- Home

- »

- Medical Devices

- »

-

U.S. Hospital Consumables Market Size & Share Report 2030GVR Report cover

![U.S. Hospital Consumables Market Size, Share & Trends Report]()

U.S. Hospital Consumables Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (IV Solutions, Procedure Trays, Non-woven Disposable Products, Catheters), And Segment Forecasts

- Report ID: GVR-3-68038-009-5

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

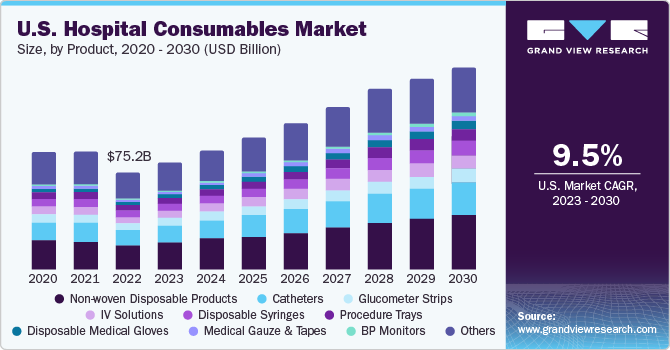

The U.S. hospital consumables market size was valued at USD 75.18 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.55% from 2023 to 2030. The rising number of surgeries, growing elderly population, technological advancements in surgical procedures, and rising preference for minimally/non-invasive surgeries are the key factors driving market growth. Furthermore, the growing prevalence of chronic diseases such as arthritis, migraine, and cancer is also supporting market expansion. As per a report published by the American Cancer Society, in the U.S., around 1.9 million new cancer cases are anticipated to be diagnosed, with around 609,820 deaths, in 2023. People suffering from these diseases often require surgical interventions. This is anticipated to create a strong demand for hospital consumables in the coming years.

The presence of a large patient pool suffering from chronic diseases leads to an increase in the number of hospital admissions. According to the Partnership to Fight Chronic Disease, Americans suffering from chronic diseases account for 81% of hospital admissions. Therefore, the frequent growth in the prevalence of chronic diseases, coupled with the increasing number of hospital admissions, is expected to drive market growth.

Aging is the greatest risk factor for cardiovascular, urological, and neurological diseases. These diseases generally require surgical/diagnostic procedures, necessitating the use of consumables such as gloves, guidewires, catheters, stethoscopes, and thermometers. Elderly people (aged ≥65 years) are currently the fastest-growing section of the general population in the U.S. According to the U.S. Census Bureau, as of June 2023, the U.S. population aged 65 and over increased approximately five times quicker than the total population from 1920 to 2020. In 2020, the elderly population in the U.S. accounted for 16.8% of the total population, and around 1 in 6 Americans were 65 or older.

The demand for Minimally Invasive Surgeries (MIS) is increasing rapidly worldwide. These procedures cause lesser trauma to patients and facilitate quicker recovery than invasive procedures, such as open-heart surgeries. Research results published by manufacturers (Ethicon Endo-Surgery, Inc.) suggest that MIS is rapidly replacing open/invasive surgeries owing to higher patient satisfaction due to fewer incision wounds and lower risk of post-surgical complications & lower mortality rates.

Medical consumables, such as guidewires, cannulas, and catheters, are generally used in minimally invasive procedures; thus, rising demand for MIS is expected to boost market growth during the forecast period. Moreover, these advanced surgeries are mostly performed in hospital settings; thus, the increasing popularity of these surgeries and demand for consumable medical devices are expected to drive market growth.

Product Insights

The non-woven disposable products segment accounted for a significant revenue share of approximately 23.2% in 2022. Non-woven disposables are a distinctive class of textile materials bonded together to form a lucid structure and are used for the complete safety of medical professionals. They are either made from natural fibers, such as cotton and linen, or synthetic fibers, such as polypropylene, polytetrafluoroethylene, and polyester. These fabrics protect patients and medical professionals from hospital-acquired infections (HAI), thus increasing their hospital demand over the forecast period.

The U.S. hospital consumables market has been classified into 18 key product categories. Of these, the disposable medical gloves segment is expected to advance at the fastest CAGR of 14.4% over the forecast period, owing to factors such as the growing demand for precautions at healthcare facilities, the rising prevalence of hospital-acquired infections, and the increase in medical procedures and surgeries. The demand for disposable gloves is growing to ensure safety and hygiene during these procedures. According to the American College of Surgeons (ACS), an estimated 15 million Americans undergo surgery every year. This includes both inpatient and outpatient procedures.

Key Companies & Market Share Insights

Key players are adopting strategies, such as mergers & acquisitions, partnerships, and new product launches, to strengthen their foothold in the market. For instance, in April 2023, Medline stated that it had entered a long-term prime vendor collaboration with DCH Health System (DCH) to address healthcare needs in the West Alabama region. The two organizations will work together to develop new strategies to improve patient outcomes and streamline supply chain processes.

Another notable instance is when, in August 2022, Owens & Minor, Inc. announced a new strategic alliance and a reaffirmed commitment to developing a special integrative service model for resilient supply chains of their products with Allina Health. Some of the key players operating in the U.S. hospital consumables market include:

-

McKesson Medical-Surgical Inc.

-

Medline Industries, Inc.

-

B. Braun SE

-

Terumo Medical Corporation

-

Owens & Minor

-

Smith+Nephew

-

Cardinal Health

-

3M

U.S. Hospital Consumables Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 157.60 billion

Growth Rate

CAGR of 9.55% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

U.S.

Key companies profiled

McKesson Medical-Surgical Inc.; Medline Industries, Inc.; B. Braun SE; Terumo Medical Corporation; Owens & Minor; Smith+Nephew; Cardinal Health; 3M

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hospital Consumables Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. hospital consumables market report on the basis of product:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Disposable Medical Gloves

-

IV Kits

-

Medical Gauze & Tapes

-

Disposable Syringes

-

Sharps Disposable Containers

-

Catheters

-

Non-woven Disposable Products

-

Surgical Blades

-

Medicine Cups

-

Cannula

-

Guidewires

-

Thermometer

-

Stethoscope

-

Glucometer Strips

-

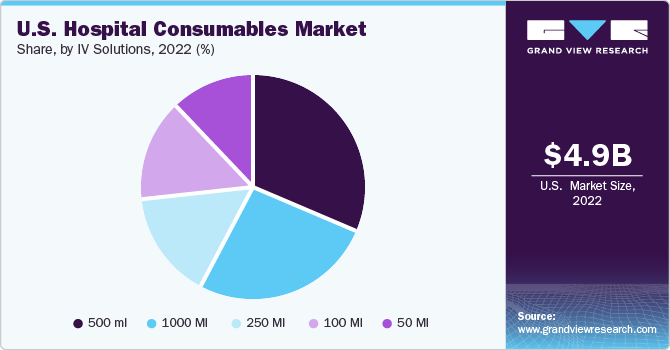

IV Solutions

-

50 ml

-

100 ml

-

250 ml

-

500 ml

-

1000 ml

-

-

BP Monitors

-

Procedure Trays

-

Laceration Trays

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. hospital consumables market size was estimated at USD 75.17 billion in 2022 and is expected to reach USD 83.20 billion in 2023.

b. The U.S. hospital consumables market is expected to witness a compound annual growth rate of 9.55% from 2023 to 2030 to reach USD 157.59 billion by 2030.

b. The U.S. hospital consumables market has been classified into 17 key product categories, out of which non-woven disposable products accounted for the leading share of approximately more than 23.23% of the overall revenue in 2022.

b. Some key players operating in the U.S. hospital consumables market include McKesson Medical-Surgical Inc.; Medline Industries, Inc.; B. Braun Melsungen A.G.; Terumo Medical Corporation; Owens and Minor; Smith And Nephew, Inc.; Cardinal Health; and 3M.

b. Key factors that are driving the market growth include growing number of surgeries in the U.S, rising prevalence of chronic diseases coupled with expanding geriatric population in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.