- Home

- »

- Clinical Diagnostics

- »

-

U.S. Influenza Diagnostics Market Size & Share Report, 2030GVR Report cover

![U.S. Influenza Diagnostics Market Size, Share & Trends Report]()

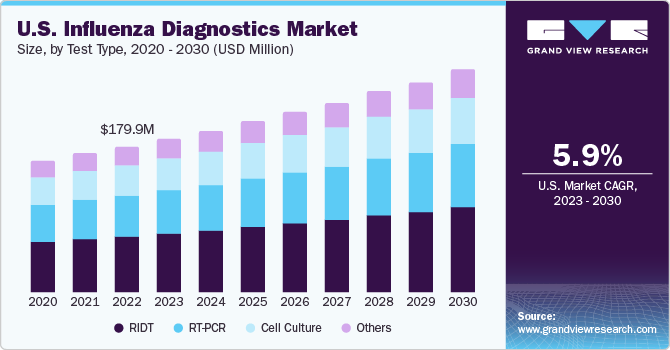

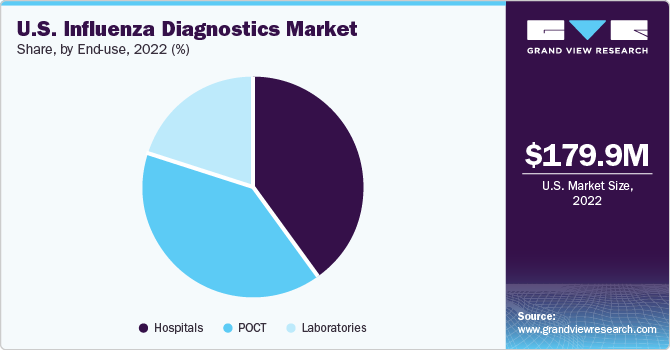

U.S. Influenza Diagnostics Market (2023 - 2030) Size, Share & Trends Analysis Report By Test Type (RIDT, RT-PCR, Cell Culture, Others), By End-use (Hospitals, POCT, Laboratories), And Segment Forecasts

- Report ID: GVR-3-68038-788-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Influenza Diagnostics Market Trends

The U.S. influenza diagnostics market size was valued at USD 179.9 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The recurring seasonal outbreaks of influenza act as a key driving force for the market. Increased awareness among people along with screening efforts and advancements in diagnostic technologies contribute to market expansion and growth. Influenza, being a contagious disease, can be easily transmitted from one person to another, especially in public places where the infected patients serve as the carriers of the disease. This creates a demand for diagnostic techniques on a larger scale.

The COVID-19 pandemic had a substantial impact on the influenza diagnostics market in the U.S., as it helped raise awareness regarding the importance of accurate and fast disease diagnosis. Technological developments fueled by the pandemic, such as faster and more precise molecular testing procedures, resulted in the growing demand for influenza diagnostics. The infrastructure built to accommodate COVID-19 testing greatly increased influenza testing capacity and efficiency.

During the pandemic, syndromic testing, which screens for numerous respiratory diseases, including influenza, gained popularity, significantly strengthening the market. Furthermore, COVID-19 diagnostics research and development activities resulted in the emergence of breakthrough technologies and platforms that have been useful for influenza testing as well. However, the pandemic slowed down clinical trials in the U.S., resulting in a hindrance to market growth. Many clinical trials were postponed or delayed due to safety concerns and difficulties in recruiting participants during this period.

The rising disease prevalence in the U.S. is anticipated to propel market expansion. According to the Centers for Disease Control and Prevention (CDC), influenza caused 9 million illnesses, 4 million medical visits, 10,000 hospitalizations, and 5,000 fatalities during the 2021-2022 influenza season. The influenza season, commonly known as flu season, happened in two waves, with the second wave having a larger number of hospitalizations.

An increase in awareness about the importance of flu vaccinations and early detection is also expected to contribute to market growth. Public health initiatives and educational campaigns are also beneficial to market expansion as they emphasize the significance of timely testing. The continued focus by the government and private bodies on prevention and proactive healthcare measures further boosts the demand for diagnostic tests.

The rising geriatric population in the country is one of the major factors for the increasing demand for influenza diagnostics. Elderly people are highly susceptible to various diseases as they are immunologically vulnerable and at a greater risk of contracting influenza. According to the CDC, individuals aged 65 and above in the U.S. account for around 58% of influenza-related hospitalizations. These facts are indicative of the rising disease incidence in the geriatric population, thus necessitating an increasing demand for diagnostic products.

Additionally, individuals with a high risk of contracting the flu virus consist of children, pregnant women, immunosuppressed patients suffering from various chronic diseases, and healthcare workers. According to the CDC, in April 2019, a total of 186 influenza-related pediatric deaths in the U.S. had been reported for the season. Additionally, 49.1% of pregnant women received flu vaccination in 2018 and 38% of pregnant women received both flu and Tdap (Tetanus, diphtheria, and pertussis) vaccines.

Test Type Insights

The RIDT segment dominated the market with the largest revenue share of 36.2% in 2022 and is also expected to expand at the fastest CAGR of 6.5% from 2023 to 2030, owing to the easy availability of these tests and user-friendly applications for fast and effective diagnosis. Additionally, the World Health Organization (WHO) has recommended the use of RIDT for influenza diagnosis due to its moderately complex, sensitive, specific, and accurate features.

Based on test type, the U.S. influenza diagnostics market is segmented into RIDT, RT-PCR, cell culture, and others. The RT-PCR segment held a significant share of 21.8% of the market in 2022. It delivers results faster in comparison to cell culture, ranging from 2 minutes to less than 2 hours. This technique also aids in the identification of antiviral resistance. Advancements in these technologies are further expected to boost market growth during the forecast period.

For instance, Thermo Fisher Scientific Inc. offers QuantStudio 3 and 5 RT-PCR systems, which are simple and easy to use and designed for both new and experienced users. QuantStudio 3 and 5 RT-PCR, when combined with the Thermo Fisher Cloud platform, helps individuals to remotely monitor and access results and also enables collaboration with colleagues anytime and anywhere. Therefore, such technological advancements are anticipated to further fuel market growth during the forecast period.

Cell culture is one of the oldest and most reliable methods of diagnosing flu cases and takes 3 to 10 days post-sampling to provide accurate results. This method provides accurate statistics and also enables healthcare professionals to distinguish between various types of influenza viruses. The others segment, which includes immunoassay kits, is expected to expand at a lucrative CAGR over the forecast period. The rise in immunoassay testing offered by market players is expected to fuel industry growth.

For instance, Becton, Dickinson and Company offers the BD Veritor Plus system, a digital immunoassay that is used for the detection of influenza A and B. The product is more efficient than RIDTs in terms of sensitivity and specificity, owing to its integrated software and efficient interpretation of various infectious diseases.

End-use Insights

The hospitals segment dominated the market with the largest revenue share of 40.4% in 2022, owing to the rising flu prevalence in the U.S. According to the CDC, during the 2021-2022 influenza season in the country, the incidence of symptomatic illnesses caused by the influenza virus ranged from 7.6 to 15.5 million cases. This resulted in a significant number of medical visits, ranging from 3.5 to 7.4 million. Furthermore, the severity of the illness led to hospitalizations ranging from 82,000 to 185,000 cases. Tragically, the impact of the virus resulted in deaths ranging from 3,700 to 20,800.

Based on end-use, the market is segmented into hospitals, laboratories, and POCT. The POCT segment is expected to advance at the fastest CAGR of 6.3% over the forecast period. This growth can be attributed to the advanced technologies developed by market players. For instance, bioMerieux SA offers an easy-to-use, cost-effective, and reliable POCT product, BIONEXIA Influenza A+B, a rapid test for the detection of influenza A & B viruses in humans using nasopharyngeal samples.

New technological advancements in POCT kits facilitating error-free results are expected to boost the U.S. market for influenza diagnostics over the forecast period. Laboratory testing most often involves the usage of real-time PCR techniques. Some advantages of this form of testing include accurate results, sensitivity, cost-effectiveness, and the ability to test multiple samples at once.

Key Companies & Market Share Insights

The rise in the adoption of home testing kits has created a huge demand for influenza diagnostics in recent years. The high demand has created fierce competition in the regional market, thus making space for new companies to venture through advanced products and disruptive technologies, opening up space for innovation in this field. For instance, in October 2017, Alere Inc. obtained 510(k) marketing clearance from the U.S. FDA for their diagnostic test Alere i Influenza A & B 2. This test is designed to effectively detect related infections in both adults and children. The product is a rapid molecular assay that delivers fast and accurate results with high specificity.

In another development, in August 2017, Meridian Bioscience expanded its ImmunoCard STAT! product line with the introduction of ImmunoCard STAT! FLU A&B. This product is used to detect the presence of influenza A & B in nasopharyngeal and nasal swabs within 10-15 minutes. Thus, the rising incidences of product launches by leading market players are further expected to fuel market growth during the forecast period. Some of the major participants in the U.S. influenza diagnostics market include:

Key U.S. Influenza Diagnostics Companies:

- 3M

- Abbott

- BD

- Meridian Bioscience

- Quidel Corporation

- F. Hoffmann-La Roche Ltd

- SA Scientific Ltd.

- SEKISUI Diagnostics

- Thermo Fisher Scientific Inc.

U.S. Influenza Diagnostics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 282.9 million

Growth rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, end-use

Country scope

U.S.

Key companies profiled

3M; Abbott; BD; Meridian Bioscience; Quidel Corporation; F. Hoffmann-La Roche Ltd; SA Scientific Ltd.; SEKISUI Diagnostics; Thermo Fisher Scientific Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Influenza Diagnostics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. influenza diagnostics marketreport based on test type, and end-use:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

RIDT

-

RT-PCR

-

Cell Culture

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

POCT

-

Laboratories

-

Frequently Asked Questions About This Report

b. The U.S. influenza diagnostics market size was estimated at USD 179.9 million in 2022.

b. The U.S. influenza diagnostics market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 282.9 million by 2030.

b. RIDTs dominated the U.S. influenza diagnostics market with a share of 36.2% in 2022. This is attributable to the increasing incidence of respiratory diseases in the U.S. since the onset of the pandemic.

b. 3M, Abbott, BD, Quiden Corporation, Roche Diagnostics, Sekisui Diagnostics, and Thermo Fisher Scientific are some of the major players operating in the U.S. Influenza Diagnostics Market.

b. Key factors that are driving the market growth include the increasing incidence of influenza and other respiratory diseases and technological innovation in communication technology in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.