- Home

- »

- Advanced Interior Materials

- »

-

U.S. Filtration & Drying Equipment Market, Industry Report, 2030GVR Report cover

![U.S. Filtration & Drying Equipment Market Size, Share & Trends Report]()

U.S. Filtration & Drying Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Centrifuges, Agitated Nutsche Filter-Dyers), By End-use (Pharmaceutical, Water and Wastewater Treatment), And Segment Forecasts

- Report ID: GVR-4-68040-229-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

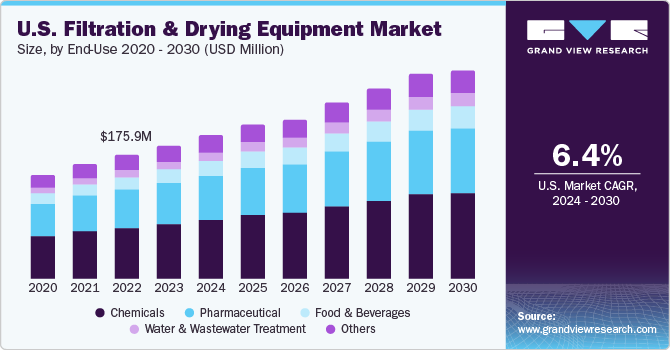

The U.S. filtration & drying equipment market size was estimated at USD 189.2 million in 2023 and is anticipated to grow at a CAGR of 6.4% from 2024 to 2030. The increasing demand for filtration & drying equipment in the U.S. is driven by various factors, such as the stringent quality requirements for pharmaceutical products, the desire for more efficient manufacturing processes, and the emphasis on maintaining product purity. Filtration & drying equipment plays a crucial role in ensuring the production of high-quality pharmaceuticals by facilitating processes like separation, purification, and drying of pharmaceutical compounds. As the pharmaceutical industry continues to advance, the demand for advanced and reliable filtration and drying equipment is expected to persist.

Sewage processing and water and wastewater treatment both employ filtration and drying equipment. They are used to take metal shavings and other particles out of industrial lubricants. Throughout the production process, this equipment is essential for the separation of valuable synthetic components. The primary drivers of the market's growth are the world's expanding food and beverage, pharmaceutical, and chemical end-use industries.

Furthermore, it is anticipated that the growing demand for filtration and drying equipment in the forecast period will be mostly driven by the increasing expenditures made in the water and wastewater treatment sector to promote sustainable wastewater management. Due to their strong chemical resistance and adherence to the pertinent filtration requirements to achieve the best possible quality of end products, filtration, and drying equipment are being adopted by the chemicals sector more and more. This equipment is a reliable, secure, and useful technical solution that can be effectively created and optimized to meet different process requirements.

The U.S. pharmaceutical sector is expanding as a result of an aging population. Aside from the aging and growing population, other factors expected to propel the expansion of the U.S. pharmaceutical business include increased spending power and access to high-quality healthcare facilities for middle-class and lower-class families. Pharmaceutical corporations' growing emphasis on uncommon and specialized illnesses is another element fueling the pharmaceutical industry's growth. Technological advancements in the areas of implantables, bioelectronics, cell treatments, nucleic acid therapeutics, and advanced biologics have drawn interest from nonpharmaceutical corporations such as Qualcomm, and others, stimulating the expansion of the U.S. pharmaceutical market. Filtration & drying equipment market growth is being driven by the previously mentioned factors.

According to the National Health Expenditure Data, U.S. medicare spending increased by 8.4% to USD 900 billion in 2021. Moreover, Medicaid spending has increased by 9.2% to USD 734 billion compared to 2020. Furthermore, in 2021, the U.S. spending for medicines has increased by 12% due to increased demand for COVID vaccines, boosters, treatments, and prescription medication usage was 194 billion daily doses across the U.S. These aforementioned factors are expected to drive the demand for filtration & drying equipment in the pharmaceutical industry over the forecast period.

Market Concentration & Characteristics

The U.S. filtration & drying equipment market is marked by a moderate level of innovation. Technology is constantly being developed to increase productivity, reduce energy use, and promote environmental sustainability, although innovation is not happening at the same rate as it is in certain other high-tech sectors. Refinement of current technology is the primary focus of innovation, as opposed to revolutionary breakthroughs.

The level of mergers & acquisitions activity in the market tends to be moderate. Businesses may look to acquire companies to broaden their product offerings, break into untapped markets. In contrast to certain other industries such as pharmaceutical, chemical, and food & beverage the market is not marked by a high frequency of large-scale mergers or widespread consolidation.

Moreover, the market is highly impacted by regulations, especially those that deal with quality control, safety requirements, and environmental standards. For producers and users of filtering and drying equipment, compliance with laws such as OSHA standards for workplace safety and EPA regulations for emissions management is essential as it shapes market dynamics and propels product development.

In many industrial processes, when these technologies are critical for eliminating pollutants, drying products, or separating solids from liquids, there aren't many service substitutes for filtration and drying equipment. Alternative techniques, including air drying rather than utilizing drying equipment, might work in some situations, but they frequently fall short of the effectiveness and efficiency of specialist filtration and drying equipment.

Product expansion in the market is moderate and is driven by changing client wants and technical improvements. To satisfy the varied needs of multiple industries, manufacturers may launch new goods with enhanced efficiency, automation features, or customization options. The rate of product expansion is slower than in certain quickly changing industries, nevertheless.

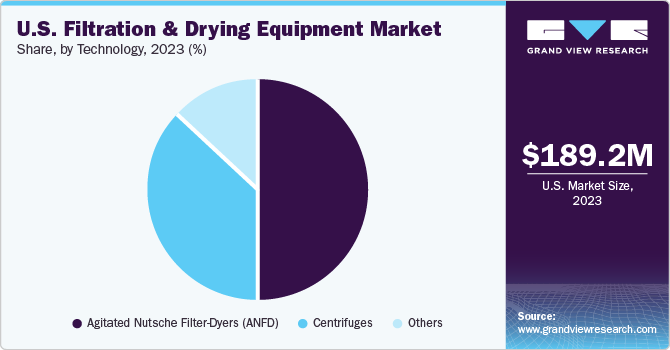

Technology Insights

The Agitated Nutsche Filter-Dyers (ANFD) segment accounted for the significant market share in 2023, owing to its many benefits and wide range of applications in industrial settings. It effectively integrates the filtration, washing, and drying operations into one unit, reducing the need for many pieces of machinery. Isolating solids is the main goal of ANFD in batch-oriented processing.

Although there are numerous methods for removing APIs from a slurry, the most advantageous approach combines the steps of slurry filtering, product washing, and vacuum drying into a single apparatus. ANFD offers many benefits, including the ability to maintain an inert gas atmosphere, the ability to blend goods before discharging, and the maintenance of product purity throughout the whole process. Applications for ANFD include wastewater treatment, paint, varnish, and surface coatings; it is also used in textile and dye manufacturing.

The centrifuges technology held a significant market share in 2023 due to their effectiveness in separating solids from liquids using high-speed rotational forces, providing a quick and efficient way to achieve high degrees of clarity. A centrifuge is a device that uses density to separate liquids, gasses, or other substances. Rotating a container holding the chemical quickly causes the separation to occur. The resulting forces cause the heavier components to descend to the bottom of the container. The resulting forces cause the heavier components to descend to the bottom of the container.

End-use Insights

The chemical end-use segment dominated the market and accounted for the largest revenue share of 41.8% in 2023. This growth is attributed to their strong chemical resistance and adherence to the pertinent filtration requirements. These devices are technologically sound, long-lasting, and safe solutions that may be effectively built and tuned to meet a variety of process requirements. High-performance filtration and drying equipment have optimal heat transfer, short drying durations, and superior product discharge performance, and must be installed in chemical plants. There are numerous uses for filtration and drying equipment in the petrochemical sector. They are utilized in the production of biodiesel, oil lagoon cleaning, slop oil processing, crude oil storage tank bottom sludging, and oil recovery after caustic in-barrel washing. They also separate glycerin, fatty acids, and salt.

The pharmaceuticals segment held a substantial market share in 2023 as filtration & drying equipment is frequently used in the pharmaceutical industry for the large-scale production of drugs and biological products, the assessment of suspensions and emulsions, and the computation of the molecular weight of colloids, Active pharmaceutical ingredients (APIs) are produced under strict regulations in the pharmaceutical business since they are the active component of medications and are consequently governed by the Food and Drug Administration.

The food & beverage segment experienced significant growth in 2023. Food & beverage processing equipment must be kept in good working order to preserve freshness and extend shelf life. Filtration & drying procedures are essential to this process. Industrial manufacturing uses filtration & drying equipment extensively because it lowers the risk of contamination of finished goods by removing contaminants and preserves the flavor and quality of produced food and beverages.

Key U.S. Filtration & Drying Equipment Company Insights

The U.S. filtration & drying equipment market is being advanced by leaders like GMM Pfaudler and Hosokawa Micron Powder Systems, who provide contemporary solutions to fulfill a variety of industry demands. These businesses establish industry norms and drive market trends through strategic collaborations and a dedication to excellence.

Key players in the market include Hosokawa Micron Powder Systems; GMM Pfaudler; and EKATO HOLDING GmbH.

-

Hosokawa Micron Powder Systems offers solutions for powder and particle processing technologies are provided by. Its centers for research and development, engineering, production, and servicing are dispersed throughout the Americas, Europe, and Oceania/Asia. The company creates size-reduction equipment and powder processing solutions for the culinary, chemical, plastic mineral, cosmetic, and pharmaceutical industries.

-

GMM Pfaudler offers brands including PFAUDLER, EDLON NORMAG, EQUILLOY MAVAG, MIXION, and INTERSEAL. Under the PFAUDLER brand, it provides glass-lined technology; under the NORMAG name, it provides lab and process glass. In addition, the company provides comprehensive process solutions for a variety of uses, such as filtration, evaporation, drying, reaction, distillation, and acid recovery.

Pope Scientific Inc., Pargreen Process Technologies, and Clean Liquid Systems are other participants operating in the U.S. Filtration & Drying Equipment Market.

- Pope Scientific Inc. produces laboratory instruments for scientific applications, designed systems, and equipment for chemical processing. Pope Scientific Inc. offers a range of products such as dewar flasks, sanitary pressurizable mixers, nutsche filter-dryers, wiped-film still systems and processing equipment, fractional distillation equipment, hybrid wiped film/fractional still systems, vessels, reactors, and process systems.

Key U.S. Filtration & Drying Equipment Companies:

- Hosokawa Micron Powder Systems

- Little Men Roaring, LLC

- Pope Scientific Inc.

- Chem Flowtronics

- GMM Pfaudler

- EKATO HOLDING GmbH

- Pargreen Process Technologies

- Clean liquid systems

- Jaygo Incorporated

Recent Developments

-

In January 2024, GMM Pfaundler and Altilium Group joined forces to transform the mineral extraction and processing industry. This alliance represents a much-needed effort to battle and mitigate the environmental difficulties inherent to the sector, in addition to streamlining operating efficiency and lowering costs. Through this partnership, undiscovered mineral extraction riches will be unlocked through the optimization of GMM Pfaudler's equipment for DNi ProcessTM plant operations. Furthermore, both organizations will work together to sell GMM Pfaudler technology in addition to the environmentally beneficial Altilium technology.

-

In December 2023, GMM Pfaudler successfully acquired Professional Mixing Equipment Inc. (MixPro), Canada. This calculated step bolsters our industrial mixing company and our dedication to providing our clients with top-notch goods and services that enhance their operational efficiency.

U.S. Filtration & Drying Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 203.6 million

Revenue forecast in 2030

USD 295.2 million

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use

Key companies profiled

Hosokawa Micron Powder Systems; Little Men Roaring, LLC; Pope Scientific Inc.; Chem Flowtronics; GMM Pfaudler; EKATO HOLDING GmbH; Pargreen Process Technologies; Clean liquid systems; Jaygo Incorporated.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Filtration & Drying Equipment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. filtration & drying equipment market report based on technology, and end-use.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Centrifuges

-

Agitated Nutsche Filter-Dyers (ANFD)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Chemicals

-

Water and Wastewater Treatment

-

Food & Beverages

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. filtration & drying equipment market was valued at USD 189.2 million in the year 2023 and is expected to reach USD 203.6 million in 2024.

b. The U.S. filtration & drying equipment market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 295.2 million by 2030.

b. The Agitated Nutsche Filter-Dyers (ANFD) segment accounted for the largest market share in 2023 owing to its many benefits and wide range of applications in industrial settings. It effectively integrates the filtration, washing, and drying operations into one unit, reducing the need for many pieces of machinery.

b. The key market player in the U.S. filtration & drying equipment market includes Hosokawa Micron Powder Systems; Little Men Roaring, LLC; Pope Scientific Inc.; Chem Flowtronics; GMM Pfaudler; EKATO HOLDING GmbH; Pargreen Process Technologies; Clean liquid systems; Jaygo Incorporated.

b. The key factors that are driving the U.S. filtration & drying equipment market include, the need for more effective manufacturing techniques, the strict quality standards for pharmaceutical items, and the need to preserve product integrity. Furthermore, it is anticipated that the need for sophisticated and dependable filtering and drying equipment will be sustained as the pharmaceutical sector develops.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.