expand at a significant CAGR over the forecast period. According to the NCBI, Class I and Class II malocclusions have the highest prevalence and the adoption of clear aligners that are helpful in treating this condition has gradually increased. This is attributed to the fact that many teenagers prefer avoiding discomfort caused by the metal braces and desire to look aesthetically appealing.

End-use Insights

The standalone practices segment dominated the market with a revenue share of 52.9% in 2023. Several orthodontists recommend clear aligner treatment as it provides healthier periodontal tissue and there is reduced risk of enamel decalcification compared to metal brackets. Furthermore, there are numerous benefits associated with choosing private/standalone dental services. Some of these benefits include a wider range of dental treatments, shorter wait times, specialized & quality service as well as high adoption of the latest equipment, and quality materials.

The group practices segment is projected to grow at a significant CAGR over the forecast period. Group dental practices are carried out at a single location with multiple dentists. With high cost of business and increased government oversight through regulations & mandates, the acceptance of dental group practice has been increasing. As per the American Dental Association, dentistry market is highly fragmented with over 86% of the private practice. According to Richmond Dental, many dentists are opting for group practice model to minimize costs and liabilities, as well as maximize their earning potential while adopting advanced technologies.

Dentist Type Insights

The orthodontists segment held the largest market share of 67.6% in 2023. This is attributable to the fact that doctors refer a significant number of patients to dental specialists for therapies including clear aligner treatments. Orthodontists have expertise in the correction, treatment, and prevention of misalignment of the teeth or jaw.

The general dentists (GD) segment is anticipated to grow at a prominent growth rate over the forecast period. With the increasing demand for cosmetic restoration and clear aligner treatments, the adoption of clear aligner services has surged among general dentists. Numerous manufacturers in the market are now entering into strategic partnerships with general dentists and are providing them with the necessary training and support to use clear aligner treatment in their dental practices.

Duration Insights

The medium treatments (treatment > 6-12month/ 20-40 sets of aligner) segment held the largest market share of 49.4% in 2023. Majority of dental misalignment cases are treated within the timeframe of 6 to 12 months. In addition, the duration of treatment also depends on the severity of orthodontic complexities. Issues including minor gaps between the teeth can be treated within 6 months; however, the duration may vary, depending on the condition. As per Fine Orthodontics, an orthodontic clinic in the U.S, the average time for clear aligner treatment is 12 months, especially among teenagers.

The small little beauty alignments segment is projected to depict a remarkable growth rate over the forecast period. Dental conditions including diastema and minor crowding with less complexity can be treated in 6 months. The increasing need to enhance dental aesthetics among the adult population in the U.S. is fueling the segmental growth.

Material Insights

The polyurethane segment held the largest market share of 77.2% in 2023. The dominance is attributable to the widespread adoption of polyurethane-based Invisalign clear aligners. Polyurethane is adopted to create both hard and soft parts of aligners because of its versatile characteristics. This material helps in devising robust components wherein the teeth can be fitted into alignment, while still being soft enough to be worn for prolonged durations.

The others segment is projected to witness significant growth rate over the forecast period. Other materials include polyethylene (PE), polyethylene terephthalate (PET), and polypropylene. The increasing advancements in the materials used is likely to bring about major transformations in the applications of clear aligners. For instance, in February 2022, OraPharma announced the launch of custom clear aligner system that is made of high-performance material with three-layer design. The high quality plastic material is crack resistant and is proven to stay clearer longer.

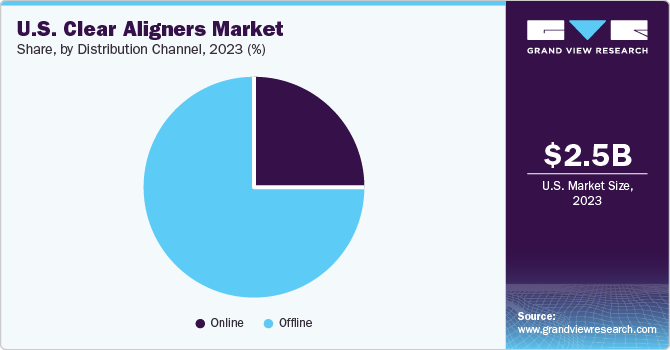

Distribution Channel Insights

The offline segment held the highest market share of 74.8% in 2023. Clear aligners are pitched to General Dentists (GDs), dental specialists, dental laboratories, orthodontists, DSOs and third-party distributors. Key market players in the U.S. carry out its sales operations primarily through offline channels. The provision of discounts by these players is further boosting the segment growth. For instance, Invisalign sometimes offers lucrative discounts, encouraging dentists and orthodontists to actively sell teeth-straightening aligners, which increases their profit per patient.

Online channel is the fastest growing distribution channel owing to the increasing trend of Direct-to-Consumer (DTC) business model, clear aligner companies have witnessed high adoption of the online sales channel. Furthermore, this is the current trend in the market, and will open new growth avenues for the players in the U.S. market.

Key U.S. Clear Aligners Company Insights

Some of the key players operating in the market include Align Technology and Dentsply Sirona among others. 3M, Ormco Corporation (Envista Corp), and TP Orthodontics, Inc. are some of the emerging market participants in the market.

One of the key factors driving competiton among market players is the rapid adoption of advanced digital technology including intraoral scans, digital tooth set-ups, 3D printers, and CAD/CAM appliances. Moreover, a significant number of these players are rapidly opting for strategic expansions and collaborations for product innovation, increasing their geographical presence, and increasing sales volume. For instance, in April 2023, Henry Schein Inc. entered into a partnership with Biotech Dental Group for making expansion in its digital workflow, provide clear aligner solutions to customers, and improve clinical results for dental professionals.

Key U.S. Clear Aligners Companies:

- Dentsply Sirona

- Ormco Corporation (Envista)

- Henry Schein, Inc.

- SmileDirectClub

- Align Technology, Inc.

- Argen Corporation

- TP Orthodontics, Inc.

- 3M

Recent Developments

-

In February 2022, Ormco Corporation announced Release 12 of its Spark Clear Aligners with groundbreaking clinical innovations, case-planning enhancements, and product optimization for delivering more efficiency, control, and flexibility to doctors.

-

In October 2022, Align Technology announced the launch of the iTERO Exocad connector for enabling doctors with advanced visualization in the field of digital orthodontics that includes the treatment of clean aligner.

-

In February 2021, the Align Technology announced the commercial availability of Invisalign G8 with SmartForce Aligner Activation, which is integrated with its biomechanics innovation software.

U.S. Clear Aligners Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.15 billion

Revenue forecast in 2030

USD 15.59 billion

Growth rate

CAGR of 30.6% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age, end-use, dentist type, duration, material, distribution channel

Country scope

U.S.

Key companies profiled

Dentsply Sirona; Ormco Corporation (Envista); Henry Schein, Inc.; SmileDirectClub; Align Technology, Inc.; Argen Corporation; TP Orthodontics, Inc.; 3M

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Clear Aligners Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. clear aligners market based on age, end-use, dentist type, duration, material, and distribution channel:

-

Age Outlook (Revenue in USD Million, 2018 - 2030)

-

Adults

-

Teens

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Stand Alone Practices

-

Group Practices

-

Others

-

-

Dentist Type Outlook (Revenue in USD Million, 2018 - 2030)

-

General Dentists

-

Orthodontists

-

-

Duration Outlook (Revenue in USD Million, 2018 - 2030)

-

Comprehensive Malfunction ( treatment > 12month/ > 40 sets of Aligner)

-

Medium Treatments (treatment > 6-12month/ 20-40 sets of Aligner)

-

Small Little Beauty Alignments

-

-

Material Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Polyurethane

-

Plastic Polyethylene Terephthalate Glycol

-

Others

-

-

Distribution Channel Outlook (Revenue in USD Million, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. clear aligners market was estimated at USD 2.49 billion in 2023 and is expected to reach USD 3.15 billion in 2024.

b. The U.S. U.S. clear aligners market is expected to grow at a CAGR of 30.6% from 2024 to 2030 to reach USD 15.59 billion in 2030.

b. Adults dominated the market with 60.2% in 2023. During COVID-19 times adult population had to attend web meetings, which highlighted the importance of dental aesthetics resulting in high penetration of clear aligners among the target population.

b. Some of the key players operating in the market include Align Technology and Dentsply Sirona among others. 3M, Ormco Corporation (Envista Corp), and TP Orthodontics, Inc. are some of the emerging market participants in the market.

b. Key factors that drive market growth include the increasing prevalence of malocclusions, and a robust presence of advanced infrastructure & technology, such as CAD/CAM software solutions & digital radiography.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.