- Home

- »

- Advanced Interior Materials

- »

-

U.S. Copper Flat Rolled Products Market Size Report, 2033GVR Report cover

![U.S. Copper Flat Rolled Products Market Size, Share & Trends Report]()

U.S. Copper Flat Rolled Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Copper Sheets, Copper Strips, Copper Plates), By End-use (Construction), And Segment Forecasts

- Report ID: GVR-4-68040-613-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

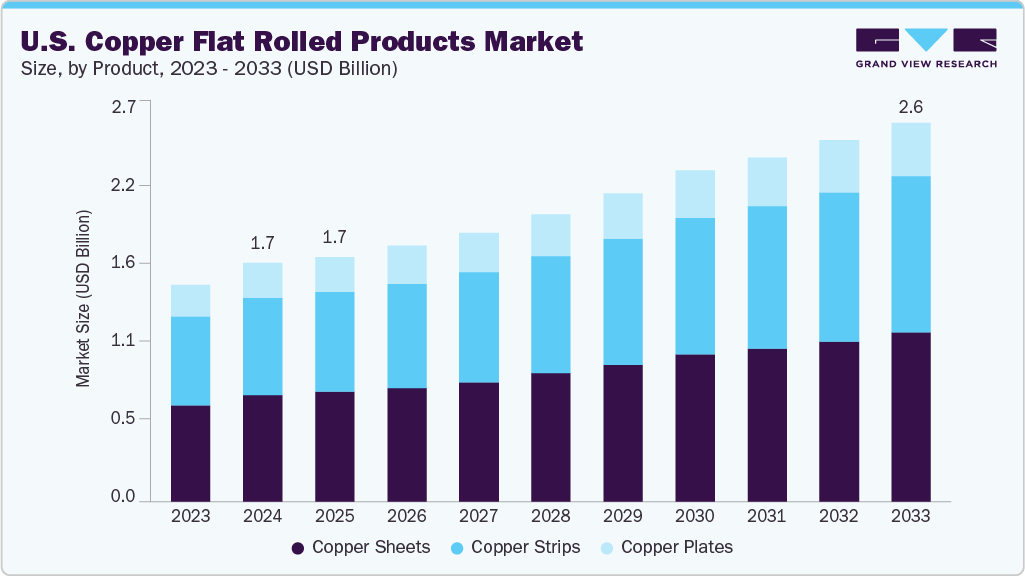

The U.S. copper flat rolled products market size was estimated at USD 1.65 billion in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2033. The market is experiencing steady growth, driven by increasing demand from the electrical and electronics sector, ongoing infrastructure modernization efforts, and the rapid advancement of the electric vehicle industry. Government initiatives supporting clean energy, grid upgrades, domestic manufacturing, and growing investment in EV production and charging networks further fuel the need for high-performance copper materials across multiple sectors.

They are highly valued across industries due to their exceptional combination of electrical, thermal, and mechanical properties. One of their most important attributes is excellent electrical conductivity, second only to silver, making copper essential for use in printed circuit boards (PCBs), connectors, busbars, and transformer windings. Additionally, copper's superior thermal conductivity allows for efficient heat dissipation, which is crucial in maintaining the performance and reliability of electronic and power systems. Its high malleability and ductility enable it to be easily formed into thin foils and strips, supporting the production of compact and intricate components required in advanced electronics.

Advancements in electric vehicle technology and energy infrastructure are driving a substantial increase in demand for flat-rolled copper products. The development of highly efficient electric drivetrains, advanced battery management systems, and next-generation charging networks requires materials that offer exceptional electrical conductivity, superior thermal performance, and robust durability-qualities inherent to copper. As solid-state batteries and high-voltage EV systems gain traction, the need for precisely manufactured copper foils and sheets becomes increasingly critical to meet the performance and reliability standards of these emerging technologies.

Recently, the U.S. government announced substantial investments under the Inflation Reduction Act to accelerate domestic clean energy projects and EV manufacturing. This initiative includes funding for upgrading the national power grid and expanding EV charging infrastructure, which is expected to boost the consumption of copper flat-rolled products further, reinforcing their critical role in supporting America’s clean energy and transportation ambitions.

Drivers, Opportunities & Restraints

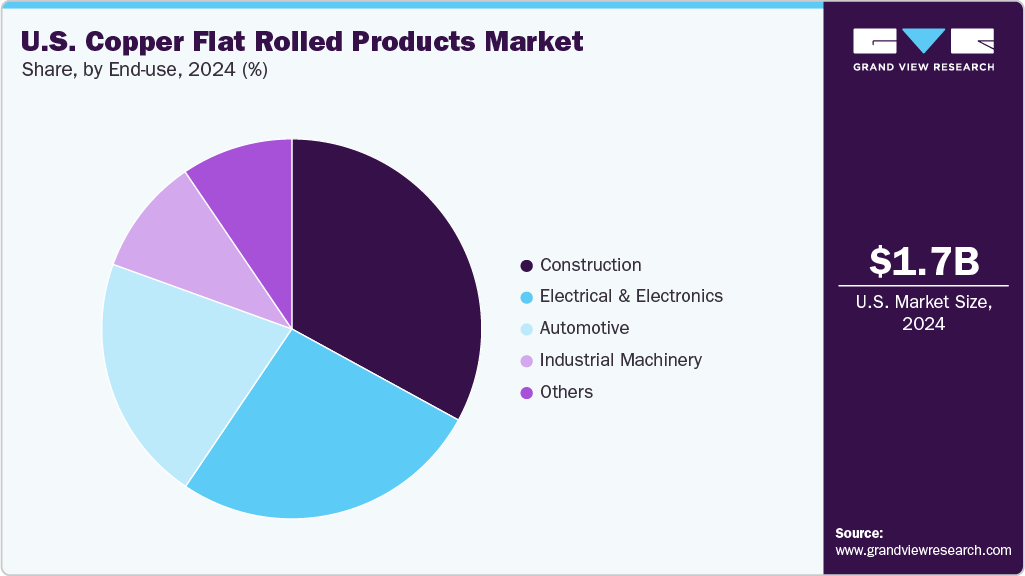

The U.S. copper flat rolled products market is experiencing robust growth in the construction sector, driven by increasing demand for durable, high-performance materials and the revival of infrastructure development projects. They are widely used in construction for roofing, cladding, flashing, gutters, and plumbing systems, owing to their excellent corrosion resistance, malleability, and aesthetic appeal. The growing emphasis on sustainable and energy-efficient building solutions has further boosted the adoption of copper in green construction practices. Additionally, federal and state-level infrastructure spending programs, including investments in housing, public buildings, and urban redevelopment, have significantly contributed to the rising demand for copper products. Government policies supporting infrastructure modernization and resilient construction are expected to propel the market further, ensuring steady growth for copper flat rolled products in the U.S. construction industry.

The growing emphasis on renewable energy sources presents substantial opportunities for the U.S. copper flat rolled products industry. Copper's role in solar panels, wind turbines, and energy storage systems is critical, facilitating efficient energy transmission and distribution. As the U.S. continues investing in clean energy projects, the demand for copper components will rise significantly.

Despite the positive outlook, the market faces several challenges. One of the primary restraints is the volatility of copper prices. Fluctuations in global copper prices, influenced by geopolitical tensions and supply chain disruptions, can impact manufacturing costs and profit margins. Environmental regulations also pose challenges to the market. Stricter ecological policies regarding mining and production processes can increase operational costs for manufacturers, affecting their competitiveness and profitability.

Product Insights

In the United States, copper flat-rolled products, especially copper strips, are witnessing strong growth, mainly due to their essential role across the electrical, electronics, and automotive sectors. With outstanding electrical conductivity and thermal stability, copper strips are a key material in electric vehicle (EV) battery connectors, busbars, and power electronics. As the country intensifies its efforts toward renewable energy adoption and expanding electric mobility, demand for copper strips used in transformers, switchgear, and components within solar and wind energy systems is rapidly increasing. Industry reports indicate that copper strips represent the fastest-growing segment in the flat-rolled copper market, fueled primarily by power and transportation infrastructure developments.

The electronics industry is further accelerating this trend, as copper strips are crucial for manufacturing connectors and printed circuit boards (PCBs), thanks to their excellent conductivity and resistance to corrosion. The rising deployment of innovative technologies, 5G networks, and high-performance data centers across the U.S. requires miniaturized, high-frequency components, where copper strips play a vital role. Moreover, the growing emphasis on energy-efficient electrical systems reinforces copper's application in motors, transformers, and other high-efficiency power equipment.

End Use Insights

In 2025, the U.S. construction industry continues to rely heavily on flat rolled products for a variety of applications, including roofing, cladding, plumbing, and HVAC systems. These materials are prized for their long-lasting durability, resistance to corrosion, and aesthetic appeal, making them well-suited for both residential and commercial projects. For instance, gutters and downspouts made from these products can endure harsh environments, such as coastal regions and areas affected by acid rain, often lasting over 50 years. Despite some market challenges, demand remains strong due to the material’s essential role in infrastructure development and the advancement of energy-efficient building solutions, underscoring its importance in the construction sector.

In the electrical and electronics industry, these products are widely utilized owing to their excellent electrical conductivity, superior thermal properties, and corrosion resistance. Sheets, strips, and foils are integral to the manufacturing of printed circuit boards (PCBs), connectors, busbars, and transformers. Their efficient conduction of electricity with minimal energy loss makes them ideal for high-frequency and high-current applications. Moreover, their exceptional thermal conductivity aids in dissipating heat generated by electronic devices, thereby enhancing performance and prolonging device lifespan. The flexibility and ease of fabrication of these materials allow for precise shaping, which is critical for compact electronics such as smartphones, computers, and industrial control systems. As technology advances and devices continue to miniaturize, demand in this sector remains robust.

Within the automotive industry, these materials play a vital role, particularly with the rapid expansion of electric vehicles (EVs). Thanks to their excellent electrical conductivity and mechanical strength, strips and foils serve as key components in battery connectors, wiring harnesses, electric motors, and power electronics. These properties facilitate efficient energy transfer and ensure reliable performance under the demanding conditions typical of automotive applications.

Copper’s superior thermal conductivity helps manage heat from batteries and drivetrains, improving safety and performance. Additionally, its corrosion resistance ensures long-lasting use in varied weather conditions. With EV adoption growing worldwide, the demand for copper flat rolled products in the automotive sector is rapidly increasing.

Key U.S. Copper Flat Rolled Products Company Insights

Key players operating in the U.S. market include Wieland Rolled Products NA, Revere Copper Products, Inc., and PMX Industries, Inc.

-

Wieland Rolled Products NA, a subsidiary of the German-based Wieland Group, is one of the largest producers of copper and high-performance alloy rolled products in North America. Formerly known as Olin Brass, the company has over 200 years of manufacturing heritage and specializes in engineered strip, sheet, and foil products used across automotive, electronics, aerospace, and industrial applications. With a strong emphasis on sustainability, innovation, and quality, Wieland operates advanced melting and rolling facilities and maintains a robust R&D infrastructure.

-

Revere Copper Products is one of the oldest manufacturing companies in the United States and a pioneer in copper production. The company produces a broad range of copper flat-rolled products, including sheets, plates, and coils used in architectural, electrical, and industrial applications. Revere’s vertically integrated production process ensures consistent quality, and its products are widely recognized for their durability and performance. The company places strong emphasis on U.S.-based manufacturing and long-term customer relationships.

-

PMX Industries is a premier manufacturer of high-quality copper and copper alloy flat rolled products. A subsidiary of South Korea’s Poongsan Corporation, PMX serves the automotive, electronics, telecommunications, and building sectors. The company operates one of North America's most technologically advanced rolling mills and is known for its precision-engineered strip, coil, and sheet products. PMX is also recognized for its focus on sustainability, having implemented an integrated environmental management system and closed-loop recycling processes.

Key U.S. Copper Flat Rolled Products Companies:

- Carter Alloys Co.

- Continental Steel & Tube Co.

- Farmers Copper Ltd.

- Interstate Metal Inc.

- PMX Industries, Inc.

- Revere Copper Products, Inc.

- Sequoia Brass & Copper

- Thin Metal Sales, Inc.

- United Copper Industries

- Wieland Rolled Products NA

Recent Developments

-

On 1 May 2025, Wieland Rolled Products North America announced the commencement of construction on a USD 500 million expansion project at its East Alton, Illinois, facility. The project includes the installation of a next-generation hot rolling mill to cater to rising demand from sectors such as electric vehicles and renewable energy. Supported by USD 231 million in incentives from Illinois’ Reimagining Energy and Vehicles (REV) program, the expansion is projected to create 80 new jobs and strengthen domestic copper rolling capacity.

-

On 12 September 2024, Wieland Group finalized its acquisition of Aurubis AG’s flat-rolled copper products facility in Buffalo, New York. The strategic purchase, involving a site with 500 employees, has expanded Wieland’s North American manufacturing footprint. This move aims to meet growing demand in the U.S. automotive and electrical sectors while securing supply chain resilience for high-performance copper strip production.

-

On 24 August 2024, Wieland introduced CopperBond® XTF, an advanced ultra-thin copper foil explicitly designed for high-density interconnect (HDI) printed circuit boards. This new product caters to increasing demand in miniaturized electronics and battery systems, particularly in electric vehicles and smart devices, positioning Wieland at the forefront of innovation in copper materials.

-

On 9 February 2024, Revere Copper Products reported a surge in demand for its flat-rolled copper offerings from the electric vehicle and energy infrastructure sectors. In response, the company emphasized its commitment to sustainable manufacturing, stating that many copper products use up to 100% recycled content, aligning with environmentally conscious sourcing practices across industries.

U.S. Copper Flat Rolled Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.69 billion

Revenue forecast in 2033

USD 2.61 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD billion, volume kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Country scope

U.S.

Key companies profiled

Carter Alloys Co.; Continental Steel & Tube Co.; Farmers Copper Ltd.; Interstate Metal Inc.; PMX Industries, Inc.; Revere Copper Products, Inc.; Sequoia Brass & Copper; Thin Metal Sales, Inc.; United Copper Industries; Wieland Rolled Products NA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Copper Flat Rolled Products Market Report Segmentation

This report forecasts volume & revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. copper flat rolled products market report by product, and end use:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Copper Sheets

-

Copper Strips

-

Copper Plates

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Construction

-

Electrical & Electronics

-

Automotive

-

Industrial Machinery

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. copper flat rolled products market size was estimated at USD 1.65 billion in 2024 and is expected to reach USD 1.69 billion in 2025.

b. The U.S. copper flat rolled products market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 2.61 billion by 2033.

b. By product, the copper sheets segment dominated the market with a revenue share of over 44.8% in 2024.

b. Some of the key vendors in the U.S. copper flat rolled products market are Carter Alloys Co., Continental Steel & Tube Co., Farmers Copper Ltd., Interstate Metal Inc., PMX Industries, Inc., Revere Copper Products, Inc., Sequoia Brass & Copper, Thin Metal Sales, Inc., United Copper Industries, Wieland Rolled Products NA.

b. The U.S. market is experiencing robust growth in the construction sector, driven by increasing demand for durable, high-performance materials and the revival of infrastructure development projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.