- Home

- »

- Clinical Diagnostics

- »

-

U.S. Hereditary Cancer Testing Market, Industry Report, 2033GVR Report cover

![U.S. Hereditary Cancer Testing Market Size, Share & Trends Report]()

U.S. Hereditary Cancer Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Cancer, By Technology (Cytogenetic, Biochemical, Molecular Testing), By Test Type (Predictive Testing, Diagnostic Testing), By End-use (Hospitals, Clinics), And Segment Forecasts

- Report ID: GVR-4-68040-721-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

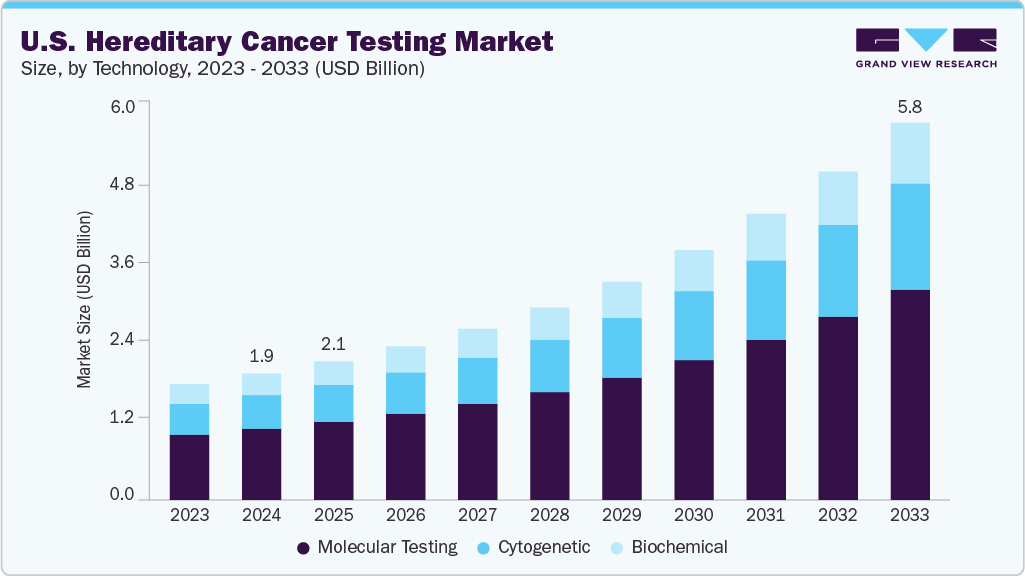

The U.S. hereditary cancer testing market was estimated at USD 1.93 billion in 2024 and is projected to reach USD 5.76 billion by 2033, growing at a CAGR of 13.32% from 2025 to 2033. The U.S. hereditary cancer testing market is driven by growing awareness of inherited cancer risks, with 5-10% of cancers linked to germline mutations. Rising adoption of guideline-based screening from NCCN and ACOG, coupled with FDA authorization of panels, is boosting clinician confidence and payer coverage. Technological advancements such as integration of DNA/RNA sequencing, digital screening tools, and combined germline-somatic profiling are expanding clinical utility. Increasing partnerships, patient education initiatives, and insurance support are further accelerating access, positioning hereditary testing as a cornerstone of precision oncology.

In the United States, between five and ten percent of all cancers are associated with inherited mutations in cancer predisposition genes. These hereditary mutations, passed down through families, increase the risk of developing cancers such as breast, ovarian, colorectal, prostate, and others. While most of the estimated 270,000 annual breast cancer cases among women, 2,000 among men, and 20,000 ovarian cancer cases occur sporadically, a notable proportion is hereditary. This underscores the importance of genetic testing as a tool for both early detection and preventive healthcare. The National Comprehensive Cancer Network (NCCN) has established guidelines to identify individuals most likely to carry mutations, primarily based on personal and family cancer histories. Yet, despite the strength of these guidelines, hereditary testing has historically been underutilized, partly because of inconsistent interpretation across laboratories and limited patient access.

The landscape is now evolving rapidly. In May 2025, Guardant Health expanded its portfolio with the launch of the Guardant Hereditary Cancer test, a blood-based germline panel that analyzes 82 genes linked to over a dozen tumor types. By integrating hereditary testing with its Guardant360 liquid biopsy platform, the company is positioning itself to serve as a single source for precision oncology solutions. “Introducing a best-in-class hereditary cancer test is another important step in achieving our mission to conquer cancer with data. It expands the portfolio we offer to support healthcare providers across the entire continuum of care.” This approach not only helps guide treatment decisions for patients but also supports risk assessment for secondary cancers and family member screening.

Myriad Genetics continues to shape the hereditary cancer testing field with its MyRisk with RiskScore test, which evaluates 48 genes while integrating polygenic risk assessment across ancestries. A recent study published in Obstetrics & Gynecology showed that the use of MyGeneHistory, an online screening tool, and patient education modules significantly increased test uptake, identifying thirty percent more eligible patients and doubling completion rates. Myriad has also strengthened market access through partnerships such as its agreement with CancerCARE for Life, enabling more than one million individuals to be screened digitally before referral for testing. “Clear, actionable results provide the foundation for personalized care plans, empowering patients to make confident, informed decisions about their health.”

Ambry Genetics, now part of Tempus AI, has also modernized its hereditary cancer portfolio with updated panels such as CancerNext, BRCANext, and ColoNext, aligning with the most recent national consensus guidelines. Its signature +RNAinsight technology, which pairs DNA and RNA sequencing, reduces variants of uncertain significance by about five percent and helps address evidence gaps in non-White populations. Equally transformative is the Ambry CARE program, a digital hereditary cancer risk assessment platform validated with 99.5 percent accuracy in applying NCCN guidelines. This program integrates with electronic health records, collects family histories directly from patients, and stratifies them based on hereditary cancer risks. “Because clinicians can trust the accuracy of our digital risk assessment tools, they can confidently scale genetic testing and ensure more patients gain access to potentially lifesaving insights.”

A pivotal milestone for the market was Invitae’s achievement in 2023, when its Common Hereditary Cancers Panel became the first of its kind to gain FDA market authorization. Covering 47 genes, the panel set a new regulatory precedent by demonstrating rigorous validation standards. The FDA’s recognition provides an added layer of confidence for clinicians and insurers, potentially accelerating adoption and reimbursement. “This authorization is a testament to our commitment to rigorous quality standards and sets a new bar for hereditary cancer testing.”

Exact Sciences entered the hereditary cancer testing space in 2024 with the launch of Riskguard, a multi-cancer hereditary panel that uses blood or saliva samples to identify genetic changes associated with ten major cancers, including breast, ovarian, prostate, and colorectal cancer. By securing Medicare and commercial coverage, the company made hereditary cancer testing more accessible to patients across the country. The integration of Riskguard with Exact Sciences’ flagship Oncotype DX and OncoExTra tests enables oncologists to combine hereditary testing with therapy selection, creating a more complete molecular picture. “Helping people understand their inherited risk and take informed actions is a crucial step toward reducing the burden of cancer.”

Foundation Medicine, through its partnership with Fulgent Genetics, expanded into hereditary testing in 2025 with the launch of FoundationOne Germline and FoundationOne Germline More. The former analyzes 50 genes, while the latter expands coverage to 154 genes, making it suitable for individuals with complex clinical histories. When paired with Foundation Medicine’s comprehensive genomic profiling portfolio, these tests provide clinicians with the ability to integrate germline and somatic testing in a single workflow. “Our new germline offerings help explain why patients developed cancer and deliver insights into potential future risks, creating a more holistic understanding of each case.”

The momentum in this market is reinforced by the American Cancer Society’s CancerRisk360 tool, which raises awareness about both hereditary and modifiable risk factors. This tool, launched in 2025, empowers individuals to assess their personal and family cancer risks alongside lifestyle factors, linking prevention and genetics in a more holistic framework.

The U.S. hereditary cancer testing market is therefore entering a new era characterized by broader test portfolios, integration of germline and somatic testing, FDA-backed regulatory standards, and digital screening solutions. Companies are not only competing on the breadth of their gene panels but also on accuracy, accessibility, and the ability to integrate seamlessly into clinical workflows. By focusing on digital health tools, payer partnerships, and population-level strategies, they are working to expand testing beyond oncology centers into primary care and preventive medicine. This evolution reflects a fundamental shift: hereditary cancer testing is no longer viewed as niche but as an essential part of comprehensive cancer care. The future trajectory suggests that the market will continue to expand rapidly, with innovation ensuring that hereditary testing is increasingly personalized, equitable, and embedded across the continuum of patient care.

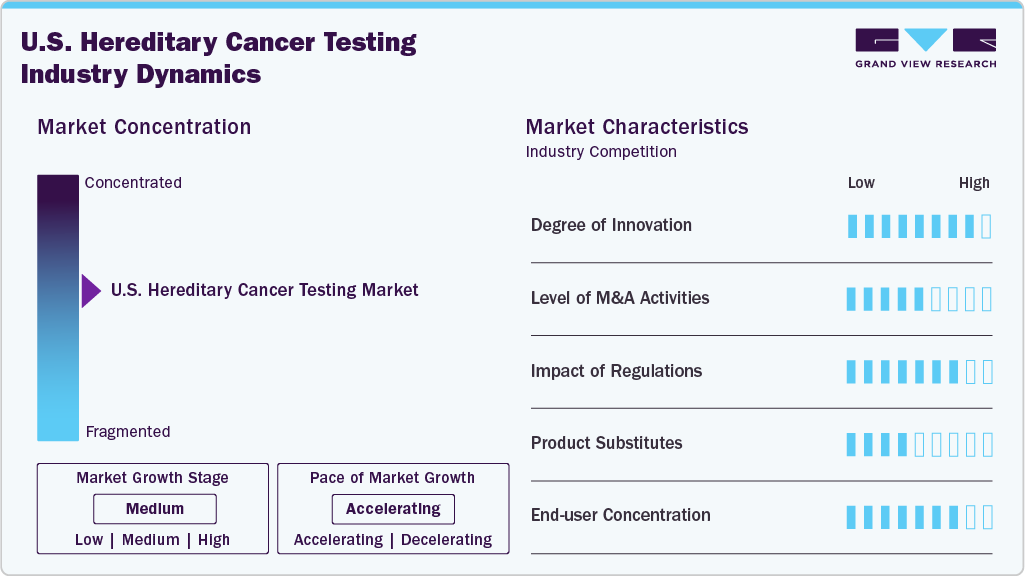

Market Concentration & Characteristics

The degree of innovation in the U.S. hereditary cancer testing market is high, reflecting both technological and systemic advancements. Companies are moving beyond traditional multigene panels to introduce FDA-authorized assays, integrated DNA and RNA sequencing, and combined germline-somatic profiling, which deliver deeper clinical insights and reduce uncertainties. Digital risk assessment tools and AI-driven patient stratification are expanding access and improving adherence to NCCN guidelines. Moreover, enhanced test coverage by payers and partnerships with health systems are embedding hereditary testing into mainstream care, positioning it as a transformative component of precision medicine.

The level of M&A activity in the U.S. hereditary cancer testing market is moderate but strategically significant. Consolidation has been driven by the need to expand testing portfolios, integrate digital health platforms, and strengthen payer and provider networks. A notable example is Ambry Genetics becoming a wholly owned subsidiary of Tempus AI in 2025, enabling the fusion of advanced genomic testing with data-driven oncology solutions. Partnerships, such as Foundation Medicine collaborating with Fulgent Genetics, also highlight quasi-M&A alliances aimed at broadening capabilities. Overall, the market reflects targeted consolidation rather than large-scale rollups.

Regulation has had a profound impact on the U.S. hereditary cancer testing market, shaping both adoption and credibility. The FDA’s 2023 authorization of Invitae’s Common Hereditary Cancers Panel marked a watershed moment, setting performance and validation standards that elevate clinical confidence and may influence payer reimbursement decisions. NCCN and ACOG guidelines continue to drive test eligibility and clinical use, ensuring alignment with evidence-based care. At the same time, regulatory scrutiny around variant interpretation underscores the need for accuracy and consistency across laboratories. Collectively, regulation is transforming hereditary testing from optional practice into a mainstream clinical standard.

Product expansion in the U.S. hereditary cancer testing market has been rapid and multi-dimensional. Companies are moving from narrow BRCA-focused panels to broad multigene assays covering dozens to over 150 genes, addressing a wider range of hereditary cancers including breast, ovarian, colorectal, prostate, and endometrial. Guardant Health, Exact Sciences, and Foundation Medicine have introduced blood- and saliva-based panels, integrating germline with liquid biopsy and tumor profiling to create comprehensive solutions. Enhancements such as Ambry’s DNA+RNA sequencing and Myriad’s polygenic risk scoring further expand clinical utility, positioning hereditary cancer testing as an essential component of precision oncology.

Regional expansion in the U.S. hereditary cancer testing market is accelerating as companies extend access beyond major oncology centers into community hospitals, primary care, and underserved populations. Programs like Ambry’s CARE platform and Myriad’s MyGeneHistory screening tool integrate with electronic health records, enabling scale across regional health systems. Payer partnerships, including Medicare and commercial insurance coverage for tests like Exact Sciences’ Riskguard, are broadening geographic reach. At the same time, minority health initiatives, such as the American Cancer Society’s CancerRisk360, are targeting disparities, ensuring hereditary testing penetrates diverse regions and patient demographics across the country.

Cancer Insights

In 2024, breast cancer accounted for the largest share of the hereditary cancer testing market, generating 12.45% of total revenue, and was also one of the fastest-growing segments with a CAGR of 13.94%. Growth is largely driven by increasing awareness of genetic risk factors, particularly BRCA1/2 mutations, which substantially heighten breast cancer susceptibility. The rising emphasis on early detection and personalized care has fueled demand for genetic testing, enabling preventive strategies such as prophylactic surgeries and targeted therapies that significantly improve patient outcomes.

Advancements in next-generation sequencing (NGS) have further accelerated adoption by enabling comprehensive analysis of multiple cancer-related genes, while artificial intelligence and machine learning are improving interpretation for more precise risk assessments. Additionally, liquid biopsy technologies are offering non-invasive alternatives for mutation detection, expanding accessibility to testing. Research breakthroughs have broadened the genetic landscape of breast cancer, making testing both more accurate and clinically valuable.

Innovation is also reshaping this segment, as seen in June 2023 when Devyser introduced the BRCA PALB2 kit, designed to sequence BRCA1, BRCA2, and PALB2-three critical genes linked to elevated breast cancer risk. The kit features a streamlined workflow, supports rapid lab adoption, and uniquely enables variant analysis in DNA from both blood and tumor tissue within a single solution. Rising public and clinical awareness of the role of BRCA1/2 and related mutations is propelling more individuals to pursue hereditary cancer testing, reinforcing its importance in identifying high-risk populations and advancing breast cancer prevention.

Technology Insights

In the U.S. hereditary cancer testing market, the molecular testing segment dominated in 2024, accounting for 56.36% of total revenue, reflecting its position as the most widely adopted technology. Growth in this segment is being propelled by the need for early detection and precision-driven treatment strategies, as genetic mutations are increasingly recognized as key risk factors for multiple cancer types. Molecular testing has become the first choice for identifying these mutations, enabling clinicians to link genetic profiles with cancer predisposition and develop individualized prevention and treatment plans. Rising awareness among patients and providers about the role of genetics in cancer care has further amplified demand. The broader shift toward precision medicine is also a critical driver, as molecular testing supports the delivery of therapies tailored to an individual’s genetic makeup. Advancements such as next-generation sequencing (NGS) are transforming the landscape, offering deeper, faster, and more comprehensive genetic insights. A notable innovation came in April 2025, when Exact Sciences introduced Oncodetect, a molecular residual disease (MRD) test capable of monitoring tumor-specific alterations across multiple cancer types, expanding the clinical applications of molecular testing beyond risk assessment into ongoing patient management.

While molecular testing holds the dominant share, the cytogenetic testing segment represents the fastest-growing area of the market. This growth is underpinned by the increasing understanding of how chromosomal alterations-including translocations, deletions, and duplications-contribute to hereditary cancer risk. Cytogenetics provides valuable insights for genetic counseling, helping families assess and manage inherited cancer predispositions. Technological innovations such as fluorescence in situ hybridization (FISH) and array comparative genomic hybridization (aCGH) have enhanced detection of chromosomal abnormalities at a finer resolution, improving the accuracy of hereditary cancer risk assessments. With U.S. healthcare providers rapidly adopting genomic tools, cytogenetic testing is poised to complement molecular methods by offering unparalleled insights into chromosomal-level changes. Together, these advancements are revolutionizing cancer prevention and patient care, positioning the U.S. as a leading market in the global evolution of hereditary cancer testing.

Test Type Insights

In 2024, predictive testing dominated the U.S. hereditary cancer testing market, accounting for 66.49% of total revenue and ranking among the fastest-growing segments. Its expansion is fueled by the rising prevalence of genetic diseases, growing demand for genetic counseling, and the increasing awareness of hereditary cancer risk. The value of predictive testing lies in its ability to identify high-risk individuals before disease onset, enabling proactive prevention through lifestyle adjustments, enhanced surveillance, or risk-reducing interventions such as prophylactic surgeries. Technological progress has been central to this growth, with next-generation sequencing (NGS) enabling simultaneous analysis of multiple cancer-related genes for comprehensive risk assessment. Liquid biopsy is also emerging as a promising, non-invasive predictive tool, improving accessibility and patient adoption. An example of innovation came in May 2024, when geneType launched its comprehensive risk assessment test for women over 30, providing insights into breast and ovarian cancer predisposition even without known mutation types.

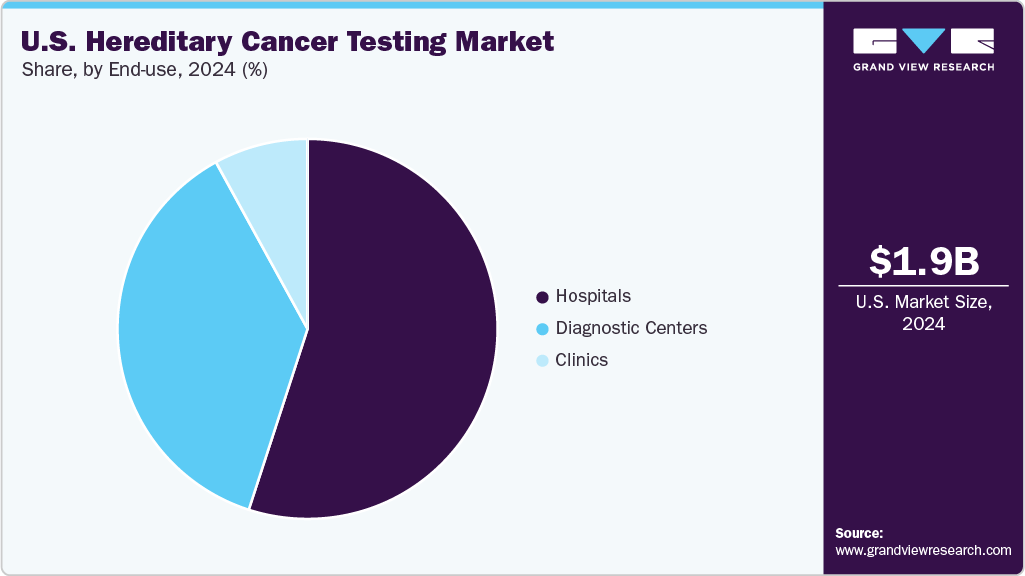

End-use Insights

In 2024, hospitals accounted for the largest share of the U.S. hereditary cancer testing market at 55.11% and emerged as the fastest-growing end-use segment. The increasing integration of hereditary cancer testing into hospital-based care reflects the growing emphasis on personalized medicine, where genetic insights guide prevention, early detection, and tailored therapeutic approaches. By incorporating genetic testing into oncology pathways, hospitals are enabling physicians to design more precise treatment strategies and improve patient outcomes, reinforcing their central role in cancer care delivery.

Supportive government initiatives and reimbursement frameworks have further accelerated adoption in hospital settings. The Centers for Medicare & Medicaid Services (CMS), for example, expanded coverage for next-generation sequencing (NGS) tests in patients with advanced cancers, significantly lowering financial barriers for both patients and providers. This policy shift has incentivized hospitals to implement hereditary cancer testing more broadly, ensuring that genetic risk assessment and precision oncology services become an integral part of routine cancer management.

U.S. Hereditary Cancer Testing Market Trends

The U.S. hereditary cancer testing market is experiencing rapid growth, projected to reach 5.76 billion by 2033, driven by technological advancements, increased awareness, and expanded insurance coverage. Key players include Myriad Genetics, Invitae, Illumina, Natera, and Labcorp are in continuously functioning in research and development for increasing their genetic tests portfolio.

Key U.S. Hereditary Cancer Testing Company Insights

Some of the key players operating in the market include Myriad Genetics, Inc., Invitae Corporation, Illumina, Inc., Bio-Rad Laboratories, Qiagen NV, F. Hoffmann-La Roche Ltd., EUROFINS SCIENTIFIC and Thermo Fisher Scientific, Inc. New disease type launch, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key U.S. Hereditary Cancer Testing Companies:

- Myriad Genetics,

- Invitae Corporation

- Bio-Rad Laboratories

- CSL Ltd

- Qiagen NV

- Danaher Corporation

- Thermo Fisher Scientific

- Abbott Laboratories

- EUROFINS SCIENTIFIC

- F. HOFFMANN-LA ROCHE LTD

- Illumina, Inc.

Recent Developments

-

In February 2025, Foundation Medicine launched hereditary germline tests, FoundationOne Germline and FoundationOne Germline More, partnering with Fulgent Genetics in U.S. It is a next-generation sequencing (NGS) test to identify genetic mutations in hereditary cancer for individuals with family history.

-

In September 2024, Ambry Genetics announced new hereditary genetic tests for genetic mutations detection concerned with hereditary cancer. Their enhanced portfolio introduced additional genes and indications, enabling a more comprehensive genetic assessment.

-

In February 2024, Exact Sciences Corp introduced Riskguard hereditary cancer test in the United States. offers a personalized assessment of genetic and familial risks for 10 prevalent cancers colorectal, breast, prostate, skin, ovarian, endometrial, pancreatic, gastric, kidney, and endocrine. This test aids in identifying inherited genetic variations that may elevate cancer risk, facilitating early detection, preventive strategies, and tailored treatment plans.

U.S. Hereditary Cancer Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.12 billion

Revenue forecast in 2033

USD 5.76 billion

Growth Rate

CAGR of 13.32% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cancer, test type, technology

Country scope

U.S.

Key companies profiled

Myriad Genetics, Invitae Corporation, Bio-Rad Laboratories, CSL Ltd, Qiagen NV, Danaher Corporation, Thermo Fisher Scientific, Abbott Laboratories, EUROFINS SCIENTIFIC, F. HOFFMANN-LA ROCHE LTD, Illumina, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hereditary Cancer Testing Market Report Segmentation

This report forecasts revenue growth at, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the hereditary cancer testing market report on the basis of test type, technology, cancer, andend-use:

-

Cancer Outlook (Revenue, USD Million, 2021 - 2033)

-

Lung Cancer

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Ovarian Cancer

-

Prostate Cancer

-

Stomach/Gastric Cancer

-

Melanoma

-

Sarcoma

-

Uterine Cancer

-

Pancreatic Cancer

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Cytogenetic

-

Biochemical

-

Molecular Testing

-

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Predictive Testing

-

Diagnostic Testing

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnostic Centers

-

Hospitals

-

Clinics

-

Frequently Asked Questions About This Report

b. The U.S. hereditary cancer testing market size was estimated at USD 1.93 billion in 2024 and is expected to reach USD 2.34 billion in 2025.

b. The U.S. hereditary cancer testing market is expected to witness a compound annual growth rate of 13.32% from 2025 to 2030 to reach USD 5.76 billion in 2030.

b. Based on cancer, breast cancer segment held the largest share of 12.45% in 2024 driven by increasing awareness of genetic risk factors, particularly mutations in BRCA1/2, which significantly elevate breast cancer risk

b. Some key players operating in the hereditary cancer testing include Myriad Genetics, Invitae Corporation, Bio-Rad Laboratories, CSL Ltd, Qiagen NV, Danaher Corporation, Thermo Fisher Scientific, Abbott Laboratories, EUROFINS SCIENTIFIC, F. HOFFMANN-LA ROCHE LTD, Illumina, Inc.

b. Key factors driving the hereditary cancer testing market growth include technological advancements of genetic testing for cancer detection, integration with precision medicine and growing awareness through public and government initiatives. In addition, rising prevalence of cancer diseases amongst the population is augmenting the adoption of hereditary cancer testing

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.