- Home

- »

- Next Generation Technologies

- »

-

U.S. eDiscovery Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. eDiscovery Market Size, Share & Trends Report]()

U.S. eDiscovery Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Organization Size, By Deployment Model (On-premise, Cloud), By End Use (Legal Sector, Healthcare), And Segment Forecasts

- Report ID: GVR-4-68040-591-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. eDiscovery Market Size & Trends

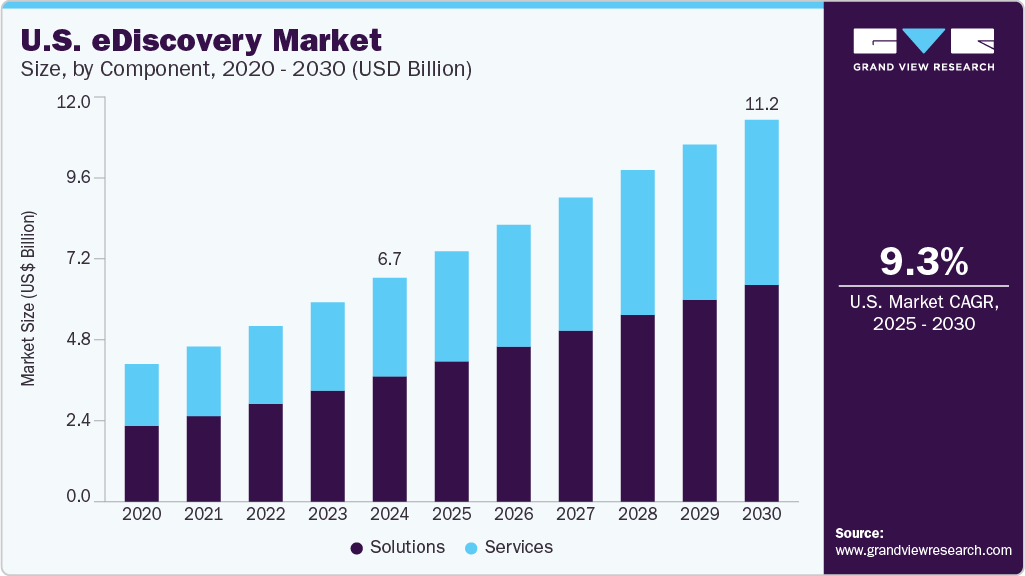

The U.S. eDiscovery market size was estimated at USD 6,560.7 million in 2024 and is expected to grow at a CAGR of 9.3% from 2025 to 2030, primarily driven by the exponential growth of electronically stored information (ESI) and the increasing complexity of data generated across industries, which necessitates advanced tools for efficient data collection and processing. Key trends include the adoption of artificial intelligence (AI) and machine learning (ML) technologies, which are revolutionizing eDiscovery processes by enabling efficient document review, data classification, and predictive coding. Additionally, there is a growing shift towards cloud-based eDiscovery solutions, offering scalability, flexibility, and remote access, which are essential for modern legal teams operating across various locations and time zones, thereby driving the growth of the market in the coming years.

Integrating artificial intelligence (AI) and machine learning (ML) into eDiscovery processes is revolutionizing the industry by automating document review, data classification, and predictive coding. These technologies reduce human error, accelerate case processing times, and lower costs by quickly identifying relevant documents. The growing adoption of generative AI and large language models (LLMs) is expected to revolutionize the eDiscovery industry further, creating new workflows and enhancing decision-making capabilities in legal teams.

Additionally, the increasing adoption of cloud-based platforms is a significant trend, driven by the need for scalable, cost-effective, and accessible eDiscovery services that support remote and distributed workforces. Cloud solutions enable centralized data management, seamless collaboration, and faster deployment than traditional on-premises systems. This shift is accelerated by the post-pandemic remote work culture and the demand for flexible, secure eDiscovery environments, thereby driving the eDiscovery industry growth.

Furthermore, with the surge in cyberattacks and data breaches, organizations are leveraging eDiscovery tools to conduct comprehensive digital investigations and gather critical evidence for legal compliance and incident response. The intersection of cybersecurity and eDiscovery is becoming increasingly important as companies seek to protect sensitive information while fulfilling regulatory obligations, driving demand for integrated solutions that address both legal and security challenges.

Moreover, U.S.-based companies in the eDiscovery market are adopting multifaceted strategies centered around technological innovation, service specialization, and strategic partnerships to maintain competitive advantage and meet evolving client demands. Key firms are also shifting toward cloud-based deployment models to offer scalable, flexible, and secure eDiscovery solutions that support remote workforces and distributed legal teams, thereby driving the market growth.

Component Insights

The solutions segment in the market registered the largest share of over 55% in 2024, driven by the growing complexity and volume of electronically stored information (ESI), which demands advanced technologies to efficiently identify, collect, preserve, process, and analyze data for legal proceedings. Increasing regulatory requirements around data privacy and security, such as CCPA and GDPR, drive organizations to adopt comprehensive eDiscovery software platforms that ensure compliance and defensibility.Additionally, the shift toward cloud-based solutions enhances scalability, accessibility, and collaboration for legal teams, driving the segmental growth.

The services segment is anticipated to record significant growth of over 8% from 2025 to 2030, driven by the increasing complexity of managing vast and diverse data sets, prompting organizations to outsource specialized eDiscovery tasks such as data processing, legal review, consulting, and managed services. Rising litigation rates and stringent compliance mandates across industries such as healthcare, finance, and government fuel demand for expert service providers who can navigate regulatory nuances and deliver cost-effective, efficient workflows. The growth of cloud-based eDiscovery has also expanded opportunities for remote and on-demand service delivery, enabling flexible engagement models.

Organization Size Insights

The large enterprises segment accounted for the largest market share in 2024, owing to their massive volumes of electronically stored information (ESI) generated across multiple departments and global operations. These organizations face complex regulatory compliance requirements, including CCPA, HIPAA, and Sarbanes-Oxley, necessitating robust, scalable eDiscovery solutions with advanced data governance and security features. Large enterprises increasingly adopt AI and machine learning technologies to automate document review and predictive coding, reducing costs and accelerating litigation readiness. They also prefer hybrid deployment models-combining on-premises control with cloud scalability-to meet stringent data privacy and security mandates.

The small and medium enterprises segment is expected to witness the highest CAGR from 2025 to 2030, driven by rising litigation risks, regulatory scrutiny, and the growing complexity of digital data even within smaller operations. Cost-effectiveness and ease of use are critical drivers for SMEs, leading to a preference for cloud-based, subscription-model eDiscovery platforms that offer scalability without heavy upfront infrastructure investment. SMEs benefit from AI-powered automation to streamline document review and reduce reliance on large legal teams, making eDiscovery more accessible. Additionally, SMEs often outsource eDiscovery services to specialized providers to compensate for limited internal resources and expertise.

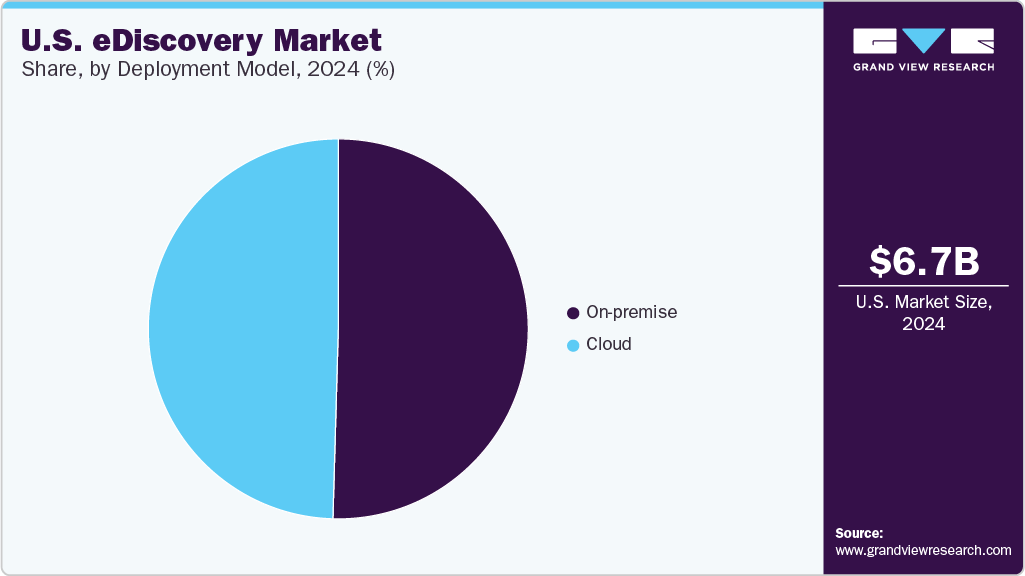

Deployment Insights

The on-premise segment registered the largest revenue share in 2024. This growth can be attributed to their high level of data control, security, and compliance, especially for industries handling sensitive information such as finance, healthcare, and government. Organizations in these sectors prioritize on-premises deployments to maintain strict data governance, enforce internal security policies, and comply with regulatory requirements, reducing risks of data breaches and unauthorized access. This deployment model allows companies to leverage existing IT infrastructure and integrate customized security protocols aligned with their compliance frameworks.

The cloud segment is expected to grow at the highest CAGR from 2025 to 2030. The primary drivers include scalability, cost efficiency, and enhanced accessibility, enabling organizations to manage exponentially growing data volumes without heavy upfront infrastructure investments. Cloud platforms offer flexible pay-as-you-go models, rapid deployment, and seamless collaboration across distributed legal teams, which are increasingly important in the post-pandemic remote work environment. Additionally, cloud solutions facilitate integration of advanced AI and machine learning tools for automated document review and predictive coding, further improving efficiency and reducing costs.

End Use Insights

The legal sector segment in the market registered the largest share in 2024, driven by increasing litigation complexity, regulatory compliance demands, and the massive growth of electronically stored information (ESI) involved in legal cases. Law firms and corporate legal departments are adopting advanced eDiscovery solutions to streamline document review, reduce costs, and accelerate case preparation. Additionally, the legal sector’s growing reliance on cloud-based platforms supports remote collaboration and scalability, essential for handling large, complex cases. The need to comply with regulations such as CCPA and HIPAA further compels legal professionals to invest in secure, defensible eDiscovery tools that maintain data privacy and auditability.

The manufacturing segment is anticipated to record the fastest growth from 2025 to 2030, driven by rising regulatory scrutiny, intellectual property (IP) protection concerns, and the growing volume of digital data generated through supply chains, product development, and operational processes. Manufacturers face complex litigation risks related to patent disputes, product liability, and compliance with environmental and safety regulations, necessitating efficient eDiscovery capabilities. The sector’s increasing digital transformation and data governance initiatives also contribute to the rising demand for comprehensive eDiscovery services and solutions.

Key U.S. eDiscovery Company Insights

Some of the key players operating in the U.S. eDiscovery market include Microsoft Corporation, Lighthouse, IBM Corporation, and others.

-

Microsoft Corporation is a leading player in the U.S. eDiscovery industry with its Microsoft Purview platform. This platform helps organizations manage legal and compliance data across Microsoft 365 services like Exchange Online, SharePoint, and OneDrive. Offering solutions from basic content search to advanced AI-powered case management, Microsoft Purview streamlines eDiscovery workflows while ensuring strong security and regulatory compliance.

-

Lighthouse specializes in providing comprehensive eDiscovery services, including data collection, processing, review, and production, leveraging AI and machine learning to improve accuracy and efficiency. Serving law firms, corporations, and government entities, Lighthouse delivers technology-driven solutions that simplify complex litigation and regulatory investigations in the U.S. market.

Conduent, Exterro, Inc. are some of the emerging market participants in the eDiscovery market.

-

Conduent Incorporated provides business process services, specializing in legal compliance and eDiscovery solutions. The company leverages advanced technology and analytics to assist organizations in managing complex legal processes, ensuring compliance with regulatory requirements, and optimizing operational efficiency.

-

Exterro, Inc. is a provider of e-discovery software solutions that cater to the needs of legal and compliance professionals. The company focuses on streamlining the e-discovery process through its comprehensive tools for data management, legal hold, and investigation workflows. The company’s platform integrates various functionalities, allowing organizations to efficiently manage their electronic data during litigation and regulatory inquiries.

Key U.S. eDiscovery Companies:

- IBM Corporation

- Microsoft Corporation

- Epiq Systems, Inc.

- Exterro, Inc.

- Casepoint LLC

- CloudNine Discovery Services Inc.

- Conduent Incorporated

- Commvault Systems Inc.

- Lighthouse

- OpenText Corporation

Recent Developments

-

In January 2025, LexisNexis launched Protégé, a personalized AI assistant designed to enhance legal professionals' productivity and work quality. Protégé employs advanced agentic AI capabilities, allowing it to autonomously complete tasks such as drafting and reviewing legal documents, summarizing case law, and generating deposition questions.

-

In January 2025, OPEXUS and Casepoint LLC announced a strategic merger, complemented by a majority investment from Thoma Bravo, a leading software-focused private equity firm. This consolidation aims to create a robust platform offering advanced data discovery and process management software tailored for government and regulated enterprises across North America.

-

In January 2025, Epiq Systems, Inc. introduced the Epiq AI Discovery Assistant and established Epiq AI Labs to advance AI-driven solutions in legal services. The Epiq AI Discovery Assistant automates over 80% of traditional eDiscovery processes, enabling reviews up to 90% faster than conventional methods and analyzing up to 500,000 documents per hour.

U.S. eDiscovery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,326.5 million

Revenue forecast in 2030

USD 11,163.9 million

Growth rate

CAGR of 9.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report Component

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, deployment model,and end use

Country scope

U.S.

Key companies profiled

IBM Corporation; Microsoft Corporation; Epiq Systems, Inc.; Exterro, Inc.; Casepoint LLC; CloudNine Discovery Services Inc.; Conduent Incorporated; Commvault Systems Inc.; Lighthouse; OpenText Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. eDiscovery Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. eDiscovery market report based on component, organization size, deployment model, and end use:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Deployment Model Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Legal Sector

-

Government and Regulatory Agencies

-

BFSI

-

Healthcare

-

Retail and Consumer Goods

-

Energy and Utilities

-

IT and Telecommunications

-

Manufacturing

-

Others

-

Frequently Asked Questions About This Report

b. The solutions segment in the market registered the largest share of over 55% in 2024, driven by the growing complexity and volume of electronically stored information (ESI), which demands advanced technologies to efficiently identify, collect, preserve, process, and analyze data for legal proceedings

b. Some key players operating in the U.S. eDiscovery market include IBM Corporation, Microsoft Corporation, Epiq Systems, Inc., Exterro, Inc., Casepoint LLC, CloudNine Discovery Services Inc., Conduent Incorporated, Commvault Systems Inc., Lighthouse, and OpenText Corporation

b. Key factors driving the U.S. eDiscovery market growth include the exponential growth of electronically stored information (ESI), increasing complexity of data generated across industries, and the integration of artificial intelligence (AI) and machine learning (ML) into eDiscovery processes.

b. The U.S. eDiscovery market size was estimated at USD 6,560.7 million in 2024 and is expected to reach USD 7,326.5 million in 2025.

b. The U.S. eDiscovery market is expected to grow at a compound annual growth rate of 9.3% from 2025 to 2030 to reach USD 11,163.9 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.