- Home

- »

- Food Additives & Nutricosmetics

- »

-

U.S. Collagen Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Collagen Market Size, Share & Trends Report]()

U.S. Collagen Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Gelatin, Hydrolyzed Collagen), By Source, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-025-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Collagen Market Size & Trends

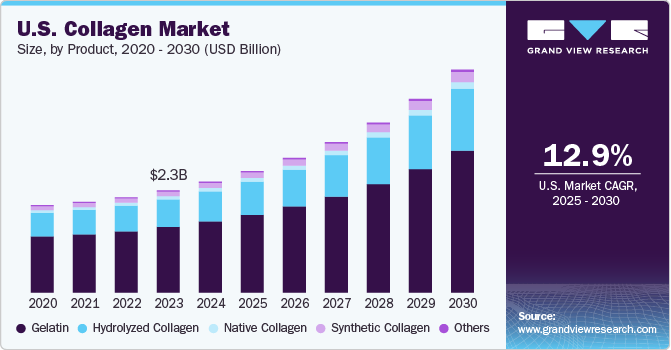

The U.S. collagen market size was estimated at USD 2,458.8 million in 2024 and is projected to grow at a CAGR of 12.9% from 2025 to 2030. The growth can be attributed to significant demand from various end use sectors, including the food & beverage and healthcare & pharmaceutical industries. The market is expected to surge on account of the rising adoption of dietary and beauty supplements by consumers. The product offers a range of benefits that may positively influence its market growth, such as promoting skin hydration, reducing wrinkles, slowing the aging process, enhancing bone density, and supporting muscle development.

In addition, it is anticipated that the market will observe growth as a result of the rising adoption of collagen-based products, which possess excellent features, including emulsification, gelling, and the binding of food products.

Drivers, Opportunities & Restraints

The U.S. market has seen increased demand across various industries, including food and beverage, biomedical materials and devices, cosmetics and wellness, and pharmaceuticals. This heightened demand has been attributed to factors such as rising disposable incomes and an increasing geriatric population, particularly in the U.S. The food and beverage industry is anticipated to significantly contribute to the demand for gelatin and hydrolyzed collagen, given collagen's essential protein content and numerous nutritional, skin, and health benefits. The evolving consumer preferences, along with the approval for the use of gelatin in food products, are expected to propel the U.S. market over the forecast period.

However, the market is expected to face challenges due to concerns about the potential transfer of diseases from animal-based raw materials such as pigskin, cattle hides, and fish scales. The possible transfer of zoonotic diseases from the use of cattle hides as raw materials for collagen extraction is projected to impede market growth. It is important for animal-based raw material suppliers, including meat producers and processors, to be mindful of the prevalence of existing diseases that may pose a risk to human health.

Product Insights

“Hydrolyzed collagen segment is expected to witness growth at 13.3% CAGR over the forecast period.”

The gelatin segment of the market was valued at USD 1,575.6 million in 2024 and is projected to reach USD 3,145.4 million by 2030. Gelatin is produced through the hydrolysis of collagen, which is extracted from various animal sources such as poultry, bovine, porcine, and marine animals. Fish is particularly used for gelatin production due to its low gelling temperatures and melting points. The increasing demand for fish products and supportive government policies are expected to drive the demand for gelatin in the coming years, thereby positively impacting the gelatin market.

Hydrolyzed collagen is predominantly derived from the bones and cartilage of bovine animals through chemical processes to produce small-chain amino acids. This substance finds extensive application in the food processing industry, particularly for the production of confectionery such as hard candies and chocolates. In addition, there is a growing trend among companies to explore product use in the management of bone-related disorders, including osteoarthritis, which is expected to contribute to the segment's growth over the forecast period.

Source Insights

“Marine segment is expected to witness growth at 13.9% CAGR over the forecast period.”

The bovine segment of the market was pegged at USD 881.3 million in 2024 and is projected to reach USD 1,802.3 million by 2030. The bovine source is frequently utilized for extracting collagen, which is present in cow bones, cartilage, and hides. Different grades are derived from these sources. Bovine collagen is widely accessible due to the large cattle population and the increasing production of beef. It is rich in type I and type III collagen, which are known to enhance the strength of bones, muscles, ligaments, and gums, as well as contribute to improved skin health.

Marine collagen, derived from fish scales, is rich in type I collagen, which strengthens skin, nails, hair, ligaments, bones, and muscles. It can be extracted from various marine sources such as sponges, jellyfish, squid, salmon, codfish, and milkfish. Its high absorption rate into the bloodstream effectively improves overall collagen levels in the body, especially in the skin.

Application Insights & Trends

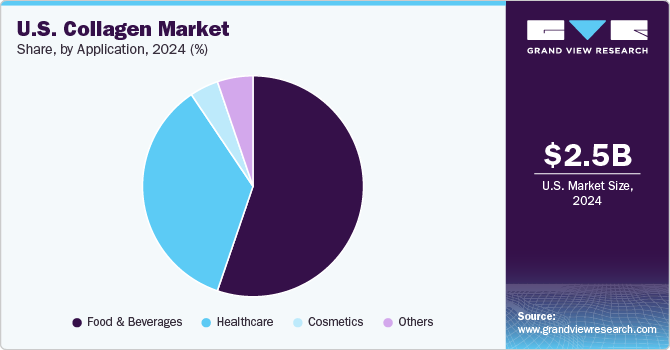

“Food & Beverages segment is expected to witness the highest growth at 13.2% CAGR over the forecast period.”

The food & beverages segment held the largest revenue share of 55.2% of the market in 2024. Functional foods with a base of collagen encompass sports energy bars, powders, butter, margarine, oatmeal, cereals, and wellness shots. Furthermore, gelatin is utilized in various functional food formulations, including jellies, gummy candies, and yogurt. In addition, there is an increasing appreciation for collagen sausage casings, particularly in regions where the origin and quality of food are of significance due to their appealing visual attributes and flavor-enhancing properties. The rising demand for sausages is expected to drive the demand for collagen casings, thereby positively impacting the market growth in the foreseeable future.

The product is further utilized in the treatment of various bone and joint-related conditions, including osteoarthritis, gouty arthritis, and juvenile rheumatoid arthritis. Arthritis, an inflammatory condition, leads to pain, swelling, stiffness, and reduced joint function. The regular consumption of collagen-infused supplements has been shown to reduce inflammation and alleviate joint pain, thereby mitigating the impact of arthritis.

Key U.S. Collagen Company Insights

Some of the key players operating in the market include Rousselot, GELITA AG, and TESSENDERLO GROUP, among others.

-

Founded in 1891, Rousselot manufactures and supplies gelatin and hydrolyzed collagen to the food, pharmaceutical, and healthcare industries. The company operates as a subsidiary of Darling Ingredients, Inc. Its product portfolio includes Gelatin, ProTake, Synergy Systems, StabiCaps, SiMoGel, and Peptan Collagen Peptides.

-

STERLING GELATIN's main focus is on manufacturing and distributing gelatin globally. The company provides its products to the pharmaceutical and food & beverage industries. It sources its gelatin from the meat processing and leather industries. The company's product range includes gelatin suitable for making hard and soft gelatin capsules, vitamin encapsulation, tablets, and tablet binding, and also for food preparation such as canned meat, marshmallows, jellies, mousse, and yogurt, among others.

Key U.S. Collagen Companies:

- Rousselot

- GELITA AG

- Tessenderlo Group

- Weishardt Holding SA

- Juncà Gelatines SL

- Symatese

- Collagen Solutions Plc

- Collagen Solutions Plc

- DSM NV

- Nitta Gelatin, NA Inc.

- Cologenesis HealthCare Pvt. Ltd.

- JBS S.A.

- Croda International Plc

Recent Developments

-

In April 2022, Rousselot announced the launch of GMP-grade GelMA for medical application. This initiative will enhance customer satisfaction with its collagen-based products worldwide.

-

In June 2023, Revive Collagen expanded internationally with Saks Fifth Avenue. The brand will introduce ready-to-drink collagen products, including marine collagen supplements with beauty ingredients and essential vitamins.

U.S. Collagen Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,694.9 million

Revenue forecast in 2030

USD 4,940.9 million

Growth rate

CAGR of 12.9% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, application

Key companies profiled

Rousselot; GELITA AG; Tessenderlo Group; Weishardt Holding SA; Juncà Gelatines SL; Symatese; Collagen Matrix; Inc.; Collagen Solutions Plc; DSM NV; Nitta Gelatin; NA Inc.; Cologenesis HealthCare Pvt. Ltd.; JBS S.A.; Croda International Plc

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Collagen Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Collagen market report based on product, source, and application.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Hydrolyzed Collagen

-

Native Collagen

-

Synthetic Collagen

-

Others

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Porcine

-

Poultry

-

Marine

-

Others

-

-

Application (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

F&B

-

Functional Foods

-

Meat Processing

-

Functional Beverages

-

Dietary Supplements

-

Confectionery

-

Desserts

-

-

Healthcare

-

Bone & Joint Health Supplements

-

Wound Dressing

-

Tissue Regeneration

-

Medical Implants

-

Cardiology

-

Research

-

Drug Delivery

-

-

Cosmetics

-

Beauty Supplements (Nutricosmetics)

-

Topical Cosmetic Products

-

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. collagen market size was estimated at USD 2,458.8 million in 2024 and is expected to reach USD 2,694.9 million in 2025.

b. The global U.S. collagen market is expected to grow at a compound annual growth rate of 12.9% from 2025 to 2030 to reach USD 4,940.9 million by 2030.

b. Bovine sources dominated the U.S. collagen market with a share of 35.8% in 2024. This is attributable to the significant abundance of bovine sources in the country and relatively lower price when compared to marine and porcine sources.

b. Some key players operating in the U.S. collagen market include Rousselot B.V., Geltia AG, Sterling Gelatin, Croda International Plc, Collagen Matrix, and JBS S.A., among others.

b. Key factors that are driving the market growth include high demand from end-use sectors including food & beverage and healthcare & pharmaceutical industry. In addition, the market is expected to benefit by the increasing adoption of collagen-based products due to superior characteristics such as gelling, emulsification, and binding of the food products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.