- Home

- »

- Paints, Coatings & Printing Inks

- »

-

U.S. Diamond Coatings Market Size, Industry Report, 2033GVR Report cover

![U.S. Diamond Coatings Market Size, Share & Trends Report]()

U.S. Diamond Coatings Market (2025 - 2033) Size, Share & Trends Analysis Report By Substrate (Metals, Ceramics, Composites), By Technology (Chemical Vapor Deposition, Physical Vapor Deposition), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-648-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Diamond Coatings Market Summary

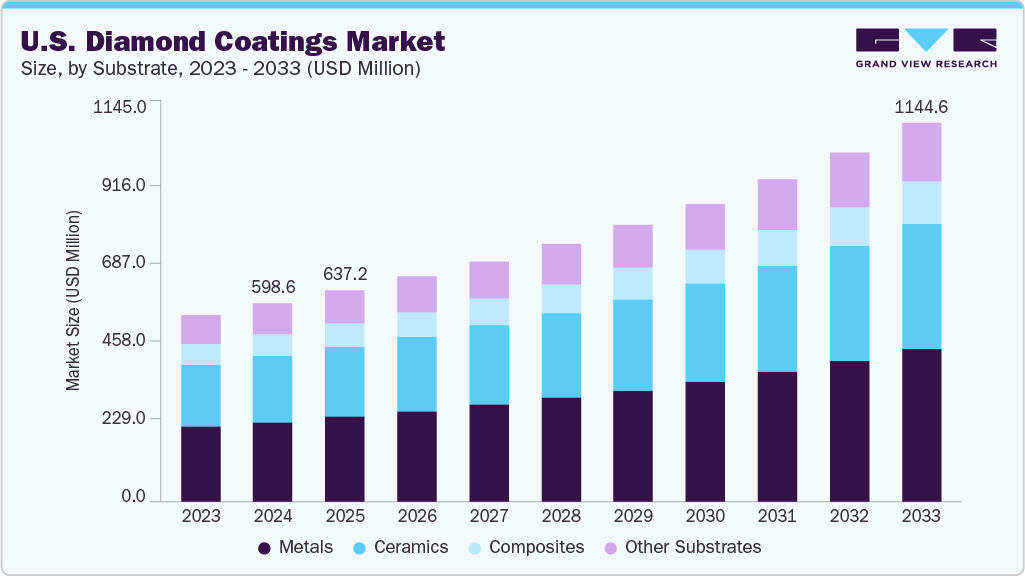

The U.S. diamond coatings market size was estimated at USD 598.6 million in 2024 and is projected to reach USD 1,144.6 million by 2033, growing at a CAGR of 7.6% from 2025 to 2033. The market is primarily driven by the growing demand for high-performance, durable coatings across industries such as industrial manufacturing, medical devices, and electronics.

Key Market Trends & Insights

- By substrate, the composites segment is expected to grow at a significant CAGR of 7.8% from 2025 to 2033 in terms of revenue.

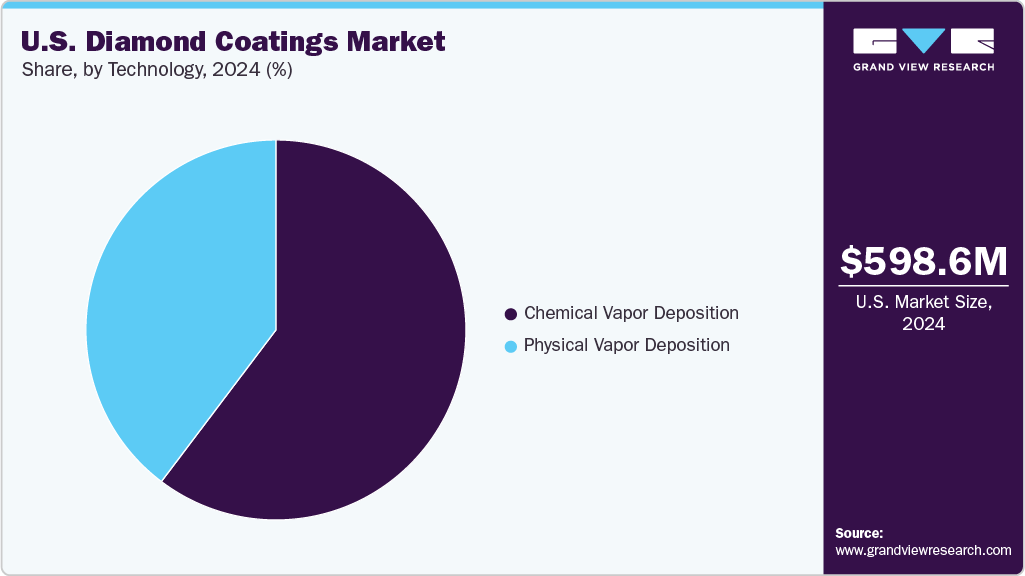

- By technology, the chemical vapor deposition segment held the largest revenue share of 60.3% in 2024 in terms of value.

- By end use, industrial segment held the largest revenue share of 41.0% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 598.6 Million

- 2033 Projected Market Size: USD 1,144.6 Million

- CAGR (2025-2033): 7.6%

The superior hardness, wear resistance, biocompatibility, and thermal conductivity of diamond coatings make them ideal for enhancing the longevity and functionality of tools, implants, and electronic components. Additionally, the increasing need for miniaturized and heat-resistant components in advanced electronics, along with rising investments in precision machines and surgical instruments, is further accelerating market growth.

The market presents significant growth opportunities driven by advancements in nanocrystalline and ultra-nanocrystalline diamond technologies, which enable improved coating performance for specialized applications. Expanding use in emerging sectors such as aerospace, defense, and high-frequency electronics, along with growing interest in additive manufacturing and 3D printing of coated components, opens new avenues for innovation. Furthermore, increasing demand for biocompatible and corrosion-resistant materials in next-generation medical devices and implants is expected to create lucrative opportunities for manufacturers.

Despite its promising outlook, the market faces challenges related to the high capital and operational costs associated with chemical vapor deposition (CVD) and physical vapor deposition (PVD) technologies. Technical complexities in achieving uniform coating thickness and adhesion on complex geometries also hinder widespread adoption. Additionally, limited scalability for large-area coatings, material compatibility issues with certain substrates, and the need for specialized infrastructure and skilled labor act as barriers to market expansion.

Market Concentration & Characteristics

The market is moderately fragmented, with a few 2 players, such as Sandvik, Sumitomot Electric Industries, Norton SaintGobain Abrasives, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Companies in the market are adopting strategies centered around technological innovation, strategic partnerships, and production scalability to gain a competitive edge. Key initiatives include the development of advanced coating solutions such as ultra-nanocrystalline and doped diamond films, as well as collaborations with medical devices, semiconductor, and cutting tool manufacturers to deliver application-specific solutions. Players are also investing in expanding CVD and PVD capabilities, protecting proprietary technologies through patents, and ensuring regulatory compliance, particularly for medical and electronic applications.

Substrate Insights

The metals segment held the largest revenue share of 40.3% in 2024, primarily due to the widespread use of metal substrates such as stainless steel, titanium, and tungsten carbide in industrial tools, cutting instruments, and medical devices. These substrates offer excellent compatibility with chemical vapor deposition (CVD) processes, allowing for uniform diamond coatings that significantly enhance surface hardness, wear resistance, and thermal conductivity. The demand is particularly high in the manufacturing and healthcare sectors, where metal-based tools and implants benefit from extended service life and improved performance under harsh operating conditions.

Ceramics, composites, and other materials represent growing substrate categories driven by their use in specialized applications. Ceramics like alumina and silicon nitride are gaining traction in electronics, aerospace, and defense due to their high-temperature resistance and electrical insulation properties, which are further improved by diamond coatings. Composites, including polymer- and metal-matrix composites, are increasingly used in lightweight engineering applications where the strength-to-weight ratio is critical. Additionally, the “other materials” segment, which includes glass, plastics, and semiconductor substrates, presents niche opportunities, particularly in optical devices and high-frequency electronics. However, challenges related to coating adhesion and thermal mismatch remain key considerations in these segments.

End Use Insights

The industrial segment emerged as the leading end-use sector, capturing a 41.0% revenue share in 2024. This dominance is primarily attributed to the extensive use of diamond-coated tools and components in manufacturing, machining, and precision engineering applications. Diamond coatings significantly enhance wear resistance, reduce friction, and extend the operational lifespan of cutting tools, dies, drills, and bearings, making them critical in high-load, high-speed industrial environments. The growing emphasis on improving manufacturing efficiency, minimizing downtime, and reducing tool replacement costs across industries such as automotive, aerospace, and metal fabrication continues to drive strong demand for diamond-coated solutions.

Other key end-use segments include medical, electrical & electronics, and other end users, each contributing to the market’s diversification. In the medical field, diamond coatings are increasingly applied to surgical instruments, orthopedic implants, and dental tools due to their biocompatibility, anti-microbial properties, and resistance to corrosion. Meanwhile, the electrical & electronics sector benefits from diamond’s superior thermal conductivity and electrical insulation, especially in heat sinks, semiconductors, and MEMS devices. The other end user category, which includes optics, defense, and luxury goods, presents niche but growing opportunities as diamond coatings gain traction for their performance and aesthetic benefits in specialized applications.

Technology Insights

Chemical vapor deposition (CVD) dominated the market with a revenue share of 60.3% in 2024, owing to its ability to produce high-quality, uniform, and adherent diamond films on a wide range of substrates, including metals, ceramics, and semiconductors. CVD technology enables precise control over coating thickness, grain structure, and purity, making it ideal for high-performance applications in industrial tools, electronics, and medical devices. Its widespread adoption is further supported by its compatibility with complex geometries and scalability for both low- and high-volume production. The rising demand for durable coatings in cutting tools, implants, and heat-sensitive electronic components has reinforced the dominance of CVD, particularly as industries seek to enhance product longevity and operational efficiency.

In contrast, physical vapor deposition (PVD) plays a more limited role in the diamond coatings market due to constraints in producing thick, defect-free diamond layers and challenges in achieving strong adhesion on certain substrates. PVD is generally used in applications requiring thinner coatings and lower temperature processing, such as decorative finishes or specific electronics. However, as CVD continues to evolve with the development of microwave plasma and hot filament variants, its technical and commercial advantages have made it the preferred technology across most high-growth end-use sectors. The lower adoption of PVD, coupled with the superior coating performance offered by CVD, explains the latter’s leading market position in 2024.

Key U.S. Diamond Coatings Company Insights

Key players, such as Sandvik, Sumitomot Electric Industries, Norton SaintGobain Abrasives, Hitachi Tool Engineering, and Oerlikon Balzers, are dominating the market.

-

Sandvik AB is a key player in the U.S. diamond coatings market, leveraging its deep expertise in materials technology and tooling solutions to deliver high-performance, diamond-coated products primarily for industrial and manufacturing applications. Through its subsidiary Sandvik Coromant, the company offers advanced cutting tools enhanced with diamond coatings to improve wear resistance, precision, and tool life, especially in demanding machining environments such as aerospace, automotive, and metalworking. Sandvik continues to invest in research and development to advance chemical vapor deposition (CVD) techniques and optimize coating performance on carbide and other metal substrates. With a strong focus on innovation, productivity enhancement, and sustainability, Sandvik remains a preferred partner for industries seeking durable and cost-effective tooling solutions.

Key U.S. Diamond Coatings Companies:

- Sandvik

- Sumitomot Electric Industries

- Norton SaintGobain Abrasives

- Hitachi Tool Engineering

- Oerlikon Balzers

- Diamond Product Solutions

- D-Coat GmbH

- NeoCoat SA

- SP3 Diamond Technologies

- Blue Wave Semiconductors

- Crystallume Corporation

- JCS Tecnologies PTE Ltd.

U.S. Diamond Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 637.2 million

Revenue forecast in 2033

USD 1,144.6 million

Growth rate

CAGR of 7.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Substrate, technology, end use

Key companies profiled

Sandvik; Sumitomot Electric Industries; Norton SaintGobain Abrasives; Hitachi Tool Engineering; Oerlikon Balzers; Diamond Product Solutions; D-Coat GmbH; NeoCoat SA; SP3 Diamond Technologies; Blue Wave Semiconductors; Crystallume Corporation; JCS Tecnologies PTE Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Diamond Coatings Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. diamond coatings market report based on technology, substrate, and end use:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Chemical Vapor Deposition

-

Physical Vapor Deposition

-

-

Substrate Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Metals

-

Ceramics

-

Composites

-

Other Materials

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electrical & Electronics

-

Medical

-

Industrial

-

Other End Users

-

Frequently Asked Questions About This Report

b. The U.S. diamond coatings market size was estimated at USD 598.6 million in 2024 and is expected to reach USD 637.2 million in 2025.

b. The U.S. diamond coatings market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2033 to reach USD 1,144.6 million by 2033.

b. The metals segment held the largest revenue share in 2024 due to the widespread use of metal substrates like stainless steel and tungsten carbide in cutting tools and medical devices, which benefit significantly from enhanced hardness and wear resistance offered by diamond coatings.

b. Some of the key players operating in the U.S. diamond coatings market include Sandvik, Sumitomot Electric Industries, Norton SaintGobain Abrasives, Hitachi Tool Engineering, Oerlikon Balzers, Diamond Product Solutions, D-Coat GmbH, NeoCoat SA, SP3 Diamond Technologies, Blue Wave Semiconductors, Crystallume Corporation, JCS Tecnologies PTE Ltd.

b. The market is driven by the rising demand for durable, high-performance coatings in industrial, medical, and electronic applications, where enhanced wear resistance, thermal conductivity, and biocompatibility are critical. Advancements in CVD technology and the need to extend the operational life of tools and components are further fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.