- Home

- »

- Next Generation Technologies

- »

-

U.S. Indoor Farming Market Size, Industry Report, 2030GVR Report cover

![U.S. Indoor Farming Market Size, Share & Trends Report]()

U.S. Indoor Farming Market Size, Share & Trends Analysis Report By Facility Type (Greenhouses, Vertical Farms), By Component (Hardware, Software), By Growing Mechanism, By Crop Category, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-208-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Indoor Farming Market Size & Trends

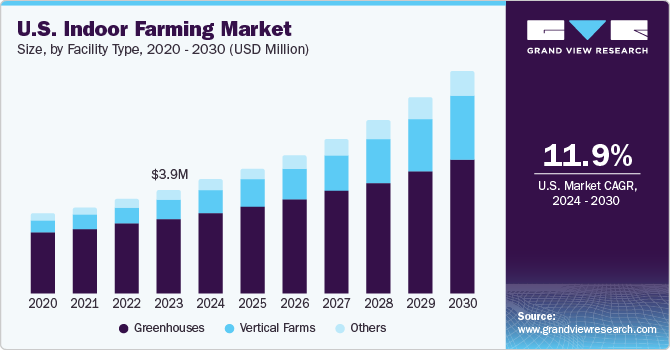

The U.S. indoor farming market size was estimated at USD 3.99 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.9% from 2024 to 2030. The increasing emphasis on living a healthy lifestyle after the pandemic has gained traction. Among the most important factors in a healthy lifestyle is the consumption of fresh and high-quality food, which is anticipated to drive market growth. The increasing environmental problems, such as groundwater depletion and soil degradation, are affecting the agriculture and food production systems. Indoor farming provides ways to grow crops year-round, reduce water wastage, and also minimizes the use of pesticides. The abovementioned advantages of indoor farming are projected to fuel the market growth. The U.S. Government encourages the developing of indoor farms through several initiatives, which in turn, is projected to fuel market growth.

Organic foods are perceived as healthier, nutritious, safer, and more environment friendly. A critical factor that influences the demand for organic food is the food purchasing behavior of consumers, which is essential for producers, policymakers, and suppliers to implement successful marketing strategies. The growing demand for organic food among consumers is anticipated to drive the vertical farming demand over the forecast period.

Arable land per capita is shrinking continuously owing to various natural reasons and human-induced activities, including the continued urbanization. As a result, there has been a continuous reduction in the per capita arable land. According to The World Bank Group, the overall arable land per capita has declined from 0.197 hectares in 2013 to 0.192 hectares in 2016. The scarcity of arable land has resulted in a rising inclination towards indoor farming activities to produce fresh foods. Vertical farming techniques enable the growing of crops in an indoor setting in layers stacked on racks, in a multi-story building, or a warehouse. These factors are anticipated to aid in the growth of the market.

The high initial investment is the key factor restraining the industry's growth. Vertical farming requires warehouses for cultivation. The high price of warehouses in an urban area compared to farmland further limits the adoption of vertical farming. In addition, the high cost of installing LEDs, active heat systems, creating a controlled environment, and high maintenance costs further restrain the market growth over the forecast period.

Market Concentration & Characteristics

The stage of market growth is high, and the rate of growth is accelerating. As indoor farming practices are in an evolving and emerging stage, technologies related to indoor farming are still novel and gaining traction. Various innovative techniques for indoor cultivation are being adopted by early-stage companies and startups for different crops, growing methods, and technologies. Therefore, the degree of innovation is moderate to high as the R&D investment is high for developing new techniques as well as refining them for crop yield optimization.

As the market for indoor farming in the U.S. is still yet emerging, there are various companies in the market, big and small, vying for an increased market share. The market is moving towards consolidation, which is also resulting in high activities of mergers of acquisitions by companies to consolidate market share or gain access to the latest innovations in indoor farming techniques and technologies related to it.

Indoor farming techniques have the advantage of growing year-round crops and reducing water wastage. However, substitutes such as outdoor farming remain the most preferred method for large-scale production of commodity crops like grains and oilseeds. Outdoor farming relies on natural sunlight, soil, and traditional irrigation methods.

While the indoor farming market is characterized by a diverse array of companies, market concentration exists among a select group of established companies that lead the industry in innovation, market share, and influence. However, the market remains dynamic, with opportunities for new entrants and disruptive technologies to challenge the dominance of incumbent companies.

Facility Type Insights

The vertical farm segment is projected to witness the fastest CAGR from 2024 to 2030, owing to the increasing demand for environment-friendly production of fruits and vegetables. The behavior of consumers is changing in purchasing foods which has resulted in a rising demand for organic food, which is expected to drive the segment growth. In indoor farming, techniques such as controlled environment agriculture technology, where the facilities use control of light, artificial environmental monitoring, and fertigation are utilized to protect crops from extreme weather conditions.

The greenhouses facility type segment dominated the market in 2023 with a revenue share of more than 70%. A greenhouse- also called a hothouse-is a closed structure made up of transparent material and used to grow plants, crops, and flowers. In greenhouses, climatic conditions are controlled to enhance quality as well as quantity of produce. Greenhouses also facilitate higher yield production than traditional farming techniques.

Component Insights

The hardware segment dominated the market in 2023 with the largest revenue share of 60.83%. This large share is attributable to the importance of hardware in maintaining the environment of indoor farms. The segment is further categorized into climate control systems, lighting systems, sensors, and irrigation systems, which allow the cultivation of indoor-grown crops. The climate control system subsegment is anticipated to witness the fastest CAGR over the forecast period, as the system helps in creating and maintaining an environment conducive to plant growth. The system aids in controlling the indoor climate with air-conditioning units, humidifiers, chillers, heaters, and air movement fans, among others.

The software segment is anticipated to register the fastest CAGR exceeding 15% from 2024 to 2030, owing to the upcoming trends in technologies and farming practices. The software helps in tracing the fruit and vegetables back to their crop batch/patch, grower, area of land/field, and supplier details. The segment is further bifurcated into the web-based and cloud-based software subsegments. The cloud-based software subsegment is projected to witness significant CAGR in the forthcoming years, as it collects millions of data points in real-time, which can be examined with machine learning techniques to determine the changes in particular environmental parameters affecting the yield and taste of the final product.

Growing Mechanism

The hydroponics segment held the largest market share of more than 56% in 2023. It is also anticipated to witness the fastest CAGR from 2024 to 2030. Hydroponics farming is a popular method as it has low installation costs and is easy to operate. Hydroponics is promoted as a method to lessen environmental harm and species extinction and prevent climate change, caused by overexploitation and intensive farming. Hydroponic farming has benefits such as it facilitates a micro-climate, using water efficiently, needing no soil, requiring less labor, and producing higher-quality food. In addition, the hydroponics method gets rid of the risk of soil organisms responsible for diseases. Consumers are becoming increasingly aware of the pesticide effects, which in turn, is projected to fuel the growth of the hydroponics segment.

The aquaponics segment is anticipated to register a substantial CAGR over the forecast period. Compared to traditional farming, aquaponic farming wastes minimal water, which is among the major advantages of aquaponic agriculture. Aquaponics utilizes approximately 90% less water than conventional farming, despite the name's implication. Furthermore, plants such as cucumbers, tomatoes, strawberries, melons, peppers, flowers, and herbs (mint, basil, wheatgrass, oregano, chives, sage, parsley) are grown through aquaponics.

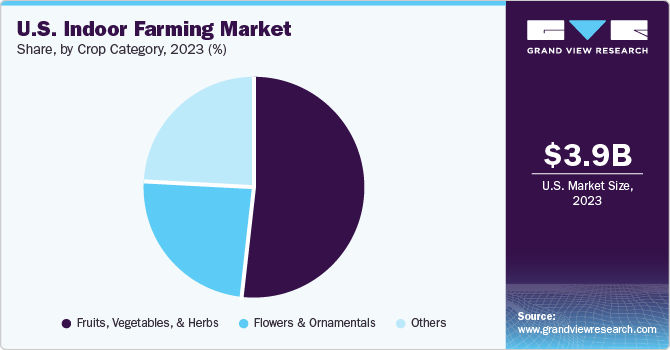

Crop Category Insights

The fruits, vegetables, and herbs segment held the largest market share in 2023 and it is anticipated to witness the fastest CAGR of 12.5% from 2024 to 2030. The growing production of commonly grown fruits, vegetables, and herbs such as lettuce, bell and chili peppers, leafy greens, cucumber, and tomato are driving the segment's growth. These crops are grown on a large scale and deliver maximum profit from their cultivation to the companies involved in the production of the crops.

The flowers and ornamentals segment is anticipated to contribute significantly to market growth over the forecast period. The segment accounted for more than 23% of the market share in 2023. The increasing usage of flowers and ornamentals for decorative and aesthetic purposes is expected to drive the growth. The segment has been further segregated into perennials, annuals, and ornamentals. The ornamentals flowers held the largest market share in 2023, owing to increasing sales.

Key U.S. Indoor Farming Company Insights

A few of the major companies in the U.S. indoor farming market include Argus Control Systems Ltd., General Hydroponics, AeroFarms, Hydrodynamics International, Illumitex, and Bowery Inc. These companies are involved in strategies such as partnerships, business expansions, new product developments, and contracts to expand their market share.

-

Illumitex, Inc. is a digital horticulture company that manufactures precision LEDs and LED luminaires. It offers industrial, horticultural, and architectural LED lighting products. The company was established in 2005 and is headquartered in Austin, Texas. It manufactures white light that is used in various areas such as food processing, warehouses, greenhouses, and horticulture. It also offers LED lighting products that are used in growers, growth chambers, and vertical farming.

-

Argus Control Systems Limited is a provider of automated control systems for aquaculture, horticulture, and other related biotechnology industries globally, with the highest number of customers in North America. The company provides its customers with automation and specialty monitoring control applications.

Plenty Unlimited Inc. and Bowery Farming Inc. are some of the emerging companies in the target market.

-

Bowery Farming, Inc. is a modern vertical farming company that builds indoor farms to grow pollutant-free, flavorful produce without consuming any excessive volumes of water, and space, among other finite resources. The company grows kale, lettuce, basil, spinach, and other green and leafy vegetables. Bowery Farming, Inc. has two R&D facilities in Kearny in the U.S. state of New Jersey.

-

Plenty Unlimited Inc. caters to the food and beverage industry. The firm utilizes an artificial environment (adjusting the temperature, humidity, waterflow, and sunlight) for the growth of the plants. Plenty Unlimited Inc. uses Plenty OS, the company’s proprietary farm OS to track the growth of the plants. Plenty Unlimited Inc. operates in the U.S. in San Francisco, California, and Laramie, Wyoming.

Key U.S. Indoor Farming Companies:

- Argus Control Systems Ltd.

- Netafim

- General Hydroponics

- Hydrodynamics International

- Illumitex

- AeroFarms

- BrightFarms Inc.

- Bowery Farming Inc.

- Gotham Greens

- Plenty Unlimited Inc.

Recent Developments

-

In March 2023, Elevate Farms announced the commencement of operations at its first wholly-owned US farm, located in Orange, New Jersey ("Elevate New Jersey"). The entire Elevate New Jersey facility measures 14,000 square feet which includes 4,750 square feet of unmanned, fully autonomous, grow room space along with processing, packaging, and administration. The farm can produce up to 11,000,000 plants, or equal to 500,000 pounds of plants, annually.

-

In January 2024, Forever Feed Technologies, announced a definitive agreement with Dr. Greenhouse, Inc., to design the controlled environment for an enterprise-scale indoor feed mill at the River Ranch Dairy in Hanford, California. The feed mill will grow Automated Sprouted Grain (ASG) to enrich the diets of over 5,000 dairy cows. FFT anticipates the indoor feed mill will begin production in late 2024.

U.S. Indoor Farming Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.40 billion

Revenue forecast in 2030

USD 8.64 billion

Growth rate

CAGR of 11.9% from 2024 to 2030

Actual data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Facility type, component, growing mechanism, crop category

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; China; India; Japan; Brazil

Key companies profiled

Argus Control Systems Ltd.; Netafim; General Hydroponics; Hydrodynamics International; Illumitex; Aerofarms; BrightFarms Inc.; Bowery Farming Inc.; Gotham Greens; Plenty Unlimited Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Indoor Farming Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. indoor farming market report based on facility type, component, growing mechanism, and crop category:

-

Facility Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Greenhouses

-

Vertical Farms

-

Shipping Container

-

Building-based

-

-

Others

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Climate Control Systems

-

Lighting Systems

-

Sensors

-

Irrigation Systems

-

-

Software

-

Web-based

-

Cloud-based

-

-

Services

-

System Integration & Consulting

-

Managed Services

-

Assisted Professional Services

-

-

-

Growing Mechanism Outlook (Revenue, USD Million, 2017 - 2030)

-

Aeroponics

-

Hydroponics

-

Aquaponics

-

-

Crop Category Outlook (Revenue, USD Million, 2017 - 2030)

-

Fruits, Vegetables, & Herbs

-

Tomato

-

Lettuce

-

Bell & Chili Peppers

-

Strawberry

-

Cucumber

-

Leafy Greens

-

Herbs

-

Others

-

-

Flowers & Ornamentals

-

Perennials

-

Annuals

-

Ornamentals

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. indoor farming market size was estimated at USD 3.99 billion in 2023 and is expected to reach USD 4.40 billion in 2024.

b. The U.S. indoor farming market is expected to grow at a compound annual growth rate of 11.9% from 2024 to 2030 to reach USD 8.64 billion by 2030.

b. The hardware segment dominated the U.S indoor farming market and accounted for the largest revenue share of more than 60% in 2023. The segment is expected to remain dominant over the forecast period. This large share is attributable to the importance of hardware in maintaining the environment of indoor farms.

b. Some of the prominent companies in the U.S. indoor farming market include Argus Control Systems Ltd., Netafim, General Hydroponics, Hydrodynamics International, Illumitex, AeroFarms, BrightFarms Inc., Bowery Farming Inc., Gotham Greens, and Plenty Unlimited Inc.

b. The U.S. indoor farming market is growing significantly due to a growing emphasis on healthy lifestyles post-pandemic, with a particular focus on the consumption of fresh, high-quality food. Additionally, increasing environmental concerns, including groundwater depletion and soil degradation, are driving interest in indoor farming as a sustainable solution, offering year-round crop growth, reduced water wastage, and decreased reliance on pesticides.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."