- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Digestive Health Supplements Market Size Report, 2033GVR Report cover

![U.S. Digestive Health Supplements Market Size, Share & Trends Report]()

U.S. Digestive Health Supplements Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Prebiotics, Probiotics), By Form (Capsules, Tablets), By Distribution Channel (Over-the-counter (OTC), Prescribed), And Segment Forecasts

- Report ID: GVR-4-68040-844-6

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Digestive Health Supplements Market Summary

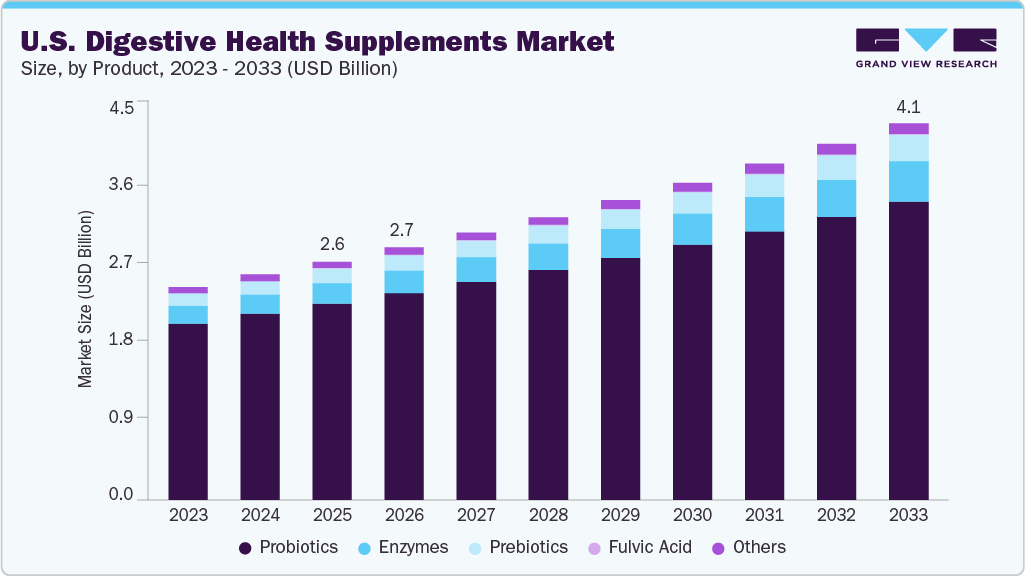

The U.S. digestive health supplements market size was estimated at USD 2,578.0 million in 2025 and is expected to reach USD 4,074.4 million by 2033, growing at a CAGR of 5.9% from 2026 to 2033. stive enzymes such as amylase, lipase, and protease are naturally produced in the body for better digestion of food.

Key Market Trends & Insights

- By product, the probiotics segment held the largest share of 82.4% in 2025.

- By form, the liquids segment is experiencing significant growth, projecting a CAGR of 7.3% from 2026 to 2033.

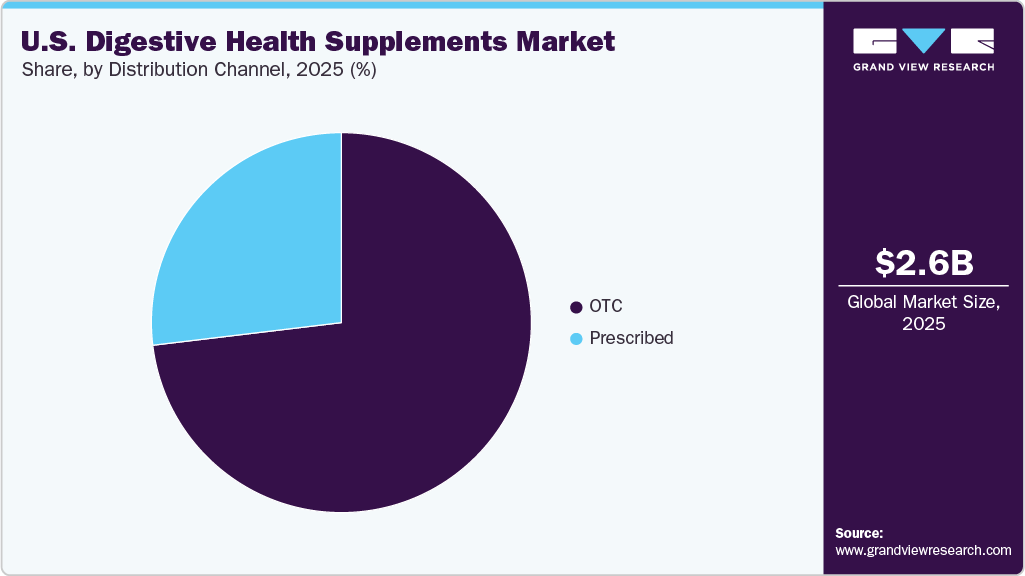

- By distribution channel, the Over-the-counter (OTC) segment held the largest market share of 73.1% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2,578.0 Million

- 2033 Projected Market Size: USD 2,578.0 Million

- CAGR (2026-2033): 5.9%

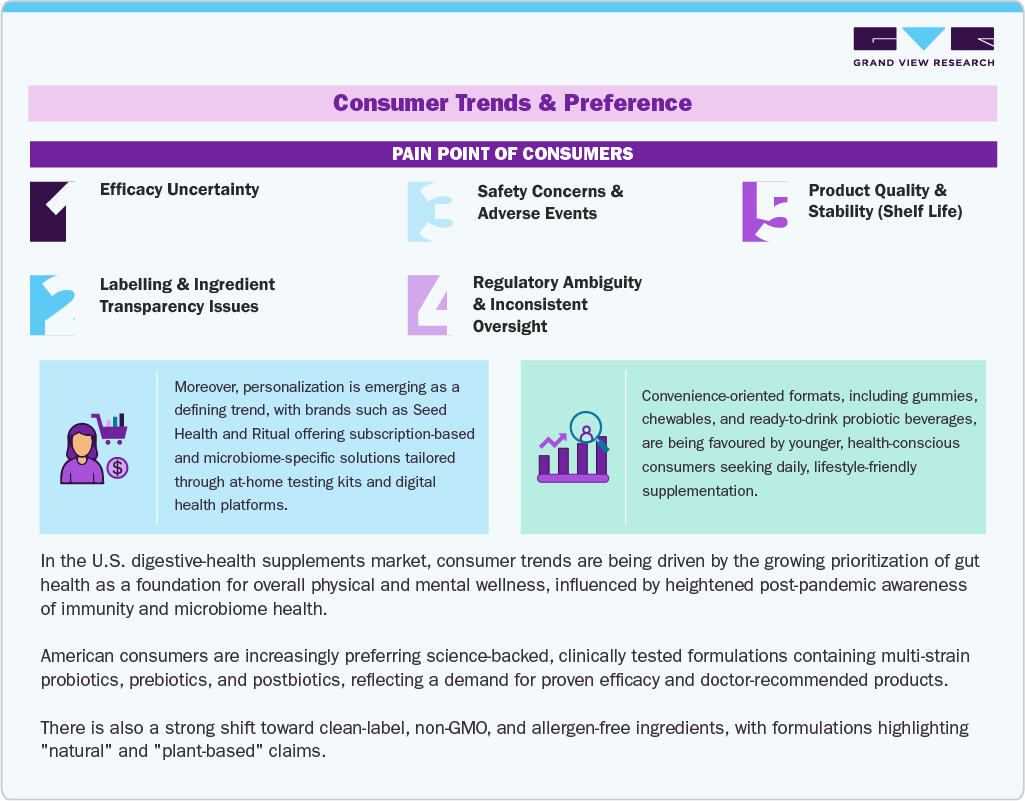

However, a substantial number of people face issues in naturally producing these enzymes, which requires them to consume enzyme supplements to fulfill the body's requirements. They generally take over-the-counter supplements for digestion-related problems such as acid reflux, gut irritation, bloating, heartburn, and diarrhea. The U.S. digestive health supplements market a rising prevalence of digestive diseases in large populations and the increasing number of weight management programs are expected to propel market growth during the forecast period.The rise of personalized nutrition is driving the U.S. digestive health supplement market. With a growing understanding that individuals have unique health needs and preferences, there is an increasing demand for digestive health supplements that cater to specific requirements. Personalized nutrition considers factors such as age, lifestyle, dietary habits, and health goals, tailoring supplement formulations to address individual variations in digestive health.

This trend aligns with the broader movement toward proactive health management, where consumers seek targeted solutions that resonate with their wellness journey. This shift toward personalization is reflected in the diversification of supplement offerings, with manufacturers incorporating a spectrum of ingredients like prebiotics, probiotics, and specific vitamins in formulations designed to meet distinct health objectives.

In addition, the demand for personalized nutrition in digestive health supplements is driven by an aging population seeking preventive health measures and a younger demographic prioritizing proactive well-being. For seniors, formulations may target age-specific digestive challenges, while younger consumers might seek supplements that align with their dietary preferences and lifestyle choices. This demographic-driven personalization reflects a nuanced understanding of diverse consumer needs, propelling the development of supplements that resonate with specific age groups and health goals.

Consumer Insights for U.S. Digestive Health Supplements Market

Product Insights

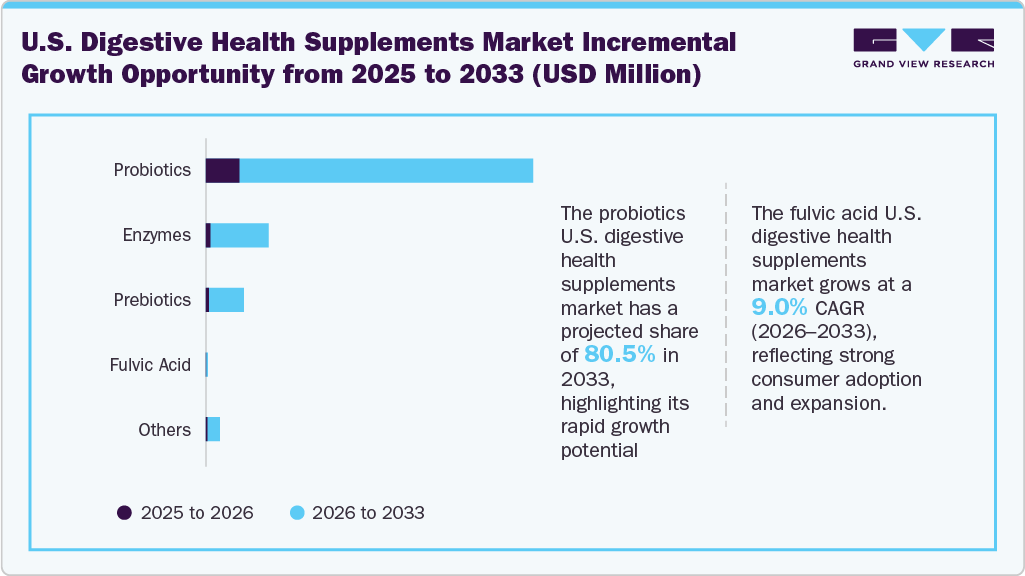

Probiotics segment accounted for the largest share of 82.4% of the revenue in 2025. Probiotics contain good bacteria, which help relieve diarrhea, constipation, and other digestive ailments. Public awareness regarding the benefits of probiotics has significantly increased in recent years. Consumers are actively seeking out probiotic-rich foods and supplements, driving segment growth. In addition, they are considered safe for consumption for most individuals by healthcare professionals. Probiotics offer a well-tolerated approach to digestive health. This positive safety profile makes them a particularly attractive option for consumers seeking natural and non-invasive solutions.

Fulvic acid segment is projected to grow at the fastest CAGR of 9.0% from 2026 to 2033. This sizeable growth is owing to the emerging widespread applications of fulvic acid in allergic symptoms such as eczema and inflammation and in reducing swelling. Fulvic acid is naturally found in radish, beetroots, and carrots. Research has shown the potential benefits of fulvic acid in replenishing the body with naturally occurring soil-based organisms, boosting the immune system, and boosting brain health. These factors are anticipated to drive the demand for fulvic acid during the forecast period.

Form Insights

The capsules segment accounted for the largest share of 40.9% of the revenue in 2025. This is owing to the advantageous property of capsules of allowing for precise dosing of active ingredients, thus ensuring consistent and controlled delivery throughout the digestive system. This is crucial for maintaining the supplement’s efficacy and maximizing its benefits. Moreover, capsules offer a convenient and easy way to consume supplements. They have an odorless and tasteless gelatin enteric coating, making them suitable for individuals who dislike the taste or texture of powders and liquids. In addition, cost-effectiveness of capsules over other options makes them a popular choice among consumers.

The digestive health liquid supplements industry is projected to grow at the fastest CAGR of 7.7% from 2026 to 2033. Tablets are known for superior stability over alternative formats such as capsules or powders. This results in a longer shelf life, reducing waste and ensuring product efficacy throughout the lifespan of the supplement. Moreover, tablets are the most familiar format for consuming medications and supplements. This high level of familiarity with tablets plays a vital role in influencing consumer preference and purchasing decisions, propelling segment expansion.

Distribution Channel Insights

The Over-the-counter (OTC) segment accounted for the largest share of around 73.1% in 2025. This is owing to the extensive availability of these supplements across several food retail chains, supermarkets, and convenience stores. Unlike prescription medicines, which the FDA regulates, these supplements are often taken without consulting the doctor. In addition, they are available in various flavors, forms, and sizes, addressing the needs of most consumers. Increased marketing efforts by manufacturers increase their awareness among people, which in turn drives them to buy these products. Furthermore, the online sub-segment is expected to witness the fastest growth rate, owing to the increasing popularity of e-commerce platforms.

The digestive health supplements through prescribed is projected to grow at a significant CAGR of 6.4% from 2026 to 2033. Increased awareness regarding the potential side effects of OTC supplements has paved the way for people to visit professionals to seek advice regarding the consumption of these supplements. The wrong dosage of enzymes is associated with severe reactions in the body. With stricter government regulations on the OTC segment, the growth prospects for prescription supplements are expected to remain promising in the upcoming years.

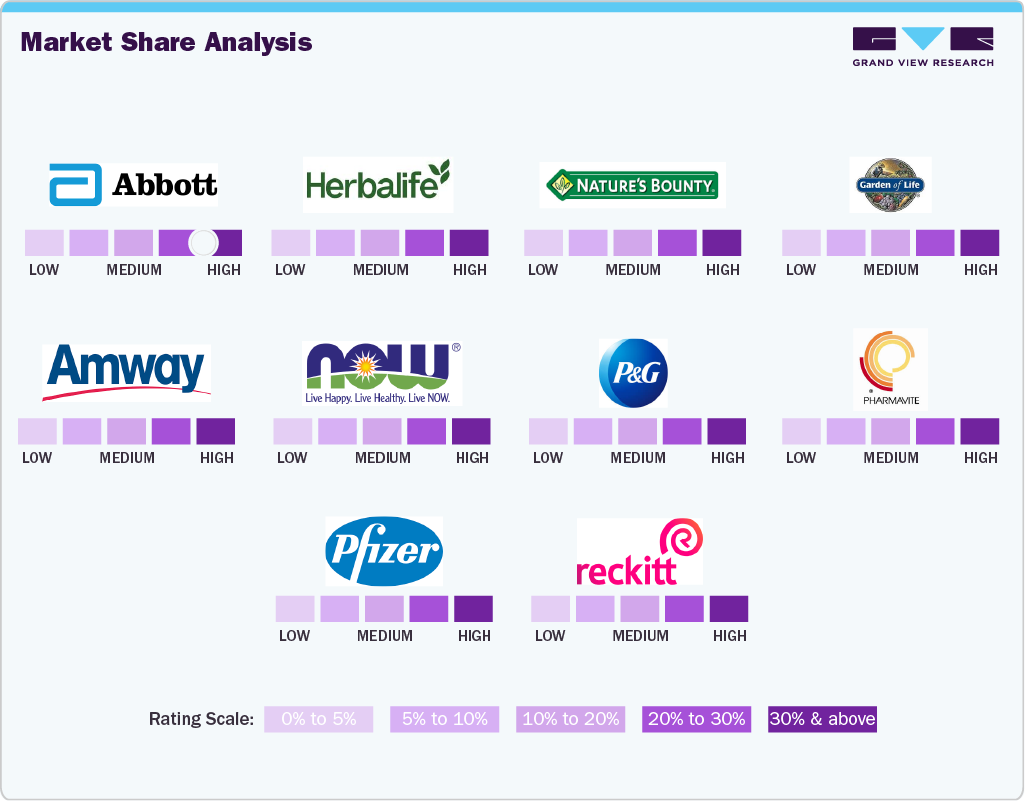

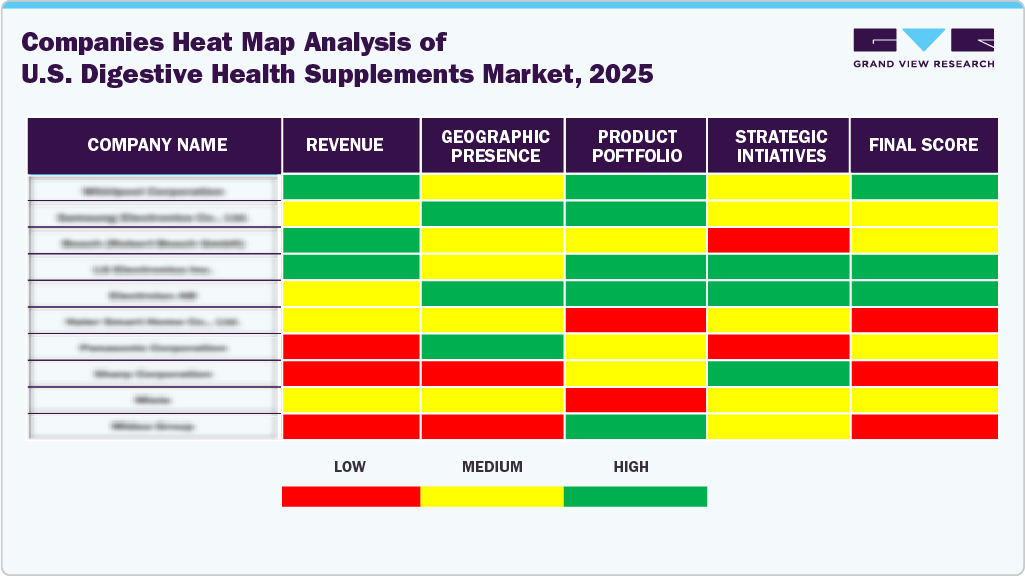

Key U.S. Digestive Health Supplements Company Insights

Some key companies involved in the U.S. digestive health supplements market include Abbott; NOW Foods; and Amway Corporation.

-

Abbott is an American multinational healthcare and medical devices company. The company offers a range of digestive medications under the name Pankreoflat digestive enzyme liquid, tablets, creon tablets, cremaffin liquid, glucerna, combinorm, and digene to address various digestion and pancreatic enzyme-related disorders.

-

Amway offers products in the areas of personal care, beauty, nutrition, and homecare. The company markets its digestive enzymes under the brand Nutrilite. It is available in capsule form and supports the body’s normal digestion of carbohydrates, protein, and dairy. Amway offers products made from natural ingredients to address liver-related issues under the same brand.

Key U.S. Digestive Health Supplements Companies:

- NOW Foods

- Amway Corporation

- Pharmavite LLC

- The Nature’s Bounty Co.

- Herbalife Nutrition Ltd.

- Abbott Laboratories

- The Procter & Gamble Company

- Pfizer Inc.

- Garden of Life LLC

- Reckitt Benckiser Group plc

Recent Developments

-

In March 2025, Nature Made, the leading national vitamin and supplement broadline brand with over 50 years of delivering high-quality products with ingredients backed by science, announced the launch of clinically studied innovations and new formulations within its Digestive portfolio to deliver a range of probiotic, prebiotic, and fiber supplements for daily gut health support and benefits based on specific wellness needs.

-

In January 2025, Amway taps into emerging gut health science and lifestyle changes to support wellbeing. The Nutrilite Begin 30 Holistic Wellness Program is a 30-day guided journey focused on adopting healthy habits and supporting gut health.

U.S. Digestive Health Supplements Market Report Scope

Report Attribute

Details

Market value size in 2026

USD 2,728.8 million

Revenue Forecast in 2033

USD 4,074.4 million

Growth rate

CAGR of 5.9% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative (Revenue) units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, distribution channel

Country scope

U.S.

Key companies profiled

NOW Foods; Amway Corporation; Pharmavite LLC; The Nature’s Bounty Co.; Herbalife Nutrition Ltd.; Abbott Laboratories; The Procter & Gamble Company; Pfizer Inc.; Garden of Life LLC; Reckitt Benckiser Group plc

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Digestive Health Supplements Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. digestive health supplements market report based on product, form, distribution channel.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Prebiotics

-

Probiotics

-

Enzymes

-

Fulvic Acid

-

Others

-

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsules

-

Tablets

-

Powders

-

Liquids

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

OTC

-

Supermarkets/Hypermarkets/Food Stores

-

Drug Stores & Pharmacies

-

Convenience Stores

-

Online

-

Others

-

-

Prescribed

-

Frequently Asked Questions About This Report

b. The U.S. digestive health supplements market size was estimated at USD 2,578.0 million in 2025 and is expected to reach USD 2,728.8 million in 2026.

b. The U.S. digestive health supplements market is expected to witness 5.9% revenue growth from 2026 to 2033 to reach USD 4,074.4 million by 2033.

b. The probiotics U.S. digestive health supplements market accounted for the largest share of 82.4% of the revenue in 2025 due to increased public awareness regarding the benefits of probiotics in recent years.

b. The key market players in the U.S. digestive health supplements market includes NOW Foods; Amway Corporation; Pharmavite LLC; The Nature’s Bounty Co.; Herbalife Nutrition Ltd.; Abbott Laboratories; The Procter & Gamble Company; Pfizer Inc.; Garden of Life LLC; Reckitt Benckiser Group plc.

b. Growth in the U.S. digestive health supplements market is being primarily driven by rising prevalence of digestive diseases in large populations and the increasing number of weight management programs globally are expected to propel market growth in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.