- Home

- »

- Clinical Diagnostics

- »

-

U.S. IVD And LDT For Autoimmune Diseases Market, 2030GVR Report cover

![U.S. IVD And LDT For Autoimmune Diseases Market Size, Share & Trends Report]()

U.S. IVD And LDT For Autoimmune Diseases Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Technology (Immunoassays, Clinical Chemistry, Molecular Diagnostics), By Application (Psoriasis, Crohn’s Disease), And Segment Forecasts

- Report ID: GVR-1-68038-287-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

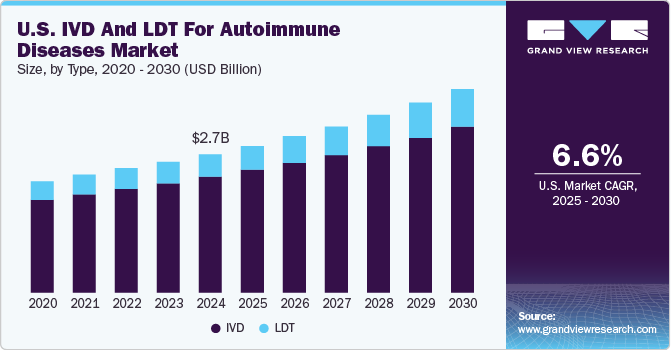

The U.S. IVD and LDT for autoimmune diseases market size was estimated at USD 2.66 billion in 2024 and is expected to grow at a CAGR of 6.6% from 2025 to 2030. The rising prevalence of autoimmune diseases has led to a higher demand for diagnostic tools. Each year, around 50 million Americans are affected by autoimmune diseases. This growing number of cases emphasizes the need for improved diagnostic methods. In addition, there is an increasing focus on early detection, with In Vitro Diagnostics (IVD) and Laboratory Developed Tests (LDT) playing a crucial role in providing faster and more accurate diagnoses. Moreover, advancements in IVD and LDT technologies are enhancing the precision and efficiency of these tests.

The increasing regulation of Laboratory Developed Tests (LDTs) by the FDA is a significant driving factor in the U.S. IVD and LDT market for autoimmune diseases. Over the years, the FDA has engaged in discussions about enhancing oversight of LDTs, holding workshops, and proposing guidance to ensure that patients and healthcare providers can trust the safety and effectiveness of these tests. Recognizing the potential risks associated with false test results, the FDA has prioritized patient safety and healthcare decision-making.

On October 3, 2023, the FDA proposed a new rule to ensure in vitro diagnostics (IVD) reliability. By April 29, 2024, this proposal was finalized, officially classifying all IVDs, including those developed by laboratories, as medical devices under the Federal Food, Drug, and Cosmetic Act. This marks a significant shift in how LDTs are regulated, as the FDA will now actively oversee their development and implementation.

Moreover, increasing penetration of laboratory-developed tests in the market is expected to drive growth over the forecast period. For instance, in February 2022, Mayo Clinic's Clinical Neuroimmunology Laboratory discovered MDS2 (serum) & MDC2 (CSF) biomarkers to identify autoimmune diseases. These biomarkers are validated and included in the phenotype-specific assay portfolio to provide valuable insights for clinicians. However, stringent regulatory frameworks in the country may impede the uptake of lab-developed tests over the forecast period. For instance, in March 2023, the U.S. FDA announced the legal battle to regulate LDTs with the laboratory industry, which can result in the market withdrawal of many LDTs in the coming years.

Next-generation sequencing (NGS) technology represents a high-throughput approach that enables sequencing entire genomes and specific DNA or RNA sequences. It is widely utilized across various fields, including genomics, proteomics, epigenomics, and transcriptomics, to investigate gene expression and genetic diversity. In rheumatoid arthritis (RA), NGS technology analyzes genetic alterations and identifies disease-related complications. It facilitates the sequencing of nucleotide sequences, such as DNA methylation, DNA sequencing, and chromatin accessibility, thereby aiding in diagnosis and treatment.

Type Insights

The IVD segment gained a major market share in 2024 and is expected to grow at a CAGR of 6.26% over the forecast period, attributed to its efficient testing for both systemic & organ-specific autoimmune pathologies and better reimbursement policies. IVD tests offer numerous benefits over traditional diagnostic methods. They provide quick results, often within hours or minutes, enabling timely intervention. IVD products are rigorously validated for accuracy, minimizing the chances of false positives and negatives, thereby reducing the risk of misdiagnosis. Moreover, IVD tests are cost-effective, requiring less infrastructure and personnel compared to conventional methods, making them accessible in various healthcare settings.

The LDT segment is expected to grow at the fastest CAGR over the forecast period. The increase in product launches for LDTs is significantly driving the U.S. in vitro diagnostics (IVD) and LDT market for autoimmune diseases. These new tests enhance diagnostic capabilities and improve disease management, leading to greater adoption among healthcare providers. As a result, the industry is experiencing robust growth, reflecting the demand for more efficient and accurate autoimmune disease diagnostics. For instance, in June 2023, Revvity's EUROIMMUN launched UNIQO 160, an advanced automated indirect immunofluorescence test (IIFT) system designed to enhance the efficiency of autoimmune disease diagnostics.

Application Insights

Psoriasis held the largest share of 15.21% in 2024 and is expected to maintain a dominant share throughout the forecast period. The rise in psoriasis prevalence and the strategic initiatives undertaken by the NPF to improve diagnostic accuracy are key factors contributing to the segment's growth. According to the National Psoriasis Foundation, USA recent studies indicate that over 8 million Americans are affected by psoriasis. This growing patient population underscores the need for enhanced diagnostic solutions to effectively manage psoriasis and its associated comorbidities. The increasing recognition of psoriasis as a significant health concern has led to an increase in awareness and demand for effective diagnostic solutions.

Crohn’s disease is anticipated to grow at the fastest CAGR during the forecast period. The rising prevalence of inflammatory bowel disease (IBD), including Crohn’s disease, is expected to contribute to segment growth. According to a new study by the Crohn’s & Colitis Foundation, in 2023, nearly 1 in 100 people in the U.S. are affected by some form of inflammatory bowel disease (IBD), one of the highest rates globally. The study revealed that more than 0.7% of Americans, or about 721 per 100,000 individuals, have IBD.

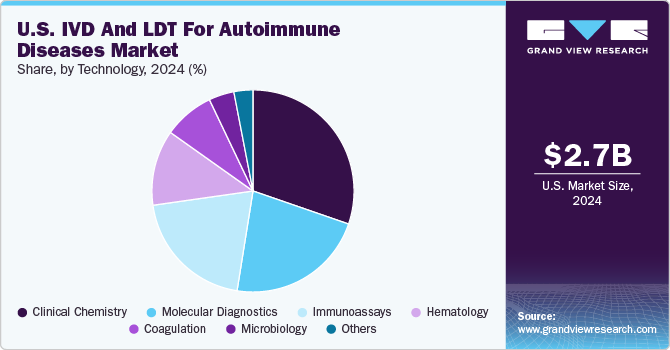

Technology Insights

The clinical chemistry segment held the largest revenue share of 30.32% in 2024. Clinical chemistry tests play a central role in testing and diagnosing various diseases in patients. The high market share of the segment is driven by factors such as demand for advances in laboratory technology and testing and a growing understanding of autoimmune diseases creating demand for clinical chemistry tests. Common samples tested are urine & blood, which helps to identify composition abnormalities in the sample that helps to identify different diseases. Additionally, primary clinical chemistry tests identify antibody markers in patients with clinical features that suggest autoimmune disease.

The molecular diagnostics segment is expected to witness the fastest growth rate, with a CAGR of 6.21% over the forecast period. The growing advancement of molecular diagnostics and increase in product launches is significantly driving the segment growth. These advancements enhance the accuracy, speed, and specificity of diagnosing autoimmune conditions, which are often challenging to detect due to their complex and variable nature.

Key U.S. IVD And LDT For Autoimmune Diseases Company Insights

Key players operating in the U.S. IVD & LDT for autoimmune diseases market are adopting strategic initiatives such as new product development, mergers & acquisitions, & partnerships to increase their share. Some of the key players are Adaptive Biotechnologies Corporation; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; bioMerieux, Inc.; Corgenix, Inc. (Sebia); F. Hoffmann-La Roche Ltd.; Quest Diagnostics Inc.; PerkinElmer, Inc.; and Abbott Laboratories. Some players are adopting strategies such as mergers and acquisitions to strengthen their presence in the market. In addition, these players are engaged in new product launches to leverage their product portfolio.

Key U.S. IVD And LDT For Autoimmune Diseases Companies:

- Adaptive Biotechnologies Corporation

- Agilent Technologies, Inc

- Bio-Rad Laboratories, Inc.

- bioMerieux, Inc.

- Corgenix, Inc. (Sebia)

- F. Hoffmann-La Roche Ltd.

- Quest Diagnostics, Inc.

- PerkinElmer, Inc

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

U.S. IVD And LDT For Autoimmune Diseases Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.82 billion

Revenue forecast in 2030

USD 3.88 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application

Country scope

U.S.

Key companies profiled

Adaptive Biotechnologies Corporation, Agilent Technologies, Inc, Bio-Rad Laboratories, Inc., bioMerieux, Inc., Corgenix, Inc. (Sebia), F. Hoffmann-La Roche Ltd., Quest Diagnostics, Inc., PerkinElmer, Inc, Abbott Laboratories, Thermo Fisher Scientific, Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. IVD And LDT For Autoimmune Diseases Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. IVD & LDT for autoimmune diseases market report based on type, technology, and application:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

IVD

-

IVD by Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

Clinical Chemistry

-

Hematology

-

Coagulation

-

Microbiology

-

Molecular Diagnostics

-

Others

-

-

IVD by Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Addison’s Disease

-

Ankylosing Spondylitis

-

Alopecia Areata

-

Rheumatoid Arthritis

-

Systemic Lupus Erythematosus

-

Systemic Sclerosis

-

Psoriasis

-

Antiphospholipid Antibody Syndrome

-

Diabetes Type 1

-

Crohn’s Disease

-

Ulcerative Colitis

-

Narcolepsy

-

Multiple Sclerosis

-

Uveitis

- Others

-

-

-

LDT

-

LDT by Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

Clinical Chemistry

-

Hematology

-

Coagulation

-

Microbiology

-

Molecular Diagnostics

-

Others

-

-

LDT by Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Addison’s Disease

-

Ankylosing Spondylitis

-

Alopecia Areata

-

Rheumatoid Arthritis

-

Systemic Lupus Erythematosus

-

Systemic Sclerosis

-

Psoriasis

-

Antiphospholipid Antibody Syndrome

-

Diabetes Type 1

-

Crohn’s Disease

-

Ulcerative Colitis

-

Narcolepsy

-

Multiple Sclerosis

-

Uveitis

-

Others

-

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

Clinical Chemistry

-

Hematology

-

Coagulation

-

Microbiology

-

Molecular Diagnostics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Addison’s Disease

-

Ankylosing Spondylitis

-

Alopecia Areata

-

Rheumatoid Arthritis

-

Systemic Lupus Erythematosus

-

Systemic Sclerosis

-

Psoriasis

-

Antiphospholipid Antibody Syndrome

-

Diabetes Type 1

-

Crohn’s Disease

-

Ulcerative Colitis

-

Narcolepsy

-

Multiple Sclerosis

-

Uveitis

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. IVD & LDT for autoimmune diseases market size was estimated at USD 2.66 billion in 2024 and is expected to reach USD 2.82 billion in 2025.

b. The U.S. IVD & LDT for autoimmune diseases market is expected to expand at a compound annual growth rate (CAGR) of 6.59% from 2025 to 2030 to reach USD 3.88 billion by 2030.

b. The clinical chemistry segment held the largest share of the U.S. IVD & LDT for autoimmune diseases market, accounting for about 30.32% in 2024. The high market share of the segment is driven by factors such as demand for advances in laboratory technology and testing and a growing understanding of autoimmune diseases creating demand for clinical chemistry tests.

b. Some key players operating in the U.S. IVD & LDT for autoimmune diseases market include Abbott, F. Hoffmann-La Roche Ltd, Siemens Healthcare GmbH, Beckman Coulter, Inc., SQI Diagnostics, Bio-Rad Laboratories, Inc., BD, Omega Diagnostics Group PLC, Thermo Fisher Scientific Inc., Mayo Foundation for Medical Education and Research, Oklahoma Medical Research Foundation (OMRF), Moleculera Labs

b. Key factors that are driving the market growth include rising prevalence of autoimmune diseases, growing number of cases emphasizes the need for improved diagnostic methods, and an increasing focus on early detection, with In Vitro Diagnostics (IVD) and Laboratory Developed Tests (LDT) playing a crucial role in providing faster and more accurate diagnoses

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.