- Home

- »

- Medical Devices

- »

-

U.S. Clinical Trial Imaging Market Size, Industry Report, 2030GVR Report cover

![U.S. Clinical Trial Imaging Market Size, Share & Trends Report]()

U.S. Clinical Trial Imaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Services (Clinical Trial Design & Consultation Services, Reading, & Analytical Services), By Modality (CT, MRI, X-Ray), By Application (NASH, CKD, Diabetes), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-240-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Clinical Trial Imaging Market Trends

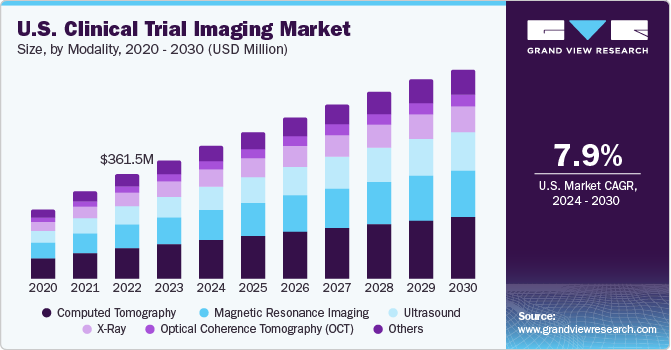

The U.S. clinical trial imaging market size was estimated at USD 408.5 million in 2023 and is expected to grow at a CAGR of 7.9% from 2024 to 2030. The market's growth is expected to be fueled by rapid growth and increasing investments in the pharmaceutical and biotechnology sectors. Also, the surge in R&D initiatives for new drug development is advantageous for market growth.

The presence of established CROs in the U.S. providing clinical trial services and the increasing number of clinical trials are driving the demand for clinical trial imaging solutions. According to estimates by Clinicaltrial.gov, as of December 2023, there were 145,218 registered studies for clinical trials in the country, accounting for 31% of total clinical trials globally. A high percentage of clinical trials across the U.S. is creating lucrative opportunities for the market players. Furthermore, high R&D spending on clinical trials has supplemented market growth. In October 2021, the FDA approved over 11 new clinical trial research, which resulted in USD 25 million in funding for four years. These grants support the development of advanced medical devices and imaging technologies for treating various diseases.

In 2023, the U.S. accounted for a market share of over 36.0% in the global clinical trial imaging market. The growing concerns about diagnostic safety and efficiency of medical imaging devices have contributed to the demand growth for clinical trial imaging. The increased adoption of medical imaging technology in primary care settings, enhanced accessibility, and high healthcare spending in the country with efficient reimbursement policies are opportunistic for market growth.

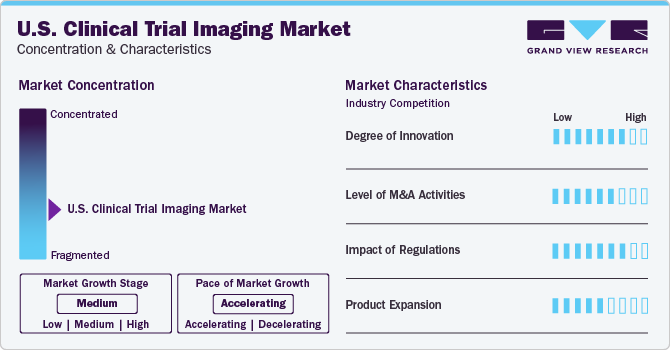

Market Characteristics & Concentration

The industry growth stage is medium (CAGR 5-10%), and the pace of the growth depicts an accelerating trend. The U.S. clinical trial imaging industry needs to be more cohesive, which is marked by the presence of many companies. The industry is in a moderate growth stage and will continue its trajectory over the forecast period.

Digitization in biomedical research paves the way for overall demand. Companies increasingly adopt big data analytics and machine learning to mine large datasets to uncover intricate patterns, predict outcomes, and refine trial designs. Machine learning algorithms analyze complex datasets, offering insights that aid in personalizing treatment approaches and predicting patient responses. This data-driven approach optimizes protocols & expedites decision-making processes. Moreover, the implementation of Blockchain ensures secure, transparent, & immutable data sharing, enhancing the integrity and traceability of trial data. Thus, digitization of clinical trials streamlines the process and increases the chances of successful trials.

The U.S. clinical trial imaging industry is characterized by a moderate level of M&A and collaboration activities undertaken by key manufacturers. Numerous players in the country are collaborating with other relevant companies to strengthen their portfolios and expand their reach. For instance, in October 2022, VIDA Diagnostics, Inc. entered a strategic partnership with RAYUS Radiology to commence 150+ locations as sites for clinical trial imaging. The sites were planned to cater to quality image acquisition and data management concerns.

Strict regulatory policies regarding patient enrollment significantly restrict the clinical trial market growth. Although these regulations are necessary to ensure patient safety, maintaining ethical conduct, & data accuracy, they pose numerous challenges for conducting clinical trials. These stringent criteria lead to fewer eligible participants, often resulting in delayed trial initiation and completion, impacting overall market growth. Moreover, these regulations increase operational costs by demanding additional screening, compliance measures, and extensive documentation. Despite such challenges, strict policies assure higher robust results and high-quality data, supporting advanced product development.

Service Insights

Project & data management services were identified as the largest segment, with a 28.7% share in 2023. Clinical trial imaging typically requires robust data management and unified coordination among numerous stakeholders. These services comprise key aspects, such as developing trial workflows, operational expertise, project tracking, transforming scans into digital images, quality assurance, real-time reporting, establishing MRI centres, data management, regulatory approvals, and resolution. Furthermore, the U.S. government has approved a cloud-driven server to secure all medical imaging records while ensuring protection against natural disasters. This system enables faster and more convenient retrieval of critical medical records.

System and technology support services are projected to grow significantly over the forecast period. This segment covers support services throughout various imaging modalities, such as MRI, ultrasound, CT, PET, OCT, and SPECT, which find applications in oncology, neurology, gastroenterology, cardiovascular diseases, musculoskeletal disorders, and medical device research for conducting clinical trials. The technological advancements in devices are anticipated to fuel the segment's growth.

Modality Insights

Computed Tomography (CT) scans captured the highest market share of 29.1% in 2023. CT scans deliver more detailed images of the body's internal structures than conventional radiography. Patients are generally more comfortable with CT than MRI because the machine is less noisy and faster. A CT scan generally lasts 5 to 10 minutes compared to 30 minutes in the case of an MRI. As factors such as patient movement and breath-holding do not affect the quality of the image produced, CT is the preferred imaging modality, especially among the paediatric & geriatric population.

The ultrasound segment is expected to grow at the fastest CAGR during the forecast period. The growing use of ultrasound technology in cardiovascular and abdominal diseases is expected to boost market demand in the country. Furthermore, increasing public and private investments in developing advanced ultrasound technologies, training programs, and teleradiology services are likely to aid market growth.

Application Insights

Oncology clinical trial imaging held the largest market share of 26.7% in 2023. The number of people diagnosed with cancer is expected to increase multi-fold in the upcoming decade. Factors including the growing prevalence of cancer cases and the increasing need for advanced therapies for treating different types of cancer are projected to fuel the segment's growth. Oncology clinical trials involve complicated imaging requirements owing to the need to analyse tumour’s and disease progression. Different imaging modalities, including MRI, CT scans, PET scans, and others, are deployed to evaluate the efficacy of cancer treatments.

The Non-alcoholic Steatohepatitis (NASH) segment is anticipated to grow fastest during the forecast period. The prevalence of NASH is expected to increase to over 63% by 2030, fuelling the need for its treatment. Companies in this market are enhancing clinical trial studies to evaluate the efficiency of therapies adopted for NASH. This is projected to be opportunistic for the segment growth.

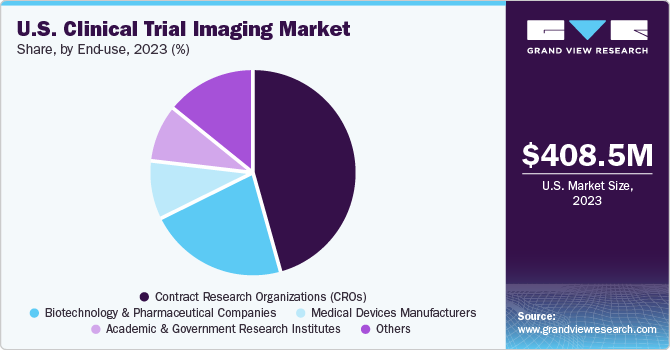

End Use Insights

The contract research organizations (CROs) segment accounted for the largest share of 45.9% in 2023. Many pharmaceutical and biotechnology companies are increasingly outsourcing clinical trials to specialized contract research organizations (CROs) to leverage their expertise, reduce costs, and accelerate the drug development process. CROs cater to a wide range of full-time and functional services to support different development stages.

The academic and government research institutes segment is expected to grow significantly over the forecast period. The increasing focus on developing novel therapeutics, the growing prevalence of rare diseases, and the rising number of clinical trials in terms of experimental & observational studies are some factors supporting segment growth. Moreover, the surging number of research institutes and the growing focus on discovering novel ways to conduct clinical trials & avoid the usage of animal models are some factors augmenting segment growth.

Key U.S. Clinical Trial Imaging Company Insights

The key U.S. clinical trial imaging companies include ProScan Imaging, IXICO plc, and Biomedical Systems Corp. Numerous market players are expanding their global footprint by establishing collaborations, partnerships, and acquisitions to tap into new markets and countries. Collaborations with healthcare providers and research institutions, such as the Mayo Clinic and academic medical centers, are opportunistic to access expertise and assess their technologies in real-world clinical settings.

Key U.S. Clinical Trial Imaging Companies:

- IXICO plc

- Navitas Life Sciences

- Resonance Health

- ProScan Imaging

- Radiant Sage LLC

- Medpace

- Biomedical Systems Corp

- Cardiovascular Imaging Technologies

- Intrinsic Imaging

- BioTelemetry

Recent Developments

-

In September 2023, GE HealthCare announced a strategic collaboration with Mayo Clinic to leverage innovation in the medical imaging and diagnostics sectors. This partnership aimed to drive the growth of advanced technologies and solutions to enhance patient care and medical diagnostics.

-

In March 2023, Clario unveiled the launch of a cloud-based image viewer designed exclusively for clinical trials. This initiative was aimed at streamlining medical image analysis and enhance its accessibility within clinical research.

-

In May 2023, Cleerly entered into a partnership with ProScan Imaging to deliver custom solutions for cardiac health. These solutions comprise analyzing and developing treatment strategies for cardiovascular health condition. The partnership was aimed at leveraging Cleerly's AI-centric platform to evaluate coronary CT angiography (CCTA) images.

U.S. Clinical Trial Imaging Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 720 million

Growth rate

CAGR of 7.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Service, modality, application, end-use

Country Scope

U.S.

Key companies profiled

IXICO plc; Navitas Life Sciences; Resonance Health; ProScan Imaging; Radiant Sage LLC; Medpace; Biomedical Systems Corp; Cardiovascular Imaging Technologies; Intrinsic Imaging; BioTelemetry

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Clinical Trial Imaging Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. clinical trial imaging market based on service, modality, application, and end-use:

-

Service Outlook (Revenue, 2018 - 2030)

-

Clinical Trial Design And Consultation Services

-

Reading And Analytical Services

-

Operational Imaging Services

-

System and Technology Support Services

-

Project and Data Management

-

-

Modality Outlook (Revenue, 2018 - 2030)

-

Computed Tomography

-

Magnetic Resonance Imaging

-

X-Ray

-

Ultrasound

-

Optical Coherence Tomography (OCT)

-

Others

-

-

Application Outlook (Revenue, 2018 - 2030)

-

NASH

-

CKD

-

Diabetes

-

Cardiovascular Diseases

-

Ophthalmology

-

Musculoskeletal

-

Oncology

-

Gastroenterology

-

Pediatrics

-

Others

-

-

End-use Outlook (Revenue, 2018 - 2030)

-

Biotechnology And Pharmaceutical companies

-

Medical Devices Manufacturers

-

Academic And Government Research Institutes

-

Contract Research Organizations (CROs)

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. clinical trial imaging market size was estimated at USD 408.5 million in 2023 and is expected to reach USD 456.9 million in 2024.

b. The U.S. clinical trial imaging market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 720.0 million by 2030.

b. Project and data management services segment held the market with the largest revenue share over 25% in 2023. Clinical trials that utilize imaging often require comprehensive data management and seamless coordination among multiple stakeholders.

b. Some key players operating in the U.S. clinical trial imaging market include IXICO plc; Navitas Life Sciences; Resonance Health; ProScan Imaging; Radiant Sage LLC; Medpace; Biomedical Systems Corp; Cardiovascular Imaging Technologies; Intrinsic Imaging; BioTelemetry

b. Key factors that are driving the market growth include growing biotechnology and pharmaceutical sectors, coupled with rising investments in research and development for the creation of new drugs aimed at treating various diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.