- Home

- »

- Medical Devices

- »

-

U.S. Eye Care Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Eye Care Market Size, Share & Trends Report]()

U.S. Eye Care Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Contact Lens, Ocular Health Products), By Mode Of Purchase (Over The Counter, Prescribed), By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-504-2

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Eye Care Market Size & Trends

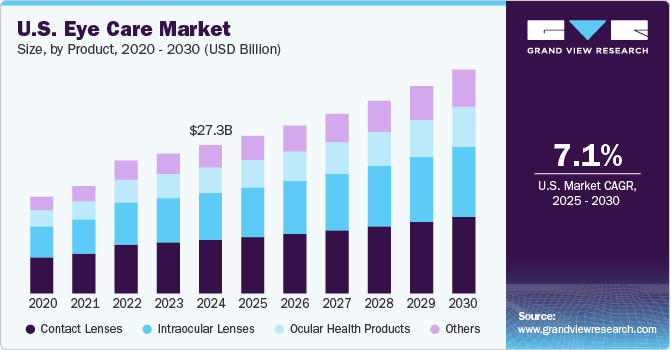

The U.S. eye care market size was estimated at USD 27.3 billion in 2024 and is expected to grow at a CAGR of 7.1% from 2025 to 2030, driven by a rising prevalence of vision disorders such as myopia, glaucoma, and cataracts. An aging population, with over 54 million adults aged 65 and older, contributes to increased demand for eye care services and products. Technological advancements, including minimally invasive surgical devices and advanced diagnostic tools, are enhancing treatment outcomes. Growing awareness of preventive eye care and the increasing adoption of digital devices are fueling demand for solutions like blue-light-blocking lenses. The U.S. market is further supported by robust healthcare infrastructure and strong investments in ophthalmic research and innovation.

In September 2023, Bausch + Lomb launched its Lumify Eye Illuminations line, featuring hypoallergenic products such as micellar cleansing water, lash and brow serum, and hydra-gel brightening cream. Developed with ophthalmologists and dermatologists, the line prioritizes safety, as demonstrated in over 15,000 applications. Free from harsh chemicals such as parabens, sulfates, and alcohol, these products address growing consumer preferences for gentle, effective eye care solutions.

Another notable development in the U.S. eye care market is the introduction of Iridex Corp’s next-generation Iridex 532 and Iridex 577 lasers. Launched in conjunction with the company’s 35th anniversary, these advanced platforms incorporate patented MicroPulse Technology and offer multiple treatment modes to address retinal disorders and glaucoma. Featuring an intuitive touchscreen interface, these lasers enhance clinical control and improve treatment precision. The announcement was made ahead of the Hawaiian Eye and Retina 2024 meeting, underscoring Iridex’s commitment to innovation and its legacy of providing reliable laser systems to ophthalmologists worldwide. According to David Bruce, President and CEO of Iridex, these lasers represent a pivotal step forward, combining cutting-edge technology with user-centric design to optimize patient care.

In addition, advancements in diagnostic tools and treatment options, such as minimally invasive surgical devices and personalized therapies, are transforming the landscape of eye care. Consumer demand for products that address both functional and cosmetic needs is also shaping market trends. For instance, hypoallergenic and nutrient-enriched products, such as Lumify Eye Illuminations, cater to the growing preference for solutions that are both effective and gentle.

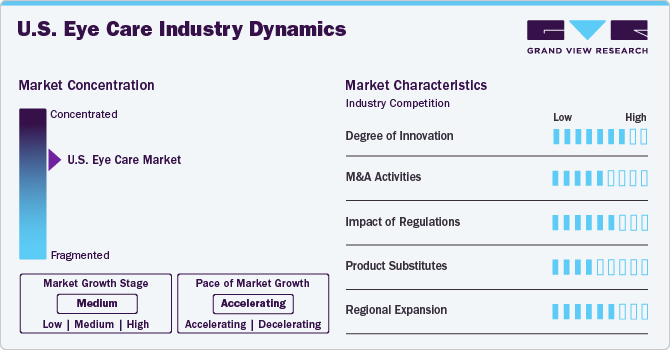

Market Concentration & Characteristics

The U.S. eyecare market is moderately concentrated, driven by a mix of large corporations and smaller players. Major players such as Johnson & Johnson Vision, Alcon, and Bausch + Lomb dominate, leveraging innovation and economies of scale. The market is characterized by advanced technology adoption, a focus on refractive surgeries, and a growing demand for premium eyewear and contact lenses. Increasing prevalence of vision disorders, aging demographics, and rising awareness about eye health are key growth drivers. Competition is fueled by ongoing R&D investments and regulatory compliance, with trends such as tele-optometry and personalized treatments shaping the industry landscape.

The U.S. eye care market is witnessing innovation with Alcon's launch of PRECISION7, a groundbreaking weekly replacement contact lens in the U.S. Featuring the world's first ACTIV-FLO System, it offers 16-hour comfort and sharp vision through day 7. Addressing affordability, it appeals to patients favoring reusable lenses despite ECPs' preference for dailies. The product is available immediately through select ECPs and nationwide by January 2025 and includes sphere and toric options. Its unique moisturizing system combines water-attracting agents with proprietary replenishing technology, enhancing comfort and performance. This launch significantly meets diverse patient needs while advancing contact lens technology.

Mergers and acquisitions are accelerating in the U.S. eye care market as companies aim to grow market share, enhance technology, and optimize operations. Bausch + Lomb plans to acquire Novartis’ dry-eye drug Xiidra for USD 1.75 billion, capitalizing on the expanding treatment market. Xiidra, generating USD 487 million in U.S.-driven sales last year (a 4% increase), is an anti-inflammatory eye drop competing with AbbVie’s Restasis and generic alternatives. The acquisition highlights the strategic focus on addressing dry-eye disease and strengthening Bausch + Lomb’s presence in the growing segment.

Regulations play a crucial role in shaping the U.S. eye care industry, ensuring safety, efficacy, and accessibility of products and services. Strict FDA approvals govern medical devices, contact lenses, and pharmaceuticals, driving innovation while maintaining patient safety. Policies such as the Contact Lens Rule protect consumer rights but require compliance from manufacturers and eye care professionals. HIPAA regulations ensure data privacy in tele-optometry, influencing digital adoption. In addition, reimbursement policies under Medicare and insurance programs impact affordability and access to treatments. While regulations promote quality and patient trust, compliance costs and extended approval timelines can challenge industry players, affecting market dynamics.

The U.S. eye care market offers substitutes across various categories beyond contact lenses and intraocular lenses. Ocular health products such as artificial tears, supplements, and eye drops are widely available. Surgical alternatives such as LASIK and cataract surgery provide permanent vision correction, reducing dependence on traditional options. Prescription (Rx) products, including medicated drops and treatments for glaucoma or dry eye, address specific conditions, while Over The Counter (OTC) options such as non-prescription eye drops and allergy relief products offer convenience and accessibility. This variety ensures consumers can select solutions tailored to their needs, creating competition and driving innovation across both prescribed and OTC segments.

The U.S. eye care market is expanding with innovative product launches. Performance Vision Technologies introduced Altius, advanced tinted contact lenses for athletes and those with light sensitivity, in the U.S. and select international markets, succeeding Nike MaxSight. Additionally, CooperVision launched Clariti 1 Day Multifocal 3 Add contact lenses in the U.S., offering all-day comfort, easy fitting, and clear vision across all distances for presbyopia patients. These advancements address diverse vision needs, emphasizing comfort and performance, while reflecting the growing demand for specialized and multifocal lenses in the U.S. market.

Product Insights

The contact lenses segment dominated the market and accounted for the largest revenue share of around 36.1% in 2024. Contact lenses offer convenient alternative to traditional eyeglasses for vision correction. Their popularity stems from factors such as improved comfort, enhanced aesthetics, and technological advancements. With options ranging from daily disposables to specialized lenses for various vision conditions, contact lenses cater to a diverse consumer base seeking both functional and lifestyle-oriented solutions for their visual needs.

The ocular health products segment is expected to exhibit the fastest growth during the forecast period, driven by increasing awareness of ocular health and preventive care. These products encompass a wide range of solutions, including drops, supplements, and protective eyewear, designed to promote eye wellness and address common conditions such as dryness, irritation, and fatigue. As consumers prioritize proactive measures to maintain optimal vision and overall eye health, the demand for ocular health products is expected to continue rising, shaping the landscape of the industry.

Mode of Purchase Insights

The prescribed (Rx) products segment dominated the market and accounted for the largest revenue share of around 61.2% in 2024 and is expected to exhibit the fastest growth during the forecast period, necessitating professional diagnosis and supervision for treatment. These products, including prescription eyeglasses, specialized lenses, and medicated drops, address various vision impairments and ocular conditions. By requiring a prescription, they ensure tailored solutions and proper management, instilling trust and reliability among consumers. Despite the rise of over-the-counter options, prescribed products remain essential for addressing complex vision issues and maintaining optimal care standards.

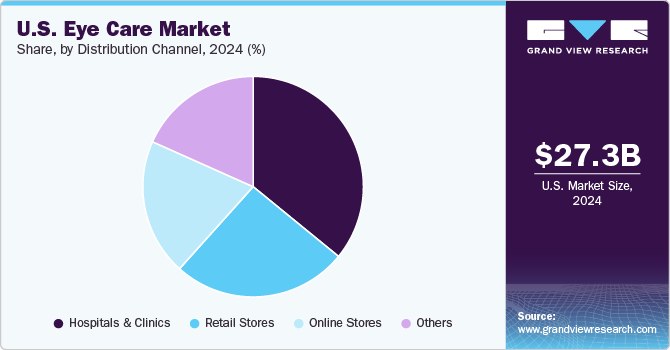

Distribution Channel Insights

The hospitals & clinics segment dominated the market and accounted for the largest revenue share of around 35.9% in 2024. Hospitals & clinics and clinics play a key role in distributing vision care products, especially prescribed items requiring professional diagnosis and supervision. These establishments offer comprehensive care services, including consultations, diagnostics, and treatment, ensuring personalized solutions for patients' vision needs. With access to specialized equipment and expertise, hospitals and clinics serve as trusted hubs for addressing complex conditions and providing continuity of care. Their integration of medical professionals and resources facilitates efficient distribution and ensures adherence to quality standards in the industry.

The online stores segment is projected to witness the fastest growth rate over the forecast period, driven by consumer demand for convenience and accessibility. Offering a diverse range of products, including contact lenses, and ocular health supplements, online platforms provide a seamless shopping experience and doorstep delivery. With features such as virtual try-on tools and user reviews, they enhance the purchasing journey, empowering consumers to make informed decisions about their vision care needs. As e-commerce continues to expand, online stores are reshaping the retail landscape, catering to customers that are comfortable and skilled in using digital tools seeking convenience and variety in their care purchases.

Key U.S. Eye Care Company Insights

Some of the key providers in the market are Bausch & Lomb Incorporated., and Alcon, Inc. These are pioneering companies offering eyecare products. These companies have leveraged their technological expertise to establish a foothold in this emerging market. Both companies focus on affordability, ease of use, and accessibility.

Key U.S. Eye Care Companies:

- Alcon, Inc.

- Johnson and Johnson Eye Care, Inc.

- Bausch & Lomb Incorporated

- Carl Zeiss Meditec AG (ZEISS International)

- Essilor International

- CooperVision

- HOYA CORPORATION

- Rayner Group

- STAAR SURGICAL

- Novartis AG

Recent Developments

-

In September 2024, Johnson & Johnson has introduced the TECNIS Odyssey intraocular lens (IOL) in the U.S., designed to provide cataract patients with precise vision across all distances and lighting conditions. This next-generation IOL offers exceptional distance vision and enables reading of 14% smaller print compared to PanOptix. Notably, 93% of patients achieved freedom from glasses at all distances. The TECNIS Odyssey IOL also demonstrates higher tolerance to residual refractive errors, allowing surgeons to deliver consistent and reliable outcomes.

-

In October 2024, EyeCare Partners (ECP), a leading provider of integrated eye care, announced its participation in AAO 2024. ECP doctors will present key innovations and data across subspecialties such as dry eye and macular degeneration. Dr. Daniel Miller, ECP Ophthalmology Division President, emphasized the significance of the event in showcasing groundbreaking research and fostering collaboration among world-class physicians. He highlighted the role of the EyeCare Partners network in advancing data-driven discoveries and elevating eye care standards. ECP aims to contribute meaningfully to ophthalmology’s future while sharing and learning at this year’s meeting.

U.S. Eye Care Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.0 billion

Revenue forecast in 2030

USD 41.2 billion

Growth rate

CAGR of 7.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode of purchase, and distribution channel

Regional scope

U.S.

Key companies profiled

Alcon, Inc.; Johnson and Johnson Eye Care, Inc.; Bausch & Lomb Incorporated; Carl Zeiss Meditec AG (ZEISS International); HOYA CORPORATION; Rayner; STAAR SURGICAL; Novartis AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Eye Care Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. eye care market report based on product, mode of purchase, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Contact Lenses

-

Intraocular Lenses

-

Ocular Health Products

-

Others

-

-

Mode Of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescribed (Rx) Products

-

Over The Counter (OTC) Products

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Retail Stores

-

Online Stores

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. eye care market size was estimated at USD 27.30 billion in 2024 and is expected to reach USD 29.00 billion in 2025.

b. The U.S eye care market is expected to grow at a compound annual growth rate of 7.11% from 2025 to 2030 to reach USD 41.23 billion by 2030.

b. Contact lenses segment dominated the product segment in eye care market with a share of 36.1% in 2024. This is attributable to increasing adoption rate and demand for contact lenses.

b. Some key players operating in the U.S eye care market include Alcon, Inc., Johnson and Johnson Eye Care, Inc., Bausch & Lomb Incorporated, Carl Zeiss Meditec AG (ZEISS International), HOYA CORPORATION, Rayner, STAAR SURGICAL, Novartis AG

b. Key factors that are driving the U.S eye care market growth include the rising prevalence of eye diseases, technological advancements in eye care devices, and government initiatives for increasing awareness regarding visual impairment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.