- Home

- »

- Next Generation Technologies

- »

-

U.S. Household Vacuum Cleaner Market Size Report, 2030GVR Report cover

![U.S. Household Vacuum Cleaner Market Size, Share & Trends Report]()

U.S. Household Vacuum Cleaner Market (2025 - 2030) Size, Share & Trends Analysis Report By Product ( Robotic, Canister, Central, Drum, Upright, Wet & Dry),, By Distribution Channel (Online, Offline), By Price Range, And Segment Forecasts

- Report ID: GVR-4-68040-509-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

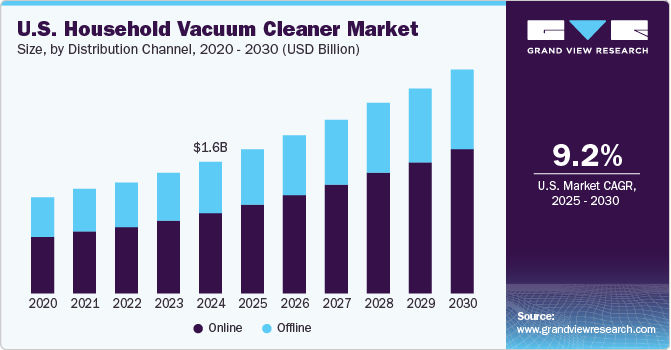

The U.S. household vacuum cleaner market size was estimated at USD 1.55 billion in 2024 and is projected to grow at a CAGR of 9.2% from 2025 to 2030. The U.S. household vacuum cleaner industry has experienced notable shift in recent years, driven by technological advancements, changing consumer preferences, and evolving market dynamics. The market growth is driven by the rising need to invest in high-end vacuums that offer superior performance, durability, and features, the popularity of vacuums that provide powerful suction, advanced filtration, and longer lifespans, and the shift toward smarter, more efficient, and user-friendly devices.

Furthermore, factors such as a growing focus on developing energy-efficient models that provide high suction power while reducing power consumption, contributing to lower utility bills and environmental benefits, growing trend toward using recyclable and biodegradable materials in vacuum cleaners, and vacuums integrated with mobile apps that allow users to monitor cleaning progress, schedule cleaning sessions, and receive maintenance reminders are also fueling the growth of the U.S. household vacuum cleaner industry.

The adoption of robotic vacuum cleaners in the United States has experienced significant growth, driven by technological advancements, increased consumer interest in smart home devices, and a desire for time-saving solutions. Consumers are increasingly integrating robotic vacuum cleaners into their smart home ecosystems. These devices offer features such as scheduling, remote control via smartphones, and compatibility with voice assistants such as Amazon Alexa and Google Assistant, enhancing user convenience. The demand for time-saving and efficient cleaning solutions is a significant driver of robotic vacuum cleaner adoption. These devices provide autonomous operation, allowing users to maintain clean homes with minimal manual effort.

There is a growing consumer preference for energy-efficient products, made from recyclable materials, and designed to reduce environmental impact. This trend aligns with broader sustainability efforts and has led manufacturers to develop vacuum cleaners that cater to eco-conscious consumers. Advancements in vacuum cleaner technology have enabled the creation of models that are both high-performing and environmentally friendly. For instance, the development of robotic vacuum cleaners with smart home integration and automatic cleaning schedules not only enhances user convenience but also promotes energy efficiency. States such as California have implemented regulations that encourage the use of energy-efficient and eco-friendly appliances. These policies have contributed to increased consumer awareness and demand for sustainable household products, including vacuum cleaners.

Automation and artificial intelligence (AI) integration are transforming the U.S. household vacuum cleaner market, offering consumers enhanced convenience, efficiency, and cleaning performance. Robotic vacuum cleaners are leveraging AI and automation to navigate homes autonomously. These devices use advanced sensors, LIDAR (Light Detection and Ranging), and camera-based technologies to map a room, detect obstacles, and determine the most efficient cleaning route. The AI allows these vacuums to adapt to changes in the environment, like furniture rearrangements or new obstacles, making the cleaning process more effective and reducing the need for human intervention. AI-powered vacuums can be set on automatic schedules, allowing them to clean at specific times of the day without manual intervention. For example, homeowners can schedule their robotic vacuum to clean while they’re at work or while sleeping, ensuring the home is clean when they return.

The growing focus on health, particularly with increasing awareness of allergies and asthma, has led to a rise in demand for vacuum cleaners equipped with HEPA (High-Efficiency Particulate Air) filters. These filters trap allergens, dust, and pet dander, making the air cleaner and healthier. As a result, vacuums with advanced filtration systems are a preferred choice for households with pets and allergy sufferers. In addition to HEPA filters, there is an increased demand for vacuums with antimicrobial features and the ability to capture even the smallest particles, improving indoor air quality. These features are particularly relevant for consumers who are focused on creating a healthier living environment.

Distribution Channel Insights

The online segment accounted for the largest market share in 2024. Online sales of cordless and battery-operated vacuum cleaners have surged due to the growing consumer desire for convenience and flexibility. These vacuums allow users to move freely without being hindered by power cords, making them ideal for quick clean-ups and multi-tasking. Additionally, advancements in battery technology have led to models with longer battery life, addressing previous limitations that deterred consumers.

The offline segment is expected to witness a notable CAGR from 2025 to 2030, driven by the growing adoption of hybrid retail strategies, and combination of online research and offline purchasing helps bridge the gap between the convenience of e-commerce and the personal interaction of in-store shopping. Retailers are blending their physical store presence with digital tools, allowing customers to research products online before visiting stores. This strategy allows consumers to check product availability, compare models, and even make reservations for in-store pickup.

Price Range Insights

The entry level segment accounted for the largest market share in 2024. The growth of this segment is driven by online sales channels, with consumers preferring the convenience of browsing and purchasing products online. E-commerce platforms such as Amazon, Walmart, wide range of affordable options, competitive pricing, and ease of access.

The premium segment is expected to witness a notable CAGR from 2025 to 2030. Brands that offer high-end models often provide superior customer service experiences, such as dedicated helplines, in-home consultations, and extended return policies. Premium vacuum brands are also increasingly offering subscription services for accessories, maintenance, and filter replacements, further enhancing the ownership experience.

Product Insights

The canister segment accounted for the largest market share of over 25% in 2024, driven by factors such as the growing focus on compact and lightweight designs to cater to smaller urban homes, and growing demand for models with retractable cords and built-in storage for accessories, Energy Star-rated models for reduced utility bills, and shift toward energy-efficient canister vacuums reflects a broader movement toward sustainability in home appliances. The U.S. consumers are increasingly conscious of energy consumption and are gravitating toward energy-efficient canister vacuums. Manufacturers are innovating with low-energy motors that maintain high suction power while reducing electricity usage. This trend is aligned with government initiatives and consumer preferences for eco-friendly appliances.

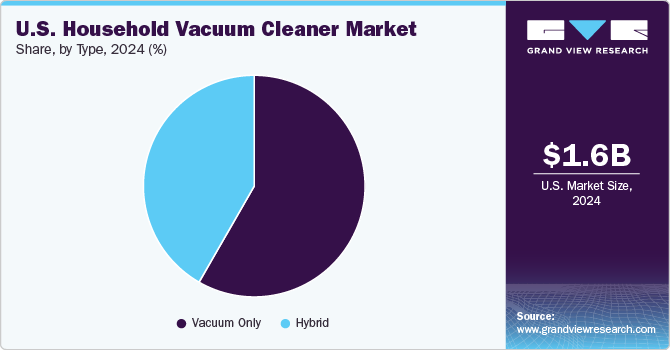

The robotic segment is expected to register the fastest CAGR of over 11% from 2025 to 2030. The growth of this segment is driven by the rising demand for robotic vacuum cleaners equipped with advanced AI capabilities, including real-time mapping, obstacle detection, and adaptive cleaning algorithms, and manufacturing of hybrid robotic vacuum cleaners, which combine vacuuming and mopping functionalities.

Key U.S. Household Vacuum Cleaner Company Insights

Some of the key players operating in the market include iRobot Corporation and SharkNinja Operating LLC.

-

iRobot Corporation is a U.S.-based consumer robot company. It designs and builds robots that assist consumers with solutions for the activities to be carried out inside and outside the home. The company's consumer robot comprises a portfolio of solutions that includes cleaning, mapping and navigation, human-robot interaction, and physical solutions.

-

SharkNinja Operating LLC is a leading player in the market, known for its innovative designs and technologies that enhance cleaning efficiency and convenience. The company operates across multiple segments, including upright, stick, handheld, and robotic vacuum cleaners, characterized by user-friendly features such as powerful suction and self-cleaning brush rolls that cater to diverse consumer needs. SharkNinja's product portfolio includes renowned models that focus on performance and reliability, positioning the brand as a trusted choice for consumers seeking effective cleaning solutions.

Xiaomi, and Beijing Roborock Technology Co., Ltd. are some of the emerging participants in the U.S. household vacuum cleaner market.

-

Xiaomi, a prominent player in the U.S. household vacuum cleaner industry, focuses on providing quality smart home products at competitive prices. The company operates through multiple segments, including Smartphones, IoT & Lifestyle Products, and Internet Services, ensuring a broad customer base and diverse offerings. Xiaomi specializes in innovative home appliances, particularly robotic vacuum cleaners like the Mi Robot Vacuum series, which incorporate advanced technologies such as smart navigation and app connectivity for enhanced user experience.

-

Beijing Roborock Technology Co., Ltd. (Roborock) has established itself as a significant competitor in the U.S. household vacuum cleaner industry, specializing in innovative robotic cleaning solutions. The company operates primarily in the smart home device segment, particularly focusing on designing and manufacturing advanced robotic vacuum cleaners and mops that utilize sophisticated technologies such as AI-driven obstacle avoidance and efficient path planning. Roborock's product lineup includes models such as the Roomba and the Roborock S series, offering features like multi-floor mapping, customizable cleaning schedules, and deep cleaning functionalities. The company is a subsidiary of Xiaomi.

Key U.S. Household Vacuum Cleaner Companies:

- iRobot Corporation

- Xiaomi

- Beijing Roborock Technology Co., Ltd. (Roborock)

- SharkNinja Operating LLC

- Neato Robotics, Inc.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Dyson

- Ecovacs Robotics Co., Ltd.

- LG Electronics Inc.

Recent Developments

-

In September 2024, Roborock, unveiled five new smart home cleaning models at IFA 2024, showcasing groundbreaking innovations such as the AdaptiLift Chassis, enabling robots to overcome thresholds, and the Qrevo Slim, the slimmest 3D ToF-navigation robot vacuum.

-

In September 2024, SharkNinja introduced the Shark PowerDetect NeverTouch Pro 2-in-1 Robot Vacuum and Mop. It features NeverStuck technology that enables the robot to lift itself over obstacles and across thresholds, preventing wet mess transfers and enhancing cleaning coverage.

-

In August 2024, LG Electronics introduced the CordZero All-in-One Tower Combi, a versatile cleaning solution that combines a stick vacuum and a robot vacuum. This system features the Dual Auto Empty function, which automatically empties the dustbins of both vacuums when docked and includes a UVC LED to inhibit bacterial growth inside the dust bag.

U.S. Household Vacuum Cleaner Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.70 billion

Revenue forecast in 2030

USD 2.64 billion

Growth rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, price range

Key companies profiled

iRobot Corporation; Xiaomi; Beijing Roborock Technology Co., Ltd. (Roborock); SharkNinja Operating LLC; Neato Robotics, Inc.; Panasonic Corporation; Samsung Electronics Co., Ltd.; Dyson; Ecovacs Robotics Co., Ltd.; LG Electronics Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Household Vacuum Cleaner Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. household vacuum cleaner market report based on product, distribution channel, and price range:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Robotic

-

Canister

-

Central

-

Drum

-

Upright

-

Wet & Dry

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Entry-level

-

Mid-tier

-

Premium

-

Frequently Asked Questions About This Report

b. The U.S. household vacuum cleaner market size was valued at USD 1.55 billion in 2024 and is expected to reach USD 1.70 billion in 2025.

b. The U.S. household vacuum cleaner market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2030 to reach USD 2.64 billion by 2030.

b. The canister segment dominated the U.S. household vacuum cleaner market with a share of over 25% in 2024. This is attributable to the factors such as the growing focus on compact and lightweight designs to cater to smaller urban homes and growing demand for models with retractable cords and built-in storage for accessories.

b. Some key players operating in the U.S. household vacuum cleaner market include iRobot Corporation, Xiaomi, Beijing Roborock Technology Co., Ltd. (Roborock), SharkNinja Operating LLC, Neato Robotics, Inc., Panasonic Corporation, Samsung Electronics Co., Ltd., Dyson, Ecovacs Robotics Co., Ltd., LG Electronics Inc.

b. The significant growth of the U.S. household vacuum cleaner market is attributed to technological advancements, changing consumer preferences, evolving market dynamics and the growing popularity of vacuums that provide powerful suction, advanced filtration, and longer lifespans, and the shift toward smarter, more efficient, and user-friendly devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.