Market Size & Trends

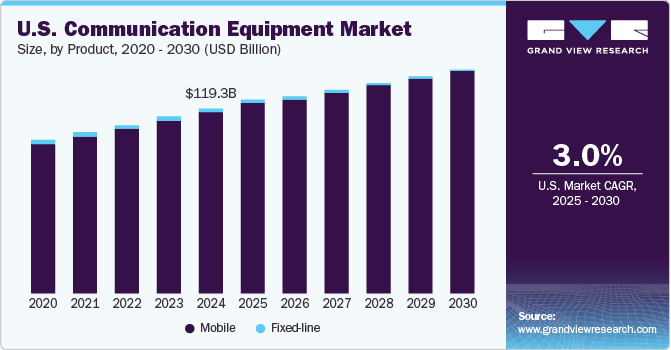

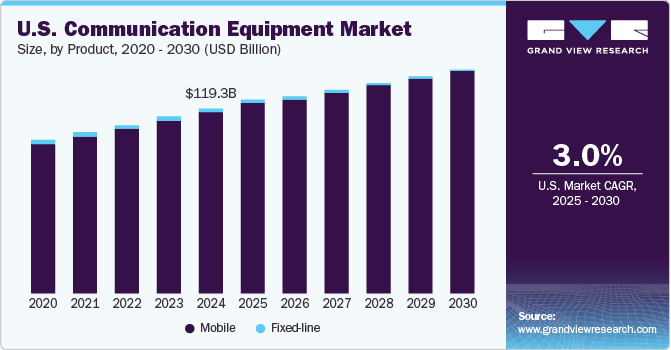

The U.S. communication equipment market size was valued at USD 119.33 billion in 2024 and is expected to grow at a CAGR of 3.0% from 2025 to 2030. The market growth is attributed to the proliferation of high-speed internet, and the rollout of 5G networks is creating a demand for advanced infrastructure to handle increased data loads and faster transmission speeds. The rise of remote work and the growing adoption of Internet of Things (IoT) devices have further heightened the need for robust and scalable networking solutions. Additionally, advancements in technologies such as artificial intelligence (AI) and machine learning (ML) are driving innovation in network management and security, creating new growth avenues.

On the consumer side, the demand for high-speed internet, streaming services, and smart home devices is pushing the need for modern routers and modems. Enterprises are also investing heavily in networking infrastructure to support cloud-based applications, big data analytics, and hybrid work environments. Sectors such as healthcare and education are increasingly relying on robust networking solutions to enable telemedicine and online learning, further contributing to demand growth.

Increased smartphone penetration in the U.S. is estimated to drive the market. On the other hand, extensive usage of wireless communication equipment has led to a subsequent decline in the sales of traditional fixed-line devices and equipment. Mobile devices have become predominant communication equipment owing to the launch of new smartphones with enhanced features and in-built applications.

Enterprises are upgrading their network infrastructure to increase wireless capacity. They are further investing to modernize their network, which is expected to fuel industry growth over the forecast period. Rising mobility applications for enterprise IT will drive new investments in wireless infrastructure. As the Internet-of-Things (IoT) ecosystem continues to expand, the wireless device market is expected to grow over the forecast period.

The expansion of wireless bandwidth capabilities and the increasing investment by telecom operators to deploy high-speed network infrastructure is expected to provide an impetus to the demand for communication equipment compatible with the changing network dynamics. Furthermore, faster and more efficient communication needs and the growing rage of social media are enabling users to adopt Voice over Internet Protocol services, thereby contributing to industry growth.

Product Insights

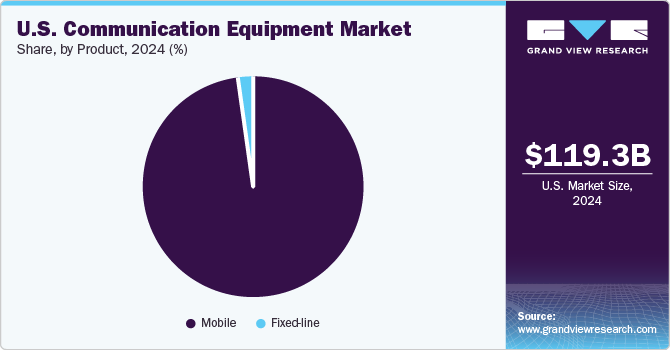

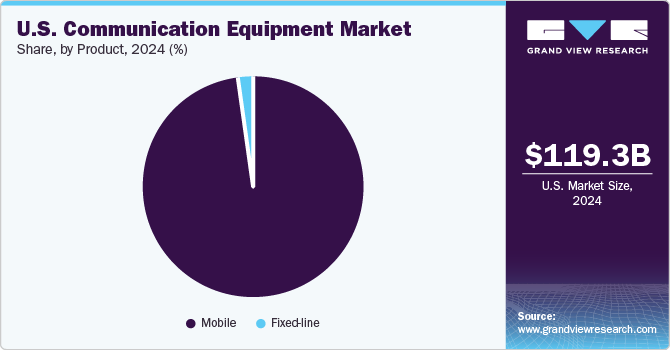

Mobile dominated the market with the largest revenue share of 98.0% in 2024. The proliferation of smartphones and mobile devices has significantly increased the demand for mobile communication equipment, including smartphones, tablets, and related accessories. The rollout of 5G networks and the continuous advancements in mobile technology have further accelerated the adoption of mobile devices, as consumers seek faster data speeds and enhanced connectivity. Additionally, the increasing reliance on mobile devices for daily activities, such as communication, entertainment, and remote work, has contributed to this market dominance. The integration of mobile technology into various sectors, including healthcare, education, and retail, has also boosted the demand for mobile communication equipment.

The fixed-line communication equipment segment contributed a revenue share of less than 2.0% in 2024. The segment is expected to decline owing to the increasing popularity and penetration of wireless devices. Furthermore, as innovations are comparatively low in the fixed-line segment, there has been a growing trend of transition toward better and more efficient networking devices. The industry is witnessing high demand in the mobile devices segment.

Key U.S. Communication Equipment Company Insights

Some key companies in the U.S. communication equipment market include Apple Inc., SAMSUNG All, LG Electronics, Lenovo, and Panasonic Corporation.

-

Apple Inc. is a global leader in the communication equipment industry, offering a wide range of innovative products and services. Its product lineup includes the iPhone, a flagship smartphone renowned for its advanced camera technology and seamless integration with other Apple devices; the iPad, which caters to various needs from professional use to portability; and the Mac series, including the MacBook Air, MacBook Pro, and iMac, known for their sleek design and high performance.

-

Samsung is a major player in the communication equipment market, offering a diverse range of products and solutions. Samsung's enterprise solutions support businesses with mobile devices, wearables, and networking equipment. Samsung's focus on innovation, quality, and customer satisfaction has established it as a leading player in the communication equipment market.

Key U.S. Communication Equipment Companies:

- Apple Inc.

- SAMSUNG All

- LG Electronics

- Lenovo

- Panasonic Corporation

- Xiaomi

- AT&T Intellectual Property

- Google Inc.

- Sony Corporation

- OnePlus

Recent Developments

-

In November 2024, Huawei unveiled its first flagship smartphone utilizing its proprietary HarmonyOS Next, signifying a deepening divide between the U.S. and the Chinese technology landscapes.

-

In July 2024, Cogeco Inc. (CGO-T) launched mobile services in Canada following its recent introduction of wireless coverage in the U.S. through its Breezeline Mobile brand.

U.S. Communication Equipment Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 125.10 billion

|

|

Revenue forecast in 2030

|

USD 144.71 billion

|

|

Growth Rate

|

CAGR of 3.0% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Apple Inc.; SAMSUNG All; LG Electronics; Lenovo; Panasonic Corporation; Xiaomi; AT&T Intellectual Property; Google Inc.; Sony Corporation; OnePlus

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Communication Equipment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. communication equipment market report based on product: