- Home

- »

- Next Generation Technologies

- »

-

U.S. Immersive Technology Market, Industry Report, 2030GVR Report cover

![U.S. Immersive Technology Market Size, Share & Trends Report]()

U.S. Immersive Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology (Virtual Reality, Augmented Reality), By Application (Training & Learning, Emergency Services), By Industry, And Segment Forecasts

- Report ID: GVR-4-68040-290-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Immersive Technology Market Trends

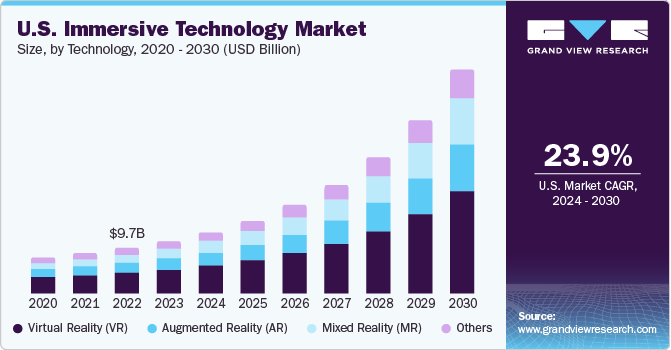

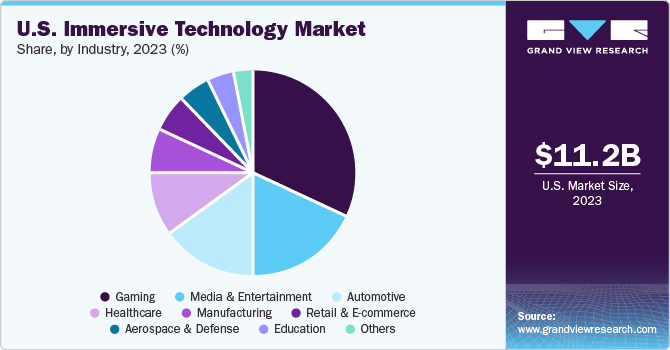

The U.S. immersive technology market size was estimated at USD 11.2 billion in 2023 and is expected to grow at a CAGR of 23.9% from 2024 to 2030. The growing demand for immersive games and immersive entertainment content is driving the growth of the market. Additionally, the growth of immersive technology is driven by several factors, including technological advancements, increased accessibility, a vast range of content and applications, and the expansion of 5G connectivity.

The emergence of social media and collaborative virtual experience has brought app developers to integrate immersive technology into their applications. Immersive technology has witnessed growing demand in education and healthcare to provide students and doctors with a real-life experience for better training and development. Furthermore, the gaming industry has integrated immersive technology into games and gaming consoles to enhance the gaming experience. With the help of immersive technology, the simulation gaming category has seen rapid growth, where players can play real-life simulation games through virtual reality.

Multinational brands have adopted immersive technology into their websites and applications, allowing customers to try and experience products virtually without leaving home, which has increased online orders and website impressions. Fashion and retail brands collaborate with social media companies to advertise their new products through immersive technology such as Augmented Reality (AR) and Mixed Reality (MR) to interact with customers.

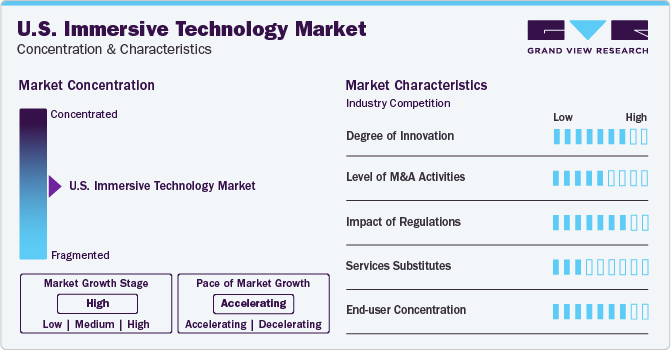

Market Concentration & Characteristics

The industry growth stage is high and pace of the market growth is accelerating. The degree of innovation is high in the industry as immersive technology companies invest heavily on new product development to sustain the industry competition and introduce new software and hardware technologies. For instance, in October 2023 Meta launched Quest3, a mixed reality headset that allows users to blend virtual elements with physical world.

The impact of regulations is high as immersive technology devices access user data and companies have to follow strict user data privacy norms. The end user concentration is high as immersive technology is widely used in different sectors such as in designing, manufacturing, education, healthcare, aerospace and aviation, gaming, retail & e-commerce and others.

Component Insights

Based on component, the hardware segment held the market share of 48.4% in 2023 and is expected to continue to dominate the market over the forecast period. The increase in demand for AR & VR headsets in the market is driving the segment growth. The headsets provide an immersive experience to the user through display, speakers, and lenses. The segment has witnessed rapid growth due to the growing ecosystem of content for gaming, education, and healthcare applications.

The software segment is expected to witness the fastest CAGR during the forecast period. The increase in demand for content creation of applications for gaming, entertainment, and educational training is anticipated to drive growth for the segment. The growing adoption of immersive technology in various industries for training, simulation, and designing account for creation of specialized software solutions.

Technology Insights

The VR segment held the largest market share in 2023. The market is driven by the advancements of VR hardware technology like higher resolution displays, improved motion tracking, and enhanced user experience. VR technology goes beyond gaming into sectors and includes education, training, and new markets such as virtual tourism.

MR is expected to grow at the fastest CAGR over the forecast period. Combining the two components of AR and VR, MR's ability to project digital information in the physical world makes it an excellent tool for training and designing. The immersive nature of MR creates an engaging learning experience. MR provides unique opportunities to retail and marketing companies to allow customers to try on products virtually, enhancing customer engagement.

Application Insights

Based on application, the training and learning segment led the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR over the forecast period. Immersive technology offers an interactive and engaging learning experience compared to traditional learning patterns. It allows hands-on practice in a safe and controlled environment for skill development, making them an ideal choice for pilot training and training for complex surgeries. In February 2024 Pixee Medical, a global leader in augmented reality for navigation in orthopedic surgery, announced to invest USD 15 millionfor the development of next-generation innovative products for the U.S. market. With this investment, the company aimed to develop new products for augmented surgeons who will benefit from latest advancements in immersive technologies.

The emergency services segment is expected to grow at the fastest CAGR over the forecast period, Immersive technology allows for simulation of realistic emergency environments for training purposes in a controlled environment. The application of immersive technology in the training of healthcare professionals has witnessed rapid growth. Additionally, fire-fighters and search-rescue operations are also using immersive technology for training and it is expected to drive the segment growth in future. In November 2023 Texas State Technical College’s EMS program launched an ambulance simulator, which is the first in North America, with the help of this ambulance simulator, students can be trained and prepared for real life emergency scenarios.

Industry Insights

Based on industry, the gaming industry dominated the market in 2023 and is expected to grow significantly over the forecast period. Continuous improvements in VR, AR, and MR hardware, including better graphics, faster processors, and more immersive interactive capabilities, enhance the gaming experience, making it more appealing to a broader audience. Various games and experiences cater to diverse preferences and interests, attracting more gamers to immersive platforms. Games that are playable across different devices, including VR and AR headsets, consoles and PCs, attract a broader audience and encourage more gamers to try immersive experiences.

The healthcare segment is expected to grow significantly during the forecast period. The increasing demand for training of healthcare professionals through simulation has accelerated innovation in immersive technology applications based on software and hardware and is expected to drive the growth.

Key U.S. Immersive Technology Company Insights

Some of the key players operating in the U.S. immersive technology market include Meta; Google; IBM; and HTC Corporation among others

-

Meta Platforms, Inc., formerly known as Facebook, Inc., is a technology conglomerate it builds technologies that help people connect, find communities and grow businesses. It offers VR headsets that have advanced processors, sensors and microphones which allow users to experience virtual reality.

Key U.S. Immersive Technology Companies:

- Meta

- Barco NV

- EON Reality

- Google LLC (Alphabet Inc.)

- HTC Corporation

- IBM Corporation

- Magic Leap

- Microsoft Corporation

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Ultraleap Limited (Leap Motion, Inc.)

- Comp12

Recent Developments

-

In February 2024, OceanaGold’s Haile Gold Mine announced an investment in immersive technology for employee training and to enhance productivity. The company planned to integrate immersive technology in operator training through simulator training. With the help of simulator, the operators can get hands-on practice for different loader types used for gold excavation.

-

In February 2024, Loft Dynamics, a provider of virtual reality (VR) flight simulators announced the opening of its first VR flight simulation hub at the company’s headquarters in North America. With the new simulation hub, the company aims for American pilots’ training through its state-of-the-art flight simulator.

-

In February 2024, Apple Inc. launched Apple Vision Pro, one of a kind mixed reality headset capable of spatial computing which disrupted the market. It allows users to work, communicate, and immerse in world of entertainment through advance spatial computing.

-

In February 2023, Sony launched PlayStation VR2 headset controller which has enhanced the PlayStation gaming experience for the users. It has 4K resolution and a higher graphics screen with reduced refresh rates and haptic feedback controllers which allows gamers a real first-person point-of-view gaming experience.

-

In June 2023, Yale School of Medicine launched Yale Center for immersive technologies. The new XRPeds lab in the pediatric department were planned to use XR and game technology for clinical interventions and research & development of pediatric care.

-

In July 2023 Bank of America introduced VR technology for training its staff, with use of AI and Meta VR headsets, the bank introduced an immersive learning experience for employee training in customer relationship management, simulated situations such as robbery, and to provide virtual tours of banks.

U.S. Immersive Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.11 billion

Revenue forecast in 2030

USD 47.49 billion

Growth rate

CAGR of 23.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, industry

Country scope

U.S.

Key companies profiled

Meta, Barco NV; EON Reality; Google LLC (Alphabet Inc.); HTC Corporation; IBM Corporation; Magic Leap; Microsoft Corporation; Samsung Electronics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Immersive Technology Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. immersive technologymarket report based on component, technology, application, and industry:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Head Mounted Display (HMD)

-

Gesture Tracking Devices (GTD)

-

Projectors & Display Walls (PDW)

-

-

Software/Platform

-

Services

-

Professional Services

-

Managed Services

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Virtual Reality (VR)

-

Augmented Reality (AR)

-

Mixed Reality (MR)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Training & Learning

-

Emergency Services

-

Product Development

-

Sales & Marketing

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Manufacturing

-

Automotive

-

Education

-

Media & Entertainment

-

Gaming

-

Healthcare

-

Retail & E-commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. immersive technology market size was estimated at USD 11.2 billion in 2023 and is expected to reach USD 13.11 billion in 2024

b. The U.S. immersive technology market is expected to grow at a compound annual growth rate of 23.9% from 2024 to 2030 to reach USD 47.49 billion by 2030

b. Based on component, the hardware segment held the market with the largest share of 48.4% in 2023 and is expected to retain its dominance over the forecast period.

b. Some key players operating in the U.S. immersive technology market include Meta, Barco NV, EON Reality, Google LLC (Alphabet Inc.), HTC Corporation, IBM Corporation, Magic Leap, Microsoft Corporation, Samsung Electronics Co., Ltd.

b. The growing demand for immersive games and immersive entertainment content are driving the growth of the immersive technology market. Additionally, the growth of immersive technology is driven by several factors, including technological advancements, increased accessibility, a vast range of content and applications, and the expansion of 5G connectivity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.