- Home

- »

- Advanced Interior Materials

- »

-

U.S. Composites Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Composites Market Size, Share & Trends Report]()

U.S. Composites Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Carbon Fiber, Glass Fiber), By Manufacturing Process (Layup, Filament, Injection Molding, Pultrusion), By Application (Automotive & Transportation), And Segment Forecasts

- Report ID: GVR-4-68040-213-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Composites Market Size & Trends

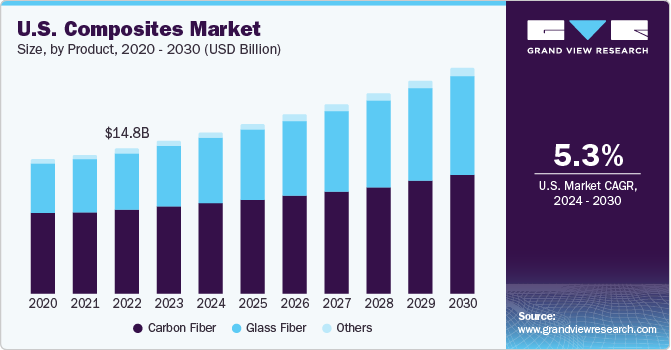

The U.S. composites market size was estimated at USD 15.58 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030. The automotive and transportation industry's need for lightweight components is driving market growth. The increased use of advanced lightweight components in manufacturing industries is also expected to fuel growth during the forecast years. In addition, the market is projected to grow due to rising capacity additions in the electrical and electronics industries, as well as steady growth in the aerospace and automotive sectors.

The increasing demand for lightweight materials in the automotive industry is one of the primary drivers for composites market in the U.S. In the aerospace and defense sectors, the demand for composites is propelled by factors such as the growth in air passenger traffic, leading to an increase in fleet sizes, and the expansion of commercial space aircraft manufacturing activities for space exploration missions by Northrop Grumman Corporation, Space Exploration Technologies Corp, and Virgin Galactic. Moreover, the presence of the leading aircraft manufacturer in the country, The Boeing Company, and the rapid growth of the aerospace industry in the U.S. is expected to drive the demand for composites in the aerospace and defense sectors. The demand is also expected to grow in the defense sector over the forecast period.

The automotive manufacturers in the U.S. are enhancing their technologies to develop vehicles having low pollution, owing to growing environmental concerns and stringent regulations regarding pollution control. The inclusion of composites in automotive production is expected to accelerate market growth progressively due to the implementation of environmental regulations in the country. The wind turbine manufacturing industry is increasingly incorporating composites because of their lightweight properties. Naval patrol boats are being constructed with either an all-composite design or a hull that features an aluminum superstructure. The use of glass composite-based patrol boats is growing in popularity due to their exceptional corrosion resistance, which reduces maintenance expenses and weight. This results in improved speed and fuel efficiency, which is projected to fuel demand for composites in the U.S. industry.

Market concentration and characteristics

The U.S. composite market is marked by a moderate level of innovation owing to the ongoing innovations in composite materials in the aerospace and automotive sectors. PPG Industries introduced PPG ENVIROCRO HeatSense powder coating for heat-sensitive wood and wood-composite products in 2020. This includes medium-density fiberboard (MDF), plywood, hardwood, and similar materials. However, innovation in the composite market does not progress as quickly as in other high-tech industries such as biotechnology and software.

Mergers and acquisitions have been prevalent in the market, with large companies acquiring specialized firms to expand their market share and capabilities. For instance, in 2020, Woodward Inc. merged with Hexcel Corp. in an all-stock transaction, giving it a controlling stake in the combined entity. This merger aimed to create a leading integrated systems provider that would propel the future of flight and energy efficiency.

Regulations moderately influence the market. Although there are safety standards and regulations, they are stable and generally do not pose any barriers to entry or operation for market players. Additionally, companies invest in research and development to introduce new products and cater to customer needs, resulting in a moderate to high level of product expansion in the market.

Product Insights

The glass fiber segment accounted for the largest market share of 58.01% in 2023. The demand for composite materials is on the rise due to various industries such as construction, wind energy, electrical & electronics and automotive & transportation having a wide use for them. Innovations are being made to enhance the strength and durability of these composites, which is making them increasingly prevalent in pipe manufacturing applications. Furthermore, the need for high-strength materials in the automotive and aerospace sectors is expected to drive market growth in the coming years. Glass fibers are preferred in various applications in the transportation sector, such as deck lids, engine covers, air ducts, underbody systems, and front-end modules, due to their superior strength, stability, flexibility, heat resistance, lightness, and durability.

The carbon fiber segment accounted for a significant market share In 2023. This growth was due to its remarkable properties, such as a high strength-to-weight ratio, high-temperature tolerance, high stiffness, low thermal expansion, and high chemical resistance. Due to these characteristics, carbon fiber is used in building and construction, military & defense, and sporting equipment. Carbon fiber is made up of carbon atoms bonded together in crystals aligned parallel to the fiber, and these fibers are combined with other materials to form a composite. Carbon fiber reinforced polymer is formed by molding carbon fiber with plastic resin. In the aircraft sector, sandwich structures made of carbon fiber-reinforced polymer composite materials are extensively used for both interior and exterior applications.

Silicon carbide fiber, aromatic polyamide fiber, and hybrid fiber are among the other composite products. Silicon carbide fiber is a rare mineral known as moissanite, and it is composed of carbon and silicon. It has exceptional properties such as high-temperature resistance, high modulus, high tensile strength, and good heat resistance.

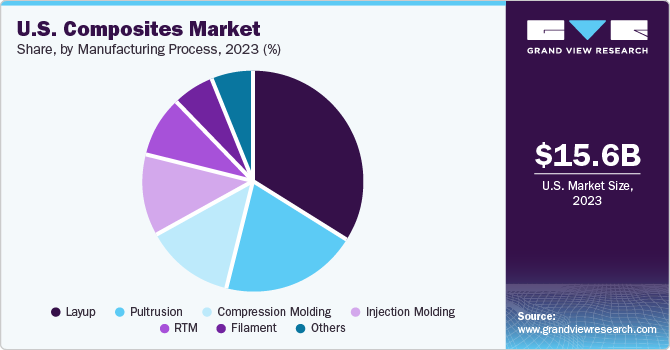

Manufacturing Process Insights

The layup process dominates the market and was responsible for the largest revenue share of 34.3% in 2023. The layup process segment in the global composites market is expected to grow during the forecast period due to the increasing production of boats, wind turbine blades, and architectural moldings. Wet layup processes are cost-effective and help to produce various shapes and sizes of composite products that are used in different applications such as marine prototypes and storage tanks. Dry layup processes use pre-impregnated fibers, also known as prepregs, which are molded in a cavity under high temperature and pressure. This process produces more uniform and even composites that are mechanically stronger than wet layup products due to the curing conditions.

The Pultrusion process had a significant market share in 2023, due to its ability to work with thermoplastic matrices such as polyethylene terephthalate (PET) and polybutylene terephthalate (PBT). This can be achieved either by surrounding the matrix with sheet material or by powder impregnation of the glass fiber. This process allows manufacturers to create solid or hollow profile-like pipes, flat bars, tubing, channels, rods, and other products.

Furthermore, the Injection molding process also held a significant market share in 2023. This process is widely used for manufacturing various kinds of composites, and the products made by injection molding are used in many different end-use industries due to the availability of a wide range of products in terms of shape, size, and properties. The process involves preparing a mixture of resin and fiber and pouring the heated mixture into a predetermined mold as required. The resin mixture is then allowed to cool and set in the mold.

Application Insights

The automotive and transportation segment led the market and accounted for the largest market share of 21.91% in 2023, owing to the advantages provided by composites, such as fuel saving due to their lightweight nature. However, the high cost of composite products has prevented their widespread use in high-end vehicles. Nonetheless, technological advancements in reducing vehicle weight are anticipated to increase the demand for carbon composites, given the superior properties of these materials, such as durability and lightweight, which are beneficial for designing and manufacturing automotive parts.

The electrical and electronics sector accounted for a significant market share. In 2023, due to the lightweight and cost-effective solutions that composites provide to the industry. Moreover, the heat-resistant quality of composites has led to increased usage of electronic goods that are prone to overheating. Additionally, composites are used to produce electronic connections, electrical housing, meter boxes, laptops, handheld devices, and switch panels.

The other application segment, which includes composites used in the medical sector, saw a significant revenue share in 2023. Composites are replacing glass and metals in medical applications due to their superior properties, which enable the production of a wide range of products to cater to different application requirements. For instance, composites are used in X-ray couches, components of MRI scanners and C scanners, mammography plates, surgical target tools and devices, tables, wheelchairs, walking aids, and stretchers. Moreover, composites are preferred for manufacturing sports equipment due to their reduced weight, low maintenance, durability, and ease of transportation. Examples of sporting equipment manufactured using composites include golf clubs, skis, tennis rackets, bicycles, and badminton rackets.

Key U.S. Composite Company Insights

In the U.S., several established players dominate the composites market and most of these players focus on direct sales to end-users in various industry verticals. Additionally, a few companies utilize an established sales and distribution network to reach customers in different regions with ease.

Key players operating in the market include Owens Corning; Hexcel Corp.; and Huntsman Corporation LLC.

-

Owens Corning has three main business segments including roofing, insulations, and composite. The composite division produces glass mats and glass fibers, which are directly sold to a limited number of shingle manufacturers.

-

Hexcel Corp. is a manufacturer of composite materials and structural parts. The company is a major producer of carbon fibers in the United States and collaborates with over 1,000 suppliers to provide raw materials, goods, and services. It operates in two business units: Composite Materials and Engineered Products.

DuPont; PPG Industries, Inc., and Woodsward Inc. are the other participants in the U.S. composite market

-

DuPont has a presence in six different segments, which are agriculture, electronics & communication, industrial bioscience, nutrition & health, performance materials, and safety & protection. Its product range caters to various industries, including food & beverage, government & public sector, automotive, building & construction, energy, marine, healthcare & medical, safety & protection, plastics, mining, electronics, and agriculture.

Key U.S. Composite Companies:

- Owens Corning

- Woodsward Inc.

- Hexcel Corp.

- PPG Industries, Inc.

- Huntsman Corporation LLC

- DuPont

- Weyerhaeuser Company

- Momentive Performance Materials, Inc.

- Cytec Industries (Solvay. S.A.)

Recent Developments

-

In February 2024, Owens Corning has announced their definitive agreement to acquire all outstanding shares of Masonite for $133.00 per share in cash. The deal represents a premium of about 38% to Masonite’s closing share price and about 46% to Masonite’s 20-day volume-weighted average price. The transaction value is around $3.9 billion, implying a purchase multiple of approximately 8.6x 2023E adjusted EBITDA2 or 6.8x when including synergies of $125 million.

-

In September 2023, Huntsman Corporation announced the start of construction on the 30-ton MIRALON® carbon nanotube materials plant. This plant, which is one of the largest of its kind in the Americas, converts methane gas to carbon nanotubes and clean-burning hydrogen. It is a significant step forward in commercializing the innovative MIRALON® technology and brings the industry closer to an industrial-scale production facility.

-

In February 2020, DuPont announced its plan to significantly expand the global capacity for DuPont™ Nomex® paper. This investment is aimed at increasing and sustaining the reliability of supply to better meet the growing needs of the aerospace, automotive, and electrical infrastructure markets. A joint venture partnership with Nippon Paper Papylia was formed to create this capacity expansion.

U.S. Composite Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.39 billion

Revenue forecast in 2030

USD 22.99 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, manufacturing process, application

Key companies profiled

Owens Corning; Woodsward Inc.; Hexcel Corp.; PPG Industries, Inc.; Huntsman Corporation LLC; DuPont; Weyerhaeuser Company; Momentive Performance Materials, Inc.; Cytec Industries (Solvay. S.A.)

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Composite Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. composite market report based on product, manufacturing process, and application.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbon Fiber

-

Glass Fiber

-

Others

-

-

Manufacturing Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Layup

-

Filament

-

Injection Molding

-

Pultrusion

-

Compression molding

-

RTM

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Wind Energy

-

Construction & Infrastructure

-

Pipes & Tanks

-

Marine

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. composites market size was estimated at USD 15.58 billion in 2023 and is expected to reach USD 16.39 billion in 2024.

b. The U.S. composites market is expected to grow at a compound annual growth rate a CAGR of 5.3 % from 2024 to 2030 to reach USD 22.99 billion by 2030.

b. The glass fiber composites accounted for the largest revenue share of 58% in 2023. Wide application demand from construction, wind energy, electrical & electronics, and automotive & transportation industries is expected to increase the demand for glass fibers.

b. Some key players operating in the composites market include Toray Industries, Inc., Owens Corning, PPG Industries, Inc., Huntsman Corporation LLC, DuPont, Weyerhaeuser Company, Momentive Performance Materials.

b. Key factors that are driving the market growth include the increasing utilization of advanced lightweight components across the manufacturing industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.