- Home

- »

- Consumer F&B

- »

-

U.S. Healthy Vegetable Chips Market, Industry Report, 2030GVR Report cover

![U.S. Healthy Vegetable Chips Market Size, Share & Trends Report]()

U.S. Healthy Vegetable Chips Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Root Vegetable Chips, Leafy Green Chips), By Nature, By Flavor, By Processing, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-565-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Healthy Vegetable Chips Market Trends

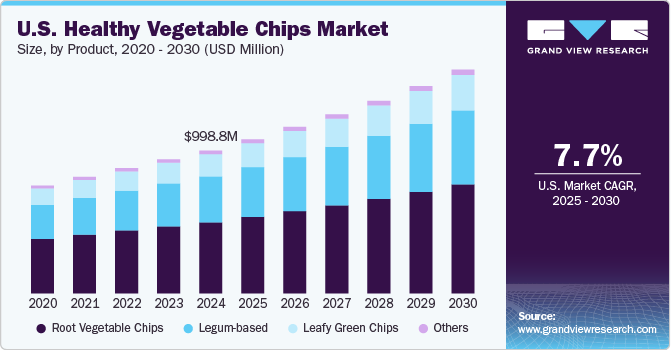

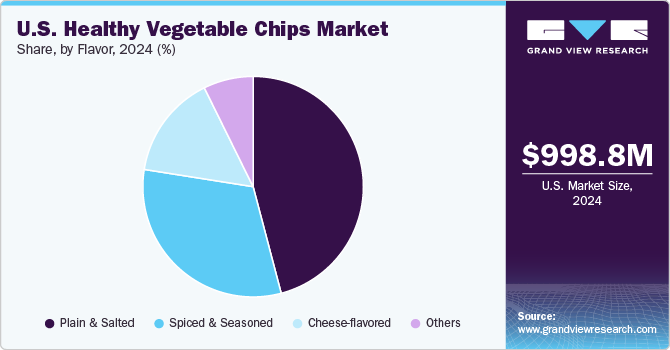

The U.S. healthy vegetable chips market size was estimated at USD 998.8 million in 2024 and is expected to grow at a CAGR of 7.7% from 2025 to 2030. As people become more health-conscious, they actively seek snacks that offer better nutritional value while satisfying cravings for something crunchy and flavorful. Traditional potato chips and other processed snacks are often high in unhealthy fats, sodium, and artificial additives, leading consumers to explore alternatives that align with their wellness goals.

The rising awareness of lifestyle-related diseases such as obesity, diabetes, and cardiovascular issues has prompted consumers to make more mindful dietary choices. Vegetable chips, often made from ingredients like kale, sweet potatoes, beets, carrots, and zucchini, provide a nutrient-rich alternative to conventional snacks. They are typically lower in calories and higher in fiber, vitamins, and antioxidants, making them a preferred option among health-conscious individuals.

In addition, clean-label trends are influencing purchasing decisions, with many consumers looking for snacks that are non-GMO, gluten-free, organic, or free from artificial preservatives. Brands are responding by offering baked or air-dried vegetable chips instead of fried versions, further enhancing their appeal among health-focused buyers. The rise of plant-based diets and the increasing popularity of vegan and vegetarian lifestyles have also contributed to the demand for vegetable chips, as they cater to consumers who prioritize plant-based nutrition.

Moreover, the advancements in processing techniques, such as air frying and improved packaging that extends shelf life, have made vegetable chips more attractive and accessible. This, coupled with their increased availability through both traditional retailers and e-commerce platforms, is helping to drive their market growth.

Another key factor is the growing influence of convenience. With busy lifestyles, American consumers seek on-the-go snack options that do not compromise health. Healthy vegetable chips, available in single-serving packs and resealable bags, fit well within this demand. Moreover, the influence of social media, fitness influencers, and diet trends such as keto, paleo, and Whole30 have encouraged consumers to explore healthier snacking habits.

Consumer Insights

Concerns about obesity rates and the prevalence of chronic diseases such as diabetes, heart disease, and hypertension are prompting consumers to adopt healthier eating habits.

Growing awareness of the importance of health and wellness encourages consumers to seek healthier dietary options, including snacks. As people become more conscious of the link between diet and health, they actively seek snacks that offer nutritional benefits and support their overall well-being. A survey conducted by Whisps, renowned for its high-protein snacks made from 100% real cheese, unveiled shifting trends in American snacking habits.

The survey, including over 2,000 American adults in April 2023, reveals a significant trend of people substituting an average of four meals per week with snacks. As individuals increasingly munch throughout the day, a staggering 79% of adults desire healthier snacks. This data underscores Americans' growing preference for convenient and nutritious snack options, highlighting a shift toward more mindful eating habits and a demand for healthier snack alternatives.

People are becoming more conscious about their snacks, focusing on ingredients, portion control, and variety. For instance, a survey conducted by Mondelēz India in October 2022 revealed a significant shift in consumer snacking habits and preferences in India. A large portion of respondents reported choosing snacks that cater to their body's needs and nutritional requirements, with 86% snacking to boost mood, find comfort, relax, and seek quiet moments.

Larger food companies are therefore expanding their presence in the healthy snacks segment by acquiring smaller, innovative brands with distinctive products and a loyal customer base. These acquisitions enable established companies to enter new markets, enhance distribution channels, and reach diverse consumer demographics, while providing smaller brands with the resources and expertise needed for growth and scalability.

For instance, in March 2025, Garden Veggie Snacks launched two new gluten-free tortilla chip flavors, Smoky BBQ and Sweet Tangy Chili, joining the Nacho Cheese and Zesty Ranch options in their Flavor Burst line. These chips contain five vegetables and non-GMO corn, with no artificial flavors or preservatives, emphasizing a "better-for-you" approach. Smoky BBQ is exclusively available at Walmart, while Sweet Tangy Chili can be found at Kroger and Amazon. The brand aims to meet consumer demand for adventurous flavors and clean ingredients, expanding its veggie-focused snack portfolio.

Product Insights

Root vegetable chips accounted for a revenue share of 49.8% in 2024. Americans are increasingly turning to root vegetable chips as a healthier snacking option. Made from nutrient-rich alternatives like sweet potatoes, beets, and carrots, these chips offer a lower-calorie, high-fiber snack that delivers essential vitamins and antioxidants. With rising health awareness and a strong demand for clean-label, organic products, consumers are attracted to their natural flavors and crunch. Advancements in processing and packaging have also boosted their availability, making root vegetable chips a convenient and appealing choice for on-the-go snacking.

The legume-based chips market is expected to grow at a CAGR of 8.2% from 2025 to 2030 as consumers seek protein-rich, high-fiber snack alternatives that align with health-conscious and plant-based diets. Made from ingredients like lentils, chickpeas, and black beans, these chips offer a nutritious alternative to traditional potato chips, appealing to those looking for gluten-free and high-protein options. Moreover, the growing popularity of plant-based and sustainable eating habits has encouraged manufacturers to develop innovative flavors and textures, further driving the demand for legume-based chips in the healthy snacking market.

Nature Insights

Conventional healthy vegetable chips accounted for a revenue share of 79.8% in 2024 as consumers seek healthier snack alternatives that don’t compromise taste or crunch. With rising awareness about the nutritional drawbacks of traditional fried snacks, many Americans are turning to chips made from kale, sweet potatoes, and beets, which offer higher levels of vitamins, antioxidants, and fiber. Advancements in baking and air-frying techniques have made these chips lower in fat and calories, while their appealing flavors and convenient packaging meet the modern demand for on-the-go snacking.

Non-GMO healthy vegetable chips are expected to grow at a CAGR of 9.9% from 2025 to 2030. Many people perceive non-GMO products as more natural, wholesome, and free from artificial modifications, aligning with their preference for clean-label and minimally processed foods. Furthermore, rising awareness about sustainable farming practices and the desire to support organic and non-GMO agriculture further drive demand for these chips. As a result, non-GMO vegetable chips are becoming a preferred snack choice for health-conscious individuals seeking nutrition and transparency in their food.

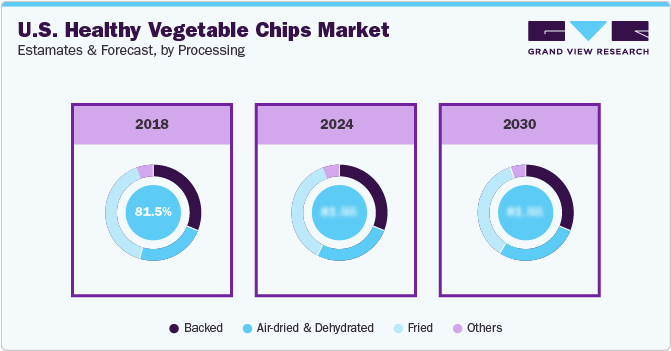

Processing Insights

Fried healthy vegetable chips accounted for a revenue share of 37.6% in 2024. These chips offer the perfect combination of crispy texture and rich flavor while being perceived as a healthier alternative to traditional potato chips. These chips retain the natural goodness of vegetables while providing the indulgent crunch that snack lovers crave. Advances in frying techniques, such as vacuum frying, have also helped reduce oil absorption, making them a more appealing option for health-conscious individuals.

Air-fried & dehydrated healthy vegetable chips are expected to grow at a CAGR of 8.7% from 2025 to 2030. Consumers in the U.S. are increasingly opting for air-fried and dehydrated vegetable chips due to their healthier nutritional profile compared to traditional fried snacks. These chips retain more natural flavors and nutrients while being lower in fat and calories, making them appealing to health-conscious individuals. In addition, the growing demand for clean-label, gluten-free, and minimally processed snacks has further boosted their popularity, as people seek guilt-free alternatives without compromising on taste and texture.

Distribution Channel Insights

Sales through offline stores accounted for a revenue share of 84.4% in 2024. Sales of healthy vegetable chips through offline channels are increasing as consumers prefer in-store shopping experiences that allow them to assess product freshness, ingredients, and packaging firsthand. Supermarkets, specialty health stores, and convenience stores play a crucial role in driving sales, offering a wide range of options and promotional deals that attract health-conscious buyers. Furthermore, impulse purchases at checkout counters and in snack aisles contribute to higher sales.

Sales of U.S. healthy vegetable chips through online channels are expected to grow with a CAGR of 9.7% from 2025 to 2030. Online platforms allow consumers to browse a wide range of brands, flavors, and product types, often with the added benefit of detailed product descriptions, nutritional information, and customer reviews. This level of transparency makes online shopping appealing for health-conscious buyers who are increasingly seeking products that align with their specific dietary needs, such as non-GMO, organic, or vegan vegetable chips. Moreover, the ability to order in bulk and the convenience of home delivery appeal to busy consumers looking for a hassle-free shopping experience.

Flavor Insights

Plain & salted healthy vegetable chips for commuters accounted for a revenue share of 45.9% in 2024. U.S. consumers choose plain and salted vegetable chips due to their simple, clean ingredients and balanced flavor. These chips offer a healthier alternative to heavily seasoned or artificially flavored snacks, appealing to those who prefer minimal processing and natural taste. The light seasoning enhances the natural flavors of vegetables while keeping sodium levels moderate, making them an ideal option for health-conscious snackers. In addition, the versatility of plain and salted vegetable chips allows them to pair well with dips and spreads, further driving their popularity among consumers looking for a satisfying yet wholesome snack.

Spiced & seasoned healthy vegetable chips are expected to grow at a CAGR of 8.7% from 2025 to 2030. Consumers in the U.S. are increasingly drawn to spiced and seasoned vegetable chips as they seek bold flavors and exciting taste experiences in their snacks. These chips perfectly balance indulgence and health, combining the crunch of vegetables with savory, tangy, or spicy seasonings. With the rise of global flavor exploration, consumers are embracing unique spice blends inspired by cuisines from around the world.

Key U.S. Healthy Vegetable Chips Companies Insights

Healthy vegetable chip manufacturers increasingly leverage advanced food processing technologies to enhance product quality, taste, and nutritional value. Techniques such as vacuum frying, air frying, and freeze-drying help preserve vegetables' natural flavors and nutrients while reducing oil content. In addition, manufacturers are incorporating smart packaging solutions, including resealable and biodegradable options, to improve convenience and sustainability. AI-driven quality control systems ensure consistency in texture and taste, while data analytics help brands optimize production efficiency and predict consumer trends. Customization is also on the rise, with brands offering a variety of seasoning blends, organic options, and personalized snack packs to cater to diverse consumer preferences.

Key U.S. Healthy Vegetable Chips Companies:

- TERRA (Hain-Celestial)

- Kibo Foods

- GoPure

- Rare Fare Foods, LLC

- PepsiCo

- Lantev Industries

- Hunter Foods Private Ltd

- Rivera Foods

- Troovy

- Calbee Harvest Snaps & WorldPantry.com

Recent Developments

-

In March 2025, Garden Veggie Snacks, a brand under the Hain Celestial Group, introduced two new flavors to its Flavor Burst Tortilla Chips line: Smoky BBQ and Sweet Tangy Chili. These chips are part of the brand's commitment to providing better-for-you snack options, featuring no artificial flavors or preservatives and combining five types of vegetables (spinach, beet, red bell pepper, carrot, and tomato) with non-GMO corn. The brand aims to meet the growing demand for healthier snacks that do not compromise on taste, aligning with consumer preferences for adventurous flavor combinations and wholesome ingredients.

-

In August 2024, Kibo Foods launched its new Veggie Crunch Chips, offering a healthy and sustainable snack option powered by green peas. These bite-sized 3D triangular chips provide 7 grams of plant-based protein per serving, are free from preservatives, added sugar, gluten, dairy, GMOs, and high saturated fat, and contain only 110 calories per serving. Available in three flavors-Sea Salt, Sour Cream & Onion, and Hot Chipotle-the chips cater to diverse taste preferences.

-

In July 2023, Taylor Farms, North America’s leading producer of fresh foods, launched a new range of Snack Packs designed for convenient, healthy snacking. These packs combine fresh vegetables like carrots, celery, radish chips, and grape tomatoes with flavorful dips from brands such as Good Foods, Fresh Cravings, and Taste of the South. The five new varieties include Chicken Salad, Veggies & Guacamole, Pimento Cheese, Dill Pickle, and Roasted Hummus, catering to diverse taste preferences.

U.S. Healthy Vegetable Chips Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.08 billion

Revenue forecast in 2030

USD 1.56 billion

Growth rate

CAGR of 7.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, flavor, processing, distribution channel

Country scope

U.S.

Key companies profiled

TERRA (Hain-Celestial); Kibo Foods; GoPure; Rare Fare Foods, LLC; PepsiCo; Lantev Industries; Hunter Foods Private Ltd; Rivera Foods; Troovy; Calbee Harvest Snaps & WorldPantry.com

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthy Vegetable Chips Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. healthy vegetable chips market report based on product, nature, flavor, processing, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Root Vegetable Chips

-

Sweet Potato Chips

-

Beetroot Chips

-

Carrot Chips

-

Others

-

-

Leafy Green Chips

-

Kale Chips

-

Spinach Chips

-

Others

-

-

Legum-based

-

Lentil Chips

-

Chickpea Chips

-

Pea Chips

-

Others

-

-

Others

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

Non-GMO

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Plain & Salted

-

Spiced & Seasoned

-

Cheese-flavored

-

Others

-

-

Processing Outlook (Revenue, USD Million, 2018 - 2030)

-

Baked

-

Air-dried & Dehydrated

-

Fried

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. healthy vegetable chips market size was estimated at USD 998.8 million in 2024 and is expected to reach USD 1,077.8 million in 2025.

b. The U.S. healthy vegetable chips market is expected to grow at a compounded growth rate of 7.7% from 2025 to 2030 to reach USD 1,564.7 million by 2030.

b. U.S. fried healthy vegetable chips accounted for a revenue share of 37.6% in 2024. Consumers in the U.S. are increasingly consuming fried vegetable chips as they offer the perfect combination of crispy texture and rich flavor while still being perceived as a healthier alternative to traditional potato chips.

b. Some key players operating U.S. healthy vegetable chips market include Calbee, Inc., PepsiCo, Inc., TERRA (Hain Celestial Group, Inc.), Sensible Portions, The Better Chip, and others

b. Key factors that are driving the market growth include rising product innovations and growing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.