- Home

- »

- Advanced Interior Materials

- »

-

U.S. & Europe Aluminum Foil Market, Industry Report 2030GVR Report cover

![U.S. & Europe Aluminum Foil Market Size, Share & Trends Report]()

U.S. & Europe Aluminum Foil Market Size, Share & Trends Analysis Report By Product (Wrapper Foils, Container Foils, Foil Lids, Pouches, Blister Packs), By End Use (Packaging, Industrial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-051-7

- Number of Report Pages: 92

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

U.S. & Europe Aluminum Foil Market Trends

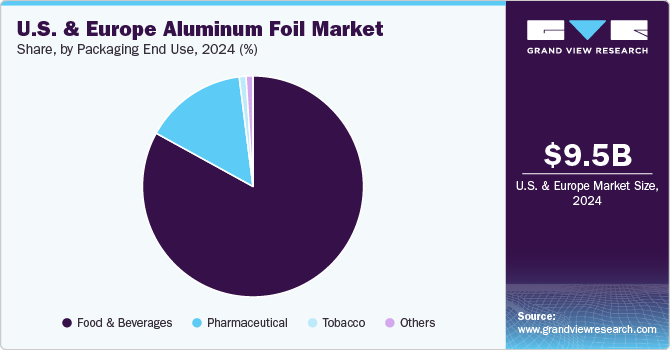

The U.S. & Europe aluminum foil market size was valued at USD 9.51 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. Aluminum foil is a flat rolled product produced by either cold rolling sheet coils or by the continuous casting of liquid aluminum. The growing demand for packaging-related applications and a rise in EV battery production are the key growth drivers for the market.

The product finds application in the packaging sector as it protects packaged goods against light, oxygen, moisture, bacteria, etc. It is also used for the packaging of tobacco, pharmaceuticals, and cosmetics.

Drivers, Opportunities & Restraints

Aluminum foil is widely used as a positive current collector in lithium-ion batteries owing to their low weight & cost and high specific capacity. The market growth is attributed to the increasing product demand in various industries, such as HVAC, food & beverage, pharmaceutical, and EV batteries. Increasing temperatures due to climate change have increased investments in HVAC systems. For instance, in May 2022, Johnson Controls announced investing USD 7.5 million for automation equipment in its commercial HVAC manufacturing plant in Norman, U.S. The new equipment is likely to increase the production capacity of the facility. As a result of the growing product demand in packaging applications, private companies are investing in the packaging industry of the country.

For instance, in September 2022, GEA, an international food-producing technology supplier, started a North American Technology Center in Frisco, Texas, U.S. Also, Pianca Packaging LLC started a new packaging facility in Lehigh Valley, U.S. The company produces containers for bakeries, food producers, and supermarkets. However, fluctuations in aluminum prices are anticipated to restrain market growth to a certain extent over the forecast period. Volatility in prices is attributed to factors such as a sudden demand for aluminum after the economic recovery from the pandemic in 2021, supply constraints owing to the cut down of aluminum production by China, and the ongoing Russia-Ukraine war.

The key players in the industry have already taken initiatives to implement new digitalized solutions and brought in automation as a step towards Industry 4.0. The implementation of smart factories in the packaging industry enhances productivity. For instance, as per the research conducted to check the profitability of applying Industry 4.0 solutions in blister factories, the transformation of a classic blister factory to a smart factory yielded 30% more effective in terms of production. Thus, the implementation of Industry 4.0 in packaging factories is anticipated to enhance production and eventually benefit the demand for aluminum foil.

Product Insights

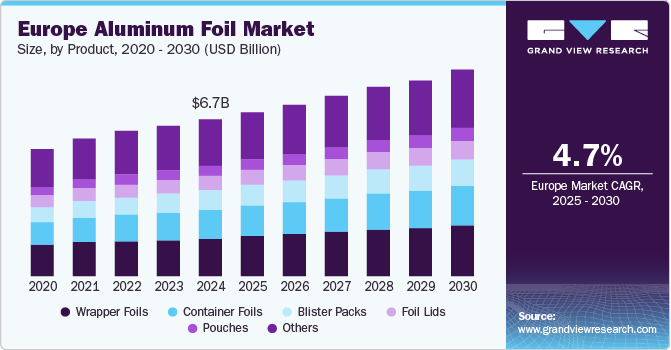

On the basis of products, the industry has been categorized into wrapper foils, container foils, foil lids, pouches, blister packs, and others. The wrapper foils segment dominated the industry in 2024 and accounted for the maximum share. The large share of the segment can be attributed to the growing demand for wrapper foils in food delivery businesses, restaurants, households, and other end-users.

Their demand has witnessed a surge, especially after the pandemic, as the masses across the world made efforts to minimize the risk of getting affected by coronavirus by relying on packaged food delivery services. The foil lids segment is estimated to account for the second-largest share of the market. The increasing investments in the pharmaceutical sector are expected to augment the demand for aluminum foil lids over the forecast period. For instance, in April 2024, AbbVie announced the expansion of Singapore's manufacture facility in Singapore.

End Use Insights

Aluminum foil is considered an ideal material for packaging food & beverages as it is lightweight, easily recyclable, and flexible. The rising investments in the food & beverage sector are expected to augment the demand for aluminum foil over the forecast period. For instance, in March 2024, Hindustan Coca-Cola Beverages (HCCB) announced an investment of USD 41.3 million (~INR 350 crore) for two manufacturing plants in the Rajgarh plant.

The other end-use of aluminum foil is the industrial segment, which is further categorized into HVAC, EV battery, and other industrial end-users. It is widely used for the manufacturing of finstock for air conditioners, heat exchangers, and car radiators. The rapid growth of the building & construction industry is expected to propel the demand for HVAC systems over the forecast period. For instance, in January 2022, the Indonesian parliament passed a law, the Capital City Bill, to build the new capital city in East Kalimantan province. The country is anticipated to invest USD 35 billion in new capital city construction, which is expected to be completed by 2024.

Regional Insights

U.S. Aluminum Foil Market Trends

The penetration of EVs is the key driver in the country. The majority of vehicle producers are inclined toward EV production. For instance, in October 2021, an announcement was made by Bentley Motors pertaining to the production of its cars that it is expected to produce plug-in hybrids and Electric Vehicles (EVs) by 2026 and 2030 respectively. The market growth in the U.S. is attributed to the increasing product demand in various industries, such as HVAC, food & beverage, pharmaceutical, and EV batteries.

The country is focusing on becoming less reliant on other nations for sourcing EV components and batteries. Due to this, in May 2022, the U.S. government announced a USD 3.1 billion fund to support the domestic manufacturing of EV batteries and components. The funding is a part of the Bipartisan Infrastructure Law and is likely to aid U.S. companies to construct new manufacturing factories and retrofit existing facilities to produce EV batteries and related components. Such initiatives are expected to propel the demand over the forecast period.

Europe Aluminum Foil Market Trends

The aluminum foil market in Europe is driven by rising investments in various industries, such as food & beverages, pharmaceuticals, EVs, and HVAC. The European Union (EU) has set an ambitious target to become climate-neutral by 2050. In May 2022, The EU announced EUR 20 billion (USD 20.4 billion) to boost the sales of clean vehicles and to set up 1 million hydrogen and EV charging stations by 2025. Also, the increasing demand for EVs has pushed private players to invest in electric vehicle manufacturing.

Germany aluminum foil market is anticipated to remain a key player in the European aluminum foil market, driven by its robust packaging and automotive industries. The market is likely to benefit from advancements in recycling technologies and increasing demand for sustainable materials. The adoption of lightweight solutions is projected to fuel growth in the automotive sector.

The aluminum foil market in the UK is likely to witness steady demand, particularly from the food and beverage industry, due to the growing preference for convenience packaging. Sustainability concerns are anticipated to drive innovation in recyclable and biodegradable foil options. The construction sector is also projected to contribute to the market growth with increased use of insulation.

Italy's aluminum foil market is anticipated to grow, supported by its thriving food packaging industry and strong export potential. The country's focus on high-quality and specialized foil products is likely to create a competitive edge. Demand is projected to rise with increasing adoption in the pharmaceutical and cosmetics sectors.

Key U.S. & Europe Aluminum Foil Company Insights

Some of the key players operating in the industry include Dongwon Systems, GLS Group, and Hindalco Industries Limited

-

Dongwon Systems is engaged in the business of packaging. Its categories include glass bottles, soft packing, aluminum cans, PET bottles, steel cans, paper boxes, industrial films, sanitary films, and others.

-

GLS Group offers innovative and sustainable solutions to industries such as packaging, chemicals, aluminum, packaging, and industrial films.

-

Hindalco Industries Limited is a subsidiary of the Aditya Birla Management Corporation Pvt. Ltd. The company is a market leader in copper and aluminum products. It is one of the biggest producers of primary aluminum in Asia and among the largest aluminum rolling companies in the world.

Key U.S. & Europe Aluminum Foil Companies:

- Dongwon Systems

- GLS Group

- Hangzhou dingsheng industrial group co. LTD

- Hindalco Industries Limited

- Jindal (India) Limited

- LKSB Aluminum Foils

- QualityFoil sarl

- Raviraj Foils Limited

- Shyam Metalics

- SNTO (Suntown Technology Group Corporation Limited)

Recent Developments

-

In April 2022, GLS and ELOPAK announced a joint venture in India, known as GLS Elopak. It is a high-precision aseptic carton manufacturing and service company, providing to the Food and Agro Producting sectors.

-

In June 2022, Metal Exchange Corporation announced the acquisition of Medalco Metals, a distributor of light aluminum rolled products, including aluminum foil, in the U.S. The acquisition is likely to help Metal Exchange Corporation diversify its customer base in the growing industries such as HVAC, automotive, building, and flex.

U.S. & Europe Aluminum Foil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.96 billion

Revenue forecast in 2030

USD 12.86 billion

Growth Rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative Units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and region

Regional scope

U.S. and Europe

Country scope

U.S., Germany, UK, Italy, Russia and Turkey

Key companies profiled

Dongwon Systems, GLS Group, Hangzhou dingsheng industrial group co. LTD, Hindalco Industries Limited, Jindal (India) Limited, LKSB Aluminum Foils, QualityFoil sarl, Shyam Metalics, Raviraj Foils Limited, SNTO (Suntown Technology Group Corporation Limited)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. & Europe Aluminum Foil Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. & Europe aluminum foil market report on the basis of product, end use and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wrapper Foils

-

Container Foils

-

Foil Lids

-

Pouches

-

Blister Packs

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Food & Beverages

-

Pharmaceutical

-

Tobacco

-

Others

-

-

Industrial

-

HVAC

-

Battery

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Europe

-

Germany

-

UK

-

Italy

-

Turkey

-

Russia

-

-

Frequently Asked Questions About This Report

b. The U.S. & Europe aluminum foil market size was estimated at USD 9.51 billion in 2024 and is expected to reach USD 9.96 billion in 2025.

b. The U.S. & Europe aluminum foil market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 12.86 billion by 2030.

b. Based on product, wrapper foils accounted for a revenue share of more than 22.0% in 2024 of the overall market. The immense popularity in the packaging industry owing to the lightweight, superior barrier properties, cost-effectiveness, and ease of use has fueled the consumption of these foils by supermarkets, restaurants, food delivery businesses, and households.

b. Some of the key vendors of the U.S. & Europe aluminum foil market are Dongwon Systems, GLS Group, Hangzhou dingsheng industrial group co. LTD, Hindalco Industries Limited, Jindal (India) Limited, LKSB Aluminum Foils, QualityFoil sarl, Shyam Metalics, and Raviraj Foils Limited, among others

b. Increasing demand for packaging segment in order to increase shelf life, enhance safety, and easy availability are propelling the demand for aluminum foils in U.S. Increasing demand for packaging segment in order to increase shelf life, enhance safety, and easy availability are propelling the demand for aluminum foils in U.S. and Europe regions.and Europe regions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."