- Home

- »

- Clinical Diagnostics

- »

-

Hereditary Cancer Testing Market Size & Share Report, 2033GVR Report cover

![Hereditary Cancer Testing Market Size, Share & Trends Report]()

Hereditary Cancer Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Cancer, By Technology (Cytogenetic, Biochemical, Molecular Testing), By Test Type (Predictive Testing, Diagnostic Testing), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-588-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hereditary Cancer Testing Market Summary

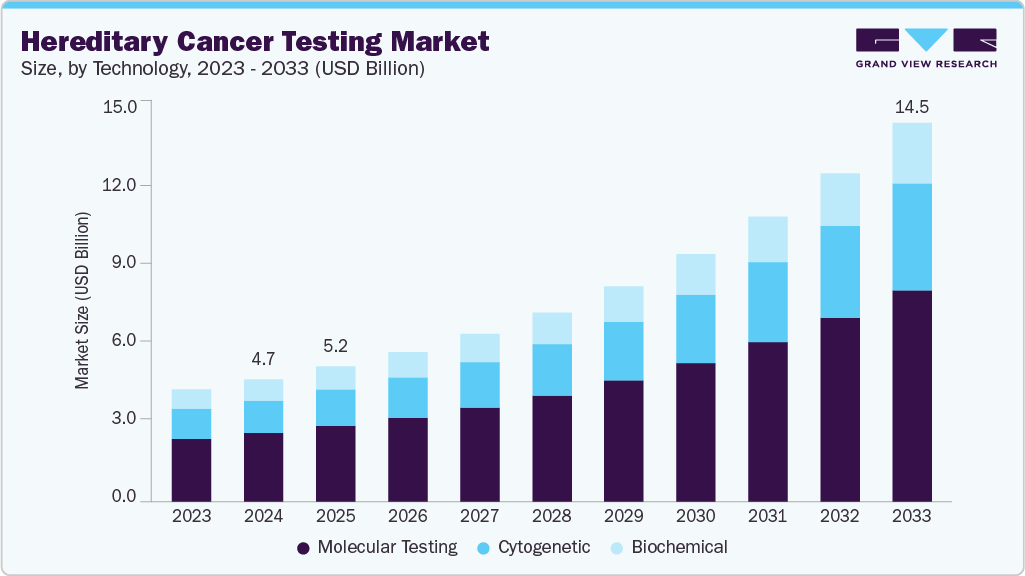

The global hereditary cancer testing market size was estimated at USD 4.67 billion in 2024 and is projected to reach USD 14.45 billion by 2033, growing at a CAGR of 13.76% from 2025 to 2033. The demand for hereditary cancer testing is increasing due to technological advancements in genetic testing for cancer detection, integration with precision medicine, and growing awareness through public and government initiatives.

Key Market Trends & Insights

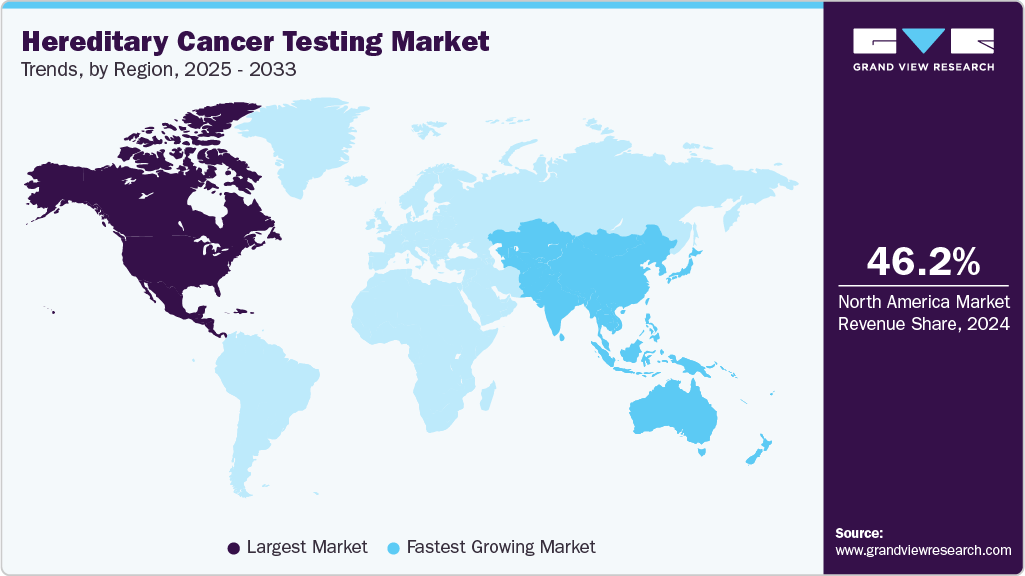

- The North America hereditary cancer testing market held the largest global revenue share of 46.14% in 2024.

- The Asia Pacific hereditary cancer testing industry is anticipated to witness the fastest CAGR of 15.16% over the forecast period.

- By cancer, the breast cancer segment held the highest market share of 11.88% in 2024.

- By technology, the molecular testing segment held the highest market share of 56.43% in 2024.

- By test type, the predictive test segment held the largest market share of 66.55% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.67 Billion

- 2033 Projected Market Size: USD 14.45 Billion

- CAGR (2025-2033): 13.76%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

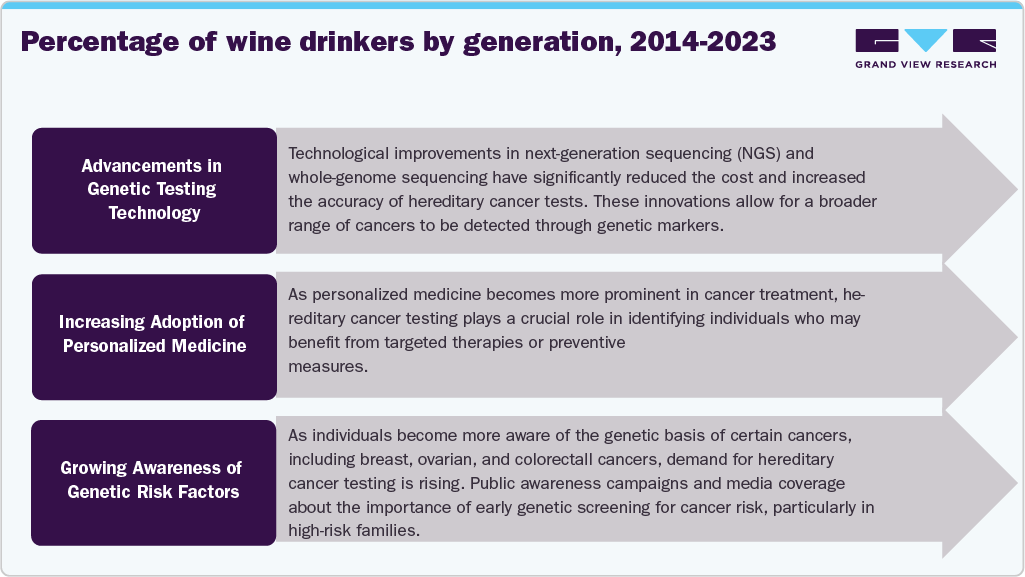

In addition, the rising prevalence of cancer diseases amongst the population is augmenting the adoption of hereditary cancer testing. According to the National Cancer Institute, hereditary cancer, caused by inherited genetic changes, accounts for 10% of all other cancer types. Hereditary cancer is passed on to coming generations as defective familial mutations in the genes, concomitantly increasing the risk of cancer. Hence, there arises a growing need among the people for early detection and for mitigating cancer symptoms.Advancements in genetic testing technologies, particularly next-generation sequencing (NGS), have significantly improved the accuracy and accessibility of hereditary cancer testing. Traditional methods lack efficiency and are time-consuming, which may prolong the treatment duration thereafter. One such testing technology is the next-generation sequencing (NGS), which can simultaneously detect millions of copies of DNA in a gene within a short span of time, allowing comprehensive profiling of multiple genes and mutations in a single test. For example, Illumina’s NovaSeq X platform offers high-throughput sequencing for analyzing large sequences of data and diagnose the condition of diseases. The innovations in genetic testing facilitate early detection of hereditary cancer mutations, guide personalized treatment plans, and monitor disease progression non-invasively. Thus, progress in oncology medicine by integration of early cancer detection systems is transforming the perspective to advanced technologies rather than traditional testing methods.

Hereditary testing plays a pivotal role in precision medicine by enabling the identification of genetic mutations that influence cancer risk and treatment response. The basis of precision medicine lies in understanding the effects of alterations in certain genes in cancer. Precision medicine is transforming cancer care to tailor tests and treatments based on individual patient characteristics. It helps identify people at high risk for cancer, allowing early interventions to reduce their risk. It also aids in detecting certain cancers at an early stage and ensures accurate diagnosis of specific cancer types. Additionally, it allows ongoing evaluation of how well a treatment is working, enabling adjustments to improve outcomes. This personalized approach improves survival rates and quality of life for cancer patients by moving beyond one-size-fits-all therapies to targeted, patient-specific care.

Growing awareness through public and government initiatives plays a crucial role in expanding hereditary cancer testing. Government efforts, for example, in February 2024, the National Institutes of Health (NIH) launched the Cancer Screening Research Network (CSRN), a clinical trials network aimed at evaluating emerging cancer screening technologies, including multi-cancer detection (MCD) tests. This initiative supports the Biden-Harris administration’s Cancer Moonshot by focusing on identifying cancers earlier, when treatment is more effective.

The National Institutes of Health (NIH) is also working continuously in prevention and screening for five major types of cancer: breast, cervical, colorectal, lung, and prostate, in order to save lives. Due to its initiatives, as of December 2024, 4.75 million deaths have been averted. Furthermore, several campaigns and online resources have raised awareness among the people for hereditary cancer testing. These combined efforts aim to empower individuals with knowledge, encourage timely testing, and support preventive care, ultimately reducing cancer incidence and improving outcomes across diverse populations.

Market Opportunities for Hereditary Cancer Testing

The hereditary cancer testing market presents significant growth opportunities, driven by increased awareness, advancements in genetic testing technologies, and a growing emphasis on personalized medicine. Here are some key opportunities in the market:

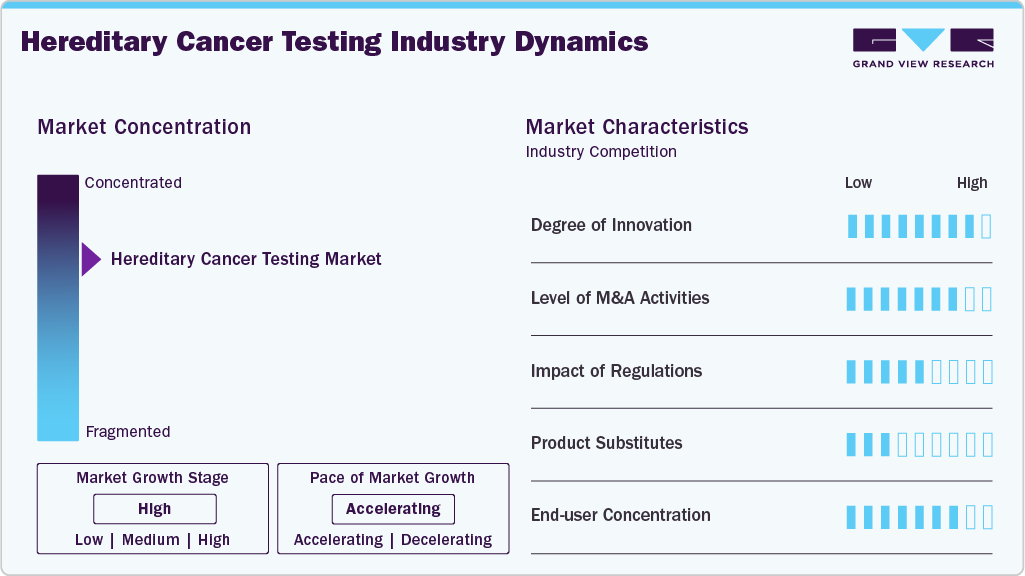

Market Concentration & Characteristics

The hereditary cancer testing market has a tremendous number of innovations, covering vast categories of cancer. Advancing technologies, such as next-generation sequencing, improve accuracy and speed, attracting more players. This rapid technological evolution attracts new players and investments, fostering competition. Established companies, such as F. Hoffmann-La Roche Ltd. and Illumina, Inc., focus on maintaining leadership through continuous R&D for innovations.

The hereditary cancer testing industry experiences significant M&A activity, primarily driven by larger companies seeking to enhance their capabilities through strategic acquisitions. Key players tend to acquire small market players to expand their product portfolio and maintain a competitive advantage. For example, in January 2022, Exact Sciences acquired PreventionGenetics for early detection and disease prevention benefits for advanced cancer. This acquisition will also expand Exact Sciences' genetic testing portfolio and help patients know the germline risks.

Regulation plays a critical role in shaping the hereditary cancer testing market. Stringent standards from regulatory bodies like the FDA and CLIA ensure the accuracy, reliability, and safety of genetic tests. While these regulations protect consumers, they also create significant barriers for new market entrants due to high compliance costs and lengthy approval processes. However, regulatory flexibility in certain regions allows for innovation, albeit within tightly controlled frameworks.

In the hereditary cancer testing market, product substitutes are limited due to the unique nature of genetic testing in detecting inherited cancer risks. While alternatives like family history assessments or imaging tests may provide some insights, they lack the specificity and predictive power of genetic testing. This makes hereditary cancer tests the primary choice for accurate risk assessment. The scarcity of viable substitutes results in a market with less price competition and higher concentration, as the key players dominate with few alternatives offering the same level of diagnostic capability.

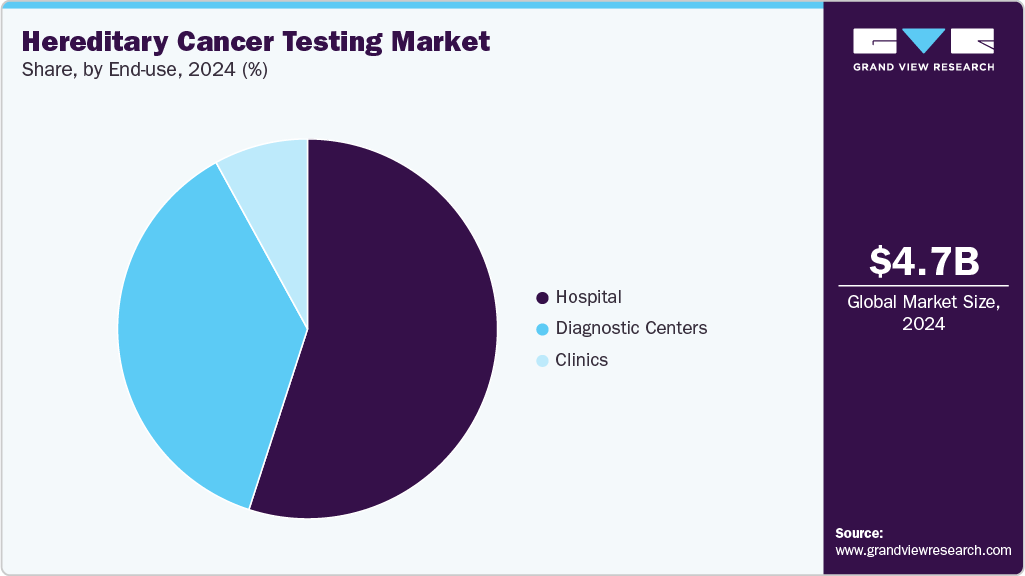

End user concentration in the hereditary cancer testing industry is moderate, with demand driven by hospitals, research institutions, and specialized cancer clinics. These institutions typically account for the largest portion of testing services, establishing a concentration of purchasers. However, the rise of direct-to-consumer genetic testing platforms, such as 23andMe and AncestryDNA, has broadened the market. While hospitals and healthcare providers maintain significant influence, these consumer-focused platforms diversify end user segments, thus reducing concentration. Despite this, large healthcare providers still hold substantial market power due to their established infrastructure and reputation in genetic testing.

New Technology and Adoption Landscape of Hereditary Cancer Testing Market

Hereditary cancer testing is evolving rapidly, driven by technological advancements that enhance diagnostic accuracy and treatment personalization. Key innovations are accelerating market growth due to enhanced speed, accuracy of detection, facilitating earlier detection, and tailored therapeutic strategies.

-

Next-Generation Sequencing (NGS): This technology allows for comprehensive analysis of multiple genes associated with hereditary cancers, enhancing the accuracy of risk assessments and facilitating early detection strategies.

-

Integration of Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being integrated into genetic testing platforms to enhance the interpretation of complex genetic data. These technologies assist in identifying patterns and predicting disease risks, contributing to more personalized recommendations for patients.

-

CRISPR-Cas9 Technology: This gene-editing tool holds potential for correcting genetic mutations at the DNA level, offering therapeutic possibilities for hereditary cancers. While still in research stages, CRISPR-Cas9 could play a significant role in future treatment paradigms.

Adoption Landscape of Hereditary Cancer Testing Market:

-

Precision Medicine: Tailoring medical treatment to individual genetic profiles.

-

Direct-to-Consumer Testing: Increased accessibility, enabling individuals to order tests without healthcare provider involvement.

-

Government Initiatives: Programs aim to make genomic testing more accessible to patients, thereby promoting early detection and personalized treatment options

These technologies and testing innovations are reshaping the market, enabling faster, more precise, and remote pathology workflows.

Cancer Insights

The breast cancer dominated the market with the largest revenue share of 11.88% and was among the fastest growing in this segment with a CAGR of 14.37% in 2024. The hereditary cancer testing market is driven by increasing awareness of genetic risk factors, particularly mutations in BRCA1/2, which significantly elevate breast cancer risk. With growing demand for early detection and personalized treatment, genetic testing enables tailored preventive strategies, such as targeted therapies and prophylactic surgeries, improving patient outcomes.

Another key driving factor in this segment is the ongoing advancements, like next-generation sequencing (NGS) have revolutionized testing, enabling comprehensive analysis of multiple cancer-related genes. AI and machine learning enhance data interpretation for more accurate risk assessments. Liquid biopsy technology under molecular testing also offers a non-invasive alternative for detecting genetic mutations, making testing more accessible. Transformations in research for identifying genetic mutations have broadened the scope of hereditary cancer testing, making it more accurate and accessible.

There are several innovations in this category, for instance, in June 2023, Devyser announced the launch of its new product, the Devyser BRCA PALB2 kit. This kit enables the sequencing of genetic variants in BRCA1, BRCA2, and PALB2-three key genes associated with an increased risk of breast cancer. The Devyser BRCA PALB2 offers a simplified workflow, facilitating quick laboratory integration and combining two applications in a single solution: the analysis of genetic variants in DNA from both human blood and tumor tissue.

Increasing awareness of genetic factors contributing to breast cancer, such as BRCA1 and BRCA2 mutations, is driving more people to seek hereditary cancer testing. The rising demand for early detection and risk assessment is helping detect high-risk individuals to combat this deadly disease.

Technology Insights

The molecular testing segment held the highest position, accounting for the largest share of 56.43% in 2024. Molecular testing in the hereditary cancer testing market is expediting, driven by the need for early detection and personalized treatment. One of the primary drivers is the increasing recognition of genetic mutations as key risk factors for various cancers. For identifying genetic mutations, molecular testing is the first choice in the market that enables its association with various cancers, allowing for individual assessments for prevention strategies and treatment plans. As individuals become more aware of the importance of genetics in cancer prevention and treatment, the demand for molecular testing is rising. Furthermore, the growing emphasis on precision medicine is accelerating the adoption of molecular tests, which enable healthcare providers to provide treatments based on an individual's genetic makeup. Advancements in molecular testing technologies, such as next-generation sequencing (NGS), are transforming the landscape. An example of such an innovation includes the launch of Oncodetect in April 2025 by Exact Sciences. This test is useful for detecting molecular residual disease (MRD) across multiple tumors.

Additionally, cytogenetic segment is the fastest-growing in the hereditary cancer testing market, driven by increasing understanding of how chromosomal alterations, such as translocations, deletions, and duplications, contribute to the development of hereditary cancers. It also enables more accurate genetic counseling for families at risk of passing on cancer-related mutations, which is crucial for preventive strategies. Advancements in cytogenetics have led to improved testing methods, such as fluorescence in situ hybridization (FISH) and array comparative genomic hybridization (aCGH), which allow for the detection of chromosomal abnormalities at a more granular level. These technologies have enhanced the precision of hereditary cancer risk assessments. As healthcare increasingly adopts genomic innovations, cytogenetic systems will continue to lead medical advancements, providing unmatched insights into the genetic foundations of diseases and revolutionizing patient care globally.

Test Type Insights

The predictive test accounted for the largest share of 66.55% and was among the fastest-growing tests in the segment for the year 2024. The heightened focus on genetic counseling services and the growing incidence of genetic diseases globally drive the expansion of this segment. The significance of predictive testing lies in its ability to identify individuals at high genetic risk before cancer develops, allowing for early preventive measures that can save lives. These predictive tests allow for better-informed decisions regarding lifestyle changes, enhanced screening, and therapeutic interventions.

Advancements in predictive testing technologies have played a critical role in expanding the scope and accessibility of genetic testing. Next-generation sequencing (NGS) has made it possible to analyze multiple genes simultaneously, offering a more comprehensive risk assessment for various cancers. Liquid biopsy, a non-invasive alternative, is also emerging as a promising tool for predictive testing, offering greater convenience and accessibility for patients. These advancements are making predictive tests an essential part of modern cancer care. For example, in May 2024, the geneType comprehensive risk assessment test for breast and ovarian cancer was launched by geneType for women aged 30+of age for unknown breast or ovarian cancer mutation type.

One of the key drivers is the rising awareness of the genetic factors contributing to cancer risk, particularly among individuals with a family history of cancer. Predictive tests, such as those for BRCA1/2 mutations, enable individuals to understand their genetic predisposition to certain cancers like breast, ovarian, and colorectal cancer. As a result, early intervention strategies, such as increased surveillance or preventive surgeries, are more accessible, reducing the overall cancer burden.

End Use Insights

The hospitals dominated the end use segments with the largest market share of 55.17% in 2024 and were the fastest growing among the other segments over the period. Hospitals are increasingly at the forefront of adopting hereditary cancer testing due to their central role in cancer diagnosis, treatment, and long-term patient management. Recent real-world evidence underscores the clinical and economic benefits of implementing universal hereditary cancer testing in breast cancer patients within hospital systems. For instance, a collaborative study conducted by Invitae and The Outer Banks Hospital in North Carolina demonstrated that universal testing (beyond NCCN criteria) led to meaningful clinical interventions. Approximately 13% of tested patients carried pathogenic germline variants (PGVs), and genetics-informed results influenced changes in surgery, radiation, surveillance, or follow-up in nearly 70% of patients. Importantly, 97% of patients reported that the results improved their surgical decision-making, reflecting high utility in shared care planning.

Hospitals also serve as a critical setting for addressing access disparities in rural and community populations. The Invitae-TOBH model showed that with the involvement of genetics-trained clinicians and multidisciplinary tumor boards, universal testing can be feasibly scaled even in underserved areas, without leading to overtreatment (e.g., unnecessary bilateral mastectomy or radiation). This highlights the role of hospitals in standardizing universal hereditary cancer testing as per ASBrS guidelines, ensuring equitable and optimized care delivery.

Furthermore, partnerships are emerging to expand hospital-based genetic services. For example, Foundation Medicine and InformedDNA have created referral pathways whereby physicians identifying potential germline variants through tumor genomic profiling can seamlessly connect patients to genetic counseling and confirmatory testing. This model allows hospitals to integrate somatic and germline insights into a unified treatment strategy, while ensuring compliance with guidelines and best practices. With board-certified genetic counselors available via telehealth, hospitals can extend genetic services nationwide, reducing bottlenecks and enabling broader adoption of precision oncology.

Regional Insights

The North America hereditary cancer testing market held the largest global revenue share of 46.14% in 2024. The market is experiencing robust growth, driven by advancements in next-generation sequencing (NGS), increasing awareness of genetic risks, and expanded insurance coverage. Technological advancements, including the development of blood-based tests for minimal residual disease detection, are enhancing early diagnosis and personalized treatment strategies. Collaborations, partnerships are increasing in this region, for example, in October 2023, a rural hospital system in North Carolina demonstrated the clinical benefits of implementing universal hereditary cancer testing for all breast cancer patients conducted in collaboration with Invitae, the study found that 91.4% of patients underwent testing, with 13% identified as carriers of pathogenic germline variants. Genetic test results informed clinical management decisions in 70% of cases, leading to changes in surgery, radiation, surveillance, and follow-up care. This approach improved patient outcomes and optimized resource utilization, providing a model for integrating genetic testing into rural healthcare settings.

U.S. Hereditary Cancer Testing Market Trends

The U.S. hereditary cancer testing industry is experiencing rapid growth, projected to reach 5.76 billion by 2033, driven by technological advancements, increased awareness, and expanded insurance coverage. Key players, include Myriad Genetics, Invitae, Illumina, Natera, and Labcorp, are continuously functioning in research and development to increase their genetic test portfolios.

Europe Hereditary Cancer Testing Market Trends

The European hereditary cancer testing industry was experiencing significant growth in this industry. Technological innovations, such as the integration of artificial intelligence and machine learning in genetic testing platforms, are enhancing diagnostic accuracy and predictive capabilities. For instance, in September 2022, Eurofins Genoma announced the launch of niPGT-A in preimplantation genetic screening for aneuploidy that plays a crucial role in Assisted Reproductive Technology (ART) applications. The expansion in this region is driven by advancements in other technologies, increasing awareness of genetic risks, and rising demand for personalized medicine.

The UK hereditary cancer testing market is expanding rapidly, driven by the increasing adoption of personalized medicines and escalating government initiatives. Innovations in research and development and early detection genetic tests are focused on improving patients’ needs in hereditary cancer testing. Technological progress, such as the integration of artificial intelligence and machine learning in genetic testing platforms, is enhancing diagnostic accuracy and predictive capabilities. These advancements are facilitating early detection and personalized treatment strategies, improving patient outcomes.

The hereditary cancer testing market in Germany is rapidly growing, driven by rising cancer incidence, government initiatives, and advancements in precision medicine and next-generation sequencing technologies. Key players include Myriad Genetics, Illumina, Qiagen, and Thermo Fisher Scientific, which are expanding their offerings with comprehensive gene panels and improved diagnostic accuracy. The market benefits from increased awareness, enhanced insurance coverage, and integration of AI for data interpretation, positioning Germany as a leading hub in hereditary cancer diagnostics.

Asia Pacific Hereditary Cancer Testing Market Trends

The Asia Pacific hereditary cancer testing industry is anticipated to witness the fastest CAGR of 15.16% over the forecast period. The market is rapidly expanding, driven by rising cancer incidence, Increased adoption of precision medicine, and advancements in next-generation sequencing technologies. Expansions in the market, such as in November 2024, when Advanced Genomics APAC partnered with 3BIGS to expand cancer screening tests in Asia Pacific, powered by AI technology integration. These initiatives are reflecting robust demand for early cancer detection and personalized treatment options for hereditary cancer testing.

The China hereditary cancer testing market is rapidly growing, driven by rising cancer prevalence, increasing awareness, and expanding healthcare infrastructure. Advancements in technologies and direct-to-consumer (DTC) testing have improved accessibility and accuracy. Key players include BGI, Berry Genomics, Daan Gene, WuXi NextCODE, and Annoroad Gene Technology. Government initiatives like the Healthy China 2030 plan and breakthroughs such as the first IVF pregnancy using polygenic risk scores for cancer risk assessment further propel market growth. Collaborations and partnerships are reflecting strong demand for early detection and personalized cancer prevention strategies.

The hereditary cancer testing market in Japan is growing steadily, driven by rising cancer incidence, increasing adoption of precision medicine, and advancements in next-generation sequencing (NGS) technologies. Government support, such as the National Cancer Center’s NCC Oncopanel for multi-gene testing, enhances accessibility and accuracy. Key players include Myriad Genetics, Sysmex Corporation, and Ambry Genetics, which focus on expanding genetic testing panels and integrating AI for better data interpretation. The market is projected to grow, fueled by growing awareness, personalized treatment approaches, and extensive R&D investments in biotechnology and cancer diagnostics.

Latin America Hereditary Cancer Testing Market Trends

The Latin America hereditary cancer testing industry is anticipated to grow at a substantial CAGR over the forecast period. The market is growing due to increasing adoption of personalized medicines, rising healthcare investments, and demand for early diagnosis of cancer. Expansions and partnerships are paving the way for innovations in cancer detection by analyzing several biomarkers. For instance, in August 2021, Dasa expanded its partnership with SOPHiA GENETICS to introduce the first decentralized cancer biomarker detection solution in Latin America.

The Brazil hereditary cancer testing market is rapidly growing, driven by rising cancer incidence, increased government initiatives, and advancements in next-generation sequencing (NGS) technologies. Key players such as Dasa, Myriad Genetics, Illumina, and Natera are expanding testing accessibility and precision oncology testing. Growing awareness, improved insurance coverage, and expanding medical infrastructure further fuel market growth. Brazil’s focus on precision medicine and genomic research, alongside increasing adoption of multi-gene panels and direct-to-consumer testing, supports market growth, enhancing early cancer detection and personalized treatment options.

Middle East and Africa Hereditary Cancer Testing Market Trends

The Middle East and Africa (MEA) hereditary cancer testing industry is growing steadily, driven by rising cancer incidence, increasing awareness, and expanding availability of advanced genetic testing technologies like next-generation sequencing. Key players include Illumina, Invitae Corporation, Centogene, and Eurofins Scientific. For example, in January 2025, Diatech Pharmacogenetics collaborated with Merck to provide access to the MEA population to personalized medicine in hereditary cancer. Government initiatives, improved healthcare infrastructure, and growing demand for early diagnosis and personalized treatment further propel market growth. Despite challenges like high testing costs and regulatory hurdles, the market is projected to grow, leading to adoption and innovation in hereditary cancer diagnostics.

The Saudi Arabia hereditary cancer testing market is expanding, driven by rising cancer incidence, growing awareness through government initiatives like Vision 2030, and advancements in technologies. Key players include Anwa Medical Labs, NoorDX, Scientific Laboratories Alliance, ELAJ Group, and Genetrack Saudi Arabia. Increased demand for personalized medicine, improved healthcare infrastructure, and expanding direct-to-consumer genetic testing services further fuel market growth. The market is projected to grow due to reflection in strong adoption of precision oncology and preventive healthcare strategies in the region.

Key Companies & Market Share Insights

Some of the key players operating in the market include Myriad Genetics, Inc., Invitae Corporation, Illumina, Inc., Bio-Rad Laboratories, Qiagen NV, F. Hoffmann-La Roche Ltd., EUROFINS SCIENTIFIC and Thermo Fisher Scientific, Inc. New disease type launch, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Hereditary Cancer Testing Companies:

The following are the leading companies in the hereditary cancer testing market. These companies collectively hold the largest market share and dictate industry trends.

- Myriad Genetics,

- Invitae Corporation

- Bio-Rad Laboratories

- CSL Ltd

- Qiagen NV

- Danaher Corporation

- Thermo Fisher Scientific

- Abbott Laboratories

- EUROFINS SCIENTIFIC

- F. HOFFMANN-LA ROCHE LTD

- Illumina, Inc.

Recent Developments

-

In February 2025, Foundation Medicine launched hereditary germline tests, FoundationOne Germline and FoundationOne Germline More, partnering with Fulgent Genetics in the U.S. It is a next-generation sequencing (NGS) test to identify genetic mutations in hereditary cancer for individuals with a family history.

-

In September 2024, Ambry Genetics announced new hereditary genetic tests for genetic mutations associated with hereditary cancer. Their enhanced portfolio introduced additional genes and indications, enabling a more comprehensive genetic assessment.

-

In February 2024, Exact Sciences Corp introduced the Riskguard hereditary cancer test in the United States, offering a personalized assessment of genetic and familial risks for 10 prevalent cancers, namely, colorectal, breast, prostate, skin, ovarian, endometrial, pancreatic, gastric, kidney, and endocrine. This test aids in identifying inherited genetic variations that may elevate cancer risk, facilitating early detection, preventive strategies, and tailored treatment plans.

Hereditary Cancer Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.15 billion

Revenue forecast in 2033

USD 14.45 billion

Growth rate

CAGR of 13.76% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cancer, technology, test type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Myriad Genetics; Invitae Corporation; Bio-Rad Laboratories; CSL Ltd; Qiagen NV; Danaher Corporation; Thermo Fisher Scientific; Abbott Laboratories; EUROFINS SCIENTIFIC; F. HOFFMANN-LA ROCHE LTD; Illumina, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hereditary Cancer Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hereditary cancer testing market report based on cancer, technology, test type, end use, and region:

-

Cancer Outlook (Revenue, USD Million, 2021 - 2033)

-

Lung Cancer

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Ovarian Cancer

-

Prostate Cancer

-

Stomach/Gastric Cancer

-

Melanoma

-

Sarcoma

-

Uterine Cancer

-

Pancreatic Cancer

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Cytogenetic

-

Biochemical

-

Molecular Testing

-

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Predictive Testing

-

Diagnostic Testing

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnostic Centers

-

Hospitals

-

Clinics

-

-

Regional Outlook (Revenue in USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hereditary cancer testing market size was estimated at USD 4.67 billion in 2024 and is expected to reach USD 5.15 billion in 2025.

b. The global hereditary cancer testing market is expected to witness a compound annual growth rate of 13.76% from 2025 to 2033 to reach USD 14.45 billion in 2033.

b. Based on cancer, breast cancer segment held the largest share of 11.88% in 2024 driven by increasing awareness of genetic risk factors, particularly mutations in BRCA1/2, which significantly elevate breast cancer risk

b. Some key players operating in the hereditary cancer testing include Myriad Genetics, Invitae Corporation, Bio-Rad Laboratories, CSL Ltd, Qiagen NV, Danaher Corporation, Thermo Fisher Scientific, Abbott Laboratories, EUROFINS SCIENTIFIC, F. HOFFMANN-LA ROCHE LTD, Illumina, Inc.

b. Key factors driving the hereditary cancer testing market growth include technological advancements of genetic testing for cancer detection, integration with precision medicine and growing awareness through public and government initiatives. In addition, rising prevalence of cancer diseases amongst the population is augmenting the adoption of hereditary cancer testing

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.