- Home

- »

- Advanced Interior Materials

- »

-

U.S. Laminar Airflow Cabinet Market, Industry Report, 2033GVR Report cover

![U.S. Laminar Airflow Cabinet Market Size, Share & Trends Report]()

U.S. Laminar Airflow Cabinet Market (2025 - 2033) Size, Share & Trends Analysis Report By Size (2x2 Feet, 3x2 Feet, 4x2 Feet), By Product, By Class (Class 1, Class 2), By End-use (Food & Beverage, Hospitals, Semiconductor & Electronics, Cleanrooms), And Segment Forecasts

- Report ID: GVR-4-68040-692-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Laminar Airflow Cabinet Market Summary

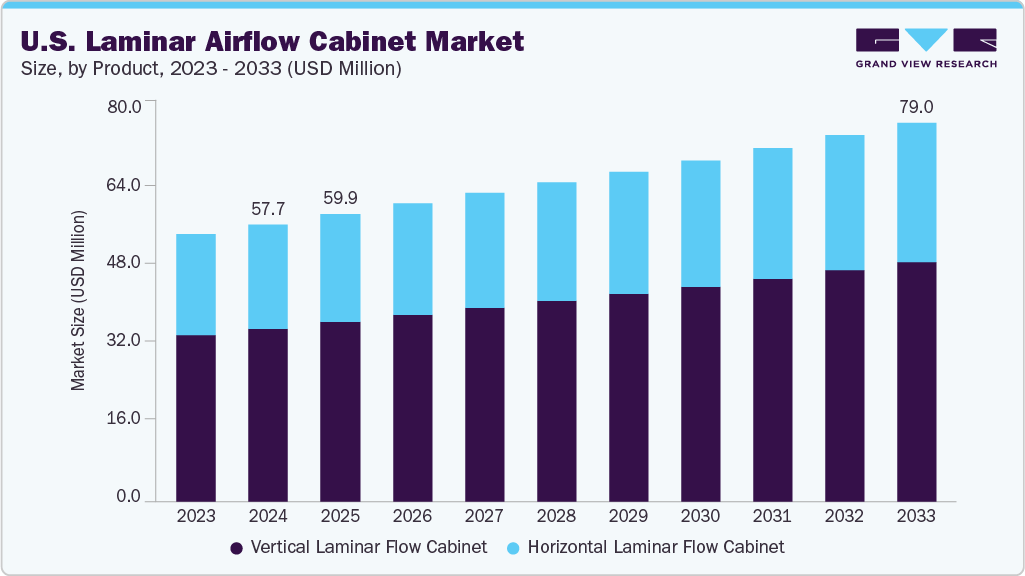

The U.S. laminar airflow cabinet market size was estimated at USD 57.7 million in 2024 and is projected to reach USD 79.0 million by 2033, growing at a CAGR of 3.5% from 2025 to 2033. The market is primarily driven by increasing demand from the pharmaceutical and biotechnology sectors, fueled by rising R&D investments and the expansion of sterile manufacturing facilities.

Key Market Trends & Insights

- By size, 4x2 feet laminar airflow cabinets dominate the market and account for 29.8% share in 2024.

- By product, the vertical laminar flow cabinet segment dominated the market and accounted for a 62.5% share in 2024.

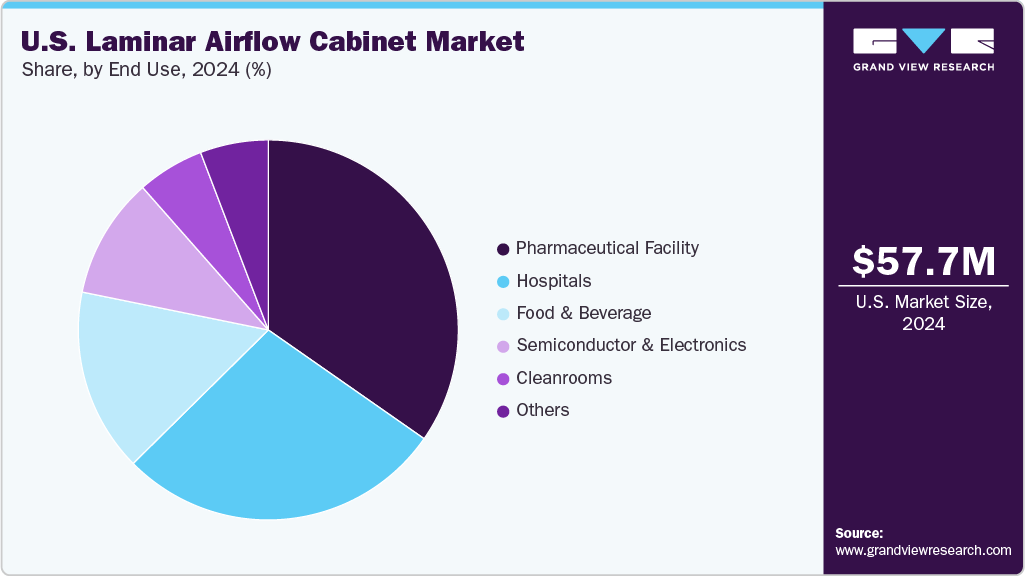

- By end-use, the pharmaceutical facilities held a significant share in the market and accounted for a share of 34.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 57.7 Million

- 2033 Projected Market Size: USD 79.0 Million

- CAGR (2025-2033): 3.5%

With heightened focus on drug safety and contamination control, companies are adopting laminar flow cabinets to meet stringent FDA and GMP compliance standards. Another key driver is the growing emphasis on infection control and cleanroom standards across healthcare, diagnostics, and clinical testing laboratories in the U.S. Regulatory bodies such as the CDC, EPA, and OSHA mandate strict air quality and biosafety protocols, pushing organizations to install certified laminar flow systems. The adoption of HEPA-filtered cabinets with real-time monitoring features is increasing to ensure environmental safety and regulatory compliance. Moreover, increased awareness about occupational safety and the rise of pandemic preparedness programs continue to boost the need for efficient and safe airflow systems in critical U.S. applications.

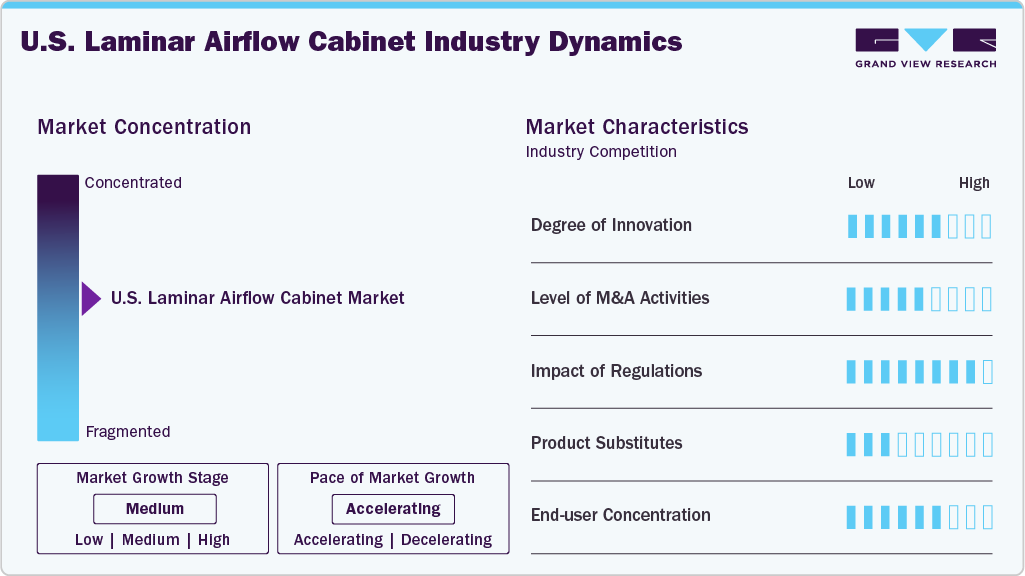

Market Concentration & Characteristics

The U.S. laminar airflow cabinet industry is moderately concentrated, with a few key players holding significant market share. Established manufacturers dominate due to their advanced technology, broad product portfolios, and strong distribution networks. However, emerging companies are entering the space with innovative solutions and competitive pricing. This balance creates a market where competition exists, but leadership remains with a limited number of major firms.

The U.S. laminar airflow cabinet industry exhibits a high degree of innovation, driven by advancements in filtration, airflow technology, and automation. Manufacturers are integrating features like energy-efficient motors, smart sensors, and real-time monitoring systems. Innovation is also focused on enhancing cabinet ergonomics and user safety. These developments help meet evolving research, healthcare, and pharmaceutical needs.

M&A activity in the U.S. laminar airflow cabinet industry remains moderate, with companies seeking strategic partnerships to expand their capabilities and geographic reach. Larger firms often acquire smaller players to access proprietary technologies or niche markets. These consolidations help enhance product offerings and streamline distribution. The trend supports market stability and strengthens competitive positioning.

Regulation significantly shapes the U.S. laminar airflow cabinet industry, especially in sectors like healthcare and pharmaceuticals. Compliance with FDA, OSHA, and ISO standards ensures product safety and performance consistency. Manufacturers must regularly update designs and processes to align with evolving regulatory expectations. These requirements drive product innovation while creating entry barriers for new players.

Drivers, Opportunities & Restraints

The U.S. laminar airflow cabinet industry is driven by growing demand from pharmaceutical, biotech, and clinical research sectors requiring sterile environments. Increasing federal investments in life sciences and drug development boost equipment adoption. Regulatory compliance with FDA and USP standards further accelerates usage. Technological upgrades in airflow control and filtration also support market growth.

Expanding applications in personalized medicine, cell therapy, and diagnostics present new opportunities for laminar airflow cabinets in the U.S. Growing focus on cleanroom automation and energy-efficient systems opens space for innovation. Rising demand from academic institutions and private labs adds to market potential. Integration of IoT and smart monitoring features offers additional growth avenues.

High initial cost and maintenance requirements of advanced laminar airflow systems can limit adoption, especially among smaller facilities. Strict regulatory approvals and validation procedures may delay product deployment. Limited awareness in non-healthcare segments can restrict broader usage. In addition, supply chain issues and component shortages can impact production timelines.

Size Insights

The 4x2 feet laminar airflow cabinets dominate the market and account for 29.8% share, due to their compact design and suitability for small to mid-sized laboratories. It is widely used in pharmaceutical compounding, clinical testing, and academic research where space efficiency is crucial. These units are cost-effective and easy to install, making them a preferred choice. Their versatility across various lab settings supports consistent demand.

The 6x2 feet segment is witnessing the fastest growth owing to its larger workspace, which accommodates multiple users and complex procedures. It is increasingly adopted in high-throughput pharmaceutical manufacturing and advanced biotech research. Facilities seeking higher productivity and improved workflow prefer this size. Growing investments in large-scale cleanroom infrastructure also drive demand.

Product Insights

Vertical laminar flow cabinets dominate the market and accounted for a 62.5% share in 2024 due to their strong performance in pharmaceutical and clinical research environments. These cabinets offer top-down airflow, reducing contamination risks and protecting the sample and operator. They are widely used in hospitals, cleanrooms, and GMP-compliant labs, aligning with stringent U.S. regulatory standards. Their compact design and enhanced safety features make them a top choice for sterile applications nationwide.

Horizontal laminar flow cabinets segment is expected to grow at a significant CAGR of 3.2% from 2025 to 2033 in terms of revenue. Horizontal laminar flow cabinets are gaining traction in the U.S. due to increasing demand from electronics manufacturing, medical device assembly, and diagnostic labs. These cabinets provide uniform airflow across the workspace, offering better visibility and user comfort during precision tasks. With the rise of semiconductor R&D and microelectronics fabrication in the U.S., their adoption is expanding rapidly. Moreover, their cost-effectiveness and ease of maintenance contribute to strong growth in non-sterile, clean work environments.

Class Insights

Class 1 dominated the market and accounted for a share of 40.3% in 2024 due to their widespread use in applications where product protection is the primary concern. These units are commonly used in pharmaceutical compounding, chemical handling, and quality control labs. Their simple design, lower cost, and compliance with OSHA safety standards make them a preferred option. The growing demand for basic containment in non-biological settings supports their strong market position.

The class 2 segment is expected to grow at a significant CAGR of 3.5% from 2025 to 2033 in terms of revenue. Class 2 cabinets are experiencing significant growth in the U.S. due to rising needs for personnel and product protection in biotech and clinical laboratories. These units are essential in handling infectious materials and are aligned with CDC and NIH biosafety guidelines. Increasing investments in healthcare infrastructure and infectious disease research are driving their adoption. Their dual protection capabilities make them ideal for sensitive diagnostic and therapeutic applications.

End-use Insights

Pharmaceutical facilities held a significant share in the market and accounted for a share of 34.7% in 2024, owing to strict sterility requirements in drug development and manufacturing. These facilities rely heavily on laminar flow systems to comply with FDA and USP <797>/<800> guidelines. The growth of biologics and injectable drugs further boosts demand for contamination-free environments. High R&D activity and expansion of GMP-certified facilities reinforce their market dominance.

The semiconductor and electronics segment is the fastest-growing end use sector in the U.S. due to increasing investments in advanced chip fabrication and microelectronics. These industries require ultra-clean environments to ensure defect-free production of sensitive components. Government support for domestic semiconductor manufacturing is accelerating cleanroom expansion. As a result, demand for horizontal and vertical laminar airflow cabinets is rising sharply.

Key U.S. Laminar Airflow Cabinet Company Insights

Some key players operating in the market include MRC Group, Esco Micro Pte. Ltd., and Biobase Biodusty (Shandong), Co., Ltd.

-

MRC Group is a prominent manufacturer and supplier of scientific, laboratory, and analytical equipment, serving pharmaceuticals, biotechnology, food & beverage, chemical, and environmental testing industries. The company offers a wide range of products, including laminar airflow cabinets, incubators, centrifuges, and cleanroom solutions. MRC caters to academic institutions and industrial research facilities with advanced, customizable instruments. It maintains a strong U.S. presence through distribution partnerships and export operations. The company is known for delivering reliable solutions that meet strict international quality and safety standards.

-

Esco Micro Pte. Ltd. operates across multiple industries, including pharmaceuticals, biotechnology, medical research, and electronics manufacturing, offering specialized clean-air and contamination control solutions. The company’s product range includes laminar flow cabinets, biosafety cabinets, isolators, and fume hoods, widely used in cleanrooms, laboratories, and IVF clinics. Its solutions are built to meet global regulatory standards and feature advanced filtration systems and antimicrobial surfaces. Esco also supports emerging and developed markets with localized manufacturing and R&D capabilities. The company continues to innovate in energy-efficient and user-centric designs tailored to high-precision environments.

Key U.S. Laminar Airflow Cabinet Companies:

- MRC Group

- Esco Micro Pte. Ltd.

- Biobase Biodusty(Shandong), Co., Ltd.

- Thermo Fisher Scientific Inc.

- Lamsystems

- Airclean Systems

- Allentown Inc.

- Kimberly-Clark Corporation

- Labconco Corporation

- NuAire

Recent Developments

-

In October 2024, Esco Medical introduced the MIRI Laminar Flow Cabinet, designed for IVF labs with advanced airflow control and high-efficiency ULPA filtration. It features low noise, energy-saving operation, and ergonomic enhancements. The unit supports clean, vibration-free environments for delicate procedures, and its antimicrobial coating adds an extra layer of protection.

-

In October 2024, Germfree acquired Arcoplast to strengthen its cleanroom and containment facility offerings. This move enhances its ability to deliver turnkey solutions with advanced, seamless architectural finishes. The acquisition supports growth in biopharma, high-containment labs, and sterile manufacturing and broadens Germfree’s presence in modular and fixed cleanroom markets.

-

In March 2023, Kewaunee highlights new advancements in laminar flow hood technology, focusing on better airflow control, energy efficiency, and user-friendly features. These upgrades enhance safety and performance in labs. The improvements are especially valuable for pharmaceutical, biotech, and precision manufacturing environments.

U.S. Laminar Airflow Cabinet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 59.9 million

Revenue forecast in 2033

USD 79.0 million

Growth rate

CAGR of 3.5% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Size, product, class, end-use

Country scope

U.S.

Key companies profiled

MRC Group; Esco Micro Pte. Ltd.; Biobase Biodusty(Shandong), Co., Ltd.; Thermo Fisher Scientific Inc.; Lamsystems; Airclean Systems; Allentown Inc.; Kimberly-Clark Corporation; Labconco Corporation; NuAire

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Laminar Airflow Cabinet Market Report Segmentation

This report forecasts revenue growth at the U.S., regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. laminar airflow cabinet market report based on size, product, class, and end-use:

-

Size Outlook (Revenue, USD Million, 2021 - 2033)

-

2x2 Feet

-

3x2 Feet

-

4x2 Feet

-

6x2 Feet

-

8x2 Feet

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Vertical Laminar Flow Cabinet

-

Horizontal Laminar Flow Cabinet

-

-

Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Class 1

-

Class 2

-

Class 3

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Hospitals

-

Semiconductor & Electronics

-

Cleanrooms

-

Pharmaceutical Facility

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. laminar airflow cabinet market size was estimated at USD 57.7 million in 2024 and is expected to be USD 59.9 million in 2025.

b. The U.S. laminar airflow cabinet market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2033 to reach USD 79.0 million by 2033.

b. Vertical laminar flow cabinets dominate the market and accounted for 62.5% share in 2024, due to their strong performance in pharmaceutical and clinical research environments. These cabinets offer top-down airflow, reducing contamination risks and protecting both the sample and operator. They are widely used in hospitals, cleanrooms, and GMP compliant labs, aligning with stringent U.S. regulatory standards.

b. Some of the key players operating in the U.S. laminar airflow cabinet market include MRC Group; Esco Micro Pte. Ltd.; Biobase Biodusty(Shandong), Co., Ltd.; Thermo Fisher Scientific Inc.; Lamsystems; Airclean Systems; Allentown Inc.; Kimberly-Clark Corporation; Labconco Corporation; NuAire.

b. Key factors driving the U.S. laminar airflow cabinet market include rising demand for sterile environments in pharmaceutical and biotech research. Stringent FDA and OSHA regulations are pushing facilities to adopt advanced contamination control solutions. Additionally, innovation in energy-efficient and smart airflow systems is fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.