- Home

- »

- Biotechnology

- »

-

U.S. Gene Therapy Market Size, Industry Report, 2030GVR Report cover

![U.S. Gene Therapy Market Size, Share & Trends Report]()

U.S. Gene Therapy Market (2024 - 2030) Size, Share & Trends Analysis Report By Indication (Multiple Myeloma, Spinal Muscular Atrophy, Inherited Retinal Disease), By Route Of Administration, By Vector Type (Lentivirus, AAV, Adenovirus), And Segment Forecasts

- Report ID: GVR-4-68040-226-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Gene Therapy Market Size & Trends

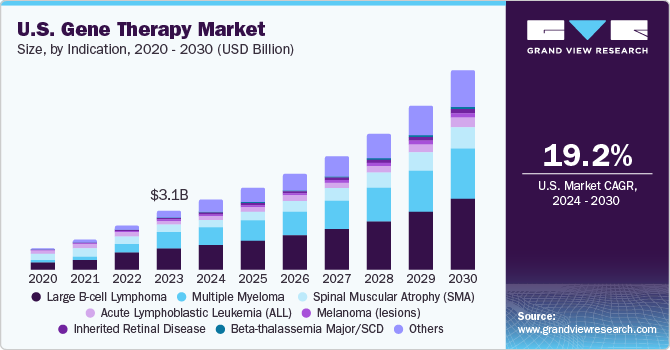

The U.S. gene therapy market size was estimated at USD 3.11 billion in 2023 and is expected to grow at a CAGR of 19.21% from 2024 to 2030. The gene therapy market includes DNA-based therapies involving the delivery of a functional copy of a defective gene or the correction of a mutated gene. DNA-based therapies are delivered using various methods such as viral vectors, plasmids, or gene editing tools. The robust gene therapy pipeline is expected to boost the market growth in the forecast period. Researchers are working to make gene therapy available at clinics. Various universities and institutes have a broad portfolio of products in the pipeline, which, in turn, is expected to boost revenue generation in the future.

The COVID-19 pandemic has had a notable impact on the U.S. gene therapy industry. While the market for gene therapies is expected to grow significantly in the years ahead, the pandemic caused some delays in clinical trials. Nevertheless, the pandemic also highlighted the importance of gene therapy in preventing and treating diseases, which could lead to increased investment and funding for the field. Despite the challenges posed by the pandemic, the U.S. gene therapy industry remains poised for growth and innovation in the future.

Technological advancements in gene editing, viral vector development, and delivery mechanisms have propelled gene therapy from the realms of speculation to clinical application. Innovations like CRISPR-Cas9 technology have revolutionized gene editing, allowing for precise modifications in genetic sequences with unprecedented accuracy and efficiency. Similarly, advancements in viral vectors, including adeno-associated viruses (AAVs) and lentiviruses, have enhanced the delivery of therapeutic genes to target cells, improving the efficacy and safety of gene therapy treatments.

An increase in funding and investments in gene therapy advancements is expected to provide lucrative growth opportunities to market players. For instance, in January 2022, Ori Biotech raised more than USD 100 million in a Series B funding to introduce a novel cell & gene therapy developing platform. This funding allowed for a rapid transition from precommercialization to market launch. In October 2023, NIH granted nearly USD 40 million to Yale School of Medicine which would support the development of phase 2 CRISPR-based gene therapy platform which would directly target genetic brain diseases such as H1-4 (HIST1H1E) syndrome and Angelman syndrome.

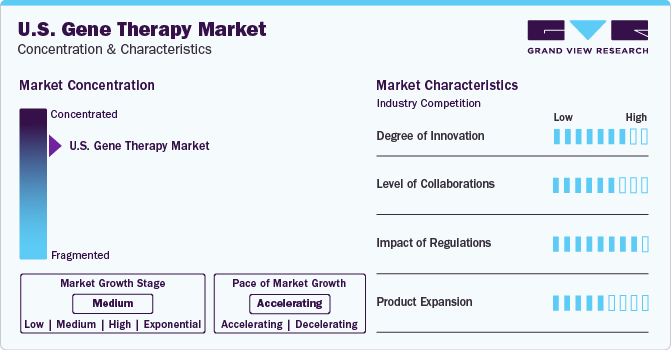

Market Concentration & Characteristics

The market growth stage is high and the pace of growth is accelerating. With the increasing prevalence of genetic disorders and chronic diseases, there is a growing demand for effective treatments. Gene therapy offers the potential for long-term or even permanent solutions to these conditions, driving market growth. In addition, gene therapy is being explored for a wide range of diseases, including rare genetic disorders, cancer, and infectious diseases. As the understanding of genetics and molecular biology deepens, the potential applications of gene therapy continue to expand, attracting more interest and investment.

In the U.S. gene therapy market, partnerships and collaboration activities are high level of engagement within the industry. These collaborations offer a numerous benefit, including shared resources, reduced financial risk, and access to specialized technologies and regulatory knowledge. By pooling resources and knowledge, companies are expected to accelerate research and development timelines, navigate regulatory pathways more effectively, and ultimately enhance the likelihood of bringing innovative gene therapies to market. For instance, in January 2023, Voyager Therapeutics and Neurocrine Biosciences entered a strategic collaboration for commercialization & development of Voyager’s GBA1 program and other next-generation gene therapies for neurological diseases.

Gene therapy is regulated by the U.S. Food and Drug Administration (FDA) and the National Institutes of Health (NIH). Gene therapies are regulated as biologics by the Center for Biologics Evaluation and Research (CBER), which is a part of the FDA. In addition, gene therapy products are regulated by the Office of Tissues and Advanced Therapies (OTAT). With recent approvals of notable gene therapies, major biopharma companies are making alliances and deals to gain higher shares in the market. For instance, in December 2022, FDA approval of Adstiladrin for individuals with high-risk Bacillus Calmette-Guérin indifferent non-muscle invasive bladder tumor with carcinoma in situ with or without papillary cancers.

The U.S. market for gene therapy currently exhibits a high level of product expansion. Innovations in delivery systems are anticipated to enhance the efficacy and safety of gene therapies. Investing in the development of advanced delivery technologies such as viral vectors, lipid nanoparticles, and exosomes would expand the application of gene therapy to more challenging disease targets and improve patient outcomes. Moreover, combining gene therapy with other treatment modalities such as immunotherapy, chemotherapy, or targeted therapy would synergistically enhance therapeutic efficacy and address complex diseases with multifactorial causes. Thereby boosting the product expansion over the forecast period. For instance, in September 2023, the phase 1 clinical trial of combination gene therapy and immunotherapy treatment of first-in human trial is anticipated to extend the survival rate in patients with brain cancer gliomas.

Indication Insights

Based on indication, the market is segmented into Large B-cell lymphoma, multiple myeloma, spinal muscular atrophy (SMA), acute lymphoblastic leukemia (ALL), melanoma (lesions), inherited retinal disease, beta-thalassemia major/SCD, and others. The Large B-cell lymphoma segment held the largest revenue share of 36.04% in 2023. Diffuse large B-cell lymphoma (DLBCL) is the most common non-Hodgkin Lymphoma (NHL) subtype. It is estimated to account for around 30%-40% of all cases. For instance, in May 2018, the U.S. FDA approved Kymriah for the treatment of adult patients with refractory or relapsed large B-cell lymphoma, including DLBCL.

The inherited retinal disease segment is expected to register a significant CAGR over the forecast period. An increase in R&D activities for the development of gene therapies for treating ocular diseases, including inherited retinal disease, has driven the segment. For instance, a therapy for the treatment of patients with Leber congenital amaurosis (LCA) using AAV to deliver the gene for human RPE65 to the retinal pigment epithelium is currently in phase 3 clinical trial which is expected to complete in 2029.

Vector Type Insights

Based on vector type, the market is segmented into retrovirus & gamma retrovirus, lentivirus, AAV, adenovirus, modified herpes simplex virus, and others. The lentivirus dominated with a revenue share of 43.74% in 2023. Gene therapy viral vectors extracted from lentiviruses offer many advantages over conventional gene vectors like retrovirus such as ability to provide stable and long-term gene expression, ability to induct themselves to non-dividing cells, possible generation of replication adept lentiviruses during vector preparation, and many more. This contributes to the segment’s growth, thus driving its dominance in the market. In December 2023, a numerous randomized clinical trial was started to evaluate OTL-203 (gene therapy) and stem cell transplant (standard of care) in individuals affected with MPS-IH (Hurler syndrome), is using lentivirus. This clinical trial is expected to be complete at the start of 2031. Thus, the rising usage of lentivirus in clinical trials is anticipated to boost the growth of the segment.

The AAV segment is expected to grow at a highest CAGR over the forecast period. This is attributed to the increasing demand due to the result from clinical trials pertaining to development of ocular and orthopedic gene therapy treatment exhibiting increased efficacy and efficiency. Moreover, the growing number of clinical trials and R&D activities are further anticipated to contribute to the growth of the segment over the forecast period. For instance, an ongoing clinical trial of AAV5-hRKp.RPGR vector for participants with X-linked retinitis pigmentosa uses AAV as their vector which is proposed to get completed by the end of 2029.

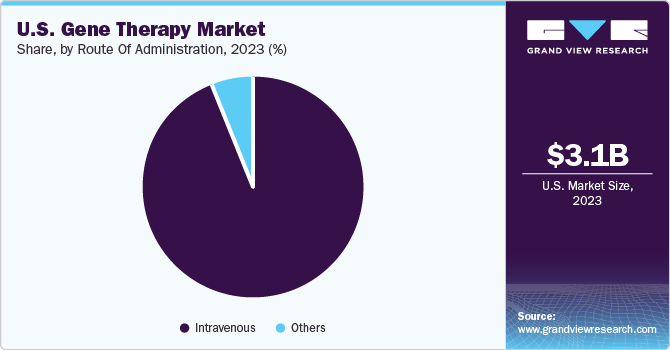

Route Of Administration Insights

Based on route of administration, the market is segmented into intravenous and others. The intravenous segment dominated the market share in 2023 and is anticipated to grow at a higher CAGR over the forecast period. Intravenous administration typically involves shorter treatment durations and less invasive procedures compared to alternative routes such as intramuscular or subcutaneous injections. This increases the convenience and reduces the discomfort for patients thereby improving the treatment adherence and overall patient satisfaction, driving preference for intravenous gene therapy products.

The others segment is expected to grow at a significant CAGR over the forecast period. This segment includes transcutaneous, subretinal, topical, and intravitreal routes of administrations. RGX-314 is being developed as a unique one-time gene therapy for the treatment of patients with neovascular age-related macular degeneration (wet AMD) which is expected to be completed by 2026. Thus, the rising number of clinical trials is expected to drive the growth of the market.

Key U.S. Gene Therapy Company Insights

The market players are adopting product approval to increase the reach of their products and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

-

In December 2023, Tome Biosciences announced the investment of over USD 200 million to advance the programmable genomic integration platform which would enable DNA sequencing into any programmed genomic location. This investment is anticipated to contribute to the growth of the market.

-

In January 2023, Spark Therapeutics and Neurochase established a strategic collaboration to develop Neurochase’s unique delivery technology for use with selected gene treatments for rare disorders in the CNS. In this agreement, Neurochase will contribute its extensive knowledge in direct drug delivery technology to Spark’s premier AAV platform.

-

In September 2022, Eli-cel, also known as SKYSONA, was given accelerated approval by the U.S. FDA to decrease the course of neurological dysfunction in 4- to 17-year-old boys with early, active Cerebral Adrenoleukodystrophy (CALD). In addition, the company declared that the clinical hold that had been placed on the eli-cel clinical development program had been lifted.

Key U.S. Gene Therapy Companies:

- Amgen Inc.

- Novartis AG

- F. Hoffmann-La Roche

- Gilead Sciences, Inc.

- bluebird bio, Inc.

- Bristol-Myers Squibb Company

- Legend Biotech.

- BioMarin.

- uniQure N.V.

- Merck & Co.

- Sarepta Therapeutics, Inc.

- Krystal Biotech, Inc.

- CRISPR Therapeutics.

Recent Developments

-

In February 2024, Encoded Therapeutics announced the launch of gene therapy trial for Dravet syndrome. FDA granted the organization for the investigational new drug application.

-

In August 2022, ZYNTEGLO (betibeglogene autotemcel), a one-time gene therapies specifically created to treat the fundamental genetic cause of beta-thalassemia in pediatric and adult patients who necessitate regular Red Blood Cell transfusion, was approved by the U.S. FDA.

-

In June 2022, REGENXBIO Inc. established its new Manufacturing Innovation Center, a gene therapy manufacturing facility. The company invested USD 65 million in the new facility, allowing end-to-end control of gene therapy manufacturing in Maryland.

U.S. Gene Therapy Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.40 billion

Growth rate

CAGR of 19.21% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication, route of administration, vector type

Key companies profiled

Amgen Inc.; Novartis AG; F. Hoffmann-La Roche; Gilead Sciences, Inc.; bluebird bio, Inc.; Bristol-Myers Squibb Company; Legend Biotech.; BioMarin.; uniQure N.V.; Merck & Co.; Sarepta Therapeutics, Inc.; Krystal Biotech, Inc.; CRISPR Therapeutics.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Gene Therapy Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. gene therapy market report based on indication, route of administration, and vector type:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Large B-cell Lymphoma

-

Multiple Myeloma

-

Spinal Muscular Atrophy (SMA)

-

Acute Lymphoblastic Leukemia (ALL)

-

Melanoma (lesions)

-

Inherited Retinal Disease

-

Beta-thalassemia Major/SCD

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous

-

Others

-

-

Vector Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lentivirus

-

RetroVirus & Gamma RetroVirus

-

AAV

-

Modified Herpes Simplex Virus

-

Adenovirus

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. gene therapy market size was estimated at USD 3.11 billion in 2023 and is expected to reach 3.63 billion in 2024.

b. The U.S. gene therapy market is expected to grow at a compound annual growth rate of 19.21% from 2024 to 2030 to reach USD 10.40 billion by 2030.

b. The large B-cell lymphoma segment dominated the market for U.S. gene therapy and held the largest revenue share of 36.04% in 2023.

b. Some key players operating in the U.S. gene therapy market include Amgen Inc.; Novartis AG; F. Hoffmann-La Roche; Gilead Sciences, Inc.; bluebird bio, Inc.; Bristol-Myers Squibb Company; Legend Biotech.; BioMarin.; uniQure N.V.; Merck & Co.; Sarepta Therapeutics, Inc.; Krystal Biotech, Inc.; and CRISPR Therapeutics.

b. The growth of the market is attributed to factors such as increasing number of clinical trials, robust gene therapy pipeline, and the rise in the prevalence of rare genetic disorders such as inherited retinal disorders or sickle cell anemia.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.