- Home

- »

- Homecare & Decor

- »

-

U.S. Kitchenware Market Size, Trends, Industry Report, 2033GVR Report cover

![U.S. Kitchenware Market Size, Share & Trends Report]()

U.S. Kitchenware Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cookware, Bakeware, Tableware), By Application (Residential, Commercial), By Distribution Channel (Specialty Stores, Online Retail), And Segment Forecasts

- Report ID: GVR-4-68040-678-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Kitchenware Market Size & Trends

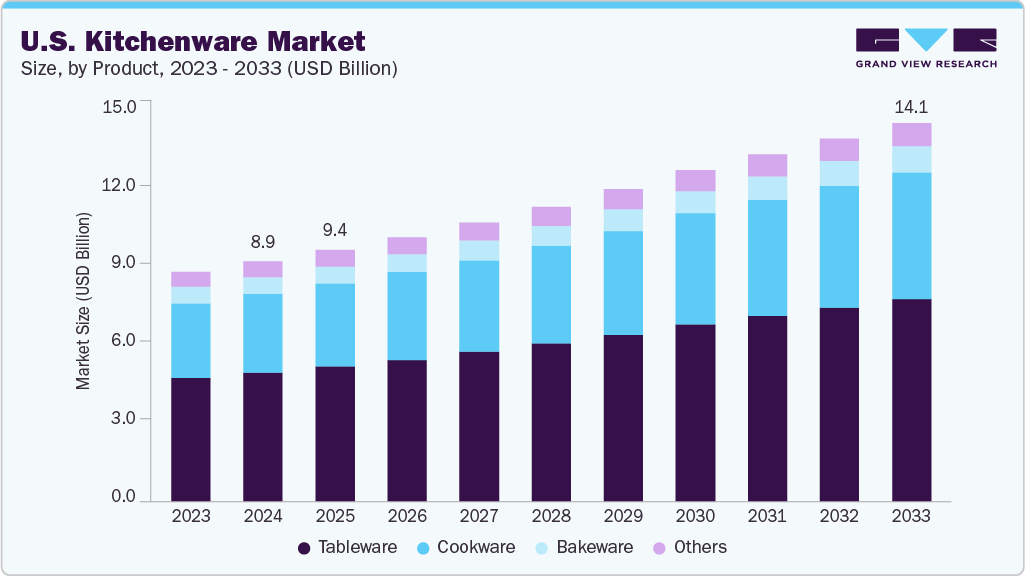

The U.S. kitchenware market size was estimated at USD 8,955.7 million in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2033. The market is driven by a growing preference for home cooking, influenced by post-pandemic habits, health awareness, and cost-saving needs. Urbanization and the rise of smaller households are boosting demand for compact, multifunctional, and space-saving kitchen tools. In addition, there is a strong shift toward aesthetically designed, premium-quality products that align with modern kitchen décor and are often showcased on social media platforms.

According to the National Frozen and Refrigerated Foods Association (NFRA), in 2024, 64% of Americans cook at home to save money and maintain better control over their budgets. 81% of consumers prepare most of their meals at home. The cooking confidence gained during the pandemic has encouraged many to explore new ideas for preparing healthier meals.

A National Frozen and Refrigerated Foods Association survey reveals that over 54% of consumers learn about food and cooking through platforms like TikTok and YouTube. Social media often showcases beautifully styled kitchenware and visually appealing dishes, inspiring others and fueling demand for stylish, high-quality kitchen tools. This combination of functionality and aesthetic appeal continues to drive market growth, as consumers increasingly invest in durable, well-designed products that enhance the look and experience of home cooking and baking.

Consumers increasingly prioritize BPA-free, non-toxic, and eco-friendly kitchenware, seeking materials like high-grade stainless steel, glass, bamboo, ceramic, and food-grade silicone. These materials are favored because they don’t leach harmful chemicals, avoid PFAS “forever chemicals,” and align with environmentally conscious values. Alongside safer materials, kitchenware that promotes portion control, oil-free cooking, and food safety is gaining traction.

Digital measuring spoons and portion-control gadgets enable precise ingredient usage, critical for mindful, healthier eating. For instance, the GreenLife Soft Grip cookware collection offers ceramic nonstick cookware free from PFAS, PFOA, and other harmful substances. It is made using recycled aluminum and coated with Thermolon, a nontoxic, eco-friendly ceramic material.

The kitchenware industry is embracing smart technology, with products like digital measuring spoons, app-connected kitchen scales, and Bluetooth-enabled thermometers becoming mainstream. These gadgets enhance cooking precision, integrate with fitness or recipe apps, and offer features like barcode scanning, nutritional tracking, and step-by-step guided recipes. For example, scales such as the Drop Kitchen connected scale sync via Bluetooth to apps, guiding cooks through interactive recipes. Thermometers with wireless connectivity (e.g., INKBIRD’s Bluetooth meat thermometers) allow real-time monitoring and cooking alerts.

Trump Tariff Impact

As of March 12, 2025, the U.S. imposed a 25% tariff on all steel and aluminum imports under Section 232 of the Trade Expansion Act, which was later increased to 50% on June 4, 2025, for most countries except the UK. These tariffs apply specifically to the metal content of products, affecting kitchenware items such as stainless-steel cookware, cutlery, sinks, and utensils. Moreover, finished stainless kitchenware imported from China faces separate tariffs of up to 45%, with certain items like sinks subjected to rates as high as 70%.

The U.S. has long imposed high anti-dumping (63.86%-76.64%) and countervailing duties (75.6% or 190.71%) on stainless steel coil imports from China, limiting such exports to less than 2% of China's total stainless shipments. While the direct effect of Trump's tariffs on coil exports is minimal, the impact on indirect exports, such as stainless steel kitchenware, white goods, and industrial components, is increasing, particularly for suppliers dependent on the U.S. market. In 2024, about 20% of China's stainless tableware and kitchenware exports went to the U.S.

Consumer Insights & Surveys

Certain kitchen utensils are nearly universal in American households. According to a study by YouGov in 2023, items like measuring cups, can openers, spatulas, and measuring spoons are found in over 90% of kitchens, highlighting their essential role in everyday cooking. Furthermore, nine other tools, including steak knives, cutting boards, whisks, and peelers, are owned by more than 80% of people, indicating strong, widespread utility.

According to the Private Label Manufacturers Association (PLMA) Kitchenware & Cookware Consumers Survey, most consumers purchase kitchenware and cookware products occasionally rather than frequently. The highest number of buyers tend to shop for these items once or twice a year, likely due to the durable nature of kitchenware, which does not require frequent replacement. A significant group also buys every few months, possibly influenced by seasonal needs, trends, or ongoing kitchen upgrades. Fewer consumers make monthly or weekly purchases, which may reflect avid cooks, food content creators, or individuals replacing worn-out tools more often.

Product Insights

Tableware accounted for about 53.74% of the U.S. kitchenware industry's revenue share in 2024. Tableware, which includes dinnerware, flatware, stemware, and related accessories, is experiencing strong demand. This demand is fueled by changing lifestyles, higher disposable incomes, and shifting consumer preferences toward aesthetic appeal and functional design. As more individuals look to enhance their everyday meals and at-home social dining experiences, the demand for stylish, durable, and often environmentally friendly tableware continues to rise.

In September 2024, CHUK by Pakka introduced a new line of 100% compostable tableware made from bagasse to promote sustainability within the food service sector. The collection features a durable, heat-resistant beverage cup for hot and cold drinks, a robust 4-inch dona for caterers and event planners, and a versatile 3-compartment snack tray ideal for food trucks and outdoor dining setups. These eco-conscious products offer a practical solution to reducing single-use plastic waste.

Demand for cookware is projected to rise at a CAGR of 5.5% from 2025 to 2033. A surge in home cooking, increased health awareness, and a growing preference for efficient and multifunctional kitchen solutions drive the demand for cookware products in the U.S. The key product categories, such as pressure cookers, pots and pans, and microwave-safe cookware, have emerged as significant contributors to market expansion.

The rising demand for pressure cookers is largely attributed to their time efficiency and convenience, aligning with consumers seeking streamlined cooking methods. Technological advancements in the kitchenware industry have further enhanced this segment, resulting in modern pressure cookers with advanced safety features and programmable settings, including electric models such as Instant Pots. Health-conscious consumers are particularly drawn to these appliances due to their ability to preserve the nutritional value of food. In addition, microwave-safe cookware is gaining traction among urban populations seeking quick and healthy meal preparation options. For instance, Sistema Microwave Collection, made from BPA-free plastic with steam release vents, is ideal for busy individuals seeking quick, healthy, and mess-free meal preparation.

Application Insights

Kitchenware used for residential application accounted for about 68.24% in 2024. The residential kitchenware market has grown strongly in recent years, due to changing lifestyles, evolving consumer habits, and a growing interest in cooking at home. A survey by the National Frozen & Refrigerated Foods Association (NFRA) found that nearly three in five people started cooking at home, showing a clear move toward home-prepared meals. This shift has boosted demand for all kinds of kitchenware, like cookware, bakeware, cutlery, utensils, and food storage. Urbanization and the rise of smaller, nuclear households have also played a big role. As more people set up their own homes, especially in fast-growing regions, there has been a greater need for practical, easy-to-use, and space-saving kitchen tools.

The demand for kitchenware used for commercial applications is estimated to grow at a CAGR of 5.5% over the forecast period. The demand for commercial kitchenware is closely tied to the expansion of the restaurant and food service industry. According to data from the National Restaurant Association (NRA), U.S. food service sales grew by 8.6% from 2022 to 2023, surpassing USD trillion for the first time. Sales are projected to rise another 5.4% in 2024, reaching USD 1.1 trillion.

Furthermore, the U.S. Department of Commerce’s Bureau of Economic Analysis (BEA) reported that the food service sector contributed 2.5% to the nation’s GDP in 2023, around USD 684 billion. This surge in restaurant activity has led to greater investments in durable, efficient, and scalable kitchen equipment as commercial establishments seek to keep pace with rising demand.

Distribution Channel Insights

The sale of kitchenware through supermarkets & hypermarkets accounted for a revenue share of about 40.25% in 2024. Consumers often choose supermarkets and hypermarkets for kitchenware purchases due to their convenience, wide product selection, and competitive pricing. These one-stop retail destinations allow shoppers to buy groceries and household items in a single trip, saving time and effort. The ability to see, touch, and compare products in person and assistance from in-store staff add to the appeal of physical retail. These stores cater to diverse budgets by offering everything from basic kitchen tools to premium cookware, often accompanied by seasonal deals, bundle offers, and loyalty rewards.

The sale of kitchenware through online retail channels is expected to grow at a CAGR of 6.0% from 2025 to 2033. Online shopping allows customers to browse and buy anytime, making it especially appealing for busy individuals or those in remote locations. The availability of multiple brands across various price points, exclusive discounts, flash sales, and festive deals appeals to cost-conscious shoppers. Added benefits such as easy returns, doorstep delivery, and secure payment options have further boosted consumer confidence, particularly in the post-pandemic era. According to a Private Label Manufacturers Association (PLMA) survey, many consumers reported buying kitchenware and cookware online, reflecting a strong and growing preference for digital shopping in this category.

Key U.S. Kitchenware Company Insights

The market includes a mix of established brands and emerging players. Leading companies are proactively adapting to changing trends in kitchenware and expanding their offerings to maintain and strengthen their market position.

-

Groupe SEB is a global leader in cookware and small household appliances, recognized for its diverse portfolio of over 45 brands, including Tefal, Moulinex, Krups, Rowenta, WMF, All-Clad, and Supor. With operations spanning more than 150 countries, the company sells over 344 million products annually, serving a broad and varied consumer base. Its offerings range from kitchen appliances such as coffee makers and blenders to cookware and home care products like vacuum cleaners, irons, and hair dryers.

-

Meyer International Holdings Limited is a prominent global manufacturer and distributor of cookware and kitchenware, with a strong presence in over 30 countries. Its extensive brand portfolio features well-known names such as Circulon, Anolon, Farberware, Rachael Ray, Ruffoni, and BonJour. Meyer offers various products, including tri-ply stainless steel cookware, nickel-free Japanese steel utensils, pre-seasoned cast iron pans, ceramic-coated cookware, and advanced nonstick solutions.

Key U.S. Kitchenware Companies:

- Target Brands, Inc.

- Newell Brands

- Groupe SEB

- Meyer International Holdings Limited

- Tramontina

- The Vollrath Company, LLC

- Lifetime Brands

- Hamilton Beach Brands Holding Company

- Cuisinart

- OXO International, Ltd.

Recent Developments

-

In January 2025, Tefal partnered with the Paul Bocuse brand to introduce a premium cookware collection that blends the richness of French culinary heritage with contemporary innovation. Designed to bring professional-quality tools into home kitchens, the collection includes 12 essential pieces: frypans, woks, sauté pans, saucepans with lids, and a stewpot. Crafted from high-grade materials like uncoated 18/10 stainless steel and aluminum with a durable Titanium non-stick coating, the collection emphasizes performance and longevity.

-

In May 2024, Groupe SEB and Meyer Corporation jointly established the Cookware Sustainability Alliance (CSA), a U.S.-based nonprofit organization promoting science-based cookware safety and sustainability information. The CSA aims to address widespread misinformation, especially concerning nonstick materials such as PTFE, and actively participate in policy discussions surrounding PFAS regulations. By bringing together experts from various fields, the alliance supports informed decision-making across the industry, legislative bodies, and consumer education initiatives.

-

In March 2024, IKEA introduced a new collection of emerald green glassware, capturing the season’s popular color trend. Featuring items such as glasses and vases, the jewel-toned range brings a sense of elegance and vibrancy to various home settings. Interior designer Ashley Banbury notes that rich green hues evoke comfort and luxury, aligning with the increasing preference for nature-inspired and sustainable design. This collection combines timeless charm with a playful, vintage-inspired style, making it a fitting choice for minimalist and bold interiors.

U.S. Kitchenware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,388.3 million

Revenue forecast in 2033

USD 14,108.5 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

U.S.

Key companies profiled

Target Brands, Inc.; Newell Brands; Groupe SEB; Meyer International Holdings Limited; Tramontina; The Vollrath Company, LLC; Lifetime Brands; Hamilton Beach Brands Holding Company; Cuisinart; OXO International, Ltd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Kitchenware Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. kitchenware market report by product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cookware

-

Pots & Pan

-

Pressure Cooker

-

Microware Cookware

-

-

Bakeware

-

Tins & Trays

-

Cups

-

Molds

-

Pans & Dishes

-

Rolling Pin

-

Others

-

-

Tableware

-

Dinnerware

-

Flatware

-

Stemware

-

-

Others

-

Cooking Racks a

-

Cooking Tools

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. kitchenware market was estimated at USD 8,955.7 million in 2024 and is expected to reach USD 9,388.3 million in 2025.

b. The U.S. kitchenware market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 14,108.5 million by 2033.

b. Tableware products accounted for the largest share of about 53.74% of the U.S. kitchenware market in 2024. This demand is fueled by changing lifestyles, higher disposable incomes, and shifting consumer preferences toward both aesthetic appeal and functional design.

b. Some of the key players in the U.S. kitchenware market is Target Brands, Inc.; Newell Brands; Groupe SEB; Meyer International Holdings Limited; Tramontina; The Vollrath Company, LLC; Lifetime Brands; Hamilton Beach Brands Holding Company; Cuisinart; OXO International, Ltd.

b. The U.S. kitchenware market is driven by a growing preference for home cooking, influenced by post-pandemic habits, health awareness, and cost-saving needs. Urbanization and the rise of smaller households are boosting demand for compact, multifunctional, and space-saving kitchen tools.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.