- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Decorated Apparel Market Size, Industry Report, 2030GVR Report cover

![U.S. Decorated Apparel Market Size, Share & Trends Report]()

U.S. Decorated Apparel Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Embroidery, Screen Printing, Dye Sublimation, Digital Printing, Others), By End User, And Segment Forecasts

- Report ID: GVR-4-68040-227-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Decorated Apparel Market Trends

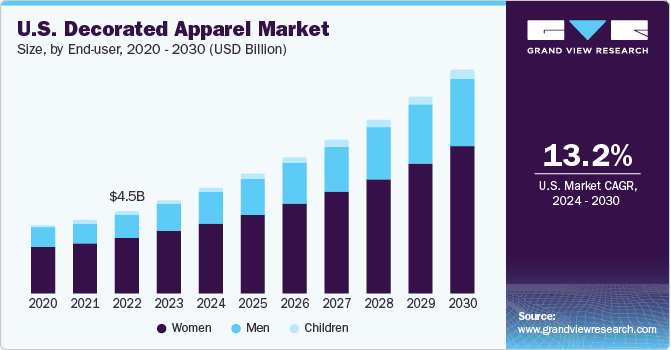

The U.S. decorated apparel market size was valued at USD 5.11 billion in 2023 and is expected to grow at a CAGR of 13.2% from 2024 to 2030. One of the major factors that are generating lucrative growth for the market is rising demand from customers for customized apparel that has aspects such as embroidery, screen-printing, and such types of work on apparel. The increasing response from customers to a thoughtful texture in clothes has also developed the potential growth patterns for the industry in recent past. Furthermore, improved demand for clothes with modern graphic designs and other clothing due to ever-changing trends is most likely to assist key companies in generating greater revenue during the next few years. In addition, an unceasingly growing trend that provides luxurious value to apparel in terms of perception and recognizes apparel as a mark of the status of quality of lifestyle is influencing the U.S. decorative apparel industry like never before.

The U.S. market accounted for a share of around 18% of the global decorated apparel market in 2023. Several businesses across the globe have already entered and new ones are now entering this highly trend-driven market. The current trends are primarily subjected to concepts such as personalization, customised designs, free-size clothing, embellishments and reflective clothes purposefully denoting certain brands, global trends, fads, incidences, causes, and more. This aspect is helping the industry to lure a greater number of customers from a diverse pool of buyers who belong to a variety of backgrounds, possess different types of buying capacity, and have numerous kinds of expectations from apparel as a product.

In addition, the use of decorated apparel for the expression of individuality, style and choice of individuals has aided the market in every sense. This brings in a huge number of customers with a variety of demands, which directly contributes to the greater growth possibility. Furthermore, the evolution of technology used by businesses and industry leaders to develop attractive clothing, which addresses the key concepts underlying the demands of customers has been playing a vital role in unending new product development ideas, increased number of engagements and growing repurchases to ensure higher levels of customer loyalty.

The greater personalization flexibility adopted by brands and efforts undertaken to reduce the environmental footprint are being acknowledged by the customers. These clothes are often priced at high ends and yet they are most likely to attain a larger market share in upcoming years. This factor is entirely empowered by the advanced technologies, and reduced amount of mass-producing processes. In addition, the Three-Dimensional Visual Merchandising System adopted by a great number of industry innovators has helped the decorated apparel market of the region in several ways.

Market Concentration & Characteristics

The U.S. decorated apparel market is characterized by a high degree of innovation and the presence of a massive number of producers. This has resulted in a developing fragmented market scenario. The key factors responsible for this are advancements in technologies used by the apparel industry, changing customer needs, the discovery of the latest trends in various parts of the globe every day, and efforts put in by market participants to attain a competitive advantage through innovation as a tool.

The businesses operating in the decorative have been putting a lot of emphasis on strategic acquisitions as it directly helps them develop a strategic advantage over competitors and assists them in establishing their presence in various segments and parts of the market. In terms of the US as a region, the presence of brands that are popularly recognized in the region as apparel decorators brings an extra competitive value to the dashboards for the decorated apparel market.

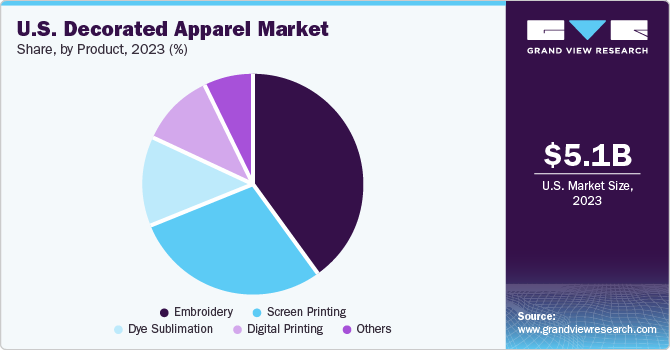

Product Insights

The embroidered apparel market accounted for a share of 39.93% in 2023. The increasing popularity of embroidery done over silhouettes, without the presence of any gender ideas is generating luring growth opportunities for the embroidery-based segment of the market. Usage of a variety of colors and threads, which bring in a patch on a part of the apparel that looks attractive. Embroidered clothing is engaging a greater number of customers in the market as it offers a variety of aspects, matches with ongoing trends and provides several alternates that may get attention from many.

The screen-printed apparel market is anticipated to grow at a CAGR of 14.8% from 2024 to 2030. Unlike traditional printing techniques, the screen-printing provides the capacity to withstand numerous washes. However, the set-up required for the segment to manufacture its products involves higher costs that are recovered only when orders are manufactured in bulk developments. Oregon Screen Impressions and Deluxe Screen Printing are some of the key companies in this segment.

End-user Insights

The women’s decorated apparel segment dominated the industry in 2023 with a share of 67.12%. The availability of numerous products such as t-shirts, Indian kurtas, fancy tops and modern decorated women's wear contributes to attracting a huge number of customers to the market. This sub-segment of the end-user-based decorated apparel market tends to frequently change its preferences and specifications of demand based on current trends, social media influences, and peer reviews. In addition, the inclusion of t-shirts and semi-formal attires in work environments has helped this segment grow in the recent past.

The men’s decorated apparel segment is projected to grow at a CAGR of over 14% from 2024 to 2030. The growth of this segment can be attributed to the increasing demand for printed sportswear, jackets, and hoodies, among others.

Key U.S. Decorated Apparel Company Insights

The U.S. decorated apparel market is characterized by the presence of several established companies involved in the business of clothing and have now started a wing of decorated apparel for a few years or decades. In addition, some companies have started their business with decorated apparel being their primary offerings.

Key U.S. Decorated Apparel Companies:

- Gildan

- Fruit of Loom, Inc.

- Downtown Custom Printwear

- Hanesbrands Inc.

- Master Printwear

- Delta Apparel, Inc.

- Target Decorated Apparel

- Garment Graphics and Promotional Products

- PRINTING United Alliance

- New England Printwear

Recent Developments

-

Delta Apparel, Inc. one of the leading providers of activewear, and lifestyle-clothing choices announced the expansion of its Salt Life brand’s retail footprint. The brand opened three new stores in the US, one in Virginia and two more in Florida lands. These locations are now representing the next stage in Salt Life's retail strategy offering, which includes full-price as well as outlet alternatives that specifically provide its range of superior ocean performance and lifestyle apparel.

-

In February 2024, PRINTING United Alliance, one of the leading member-based printing and graphic arts associations in North America, Brand Chain, the essential element in supply chain solutions for brands, and the Print Education & Research Foundation (PERF), an organization devoted to offering research and education for the printing industry, announced their merger. The three different dimensions including collaboration, innovation and education are planned to be addressed through this merger while aiming to uplift the supply chain capabilities of the printing industry.

U.S. Decorated Apparel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.76 billion

Revenue Forecast in 2030

USD 12.14 billion

Growth Rate

CAGR of 13.2% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, end-user

Key companies profiled

Gildan, Fruit of Loom, Inc., Downtown Custom Printwear, Hanesbrands Inc., Master Printwear, Delta Apparel, Inc., Target Decorated Apparel, Garment Graphics and Promotional Products, PRINTING United Alliance, New England Printwear

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Decorated Apparel Market Report Segmentation

This report forecasts revenue growth at the regional level and offers a scrutiny of the most recent industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. decorated apparel market report based on product and end-user.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Embroidery

-

Screen Printing

-

Dye Sublimation

-

Digital Printing

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

Children

-

Frequently Asked Questions About This Report

b. The U.S. decorated apparel market size was estimated at USD 5.11 billion in 2023 and is expected to reach USD 5.76 billion in 2024.

b. The U.S. decorated apparel market is expected to grow at a compound annual growth rate of 13.2% from 2024 to 2030 to reach USD 12.14 billion by 2030.

b. Women's decorated apparel dominated the U.S. decorated apparel market with a share of 67.1% in 2023. The availability of numerous products such as t-shirts, Indian kurtas, fancy tops, and modern decorated women's wear contributes to attracting a huge number of customers to the market.

b. Some key players operating in the U.S. decorated apparel market include Gildan, Fruit of Loom, Inc., Downtown Custom Printwear, Hanesbrands Inc., Master Printwear, Delta Apparel, Inc., Target Decorated Apparel, Garment Graphics and Promotional Products, PRINTING United Alliance, and New England Printwear.

b. Key factors that are driving the market growth include the growing demand for athleisure and sportswear, along with the increasing penetration of personalized apparel in the corporate sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.