- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Corrugated Plastic Sheets Market, Industry Report, 2033GVR Report cover

![U.S. Corrugated Plastic Sheets Market Size, Share & Trends Report]()

U.S. Corrugated Plastic Sheets Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (PE, PP), By Thickness (Less than 3 mm, 3 to 8 mm, Above 8 mm), By End Use (Building & Construction, Agriculture & Allied Products), And Segment Forecasts

- Report ID: GVR-4-68040-635-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Corrugated Plastic Sheets Market Summary

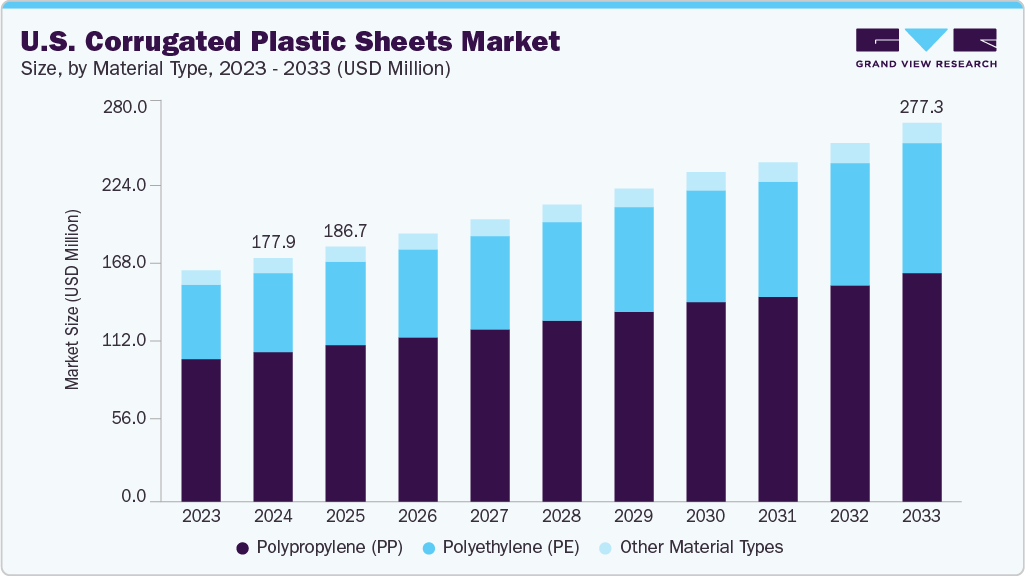

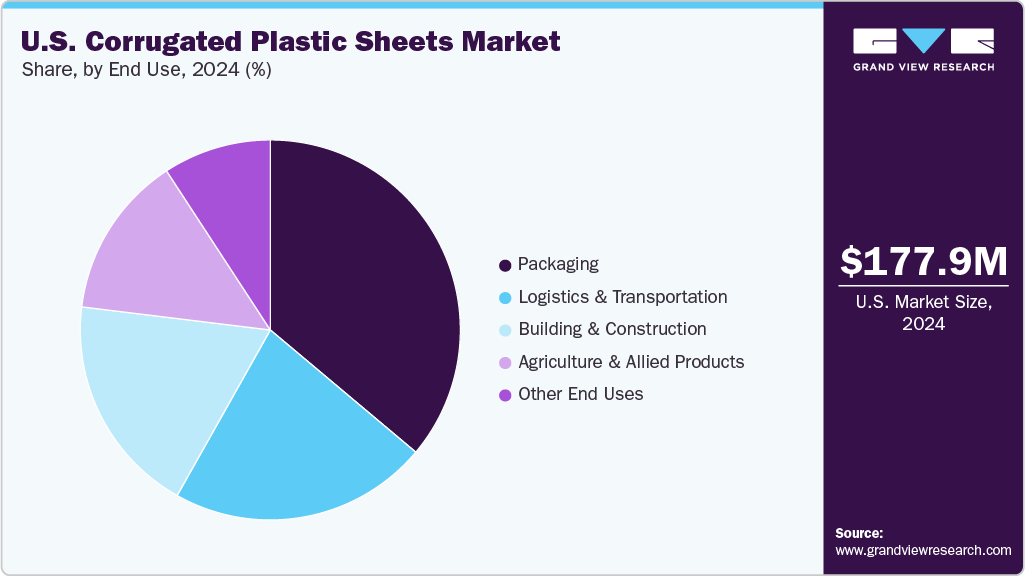

The U.S. corrugated plastic sheets market size was estimated at USD 177.9 million in 2024 and is projected to reach USD 277.3 million by 2033, growing at a CAGR of 5.1% from 2025 to 2033. Retailers are increasingly adopting modular point-of-purchase displays made from corrugated plastic sheets for their durability and reusability.

Key Market Trends & Insights

- By material type, the polyethylene (PE) segment is expected to grow at a considerable CAGR of 5.8% from 2025 to 2033 in terms of revenue.

- By thickness, the less than 3 mm segment is expected to grow at a considerable CAGR of 5.9% from 2025 to 2033 in terms of revenue.

- By end use, the packaging segment is expected to grow at a considerable CAGR of 6.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 177.9 Million

- 2033 Projected Market Size: USD 277.3 Million

- CAGR (2025-2033): 5.1%

This shift toward repeatable, high-impact promotional fixtures is prompting suppliers to ramp up capacity and diversify sheet offerings. The industry is undergoing a clear shift toward sustainability and functional innovation. Manufacturers are increasingly developing bio-based and post-consumer recycled polypropylene (PP) and high-density polyethylene (HDPE) sheets to address corporate ESG targets and consumer demand for greener packaging solutions.

Concurrently, the integration of digital printing technologies is enabling high-resolution graphics and variable data printing directly on corrugated plastic panels, expanding applications in retail signage and promotional displays. These dual forces of material innovation and enhanced customizability are setting the stage for material substitution away from traditional fiberboard and PVC boards.

Drivers, Opportunities & Restraints

Robust activity in the U.S. construction and infrastructure sectors is a primary driver of corrugated plastic sheet consumption. With construction spending projected to grow substantially through 2025, firms are favoring lightweight, moisture-resistant sheets for concrete form liners, protective barriers on job sites, and wayfinding signage. The ease of handling and installation, coupled with long service life, reduces labor and replacement costs compared to wood or metal alternatives. This breadth of applications in both commercial and residential builds is fueling stable year-on-year volume growth.

E-commerce and last-mile logistics present a compelling growth opportunity for corrugated plastic sheets. The surge in online retail has heightened demand for reusable, durable, and waterproof packaging systems, qualities inherent to corrugated plastic, which reduce product damage and returns.

Moreover, food delivery and no-contact distribution models adopted by major quick-service chains are driving interest in hygienic, easy-to-sanitize trays and partition solutions made from corrugated plastics. As retailers and logistics providers seek to balance sustainability goals with operational resilience, reusable corrugated plastic packaging is positioned to capture a significant market share.

However, the market faces growing headwinds from regulatory and cost pressures. A patchwork of state-level Extended Producer Responsibility (EPR) laws and recycled-content mandates imposes additional compliance burdens on sheet manufacturers and converters, raising production costs and complicating supply chain planning.

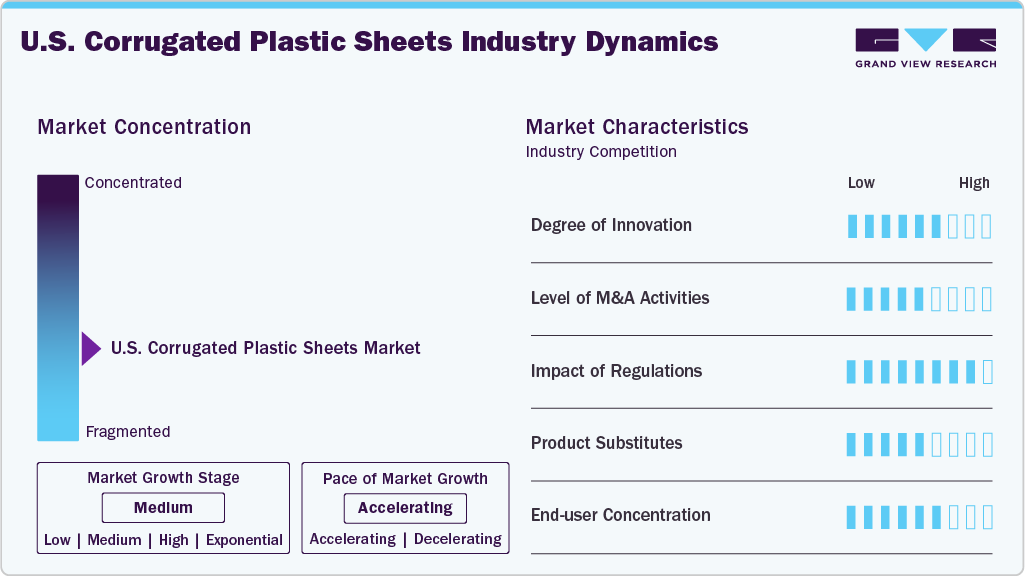

Market Concentration & Characteristics

The market is in a medium growth stage and accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies like Coroplast, Primex Plastics Corporation, SABIC, SIMONA AMERICA Industries, Plaskolite, LLC, Corplex, Mitsubishi Chemical Group, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and end uses to meet evolving industry demands.

In packaging applications, corrugated cardboard and molded pulp are increasingly favored for their widespread recycling infrastructures and lower raw‐material costs, challenging corrugated plastic sheets on both price and eco‐credentials. Biodegradable plastics also gain traction among brands seeking compostable packaging, while in signage and construction contexts, aluminum composite panels and foam boards offer higher rigidity and fire resistance, placing pressure on plastic sheet suppliers to continuously enhance material performance.

State‐level extended producer responsibility (EPR) laws are reshaping the U.S. packaging landscape, with seven states, California, Maine, Oregon, New Jersey, Washington, Colorado, and Minnesota, now mandating producer‐funded recycling programs and recycled‐content targets. These regulations force corrugated plastic sheet manufacturers to allocate budget toward compliance fees, reporting, and eco‐design R&D, while inconsistent requirements across jurisdictions add administrative overhead and complicate national supply‐chain strategies.

Material Type Insights & Trends

Polypropylene (PP) dominated the U.S. corrugated plastic sheets market across the material type segmentation in terms of revenue, accounting for a market share of 61.55% in 2024. PP corrugated sheets benefit from an optimal balance of rigidity and weight savings, making them a preferred choice for applications that demand both handling ease and structural integrity. Their inherent chemical resistance and moisture-proof properties have driven adoption in industries ranging from food packaging to automotive parts linings, where exposure to oils, solvents, or humidity is commonplace.

The polyethylene (PE) segment is anticipated to grow at a significant CAGR of 5.8% through the forecast period. PE corrugated sheets are carving out market share through their superior impact resistance and UV stability, attributes that suit outdoor signage, agricultural covers, and construction site barriers. The material’s flexibility at low temperatures also makes it an ideal candidate for cold-chain packaging solutions in pharmaceuticals and perishable foods.

Thickness Insights & Trends

3 to 8 mm led the U.S. corrugated plastic sheets market across the thickness segmentation in terms of revenue, accounting for a market share of 51.90% in 2024. Sheets in the 3-8 mm range dominate for industrial packaging and protection, offering an appropriate stiffness and lightweight maneuverability.

They excel as layer pads, box liners, and partition panels used in material-handling systems, safeguarding goods while minimizing freight costs. The segment’s versatility underpins its strong presence in automated warehousing operations, where consistent thickness tolerances are critical for robotic pick-and-place accuracy and damage-free throughput.

The less than 3 mm segment is anticipated to grow at a significant CAGR of 5.9% through the forecast period. They have surged in popularity for point-of-sale displays, retail signage, and event installations due to their exceptional printability and ease of die-cutting. Retailers leverage these ultra-thin panels to create eye-catching promotional fixtures that can be quickly assembled and recycled at end-of-campaign. The lightweight profile also translates into lower shipping and handling costs, aligning with retailers’ drive to optimize supply-chain economics for transient marketing materials.

End Use Insights & Trends

Packaging led the U.S. corrugated plastic sheets market across the thickness segmentation in terms of revenue, accounting for a market share of 36.12% in 2024. Corrugated plastic is fast becoming the linchpin of reusable and returnable packaging programs, particularly within high-value goods and perishables distribution.

Its durability and moisture resistance reduce product damage rates and minimize waste, while the potential for hundreds of reuse cycles slashes the total cost of ownership compared to single-use alternatives. Brand owners are integrating RFID and QR-code tracking onto these sheets to support circular-economy initiatives and real-time asset visibility in omnichannel fulfillment networks

The logistics and transportation segment is expected to expand at a substantial CAGR of 5.4% through the forecast period. Logistics providers are increasingly specifying corrugated plastic pallets, separation boards, and dunnage solutions to accelerate handling speeds and cut transportation costs. The material’s low weight reduces fuel consumption, and its resistance to moisture and contaminants simplifies cross-border transit by bypassing fumigation requirements.

Key U.S. Corrugated Plastic Sheets Market Companies Insights

Key players operating in the U.S. corrugated plastic sheets market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Corrugated Plastic Sheets Companies:

- Coroplast

- Primex Plastics Corporation

- SABIC

- SIMONA AMERICA Industries

- Plaskolite, LLC

- Corplex

- Mitsubishi Chemical Group

Recent Developments

-

In December 2024, Inteplast Group acquired CoolSeal USA, a polypropylene corrugated sheet and box manufacturer based in Perrysburg, Ohio. CoolSeal USA, known for its sustainable and recyclable packaging products serving industries like seafood, automotive, warehousing, and horticulture, joined Inteplast’s World-Pak Division. This acquisition expanded Inteplast’s sustainable packaging portfolio and strengthened its commitment to eco-friendly manufacturing and circular economy principles.

U.S. Corrugated Plastic Sheets Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 186.7 million

Revenue forecast in 2033

USD 277.3 million

Growth rate

CAGR of 5.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in million square meters; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material type, thickness, end use

Country Scope

U.S.

Key companies profiled

Coroplast; Primex Plastics Corporation; SABIC; SIMONA AMERICA Industries; Plaskolite, LLC; Corplex; Mitsubishi Chemical Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Corrugated Plastic Sheets Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. corrugated plastic sheets market report on the basis of material type, thickness, and end use:

-

Material Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Other Material Types

-

-

Thickness Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Less than 3 mm

-

3 to 8 mm

-

Above 8 mm

-

-

End Use Outlook (Volume, Million Square Meters; Revenue, USD Million, 2021 - 2033)

-

Packaging

-

Logistics & Transportation

-

Building & Construction

-

Agriculture & Allied Products

-

Other End Uses

-

Frequently Asked Questions About This Report

b. The global U.S. corrugated plastic sheets market size was estimated at USD 177.9 million in 2024 and is expected to reach USD 186.7 million in 2025.

b. The global U.S. corrugated plastic sheets market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 277.3 million by 2033.

b. 3 to 8 mm led the U.S. corrugated plastic sheets market across the thickness segmentation in terms of revenue, accounting for a market share of 51.90% in 2024. Sheets in the 3–8 mm range dominate for industrial packaging and protection, offering an appropriate of stiffness and lightweight maneuverability.

b. Some key players operating in the U.S. corrugated plastic sheets market include Coroplast, Primex Plastics Corporation, SABIC, SIMONA AMERICA Industries, Plaskolite, LLC, Corplex, and Mitsubishi Chemical Group

b. Retailers are increasingly adopting modular point-of-purchase displays made from corrugated plastic sheets for their durability and reusability. This shift toward repeatable, high-impact promotional fixtures is prompting suppliers to ramp up capacity and diversify sheet offerings.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.