- Home

- »

- Healthcare IT

- »

-

U.S. Laboratory Informatics Market, Industry Report, 2030GVR Report cover

![U.S. Laboratory Informatics Market Size, Share & Trends Report]()

U.S. Laboratory Informatics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (LIMS, ELN), By Delivery Mode (Cloud-based, On-premise), By Component (Software, Service), By End Use, And Segment Forecasts

- Report ID: GVR-2-68038-426-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Laboratory Informatics Market Trends

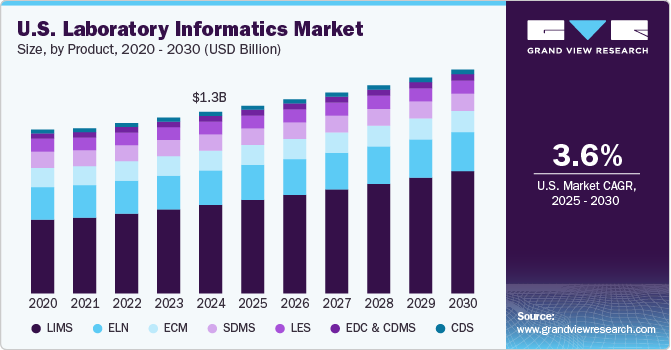

The U.S. laboratory informatics market size was estimated at USD 1.32 billion in 2024 and is expected to grow at a CAGR of 3.6% from 2025 to 2030. The growing demand for laboratory automation is expected to boost the adoption of laboratory information systems. Increasing demand for scientific data integration solutions among end-use industries, including life sciences, Contract Research Organizations (CROs), food & beverage, and chemicals, is expected to boost market growth. The increasing need for clinical workflow management in laboratories to improve operational efficiency is expected to propel the market in the coming years.

The growing number of laboratory errors in the U.S. healthcare system is emerging as a key driver for adopting laboratory informatics solutions. A study published by ECRI in September 2024 highlighted that nearly 70% of diagnostic errors occur during the testing phase, driven by technical glitches, administrative oversights, and communication gaps. Issues such as equipment misuse mishandled specimens, and mix-ups or mislabeled samples remain widespread, accounting for over 40% of these errors. Studies indicate that at least one in every 20 U.S. adults experiences a diagnostic error each year, and there is increasing urgency for advanced informatics tools that can streamline processes, reduce human error, and enhance traceability throughout the testing cycle.

Laboratory informatics platforms are becoming essential for healthcare providers to reduce laboratory errors. By improving sample tracking, automating result validation, and ensuring faster, more reliable communication of test outcomes, these systems help minimize failure points across the diagnostic journey. As providers focus on improving accuracy and safeguarding patient safety, investments in laboratory informatics systems and integrated informatics solutions are expected to drive market growth over the forecast period.

Furthermore, growing strategic partnerships to expand capabilities by key players in the U.S. is contributing to market growth. For instance, in August 2024, Sapio Sciences, a U.S.-based company that offered a lab informatics platform, partnered with CREO, a U.S.-based consultancy for delivering end-to-end laboratory information management solutions. Furthermore, this partnership combined Sapio Sciences’ lab informatics platform, Electronic Lab Notebook, LIMS, and Scientific Data Solutions with CREO’s digital transformation, validation, and operational management expertise.

The COVID-19 pandemic significantly accelerated the adoption of laboratory informatics systems across the U.S. The urgent need for rapid, accurate, and high-volume testing exposed inefficiencies in traditional laboratory workflows, pushing healthcare providers and public health agencies to adopt informatics platforms. For instance, in August 2021, LigoLab, a U.S.-based laboratory software provider, partnered with Northwest Pathology and the Florida Department of Health to deploy its TestDirectly platform for mass COVID-19 testing. This collaboration improved sample tracking and data management, highlighting the critical role of informatics during the pandemic. The pandemic-driven shift toward informatics solutions in laboratory operations is expected to continue driving market growth as healthcare systems increasingly prioritize data-driven diagnostics and disease management approaches.

Implementation of LabWare LIMS by the global contract research organization specializing in clinical research.

A global contract research organization (CRO) faced significant challenges with its 25-year-old legacy LIMS, which had become difficult to modify and costly to maintain. During the transition phase, the organization struggled with running dual systems, managing complex global sample workflows, and ensuring compliance with regulatory standards, including CFR Part 11. In addition, high sample volumes led to performance bottlenecks, highlighting the urgent need for a more robust and scalable solution to support the organization’s growing operational demands.

To address these issues, the CRO implemented LabWare LIMS with the support of Astrix. The implementation involved integrating multiple laboratory instruments and applications, automating legacy data import, and designing a secure framework to meet regulatory compliance. The deployment also focused on optimizing sample batching and improving audit processes, helping to minimize operational inefficiencies and streamline laboratory workflows.

The adoption of LabWare LIMS delivered notable improvements in operational efficiency. The CRO successfully consolidated five to six legacy systems into a single, unified platform, simplifying processes and providing real-time insights into laboratory performance. Sample throughput improved by approximately 50%, while the system’s enhanced visibility into instrument performance and production issues enabled better global operations management. Overall, implementation supported the organization’s goals of increasing productivity and maintaining high regulatory compliance standards.

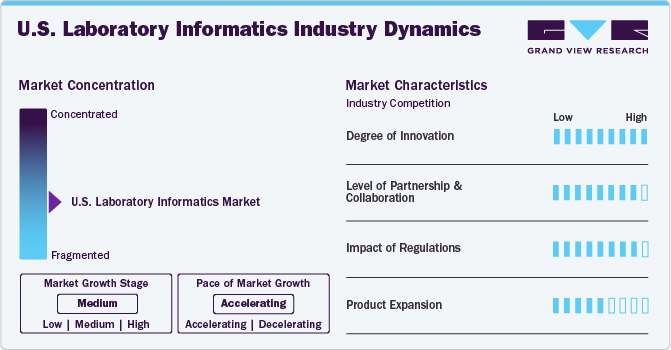

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, the impact of regulations, the level of partnerships and collaboration activities, the degree of innovation, and regional expansion. For instance, the market is fragmented, with many product and service providers entering it.

The industry's degree of innovation is high. The market is experiencing significant innovation as numerous players introduce new products characterized by rapid technological advancements, such as artificial intelligence and data analytics, for rapid digitalization of laboratory processes. For instance, in October 2024, Xybion Digital Inc. launched Xybion LIMS 10.0, a SaaS LIMS integrated with the Xybion QMS system. This system allows accelerated tests, study timelines, laboratory throughput, and full compliance with various global regulatory agencies, including the US FDA.

Key industry players engage in extensive partnerships and collaborations to increase their capabilities, expand product portfolios, and improve competencies. For instance, in March 2024, ValGenesis Inc. partnered with CSols Inc. to optimize efficiency in life science laboratories across the U.S. with cutting-edge digital validation and enhanced informatics solutions.

The impact of regulations on the market is high. The U.S. market is significantly influenced by various regulations, such as the U.S. FDA, which play a critical role in shaping laboratory systems' growth, innovation, and operational processes. The growing data security and privacy concerns regulations are evolving, driving the demand for solutions complying with regional regulations such as Clinical Laboratory Improvement Amendments (CLIA).

The industry's product expansion level is moderate. Technological advancements, changing regulatory landscapes, and the increasing need for efficiency and accuracy in laboratory operations contribute to product expansion in the market. Further, various industries are integrating laboratory informatics products into their businesses. For instance, In September 2024, Henkel AG & Co. KGaA integrated LabVantage LIMS and SAP Product Lifecycle Management (PLM) solutions into its core R&D 4.0 platform for consumer businesses.

Products Insights

Based on products, the LIMS segment accounted for the largest revenue share of more than 48% in 2024 and is expected to witness lucrative growth over the forecast period. This growth is attributed to the growing demand for integrated LIMS platforms in accordance with the requirements of life sciences and research companies to reduce errors in data management and improve the analysis and adoption of LIMS in various research laboratories in the U.S. For instance, in February 2025, LabConnect, a U.S.-based central laboratory services provider, chose Sapio LIMS of Sapio Sciences for the digital transformation of complex research workflows, enhancing data management, and streamlining sample tracking.

Electronic Lab Notebooks (ELN) accounted for the second-largest share of the U.S. market and is poised to exhibit steady growth due to increasing R&D activities in the life sciences industry and the rising need to comply with regulations. Further growing electronic lab notebook product launches by market players in the U.S. are also contributing to the significant share of the segment in the market. For instance, In December 2024, TeselaGen launched a next-generation electronic lab notebook (ELN) along with an enhanced interface for improving data management and fostering collaboration among scientists in the biotechnology sector.

Delivery Mode Insights

Based on delivery modes, the web-based solutions segment accounted for the largest revenue share of over 45% in 2024 and is projected to grow fastest over the forecast period. Labs utilizing the internet and web-based services have unparalleled accessibility, allowing lab operations to be managed and monitored from even the most remote locations using just a single monitoring device. This capability is especially advantageous for geographically dispersed research teams and organizations with multiple lab sites.

Cloud-based is anticipated to grow at the fastest growth rate over the forecast year. This is due to its affordability, scalability, dependability, and sophisticated capabilities that meet healthcare's expanding storage and computational demands. The rise of cloud laboratories offers a chance to leverage AI and Machine Learning to refine experimental methods and improve data accuracy with algorithms. Its cooperative and compatible characteristics also simplify research activities, reduce repetitive tasks, and facilitate system sharing, enhancing research outcomes.

Component Insights

Based on components, the market has been further segmented into services and software. The services segment dominated the market in 2024, driven by the rising demand for system implementation, validation, integration, and ongoing maintenance. Laboratories increasingly rely on service providers for smooth system upgrades, regulatory compliance support, and data migration from legacy platforms. In addition, service providers offer training and technical assistance, helping labs optimize workflows and ensure data accuracy. As labs continue to modernize their infrastructure, the need for expert service partnerships is expected to remain strong, supporting sustained growth in this segment over the forecast period.

Software is expected to witness the fastest market growth over the forecast period. The growing adoption of cloud-based platforms and the integration of AI-driven analytics make laboratory software more powerful and accessible. Solutions such as Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), and data analytics tools enable laboratories to automate processes, improve data integrity, and gain real-time insights. As labs increasingly seek scalable, flexible solutions to manage growing data volumes, the demand for advanced laboratory informatics software is expected to increase over the forecast period.

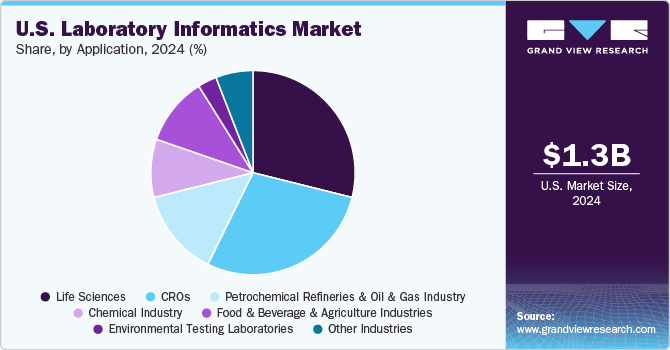

End Use Insights

Based on end use, the life sciences segment accounted for more than 28% in 2024. The increasing focus on drug discovery, personalized medicine, and biologics development generates large volumes of complex data requiring efficient management. Laboratory informatics solutions help life science companies streamline research workflows, improve data accuracy, and ensure compliance with strict regulatory standards. In addition, the growing adoption of automation and data analytics in R&D processes is increasing demand for advanced informatics platforms, supporting innovation and driving market expansion in this segment.

CROs is anticipated to grow at the fastest growth rate over the forecast year. The demand for efficient data management and regulatory compliance drives CROs to adopt advanced laboratory informatics solutions, such as ELN, LIMS, and SDMS. These technologies enable CROs to streamline workflows, ensure data integrity, enhance collaboration, and expedite the drug development process. With growth in the life sciences sector, the reliance on CROs for high-quality, cost-effective research solutions is also increasing.

Key Laboratory Informatics Company Insights

The market is highly fragmented, with many small and large players operating. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling market growth.

Key U.S. Laboratory Informatics Companies:

- Thermo Fisher Scientific, Inc.

- Waters

- LabWare

- Core Informatics

- LabVantage Solutions, Inc.

- LabLynx, Inc.

- PerkinElmer Inc.

- Abbott

- Agilent Technologies, Inc.

- IDBS

Recent Developments

-

In March 2025, LabVantage Solutions Inc. launched Version 8.9 of its LIMS Platform to deliver cutting-edge capabilities to laboratories globally. This updated version enhances daily operations by boosting productivity.

-

In December 2024, LabVantage Solutions Inc. Partnered with the Netherlands Forensic Institute (NFI) to digitalize forensic laboratory workflows.

-

In July 2024, Sapio Sciences partnered with Zifo to provide a lab informatics platform, services, and support for the biotech, clinical diagnostics, and pharmaceutical industries.

-

In November 2023, Xybion Corporation acquired Autoscribe Informatics, a U.K.-based LIMS software provider, leading to the strategic expansion of the company's global laboratory information management system (LIMS) business.

U.S. Laboratory Informatics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.62 billion

Growth rate

CAGR of 3.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, component, end use

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc.; Waters; LabWare; Core Informatics; LabVantage Solutions, Inc.; LabLynx, Inc.; PerkinElmer Inc.; Abbott; Agilent Technologies, Inc.; IDBS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Laboratory Informatics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. laboratory informatics market report based on product, delivery mode, component, end use:

-

Products Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Information Management Systems (LIMS)

-

Electronic Lab Notebooks (ELN)

-

Scientific Data Management Systems (SDMS)

-

Laboratory Execution Systems (LES)

-

Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

-

Chromatography Data Systems (CDS)

-

Enterprise Content Management (ECM)

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Web-hosted

-

Cloud-based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Life Sciences

-

Pharmaceutical and Biotechnology Companies

-

Biobanks/Biorepositories

-

Contract Services Organizations

-

Molecular Diagnostics & Clinical Research Laboratories

-

Academic Research Institutes

-

-

CROs

-

Petrochemical Refineries & Oil and Gas

-

Chemical Industry

-

Food and Beverages and Agriculture

-

Environmental Testing Labs

-

Other Industries

-

Frequently Asked Questions About This Report

b. Key factors that are driving the U.S. laboratory informatics market growth include growing demand for laboratory automation, rising need for clinical workflow management in laboratories to improve operational efficiency, and increasing demand for scientific data integration solutions among end-use industries including life sciences, Contract Research Organizations (CROs), food & beverage, and chemicals.

b. The U.S. laboratory informatics market size was estimated at USD 1.32 billion in 2024 and is expected to reach USD 1.36 billion in 2025.

b. The U.S. laboratory informatics market is expected to grow at a compound annual growth rate of 3.59% from 2025 to 2030 to reach USD 1.62 billion by 2030.

b. LIMS segment held dominated the U.S. laboratory informatics market with a share of over 48.82% in 2024. The growth of the segment is attributed to the growing demand for integrated LIMS platforms in accordance with the requirements of life sciences and research companies to reduce the incidence of errors in data management and improve analysis, and adoption of LIMS in various research laboratories in U.S.

b. Some key players operating in the U.S. laboratory informatics market include Thermo Fisher Scientific, Inc.; Waters; LabWare; Core Informatics; LabVantage Solutions, Inc.; LabLynx, Inc.; PerkinElmer Inc.; Abbott; Agilent Technologies, Inc.; IDBS.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.