- Home

- »

- Medical Devices

- »

-

U.S. Large Molecule Drug Substance CDMO Market Report, 2033GVR Report cover

![U.S. Large Molecule Drug Substance CDMO Market Size, Share & Trends Report]()

U.S. Large Molecule Drug Substance CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Biologics, Biosimilar), By Service (Contract Manufacturing, Contract Development), By Source, By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-748-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

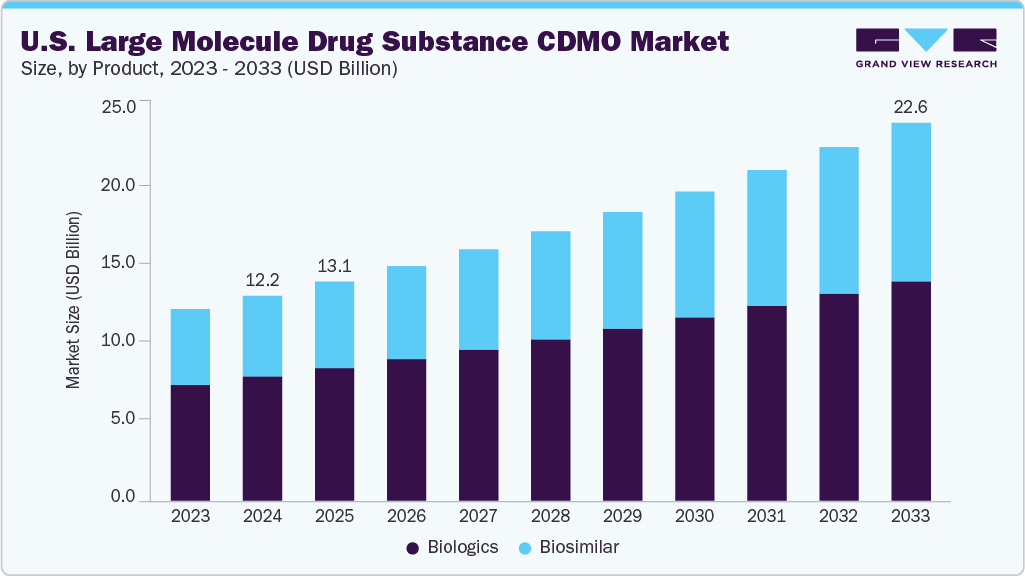

The U.S. large molecule drug substance CDMO market size was estimated at USD 12.22 billion in 2024 and is projected to reach USD 22.56 billion by 2033, growing at a CAGR of 7.06% from 2025 to 2033. This market is experiencing significant growth due to the growing prevalence of chronic diseases, further driving the demand for biologics such as monoclonal antibodies, cell therapies, and gene therapies. Moreover, increasing outsourcing trends by pharmaceutical and biotech companies to reduce costs, access specialized expertise, and accelerate commercialization are also some of the factors contributing to the market growth.

The market is driven by the growing demand for biologics to meet the growing demand for effective therapeutic options for chronic and complex diseases. The increasing prevalence of cancer, autoimmune disorders, and metabolic diseases globally is leading to the growing demand for more advanced therapies. Biologics such as monoclonal antibodies, recombinant proteins, cell therapies, and gene therapies have emerged as prominent solutions, but their development and manufacturing processes are comparatively complex and require advanced infrastructure. Therefore, several pharmaceutical and biotechnology companies increasingly turn to contract development and manufacturing organizations to streamline operations and address the growing complexity of large molecule drug development. Thus, these factors would help companies to reduce the burden of high capital investments, avoid lengthy facility set-ups, and gain faster access to specialized expertise that ensures regulatory compliance and high-quality production.

Furthermore, growing innovation and regulatory support to create a favorable environment for CDMOs in the U.S. is also contributing to the market growth. Continuous advancements in bioprocessing technologies, such as the shift towards single-use systems and the adoption of continuous manufacturing, are making biologics production more efficient, flexible, and cost-effective. These improvements not only help manufacturers meet the rising global demand but also enable CDMOs to handle more complex pipelines, including biosimilars that are rapidly emerging as patents for blockbuster biologics expire.

Opportunity Analysis

The market presents significant opportunities owing to the growing demand for biologics and advanced therapies. Moreover, increasing prevalence of chronic and rare diseases, pharmaceutical pipelines are shifting towards monoclonal antibodies, recombinant proteins, and cell and gene therapies, which require highly specialized production capabilities. Thus, the growing therapeutic focus is opening substantial opportunities for CDMOs that can provide end-to-end services, from process development to commercial-scale manufacturing. In addition, the rise of biosimilars coupled with the growing expiration of patents for blockbuster biologics, offers a robust growth avenue, as many drug developers prefer outsourcing complex biosimilar manufacturing rather than investing in expensive in-house facilities.

Product Insights

On the basis of product segment, in 2024, the biologics segment held the largest market revenue share of 60.59%. This is attributed to the rising adoption of advanced therapies to treat various chronic diseases. Biologics such as monoclonal antibodies, recombinant proteins, vaccines, and cell-based therapies are increasingly being used in oncology, autoimmune disorders, and metabolic diseases, where conventional small-molecule drugs often fail to provide adequate outcomes. Their high therapeutic efficacy, targeted mechanism of action, and ability to address previously untreatable conditions have driven significant investment from pharmaceutical companies, thereby boosting demand for large-scale manufacturing support.

The biosimilars segment is the fastest growing over the forecast period owing to the growing number of patent expiries for blockbuster biologics and the rising demand for cost-effective alternatives in the U.S. healthcare system. Moreover, increasing pressure to reduce treatment costs, biosimilars offer a viable solution, creating strong incentives for their adoption across therapeutic areas such as oncology, autoimmune disorders, and metabolic diseases.

Service Insights

On the basis of service segment, the contract manufacturing segment held the largest market share of 68.38% in 2024. The growth of the market is due to the rising demand for large-scale biologics production and the increasing reliance of pharmaceutical companies on outsourcing. Manufacturing biologics requires significant capital expenditure, specialized facilities, and highly skilled expertise, which many drug developers prefer to access through CDMOs rather than building in-house capabilities.

The contract development segment is projected to witness the fastest growth owing to the increasing complexity of large molecule drug development and the growing presence of emerging biotech firms. Early-stage companies, which often lack the infrastructure and expertise to design robust development processes, are increasingly seeking CDMOs for services such as cell line development, process optimization, analytical testing, and formulation development.

Source Insights

On the basis of source, the microbial segment dominated the market with the largest revenue share in 2024, owing to the significant use of microbial expression systems, particularly Escherichia coli and yeast, in the production of biologics such as insulin, enzymes, growth hormones, and certain therapeutic proteins. Microbial systems are well established due to their relatively simple genetic manipulation, rapid growth rates, and cost-effectiveness in large-scale production, making them highly attractive for drug developers. Thus, these factors are contributing to the market growth.

The mammalian segment is anticipated to be the fastest growing segment over the forecast period due to the increasing complexity of biologics and the rising demand for advanced therapies. Mammalian expression systems, particularly Chinese Hamster Ovary (CHO) cells, have become the gold standard for producing monoclonal antibodies, recombinant proteins, and other glycosylated biologics that require complex folding and post-translational modifications.

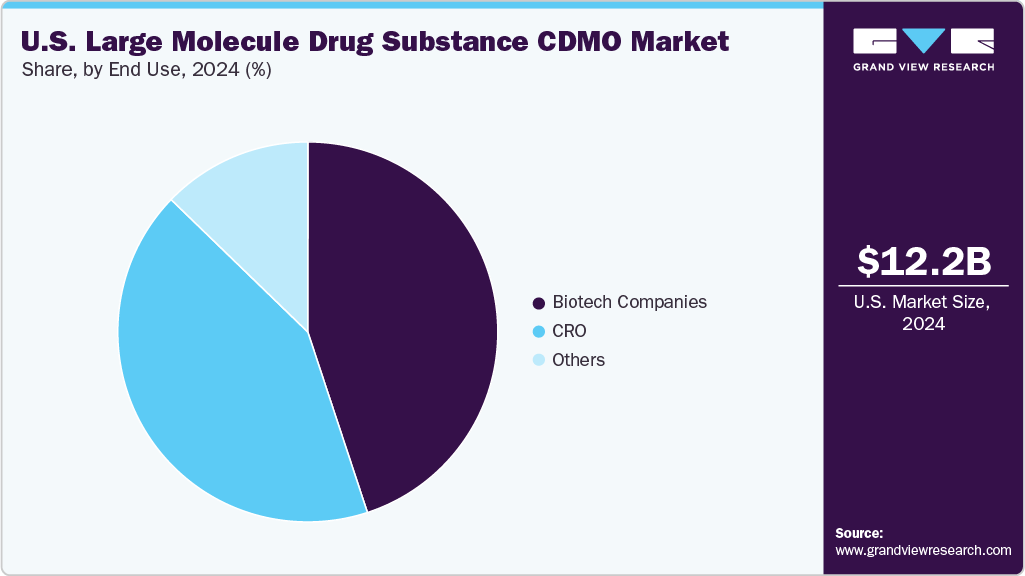

End Use Insights

On the basis of end use, the biotech companies segment held the largest share in 2024, owing to its significant role in advancing pipelines in the biologics and advanced therapeutics space. Biotech companies typically operate with limited infrastructure and financial resources, further increasing the demand for outsourcing manufacturing and development activities to CDMOs. These biotech companies majorly focus on early-stage research, discovery, and clinical validation of novel therapies, owing to which they outsource most of the activities, including process development, scale-up, and commercial manufacturing to CDMOs.

The contract research organizations (CROs) are the second fastest-growing segment in the market, driven by their essential role in supporting drug developers with specialized research, preclinical, and clinical trial services. Large molecule therapeutics such as monoclonal antibodies, recombinant proteins, and cell and gene therapies are moving through increasingly complex development pathways. Drug developers face challenges in managing time, cost, and regulatory requirements. Therefore, CROs help the companies by offering solutions in early-stage research, clinical trial design, patient recruitment, and data management, enabling companies, mainly emerging biotechs, to accelerate development timelines and reduce operational risks.

Key U.S. Large Molecule Drug Substance CDMO Company Insights

The U.S. large molecule drug substance CDMO industry is experiencing significant growth with the presence of several leading companies, include Lonza Group, Thermo Fisher Scientific, WuXi Biologics, among others. These firms offer comprehensive services from cell line development to commercial manufacturing, driving innovation and efficiency in biologic drug production.

Key U.S. Large Molecule Drug Substance CDMO Companies:

- Eurofins Scientific

- WuXi Biologics

- Samsung Biologics

- Catalent, Inc.

- Rentschler Biopharma SE

- AGC Biologics

- Recipharm AB

- Siegfried Holding AG

- Boehringer Ingelheim

- FUJIFILM Diosynth Biotechnologies

Recent Developments

-

In September 2025, Wuxi Biologics announced receiving GMP certification from Turkey’s regulatory authority (Türkiye İlaç ve Tıbbi Cihaz Kurumu, TITCK) for three of its manufacturing facilities (MFG1, MFG2, and DP5 in Wuxi) This underscores WuXi’s international quality compliance.

-

In February 2025, Eurofins announced of receiving several contracts in 2025 owing to its investment in the Mississauga site. The 2,000 L scale plant there came fully online, contributing to strong growth in H2 2024.

U.S. Large Molecule Drug Substance CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.08 billion

Revenue forecast in 2033

USD 22.56 billion

Growth Rate

CAGR of 7.06% from 2025 to 2033

Actual Data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, source, end use, country

Country scope

U.S.

Key companies profiled

Eurofins Scientific; WuXi Biologics; Samsung Biologics; Catalent, Inc.; Rentschler Biopharma SE; AGC Biologics; Recipharm AB; Siegfried Holding AG; Boehringer Ingelheim; FUJIFILM Diosynth Biotechnologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Large Molecule Drug Substance CDMO Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. large molecule drug substance CDMO market report based on product, service, source, and end use.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Biologics

-

Biosimilar

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Contract Manufacturing

-

Clinical

-

Commercial

-

-

Contract Development

-

Cell Line Development

-

Process Development

-

-

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Mammalian

-

Microbial

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biotech Companies

-

CRO

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. large molecule drug substance CDMO market size was estimated at USD 12.22 billion in 2024 and is expected to reach USD 13.08 billion in 2025.

b. The U.S. large molecule drug substance CDMO market is expected to grow at a compound annual growth rate of 7.06% from 2025 to 2033 to reach USD 22.56 billion by 2033.

b. Biologics segment dominated the U.S. large molecule drug substance CDMO market with a share of 60.59% in 2024. This is attributable to the rising adoption of advanced therapies to treat various chronic diseases along with their high therapeutic efficacy.

b. Some key players operating in the U.S. large molecule drug substance CDMO market include Eurofins Scientific; WuXi Biologics; Samsung Biologics; Catalent, Inc.; Rentschler Biopharma SE; AGC Biologics; Recipharm AB; Siegfried Holding AG; Boehringer Ingelheim; FUJIFILM Diosynth Biotechnologies

b. Key factors that are driving the market growth include increasing outsourcing trends by pharmaceutical and biotech companies to reduce costs, access specialized expertise, and accelerate drug commercialization. Moreover, the growing prevalence of chronic diseases is further driving the demand for biologics such as monoclonal antibodies, cell therapies, and gene therapies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.