- Home

- »

- Advanced Interior Materials

- »

-

U.S. Electric Baseboard Heater Market, Industry Report, 2033GVR Report cover

![U.S. Electric Baseboard Heater Market Size, Share & Trends Report]()

U.S. Electric Baseboard Heater Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Portable Baseboard Heater, Fixed Baseboard Heater), By Distribution Channel (Online, Retail Stores), By Application, By Product, And Segment Forecasts

- Report ID: GVR-4-68040-646-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Electric Baseboard Heater Market Summary

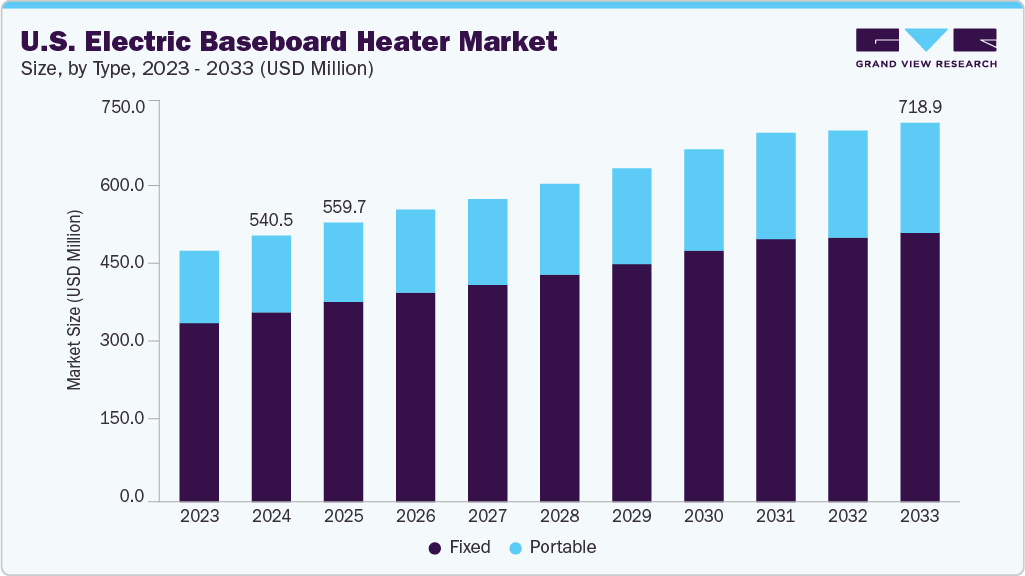

The U.S. electric baseboard heater market size was estimated at USD 540.5 million in 2024 and is projected to reach USD 718.9 million by 2033, growing at a CAGR of 3.2% from 2025 to 2033. The U.S. electric baseboard heater industry is driven by growing interest in energy-efficient and low-emission heating solutions, particularly in response to federal energy standards and sustainability goals.

Key Market Trends & Insights

- The electric baseboard heater market in the U.S. is expected to grow at a substantial CAGR of 3.2% from 2025 to 2033.

- By type, the portable baseboard heater segment is expected to grow in revenue at a considerable CAGR of 3.6% from 2025 to 2033.

- By distribution channel, the online segment is expected to grow in revenue at a considerable CAGR of 3.9% from 2025 to 2033.

- By product, the electric type segment is expected to grow at a considerable revenue CAGR of 3.3% from 2025 to 2033.

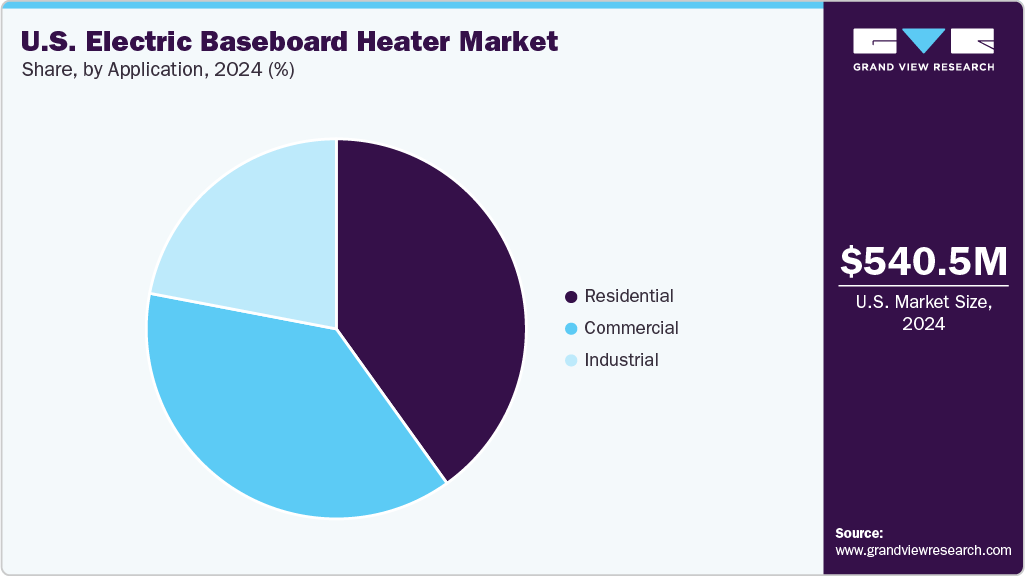

- By application, the residential segment is expected to grow in revenue at a considerable CAGR of 3.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 540.5 Million

- 2033 Projected Market Size: USD 718.9 Million

- CAGR (2025-2033): 3.2%

Consumers increasingly choose heaters with programmable thermostats and zoned temperature control to reduce electricity usage. Another key factor is the high heating demand during long winters in northern U.S. regions, such as the Midwest and Northeast. Electric baseboard heaters offer a practical solution for homeowners seeking room-specific comfort without the need for major renovations. Their ease of installation, especially in older buildings and multi-unit residences, makes them a preferred option for both new construction and retrofits. The growing market for low-maintenance and affordable heating systems is further boosting their adoption across the country.

Market Concentration & Characteristics

The U.S. electric baseboard heater market is relatively fragmented, with a mix of national brands and smaller regional manufacturers. While many local firms continue to compete effectively in specific states and regions. The market is shaped more by product innovation and customer preferences than by dominance from a single player. Despite some consolidation efforts, the overall structure remains competitive and diverse, with no clear leader controlling a major share.

The U.S. electric baseboard heater industry is witnessing steady innovation, particularly through integration with smart thermostats and home automation systems. Manufacturers enhance energy efficiency and user control to meet evolving consumer expectations. Features such as remote access, programmable timers, and adaptive heating modes are becoming more common. These advancements position electric baseboard heaters as viable options within modern, tech-enabled homes.

Mergers and acquisitions in the U.S. electric heating market are moderate but strategic, often aimed at expanding product lines or gaining regional market share. Larger firms are acquiring smaller, specialized manufacturers to broaden their offerings and strengthen distribution. Such activity also supports investment in R&D and improved manufacturing capabilities. While not highly consolidated, the market does show signs of gradual consolidation through targeted acquisitions.

U.S. regulations significantly influence the electric baseboard heater market, particularly through energy efficiency standards set by the Department of Energy. State-level policies, especially in California and the Northeast, encourage using low-emission, electric-based heating systems. Compliance with environmental standards has pushed manufacturers to design heaters that consume less power while maintaining performance. These regulations are shaping product development and influencing consumer and builder choices alike.

Drivers, Opportunities & Restraints

The market is driven by rising demand for energy-efficient, zoned heating systems, especially in colder states like New York and Minnesota. Increasing adoption of smart home technologies enhances the appeal of programmable electric heaters. Federal and state energy efficiency standards further promote the use of electric heating over fossil fuel alternatives. Growing interest in sustainable living and the electrification of homes also supports market expansion.

There is a strong opportunity for market growth through product innovation and smart integration, especially as demand for connected HVAC systems rises. Retrofits in older residential buildings and upgrades in multi-family housing present a large replacement market. Government incentives for energy-efficient home improvements can boost adoption rates. Expansion into underserved rural and low-income regions offers additional potential for volume growth.

High electricity costs in certain U.S. states may discourage some consumers from adopting electric baseboard heaters. Competition from central HVAC systems, heat pumps, and alternative energy-efficient solutions can limit market share. Limited awareness of newer, smart-enabled models may reduce interest among traditional users. Additionally, upfront installation costs and a lack of duct integration can be drawbacks in larger homes.

Type Insights

The fixed electric baseboard heaters segment dominated the market and accounted for a share of 71.6% in 2024, due to widespread use in permanent residential installations. They are especially common in colder regions and older homes where ductless heating is preferred for individual room control. Their ability to provide reliable, zone-based heating at relatively low installation costs supports continued demand. Additionally, compatibility with smart thermostats enhances their appeal for modern energy-conscious consumers.

Portable electric baseboard heaters are witnessing significant growth in the U.S. due to rising demand for flexible and temporary heating solutions. Consumers in rental properties or smaller living spaces prefer portable units for their mobility and ease of use. These heaters offer a cost-effective option for supplemental warmth without needing installation. As energy-efficient models with safety features become more available, their popularity continues to increase.

Distribution Channel Insights

Retail stores continue to lead the U.S. electric baseboard heater market and accounted for 47.6% share, as the primary distribution channel, especially in regions with seasonal demand spikes. Consumers prefer in-store purchases for immediate availability and physical comparison of products. Big-box retailers like Home Depot and Lowe’s offer various models, making selection and pickup convenient. Retail staff assistance also helps buyers choose suitable heaters for their specific home layouts.

Online sales are growing rapidly in the U.S. due to increasing consumer preference for convenience, broader product selection, and competitive pricing. E-commerce platforms like Amazon and manufacturer websites allow easy access to detailed specifications, reviews, and energy ratings. The rise of smart homes has also pushed consumers to research and buy smart-enabled heaters online. Fast shipping and frequent promotions further boost the appeal of digital purchasing channels.

Product Insights

The electric baseboard heater segment accounted for a share of 71.2% in 2024. Electric baseboard heaters continue to dominate the U.S. market due to their affordability, ease of installation, and suitability for zoned heating. These units are commonly used in older homes and smaller living spaces where central HVAC systems may not be practical. Their compatibility with programmable thermostats supports energy savings and comfort.

Hydronic baseboard heaters are gaining popularity in the U.S. as consumers seek more energy-efficient and long-lasting heating solutions. These systems offer steady, radiant heat and maintain warmth longer after power is turned off, improving overall energy efficiency. They are especially favored in colder regions for their comfort and quieter operation. Increased focus on low-emission and eco-friendly heating accelerates their growth in residential and light commercial applications.

Application Insights

The residential segment accounted for a share of 40.1% in 2024 due to strong demand for room-by-room heating in apartments, single-family homes, and multi-unit dwellings. Homeowners value these systems for their low upfront cost, easy installation, and energy-saving potential in zoned heating. They are particularly popular in colder states and older homes lacking ductwork. The ability to integrate with smart thermostats further supports their appeal in modern households.

The commercial segment is growing steadily as businesses seek efficient, low-maintenance heating for offices, retail stores, and service areas. Electric baseboard heaters offer localized climate control, which is ideal for individual rooms or entryways without the need for complex HVAC systems. Commercial operators are turning to compliant and cost-effective solutions as energy regulations become more stringent. Renovation and retrofit projects in small to mid-sized businesses also fuel increased adoption.

Key U.S. Electric Baseboard Heater Company Insights

Some of the key players operating in the market include Glen Dimplex Group., Cadet Manufacturing Company, Stelpro Design Inc.

-

Glen Dimplex is a key player in the electric heating segment, particularly recognized for its advanced baseboard heaters and integrated heating control technologies. The company emphasizes energy efficiency through smart thermostats, zoned heating, and compliance with eco-design standards. Its heating products are widely used across Europe and North America in residential retrofits and low-carbon housing projects. The brand’s investment in heat-pump hybrid systems and electric thermal storage positions it strongly in the transition toward electrified home heating.

-

Cadet specializes in electric baseboard and wall heaters tailored for localized and zoned heating applications in the U.S. market. The company’s product lines are designed for quick installation, energy control, and durability in residential and light commercial settings. Cadet’s innovation includes smart temperature management and sleek, compact designs suitable for modern interiors. It operates under the Glen Dimplex Group umbrella, benefiting from shared R&D capabilities and a strong distribution network across North America.

Key U.S. Electric Baseboard Heater Companies:

- Glen Dimplex Group.

- Cadet Manufacturing Company

- Stelpro Design Inc.

- Marley Engineered Products

- King Electric Manufacturing Co.

- Ouellet

- Danfoss A/S

- Honeywell International Inc.

- Lasko Products, LLC

- STIEBEL ELTRON GmbH & Co. KG (DE)

Recent Developments

-

In May 2025, King Electric launched the KBSH Series stainless steel unit heater to elevate temperatures in unoccupied industrial and commercial rooms up to 160°F. It is especially suited for environments such as curing chambers, food processing areas, and laboratories that require precise and high-intensity heating. The system features a remote-mounted control panel for maintaining stable temperatures while protecting sensitive components. Its durable stainless steel construction and sealed enclosure make it ideal for use in harsh and frequently cleaned settings.

-

In April 2025, Danfoss expanded its partnership with Assemblin Caverion Group through a new agreement focused on advancing energy-efficient and sustainable building solutions. The collaboration aims to upgrade various facility types, including hospitals, schools, and data centers, with modern energy systems.

U.S. Electric Baseboard Heater Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 559.7 million

Revenue forecast in 2033

USD 718.9 million

Growth rate

CAGR of 3.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, product, application.

Country scope

U.S.

Key companies profiled

Glen Dimplex Group.; Cadet Manufacturing Company; Stelpro Design Inc.; Marley Engineered Products; King Electric Manufacturing Co.; Ouellet; Danfoss A/S; Honeywell International Inc.; Lasko Products, LLC; STIEBEL ELTRON GmbH & Co. KG (DE)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electric Baseboard Heater Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. electric baseboard heater market report based on type, distribution channel, product, and application.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Portable Baseboard Heater

-

Fixed Baseboard Heater

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Retail Stores

-

Wholesale Stores

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric Type

-

Hydronic Type

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. electric baseboard heater market size was estimated at USD 540.5 million in 2024 and is expected to be USD 559.7 million in 2025.

b. The U.S. electric baseboard heater market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.2% from 2025 to 2033 to reach USD 718.9 million by 2033.

b. The fixed electric baseboard heaters segment dominated the market and accounted for a share of 71.6% in 2024, owing to their widespread use in permanent residential installations. They are especially common in colder regions and older homes where ductless heating is preferred for individual room control.

b. Some of the key players operating in the U.S. electric baseboard heater market include Glen Dimplex Group.; Cadet Manufacturing Company; Stelpro Design Inc.; Marley Engineered Products; King Electric Manufacturing Co.; Ouellet; Danfoss A/S; Honeywell International Inc.; Lasko Products, LLC; STIEBEL ELTRON GmbH & Co. KG (DE).

b. Key factors driving the U.S. electric baseboard heater market include growing demand for energy-efficient, zone-based heating and increasing adoption of smart home technologies. Supportive regulations and the need for low-maintenance heating in older and multi-family homes further boost market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.