- Home

- »

- Automotive & Transportation

- »

-

U.S. Cold Chain Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Cold Chain Market Size, Share & Trends Report]()

U.S. Cold Chain Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Storage, Transportation, Packaging, Monitoring Components), By Temperature Range, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-230-2

- Number of Report Pages: 350

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cold Chain Market Size & Trends

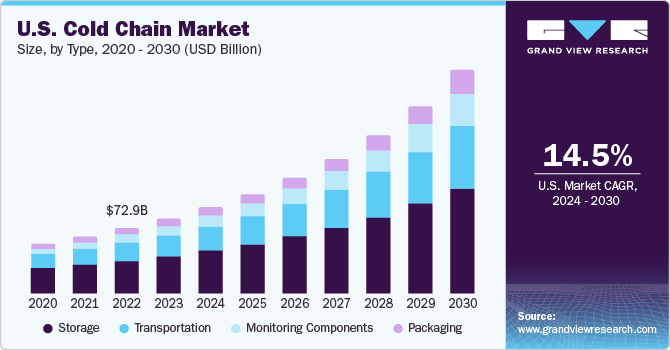

The U.S. cold chain market size was estimated at USD 72.99 billion in 2023 and is projected to grow at a CAGR of 14.5% from 2024 to 2030. The growing automation of refrigerated warehouses and increased consumption of fresh food are expected to further drive the market growth over the forecast period. In addition, the increasing e-commerce sales, rising investment in cold chains, and government initiatives to minimize food waste are expected to boost market growth. Moreover, the cold chain market has benefitted significantly from the growing penetration of sensors and Internet of Things (IoT) technology, among other advanced technologies, providing significant market growth opportunities.

In 2023, the U.S. accounted for approximately 26.9% share of the global cold chain market. The World Trade Organization (WTO) and bilateral free trade agreements, such as the North America Free Trade Agreement (NAFTA), have created opportunities for exporters in the U.S. to increase trade for perishable foods in a manner that is free of import duties.

Increasing consumer trend toward diet has urged food manufacturers to keep track of current trends and adopt new technologies to tap the market. Moreover, growing consumer awareness towards health consciousness has resulted in a surge in demand for fresh and wholesome food alternatives. This has translated into an augmented need for perishable food items like fruits, vegetables, and dairy products. To fulfill this demand, it has become imperative for food manufacturers and suppliers to maintain a temperature-controlled environment during the transportation and storage of these products. An effective cold chain management system can mitigate food waste and enhance the shelf life of the products, resulting in substantial cost savings for manufacturers and distributors, which in turn, is propelling the market growth.

Stringent food safety regulations are compelling food supply chain companies to consider new tools for controlling humidity and temperature while handling food. RFID is one such tool that has significant potential to measure and endure a wide variety of conditions and simultaneously wirelessly transmit sensory information in real-time across the supply chain. Cold chain RFID systems also assist in contaminant monitoring. RFID tags are designed to alert retailers and logistics firms when conditions deviate, allowing them to take necessary actions in case of a hazard. Advances in sensor and RFID technology have enabled greater capabilities at lower costs.RFID devices are more accurate and enable real-time monitoring of pharmaceutical products. An RFID-enabled supply chain provides higher efficiency and has created new value through product-level visibility. Hence, the RFID technology, which makes the supply chain more efficient, has aided in the growth of the cold chain industry.

The cold chain industry requires high initial investments to set up cold storage facilities, transportation networks, and other related infrastructure. High capital investment, high running costs, and the cost required for the scalability of different picking methods are the key factors restraining market companies from automating warehouses. In addition, transportation equipment used in the cold chain, such as refrigerated trucks and containers, is expensive compared to regular vehicles. The high initial investments required to set up a cold chain system can also challenge smaller companies and startups, which may find it difficult to secure the necessary funding to compete with larger established companies.

Market Concentration & Characteristics

The stage of growth of the U.S. cold chain industry is high and the rate of growth is accelerating. Technological advancements have played a significant role in driving investments in the cold chain industry. Real-time temperature monitoring, data analytics, tracking systems, and other cold chain technologies have improved the efficiency and safety of cold chain logistics, making it easier for companies to transport and store temperature-sensitive products. The degree of innovation is moderate when compared to other industries. Aerogels, phase change materials, passive and latent cooling applications, and vacuum insulation panels are some of the few examples of the breakthroughs that will gain further momentum in the coming years

The United States Food and Drug Administration (FDA), through the Food Safety Modernization Act (FSMA), has established stringent regulations for the storage and transportation of perishable food products. The regulatory bodies mandate that all food products be transported and stored in a temperature-controlled environment and that temperature data must be collected and analyzed to ensure adherence to the regulations. Therefore, the impact of regulations significantly affects the cold chain industry.

The market is fragmented with space for both large and small companies. Some of the key companies initiate acquisitions as a strategic move to consolidate market share and gain access to enhanced or evolving technologies. The level of M&A activity is moderate in the cold chain industry.

The direct substitutes to the cold chain industry are very minimal or may exist in a very specific scenario, therefore, the threat of substitution is very low. The regulations and stringent requirements for maintaining specific temperature conditions make cold chain services unique in nature.

The cold chain industry has a high end-user concentration among the food and pharmaceutical industries. Food safety and control measures for preventing foodborne diseases continue to be the major goal for food manufacturers. Faster detection methods such as immunological-based, nucleic acid-based, and biosensor-based are gaining traction in the market. Furthermore, the COVID-19 pandemic has further highlighted the importance of the cold chain industry, particularly in vaccine distribution. The increasing need for safe and effective vaccine distribution led to increased investments in developing cold storage facilities and transportation networks.

Type Insights

Based on type, the market is segmented into storage, transportation, packaging, and monitoring components. The storage segment dominated the market in 2023 with a market share of 50.6%. The large share can be attributed to an increasing preference for packaged foods in the U.S. The changing consumer preferences and varied dietary patterns and lifestyles are driving the demand for frozen foods. This is expected to boost the demand for storage solutions. Therefore, as the demand for packaged food increases, the storage capacities are also increasing, thereby fueling the growth of this segment.

Cold chain systems are critical in the transportation of pharmaceutical and food & beverage products. Due to their specific storage and transportation requirements, these goods necessitate specialized temperature-controlled facilities. This has led companies to invest in developing cold storage facilities and transportation networks to meet the rising demand for temperature-controlled logistics, which is expected to fuel the transportation segment's growth.

The products used in the cold chain packaging market comprise crates, insulated containers & boxes, cold packs, labels, temperature-controlled pallet shippers, and others. Depending on requirements such as volume and the type of temperature-sensitive product, businesses can select a particular cold chain packaging product type. Companies are introducing sustainable shipping products to address growing environmental concerns.

Some factors considered while choosing a packaging product include cost-efficiency and the material of the packaging product. Companies are introducing sustainable shipping products to address growing environmental concerns. For instance, in January 2022, U.S.-based PTG announced the launch of a new recyclable thermal shipper under its TRUEtemp NATURALS line. It maintains a temperature range of between 2°C and 8°C for 72 hours.

The monitoring components segment is anticipated to witness the fastest CAGR of 17.5% from 2024 to 2030. This growth can be attributed to technological advancements and the growing need to ensure shipment integrity, efficiency, and safety. Cold chain monitoring has benefits, such as provisioning a single technology platform to detect temperature breaches and mitigate any potential damages by initiating corrective actions. It can also help in improving predictive maintenance through sensor data analytics. With these advances, the growth of the segment further fuels the market growth.

Efficient cold storage management greatly depends on software and hardware components used for monitoring purposes. Hardware components include data loggers, remote temperature sensors, RFID devices, networking devices, and telematics devices. The stringent regulatory environment in the pharmaceutical industry surrounding the maintenance of product quality has positively influenced the adoption of cold chain temperature monitoring solutions.

Temperature Range Insights

Based on temperature range, the market is categorized into chilled (0°C to 15°C), frozen (-18°C to -25°C), and deep-frozen (below -25°C) segments. The frozen (-18°C to -25°C) segment dominated the market in 2023 with a market share of 63.3% in 2023. The segment is anticipated to register the fastest CAGR of 15.5% over the forecast period. Poultry, cakes & bread, and meat require freezing temperatures to maintain their freshness. This is fueling the requirement for frozen cold chain solutions to preserve the quality of perishable food & beverage and pharmaceutical products. Moreover, the wide availability of cold chain storage and transportation solutions for frozen temperature ranges drives the segment’s growth.

The chilled (0°C to 15°C) segment is expected to grow at a considerable CAGR of 16.6% over the forecast period. To remain fresh, many vegetables, fruits, and meat require chilled temperature ranges, usually between 2°C to 4°C, during transportation. Chilled temperature storage of perishable products such as dairy products prevents deterioration, increasing shelf life. Maintaining the quality of perishable goods and minimizing wastage is driving the segment's growth.

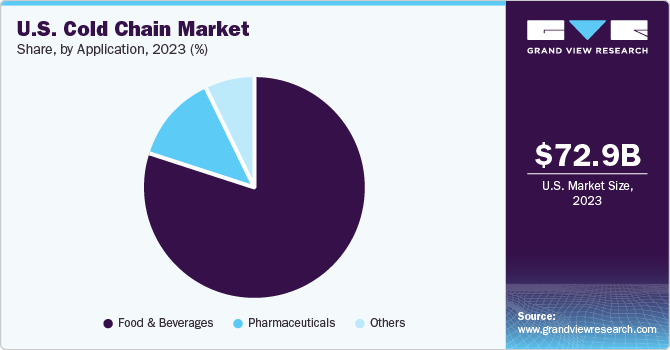

Application Insights

Based on application, the market is categorized into pharmaceuticals, food & beverages, and others segments. The food & beverages segment dominated the market in 2023 with a market share of 79.8%. Technological developments in the storage, packaging, and processing of seafood are anticipated to boost the growth of this segment. However, processed food is projected to grow significantly over the forecast years owing to continued innovations in packaging materials. Advancements in packaging materials increase the shelf life of foods. This has increased the sales of processed foods over the past few years.

The pharmaceuticals segment is anticipated to register the fastest CAGR of 16.0% over the forecast period. The pharmaceutical industry requires maintaining the efficacy and safety of pharmaceuticals, which is driving the segment growth. The cold chain in the pharmaceutical industry is driven by stringent regulatory norms as the pharmaceutical industry has many stringent regulations in the products' storage, packaging, and transportation because of safety and hygiene issues.

Key U.S. Cold Chain Company Insights

Some of the key companies operating in the market include United States Cold Storage, LINEAGE LOGISTICS HOLDING, LLC; and Americold Logistics, Inc.; among others.

-

United States Cold Storage is a temperature-controlled logistics and warehousing company that offers cold storage logistics, facilities, and services. The company provides logistics and transport solutions for frozen and refrigerated food products. It specializes in public warehousing, distribution, transportation services, cold storage, layer picking, dry warehousing, blast freezing, consolidation programs, automation, and repacking.

-

Wabash National Corporation manufactures semi-trailers and liquid transportation systems for cold storage applications. The company manufactures freight vans, platform trailers, refrigerated vans, intermodal equipment, and liquid tank trailers. It markets its products across commercial transportation, energy, portable storage, emergency management, dairy, food & beverage, chemical, aviation, government, and pharmaceutical industries.

Burris Logistics and Tippmann Group are some of the emerging companies in the U.S. cold chain industry

-

In June 2023, Honor Food, a Burris Logistics Company, acquired Sunny Morning Foods, a well-known dairy brand and food service redistributor headquartered in Fort Lauderdale, FL. Integrating Sunny Morning Foods’ valued products and service reputation into the ONEBURRIS marketplace offerings strengthens its capabilities as a complete supply chain solution. Sunny Morning Foods' Southeast reach, including parts of South America and the Caribbean, extends product offerings and competitive differentiation for Honor Foods.

-

Tippmann Group has two subsidiaries, namely Interstate Warehousing and Tippmann Construction, which specialize in the construction of cold storage and management of frozen and refrigerated distribution centers. Interstate Warehousing manages refrigerated and frozen warehousing needs, offering temperature-controlled and customized distribution solutions for the food industry.

Key U.S. Cold Chain Companies:

- Americold Logistics, Inc.

- Burris Logistics

- LINEAGE LOGISTICS HOLDING, LLC

- Wabash National Corporation

- United States Cold Storage

- Tippmann Group

- NFI Industries

- Penske

- United Parcel Service of America, Inc.

- Carrier

Recent Developments

-

In October 2023, Wabash and Fernweh, an investment firm specializing in the industrial technology sector, have entered into a 49:51 joint venture that will accelerate Wabash’s development and growth of an end-to-end digital platform that enhances the overall experience for dealers, customers, and suppliers through the ease, speed, and convenience of a connected partner ecosystem. Ayna.AI will serve as the implementation partner for the joint venture as it embarks on a journey to scale up over the coming years.

-

In October 2023, Lineage, one of the world’s leading temperature-controlled industrial REITs and integrated solutions providers announced the acquisition of eight facilities from Burris Logistics, a leading temperature-controlled food distribution company. Financial terms of the transaction were not disclosed. The addition of these eight cold storage facilities to Lineage’s warehousing network will provide nearly 1.3 million square feet of capacity and approximately 115,000 pallet positions across facilities in Lakeland, Florida; Jacksonville, Florida; McDonough, Georgia; Edmond, Oklahoma; New Castle, Delaware; Waukesha, Wisconsin; and Federalsburg, Maryland.

U.S. Cold Chain Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 83.9 billion

Revenue forecast in 2030

USD 216.2 billion

Growth rate

CAGR of 14.5% from 2024 to 2030

Historic Data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, temperature range, application

Country scope

U.S.

Key companies profiled

Americold Logistics, Inc.; Burris Logistics; LINEAGE LOGISTICS HOLDING, LLC; Wabash National Corporation; United States Cold Storage; Tippmann Group; NFI Industries; Penske; United Parcel Service of America, Inc.; Carrier

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cold Chain Market Report Segmentation

This report forecasts revenue growths at a country level and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. cold chain market based on type, temperature range, and application.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Storage

-

Facilities/Services

-

Refrigerated Warehouse

-

Private & Semi-Private

-

Public

-

-

Cold Room

-

-

Equipment

-

Blast freezer

-

Walk-in Cooler and Freezer

-

Deep Freezer

-

Others

-

-

-

Transportation

-

By Mode

-

Road

-

Sea

-

Rail

-

Air

-

-

By Offering

-

Refrigerated vehicles

-

Refrigerated containers

-

-

-

Packaging

-

Crates

-

Insulated Containers & Boxes

-

Large (32 to 66 liters)

-

Medium (21 to 29 liters)

-

Small (10 to 17 liters)

-

X-small (3 to 8 liters)

-

Petite (0.9 to 2.7 liters)

-

-

Cold chain bags/Vaccine bags

-

Ice packs

-

Others

-

-

Monitoring Components

-

Hardware

-

Sensors

-

RFID Devices

-

Telematics

-

Networking Devices

-

Others

-

-

Software

-

On-premise

-

Cloud-based

-

-

-

-

Temperature Range Outlook (Revenue, USD Million, 2017 - 2030)

-

Chilled (0°C to 15°C)

-

Frozen (-18°C to -25°C)

-

Deep-frozen(Below -25°C)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Fruits & Vegetables

-

Fruit Pulp & Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice cream

-

Others

-

-

Fish, Meat, and Seafood

-

Processed Food

-

Bakery & Confectionary

-

Others

-

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

Others

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cold chain market was estimated at USD 72.99 billion in 2023 and is expected to reach USD 83.9 billion in 2024.

b. The U.S. cold chain market is expected to progress at a compound annual growth rate of 14.5% from 2024 to 2030 to reach USD 216.2 billion in 2030.

b. The storage segment accounted for the largest revenue share of more than 50% in 2023 in the U.S. cold chain market. It will maintain its dominance over the forecast period owing to an increasing preference for packaged foods globally.

b. The key players operating in the U.S. cold chain market include United States Cold Storage, LINEAGE LOGISTICS HOLDING, LLC, and Americold Logistics, Inc., among others.

b. Key factors driving the U.S. cold chain market include the growing automation of refrigerated warehouses and increased consumption of fresh food.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.