- Home

- »

- Sensors & Controls

- »

-

U.S. Gas Detection Equipment Market, Industry Report, 2030GVR Report cover

![U.S. Gas Detection Equipment Market Size, Share & Trends Report]()

U.S. Gas Detection Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fixed, Portable), By Technology (Semiconductor, Catalytic), By End-use (Medical, Environmental, Petrochemical), And Segment Forecasts

- Report ID: GVR-4-68040-250-6

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

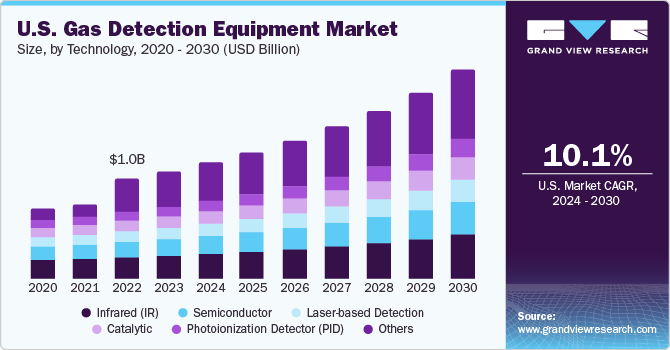

The U.S. gas detection equipment market size was estimated at USD 1.10 billion in 2023 and is expected to grow at a CAGR of 10.1% from 2024 to 2030. The demand for gas detectors has grown in recent years, owing to the rising establishment of industries globally. There is a constant presence of hazardous and toxic gases in sectors, such as mining and oil & gas, while others, such as food & beverage, construction, and wastewater treatment, may also see the presence of such gases in the environment. As they can prove to be fatal to workers and employees, if inhaled, there are regulations to protect their health, one of which is the use of sensors that can detect such gases. The United States is a leading producer of oil & gas globally, making this industry a major employer.

However, exposure to toxic gases can result in cardiac issues, as per a report by the CDC, making the utilization of gas sensors a necessity in such locations. The U.S. accounted for a 21.4% revenue share in the global market in 2023. The implementation and announcement of programs and initiatives by regulatory bodies have helped shape the market, as the U.S. government aims to reduce emissions to significantly lower greenhouse gas (GHG) emissions. In February 2024, the U.S. Environmental Protection Agency (EPA) and the U.S. Department of Energy (DOE) announced an intent to fund projects aimed at measuring and reducing methane emissions from the oil & gas sector. This followed a similar announcement made by the same bodies in July 2023, wherein they offered companies technical assistance to address methane leaks during day-to-day operations. Another toxic gas, carbon monoxide, also has strict guidelines, such as the National Ambient Air Quality Standards (NAAQS), regarding its atmospheric content. These factors have led to an increased focus on this industry.

Organizations, such as the Occupational Safety and Health Administration (OSHA) and the National Institute for Occupational Safety & Health (NIOSH), along with state authorities and industries, have established different Occupational Exposure Limits (OELs) regarding toxic elements and chemical hazards, which is expected to drive product demand. The gases present in an environment may be toxic (carbon monoxide), flammable (methane), asphyxiant, or a combination of these, and different sensor types need to be utilized for their identification. Moreover, some gases can impact workers even at lower concentrations, while some can enter the body through other paths, such as the skin. As there is a significant reliance on chemicals in industries that make the presence of toxic gases a certainty, the need for monitoring and safety equipment has risen considerably.

Gas detection systems help managers in monitoring the safety of their workers in real time, via the use of fast wireless networks that enable accurate location tracking. In addition, the integration of connected technology and the Internet of Things in gas detector systems has created significant avenues for market expansion. The use of connected gas detection devices has helped improve worker awareness and safety by providing managers with safety managers with optimal data and reporting. A sizeable number of such devices are available as wearables that can be worn by workers in sectors, such as utilities, construction, and oil & gas, which are known for posing health and safety risks. Another benefit offered by connected technologies is process automation, which helps in complying with government and organizational regulations.

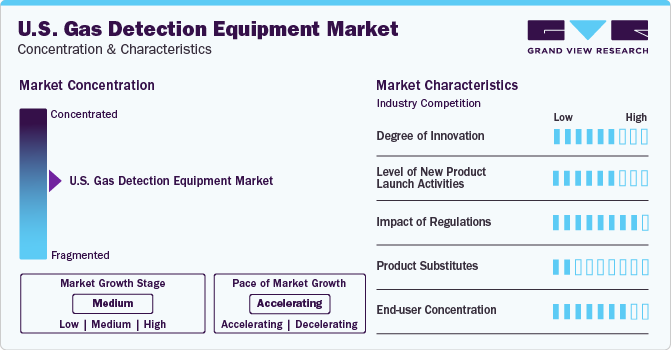

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of its growth is accelerating. The demand for gas detection equipment from major industries, such as oil & gas, petrochemicals, manufacturing, and automotive, along with stringent regulatory standards implemented by authorities, such as the U.S. EPA, OSHA, and NIOSH, has led to manufacturers constantly introducing innovative products to generate sales. For instance, in June 2021, GE Research announced that its scientists were developing a Compact Vapor Chemical Agent Detector (CVCAD), a wearable detector for first responders to provide a warning about harmful chemicals in the air.

Companies in the market have increased the pace of new product launches, through expansion of their portfolios and partnerships with organizations. For instance, in December 2022, ABB announced the launch of the Sensi+ analyzer to monitor natural gas quality and reduce pipeline maintenance and operational costs. The analyzer comprises a single device that can conduct real-time analysis of contaminants, such as H20, CO2, and H2S, in natural gas streams simultaneously. Such developments are expected to reduce emission levels, driving product adoption.

The U.S. has strict measures to ensure that businesses adopt a safe working environment for their employees, which is expected to boost the use of gas detection equipment in the country. For example, New York City and Maine have recently seen the passage of laws that require gas detectors in residential and commercial buildings. There are also several types of Occupational Exposure Limits (OELs) implemented by different organizations, such as OSHA Permissible Exposure Limits (PELs), California Division of Occupational Safety and Health (Cal/OSHA) Permissible Exposure Limits (PELs), and NIOSH Recommended Exposure Limits (RELs) that are expected to shape industrial demand for gas detection equipment in the coming years.

As gas detection equipment has become very advanced, there is a low risk of it getting replaced by alternative products. Manufacturers are making modifications to current equipment to increase their portability and efficiency, while also working on novel technologies to improve detection capabilities.

There are several end-users for gas detection solutions in the U.S., on account of the increasing level of industrialization and manufacturing activities, coupled with rising oil & gas exploration activities. The automotive industry, being a significant contributor to toxic gas emissions, has also become a notable customer for gas detection equipment. Mining is another sector where gas detectors are in high demand due to their help in accurately detecting methane emissions. These solutions have also become vital in building automation and domestic automation, as they can detect invisible gases, such as VOCs, ammonia, and ozone, keeping occupants safe from their negative health effects.

Product Insights

In terms of product, the fixed gas detector segment accounted for the largest market share of 58.94% in 2023. The use of fixed gas detectors is necessary in locations that see a frequent collection of hazardous gases that could pose health threats to workers. With an increased focus on improving safety and adhering to stringent environmental norms, there has been a significant demand for fixed gas detectors. These systems contain visual and sound alarms to enhance the alertness of workers. They also require calibration at longer time intervals, making them economical and easy to maintain. Manufacturers are launching advanced detectors with smart device connectivity and wireless options, making it very simple and efficient to simultaneously monitor and manage different devices and work areas. These factors have helped drive segment growth.

Portable gas detectors are expected to witness strong demand, advancing at a CAGR of 10.6% from 2024 to 2030. Portable, or personal, gas detectors provide benefits to industrial managers and employees, such as easy management and offering real-time alarms in case of issues or risks. Fixed gas detectors pose some drawbacks, such as increased costs for monitoring multiple areas, along with requiring a hardwired power supply system, making their portable counterpart a viable alternative. Furthermore, in sectors that require frequent worker movement, personal detectors are handy as they continuously monitor the environment for any toxic gases or chemicals. These solutions are generally used by utility crews, first responders, and maintenance professionals, as they usually work in the field, improving their alertness and preparedness.

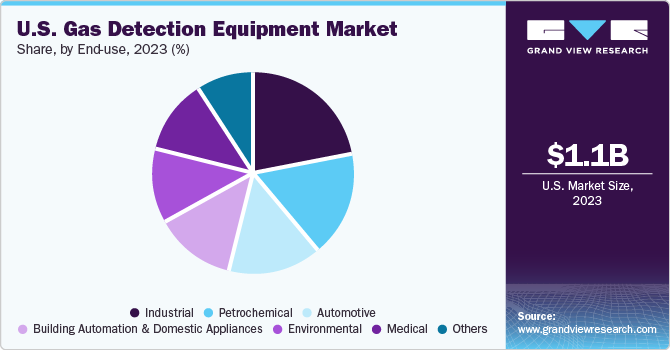

End-use Insights

The industrial segment accounted for the largest revenue share of 22.23% in 2023. The extensive adoption of gas detection solutions has been mainly driven by the growing necessity for companies to comply with government regulations. Furthermore, the increased risks posed by greenhouse gas (GHG) emissions for both human health and the environment have boosted the requirement for detectors for gas leak monitoring. According to a report by the U.S. Environmental Protection Agency (EPA), the industrial segment was the third-largest contributor to GHG emissions in 2021. As a result, the use of gas detectors in industries has become crucial as a means for tracking and minimizing the emission of gases, such as CO2 and methane.

The petrochemical end-use segment is expected to advance at the fastest CAGR of 11.3% from 2024 to 2030. There are various hazards present in petrochemical plants due to exposure to gases that may be flammable, toxic, asphyxiant, or a combination of these. As a result, there is an urgent need to continuously monitor plant zones where flammable atmospheres can be formed easily. Fixed gas detectors are used for round-the-clock monitoring of critical petrochemical processing, production, and storage areas. On the other hand, the presence of areas in the petrochemical industry with high concentrations of hazardous gases is steadily driving the demand for portable detectors.

Technology Insights

The infrared (IR) gas detection technology segment accounted for the largest market share of 26.70% in 2023. As industries require effective and reliable safety processes, there is a growing demand for IR technology in gas detectors, as it can effectively detect gases not visible to the naked eye by absorbing particular wavelengths in the infrared band. Moreover, the technology is also successful in identifying distant gas leaks, making such locations easier to inspect and avoiding the need for shutting down the facility, saving substantial costs. IR detectors can quickly determine the breaches that give out the highest emissions, making it easy to prioritize repair operations. In addition, the immunity of IR devices to wind effects leads to their convenient usage in outdoor and poor weather conditions, leading to improved industrial operations.

On the other hand, the semiconductor-based sensors segment is expected to advance at the highest CAGR of 11.1% from 2024 to 2030. Semiconductor gas sensors are widely utilized in environmental monitoring as they offer real-time data to users and consume low power, resulting in a longer operating period. Commonly used materials include carbon nanotubes, metal oxides, conducting polymers, and 2D materials. Metal oxide gas sensors are the most widely used as they are easy to fabricate, economical, and highly sensitive & stable, thus detecting both flammable and toxic gases with high efficiency. Conducting polymers have low operating temperatures and can detect organic vapors, while also being flexible and lightweight, which has made them a suitable technology for wearable sensors.

Key U.S. Gas Detection Equipment Company Insights

Some of the major companies involved in the U.S. market for gas detection equipment include ABB, Honeywell International Inc., Fluke Corporation, and Siemens.

-

Fluke Corporation is a Washington, U.S.-based company that provides gas detection equipment. It offers measurement and test instruments to various clients, such as engineers, metrologists, computer network professionals, technicians, and medical device manufacturers. The company specializes in developing easy-to-use, rugged, and high-quality products. It owns brands, such as Accelix, Comark, and Amprobe, among others

-

Honeywell International Inc. is an American multinational company headquartered in North Carolina and caters to critical industries, such as infrastructure, aerospace, manufacturing, electrification, healthcare, and infrastructure. The company offers gas and flame detection products under its safety solutions portfolio. This includes portable gas detectors manufactured by Honeywell Analytics and BW Technologies; fixed detectors for industrial purposes; and commercial gas detectors for use in offices and other commercial establishments

Emerging companies involved in the U.S. gas detection equipment industry include AirTest Technologies, Inc.; Lynred; Exponential Power; and Thermo Fisher Scientific.

-

AirTest Technologies Inc. manufactures and distributes air monitoring systems globally. It serves various industries, including oil & gas, food & beverages, healthcare, and automotive. The company has developed sensors specifically designed for commercial and industrial buildings. The company’s gas detection equipment products utilize optical gas sensors. AirTest Technologies Inc. focuses on offering innovative wireless gas detection equipment through R&D activities

-

Thermo Fisher Scientific Inc. designs and manufactures products, such as laboratory equipment, reagents, chemicals, and life science solutions, for use in biotech companies. The company has segmented its business into Life Science Solutions, Laboratory Products & Services, Specialty Diagnostics, and Analytical Instruments. Thermo Fisher provides gas detection equipment, such as single-gas and multi-gas detectors, through its Analytical Instruments segment

Key U.S. Gas Detection Equipment Companies:

- ABB

- Airtest Technologies, Inc.

- Teledyne Technologies Incorporated

- Fluke Corporation

- General Electric Company

- Honeywell International Inc.

- Lynred

- Opgal Optronics Industries Limited

- Thermo Fisher Scientific, Inc.

- Siemens

- Sensata Technologies

Recent Developments

-

In January 2024, Teledyne Gas and Flame Detection introduced an IR sensor for its advanced OLCT 100 XPIR (explosion-proof IR) fixed gas detector that would offer efficient and reliable methane detection measurements, serving the utility, industrial, and laboratory sectors. The product launch is expected to help combat the health and environment issues that methane presents in these segments, along with the rising demand for lower alarm threshold

-

In January 2024, Opgal announced the release of the advanced EyeCGas Multi Optical Gas Imaging (OGI) camera that leverages Multi-Spectral Replaceable Filters enabling highly accurate emission detection for Methane/volatile organic compounds & carbon dioxide. The solution offers features, such as wireless connectivity to stream live inspection images and videos, long-lasting batteries & long-term warranty. The company also has stated that the camera would receive free firmware upgrades, driving down operational costs for customers

-

In October 2023, Sensata Technologies launched the Sensata Resonix RGD sensor, which is the first leak detection sensor that is UL-certified for various A2L refrigerant gases used in HVAC equipment. The offering would cater to the requirements of HVAC manufacturers using hydrofluoroolefin (HFO) refrigerants instead of hydro-fluorocarbon (HFC) refrigerants, as a means to lower their contribution to global warming

U.S. Gas Detection Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.12 billion

Growth rate

CAGR of 10.1% from 2024 to 2030

Base year

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast ,company market share, competitive landscape, growth factors, and trends

Segments covered

Product, technology, end-use

Key companies profiled

ABB; Airtest Technologies, Inc.; Teledyne Technologies Inc.; Fluke Corp.; General Electric Company; Honeywell International Inc.; Lynred; Opgal Optronics Industries Ltd.; Thermo Fisher Scientific, Inc.; Siemens; Sensata Technologies

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Gas Detection Equipment Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. gas detection equipment market report based on product, technology, and end-use:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

Fixed Gas Detector

-

Portable Gas Detector

-

-

Technology Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

Semiconductor

-

Infrared (IR)

-

Laser-based Detection

-

Catalytic

-

Photoionization Detector (PID)

-

Others

-

-

End-use Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

Medical

-

Building Automation & Domestic Appliances

-

Environmental

-

Petrochemical

-

Automotive

-

Industrial

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. gas detection equipment market size was estimated at USD 1.10 billion in 2023 and is expected to reach USD 1.19 billion in 2024.

b. The U.S. gas detection equipment market is expected to grow at a compound annual growth rate of 10.1% from 2024 to 2030 to reach USD 2.12 billion by 2030.

b. The fixed gas detector segment dominated the U.S. gas detection equipment market with a share of 58.93% in 2023. With an increased focus on improving safety and adhering to stringent environmental norms, there has been a significant demand for fixed gas detectors in the U.S.

b. Some key players operating in the U.S. gas detection equipment market include ABB; Airtest Technologies, Inc.; Teledyne Technologies Incorporated; Fluke Corporation; General Electric Company; Honeywell International Inc.; Lynred ; Opgal Optronics Industries Limited; Thermo Fisher Scientific, Inc.; Siemens; Sensata Technologies.

b. Key factors that are driving the market growth include stringent regulations for workplace safety and growing oil & gas pipeline infrastructure in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.