- Home

- »

- Pharmaceuticals

- »

-

U.S. Dermatological Drugs Market Size, Industry Report 2030GVR Report cover

![U.S. Dermatological Drugs Market Size, Share & Trends Report]()

U.S. Dermatological Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Therapy (Acne, Psoriasis), By Type (Prescription, Over-the-Counter), By Route Of Administration, By Drug Class, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-512-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Dermatological Drugs Market Trends

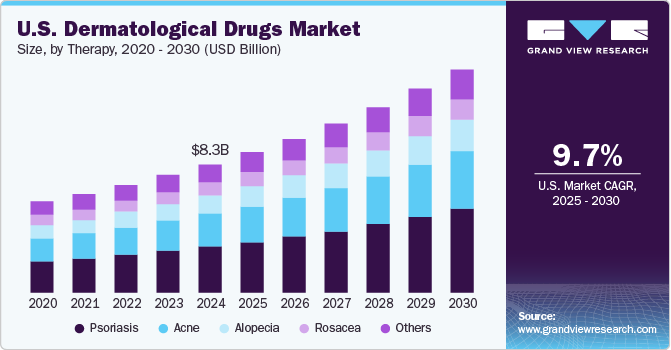

The U.S. dermatological drugs market size was valued at USD 8.32 billion in 2024 and is projected to grow at a CAGR of 9.7% from 2025 to 2030. The growing prevalence of skin diseases such as acne, psoriasis, rosacea, and others, rising awareness regarding the role of skin health in overall well-being, and the availability of effective and specifically targeted treatment options are some of the key driving factors for this market. Skin parasites, bacteria trapped in hair follicles, fungi, fluid retention, and increasing pollution levels are expected to drive market growth in the coming years.

Acne is one of the most common skin conditions in the U.S., affecting approximately 50 million individuals annually. Skin conditions with unknown causes, problems derived from a combination of genetics and environmental factors, increasing exposure to air pollution, and the impact of rapidly growing stress and anxiety on the skin have resulted in rising demand for effective treatments and dermatological drugs. Increasing emphasis on early treatment to prevent further intricacies and availability of novel therapies derived from research & development activities are expected to drive the growth of this market during the forecast period.

In recent years, innovative dermatologic therapies have gained significance. The accessibility of new drugs, topical treatments, and imaging technologies has resulted in an increasing number of individuals reporting their skin conditions to health professionals and dermatologists. Awareness has also played a vital role in the growing number of people seeking the right treatments for skin conditions.

In September, Eli Lilly and Company announced that the U.S. FDA approved a targeted IL-13 inhibitor, EBGLYSS (lebrikizumab-lbkz), for treating adults and children over 12 years of age suffering from moderate-to-severe level atopic dermatitis (eczema). The EBGLYSS is a treatment for dermatitis cases that are not controlled with topical prescription therapies.

Investments by key market participants in the medical devices and pharmaceuticals industry in innovation-based formulations and product pipelines are projected to add lucrative growth opportunities to this market. For instance, in July 2024, Johnson & Johnson announced the acquisition of a demerged subsidiary of Numab Therapeutics, Yellow Jersey, to secure global rights for NM26. It is a novel, first-in-class bispecific antibody, and is set to enter Phase 2 studies in atopic dermatitis (AD).

Therapy Insights

Based on therapy, the psoriasis segment dominated the U.S. dermatological drugs market with a revenue share of 35.8% in 2024. Nearly 2.0% of people residing in the U.S. have Psoriasis. Growth in awareness regarding psoriasis has led to increased reporting of skin conditions and seeking treatments on time. Many businesses and research institutes across the U.S. are focused on developing innovative therapeutic solutions in the field of immuno-dermatology. In addition, the expanding dermatology capabilities of healthcare companies, driven by acquisitions and portfolio integrations, are expected to drive growth in this market. In January 2025, AbbVie Inc. announced the acquisition of Nimble Therapeutics. Nimble’s investigational oral peptide IL23R inhibitor is in preclinical development for psoriasis treatment.

The acne segment is expected to experience significant growth from 2025 to 2030. The segment growth is due to acne's increasing prevalence, especially among young adults and teenagers. A large number of individuals seeking effective acne treatments, increasing social emphasis on clear skin appearances, and research-driven product developments by pharmaceutical industry participants are expected to drive the segment growth. In October 2023, Bausch Health Companies Inc. and Ortho Dermatologics (Its dermatology business) announced the U.S. FDA approval of a New Drug Application for CABTREOTM. It is indicated for topical treatment of acne vulgaris in 12 years of age & above patients.

Type Insights

The prescription segment dominated the market for the largest revenue share of 77.5% in 2024. The growth of this segment is attributed to the growing prevalence of skin diseases, such as psoriasis and eczema, and increasing exposure to pollution and environmental factors causing skin problems. Growing awareness, desire to have clear and problem-free skin, and availability of numerous affordable treatments have resulted in many individuals seeking effective treatments. However, most patients prefer consulting a dermatologist before starting with treatments to avoid side effects and further complications. Regulatory control on manufacturing, promotional activities, and common dispensing by pharmacists also contributes to the growth of this segment.

The over-the-counter segment is projected to grow significantly over the forecast period. Numerous patients prefer cosmetic solutions and skincare products before taking prescribed treatment. This includes products marketed for skin conditions such as acne, mild inflammation, irritation, fungal infections, etc. Some commonly preferred over-the-counter products include corticosteroids such as hydrocortisone, topical antibiotics such as benzoyl peroxide, and more. The growth of the e-commerce industry, availability of over-the-counter dermatology products on online portals, and factors such as convenience and affordability are likely to add growth opportunities for this segment.

Route Of Administration Insights

Topical administration accounted for the largest revenue share, 60.0%, in 2024. The growth of this market is primarily driven by the emergence of patient-friendly delivery systems integrated with effective treatments and direct application processes, leading to quicker influence on affected areas. The availability of foams, creams, lotions, gels, ointments, powders, patches, pastes, and other products contributes to the segment's growth. Ease of use and improved accessibility driven by companies' effective distribution add to the growth potential.

The parenteral administration segment is expected to grow at the fastest CAGR of 10.7% over the forecast period. Characteristics associated with this route of administration, such as speedier medication absorption, quicker relief for patients, prevention of issues such as first-pass metabolism, and improved drug effectiveness, are contributing to the segment's growth. Aging patients who have difficulty swallowing pills or tablets due to other health problems and age factors benefit from parenteral administration.

Distribution Channel Insights

Based on distribution channels, retail pharmacies dominated the market, with the largest revenue share of 50.6% in 2024. Retail pharmacies provide major opportunities for pharmaceutical companies to improve market penetration of over-the-counter products, consumer health offerings, and more through enhanced brand visibility. Awareness, ease of accessibility, and assistance provided by the staff looking after sales and operations in retail pharmacies are some of the key growth-driving factors for this segment. Strategic expansions initiated by the key retail industry participants are projected to add significant growth to this segment. In October 2024, Amazon, one of the largest retail industry players in the U.S., announced its plan to open pharmacies in 20 new cities across the U.S. under its service wing, Amazon Pharmacy, in 2025. The step aims to strengthen and expand the service area by providing fast, free delivery of prescription medications.

Hospital pharmacies are expected to experience substantial growth during the forecast period. Primarily, prescribed dermatological drugs are offered by hospital pharmacies across the U.S. The purchase of dermatological drugs in hospital pharmacies is mainly driven by requirements related to patients admitted for observations, treatment of sudden allergic reactions, treatment of chronic skin conditions, and special programs comprising hospital stays.

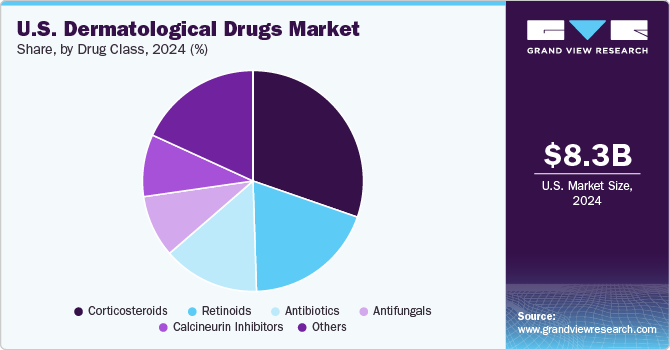

Drug Class Insights

Corticosteroids dominated the market with the largest revenue share of 30.1% in 2024. Corticosteroids are usually preferred to treat inflammatory skin problems and repetitive allergic reactions effectively. Corticosteroids are often available in various formulations, including ointments, lotions, gels, creams, foams, solutions, shampoos, and oils. Ease of accessibility, advancements in research, and numerous new formulations launched in the market are some factors adding growth to this segment.

Calcineurin inhibitors are expected to grow at the fastest CAGR of 10.8% over the forecast period. They are commonly used to treat skin conditions such as atopic dermatitis (eczema) and vitiligo. Tacrolimus and pimecrolimus are used for topical applications to treat atopic dermatitis. Calcineurin, a protein that plays a vital role in activating inflammatory cells inside the skin, enhances the effectiveness of the treatment.

Key U.S. Dermatological Drugs Company Insights

Major U.S. dermatological drugs industry companies include AbbVie Inc., Pfizer Inc., GlaxoSmithKline plc (GSK), LEO Pharma A/S, Sun Pharmaceutical Industries Ltd., and others. Key companies are adopting strategies such as investment in novel formulations, acquisition, collaborations, new product developments, and more to address the increasing demand for effective treatments and competition driven by research-based developments.

-

AbbVie Inc. is a biopharmaceutical company with a strong focus on dermatology, offering innovative treatments for various skin conditions. Its dermatological portfolio includes medications for chronic diseases such as atopic dermatitis, psoriasis, and Hidradenitis Suppurativa (HS).

Key U.S. Dermatological Drugs Companies:

- AbbVie Inc.

- Pfizer Inc.

- GSK plc.

- LEO Pharma A/S

- Sun Pharmaceutical Industries Ltd.

- GALDERMA

- Amgen Inc.

- Johnson & Johnson Services Inc.

- Novartis AG

- Eli Lilly and Company

- Almirall, S.A

- Bausch Health Companies Inc.

Recent Developments

-

In August 2024, GALDERMA received U.S. FDA approval for a monoclonal antibody, Nemluvio (nemolizumab). It is approved as a pre-filled pen for subcutaneous injection for treating adults suffering from chronic prurigo nodularis.

-

In July 2024, Arcutis Biotherapeutics, Inc., a biopharmaceutical company, received U.S. FDA approval for the supplemental new drug application (sNDA) for ZORYVE (roflumilast) cream. It is for the effective treatment of mild to moderate levels of atopic dermatitis (AD) in pediatric patients aged six and above and adults.

U.S. Dermatological Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.11 billion

Revenue forecast in 2030

USD 14.48 billion

Growth rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, Competitive landscape, growth factors, and trends

Segments covered

Therapy, drug type, route of administration, drug class, distribution channel

Key companies profiled

AbbVie Inc.; Pfizer Inc.; GSK plc.; LEO Pharma A/S; Sun Pharmaceutical Industries Ltd.; GALDERMA; Amgen Inc.; Johnson & Johnson Services Inc.; Novartis AG; Eli Lilly and Company; Almirall, S.A; Bausch Health Companies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dermatological Drugs Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dermatological drugs market report based on therapy, type, route of administration, drug class, and distribution channel:

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Acne

-

Psoriasis

-

Rosacea

-

Alopecia

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription

-

Over-the-Counter (OTC)

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Administration

-

Oral Administration

-

Parenteral Administration

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Retinoids

-

Antibiotics

-

Antifungals

-

Calcineurin Inhibitors

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. dermatological drugs market size was estimated at USD 8.32 billion in 2024 and is expected to reach USD 9.11 billion in 2025.

b. The U.S. dermatological drugs market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2030 to reach USD 14.48 billion by 2030.

b. Based on therapy, the psoriasis segment dominated the U.S. dermatological drugs market with a revenue share of 35.8% in 2024. Nearly 2.0% of people residing in the U.S. have Psoriasis . Growth in awareness regarding psoriasis has led to increased reporting of skin conditions and seeking treatments on time.

b. Some of the key players in the U.S. dermatological drugs market are AbbVie Inc.; Pfizer Inc.; GSK plc.; LEO Pharma A/S; Sun Pharmaceutical Industries Ltd.; GALDERMA; Amgen Inc.; Johnson & Johnson Services Inc.; Novartis AG; Eli Lilly and Company; Almirall, S.A; Bausch Health Companies Inc.

b. The growth of the U.S. dermatological drugs market is primarily driven by growing prevalence of skin diseases such as acne, psoriasis, rosacea, and others, rising awareness regarding the role of skin health in overall well-being, and the availability of effective and specifically targeted treatment options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.