- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Leather Goods Market Size, Industry Report, 2030GVR Report cover

![U.S. Leather Goods Market Size, Share & Trends Report]()

U.S. Leather Goods Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Genuine Leather, Synthetic Leather, Vegan Leather), By Type by Product, By Product, And Segment Forecasts

- Report ID: GVR-4-68040-228-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Leather Goods Market Size & Trends

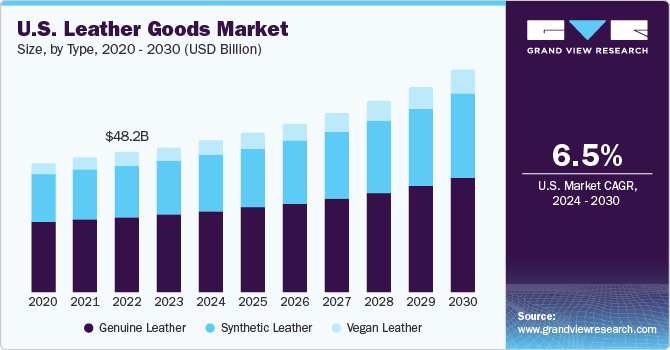

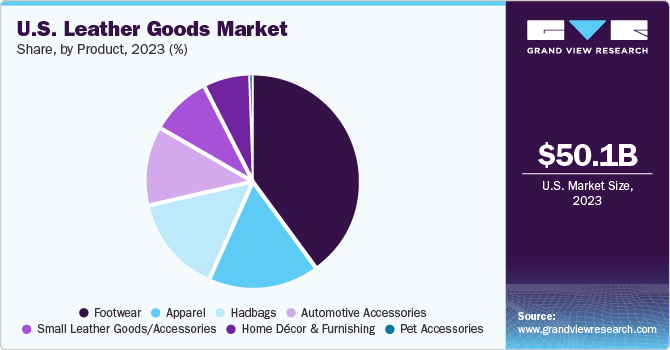

The U.S. leather goods market size was estimated at USD 50.08 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030. The market is primarily driven by surging disposable income of consumers, enhanced lifestyle standards, evolving fashion trends, and increasing domestic and international tourism. The growing demand for trendy, comfortable, and fancy leather clothes, footwear, as well as accessories, coupled with increasing brand awareness, is predicted to have a positive influence on the U.S. leather goods market.

The U.S. market accounted for a share of nearly 20% of the global leather goods market in 2023. Designers across the globe display novel fashion clothing through mediums such as fashion shows & events, thus enticing more customers towards leather clothing. Several design methods, such as Lamé, brocade, and applique, are broadly utilized on leather apparel and other stylish dresses. For instance, in September 2020, the Forever Leather Fashion show was organized in Shanghai, China. The show exhibited a variety of leather products, comprising a series of travel bags, cross-stitched trench coats, modern-style jackets, duffel bags, leather sneakers, and ankle boots. Such events help bring leather buyers, manufacturers, and designers from various regions/areas, on a large scale.

An escalating number of High-Net-Worth Individuals (HNWIs), paired with the increasing trend of designer and branded clothes in prime markets, such as the U.S., is augmenting the demand for leather products. Leather goods are elite and often exclusively priced. The demand for leather products is substantially rising in China due to the surging number of HNWIs and Ultra-High Net Worth Individuals (UHNWIs) in the nation.

Increasing cognizance regarding the harmful impacts of immoral practices in the production of apparel and footwear has thrusted the demand for sustainable products. Ecological fashion is sturdily enticing consumers as various reputed designers have been endorsing the notion of sustainability and environmentally friendly products. For instance, designers, such as Stella McCartney, have been endorsing sustainable fashion products, comprising footwear, in affordable stores, such as Zara and Top Shop, which is expected to boost the market for U.S. leather goods during the forecast period.

Moreover, numerous top brands are enlarging their product portfolios under the men's segment as fashion awareness is noted to raise among men and women. The segment for affordable luxury brands is on a growing end, in addition to traditional luxury brands. Consequently, numerous startups have developed tailored luxurious products that cater to the requirements of customers.

Market Concentration & Characteristics

The market growth stage is at medium, and the pace of growth is accelerating. This is owing to the fact that the U.S. market is highly concentrated as the country observes the presence of a large number of players operating here.

The increasing demand for and consumption of leather goods, primarily people from developing countries, have been encouraging market players to focus on innovating their offerings and produce products that are light weight in application and enquires less maintenance.

Market players primarily rely on mergers and acquisitions to gain market share, enter untapped markets, and expand their product portfolios. They plan strategic acquisitions to expand their presence and reinforce their positions in the market. In the near term, reputed companies are likely to acquire small- and medium-sized players operating in the leather goods market in a bid to facilitate regional expansion.

Players are often seen launching new products to gain traction and successfully establish their presence in the market. This also helps them to grow financially. Moreover, companies operating in this market are focused on innovations and the degree is therefore on a higher side.

Type Insights

The genuine leather goods led the market with a share of over 53% in 2023, followed by synthetic leather goods. Synthetic leather goods are less expensive than genuine leather products and are equally attractive in terms of design, which is driving their demand among consumers. Synthetic leather is primarily derived from artificial sources, such as Polyurethane (PU) and Polyvinyl Chloride (PVC). PU leather is considered to be more eco-friendly as compared to its vinyl-based counterpart, as it does not emit dioxins.

Vegan leather is projected to grow at the fastest CAGR of 8.3% from 2024 to 2030. The growth is attributed to the rising consciousness among people regarding animal cruelty. Various organizations such as PETA are actively endorsing the advantages of animal cruelty-free products and this is majorly affecting the market growth positively.

Product Insights

The leather footwear market accounted for a share of nearly 40% in 2023. Major players in the athletic footwear segment, such as Nike, New Balance, Adidas, Puma, Reebok, All birds, and Converse, have been venturing into leather athletic manufacturing, taking into consideration the increasing consumer demand for leather athletic footwear. For instance, in 2017, Nike, Inc. launched sneakers made from fly leather, a new material made by combining leftover leather scraps from tanneries and a polyester blend.

The leather automotive accessories market is projected to grow at a CAGR of 7.1% from 2024 to 2030. The increasing disposable incomes of consumers in the country and the resultant growth in sales of luxury cars and interior products are expected to drive the segment growth over the coming years.

Key U.S. Leather Goods Company Insights

The U.S. leather goods companies face intense competition from each other as some of them are among the top manufacturers of leather products, including various types of footwear, apparel, home decor, and luggage goods. These companies have large customer bases for their products in both, regional and international markets. Moreover, these market players have strong and vast distribution networks, which help them reach a larger customer base.

Key U.S. Leather Goods Companies:

- Adidas AG

- Nike, Inc.

- Puma SE

- Fila, Inc.

- New Balance Athletics, Inc.

- Knoll, Inc.

- Samsonite International S.A.

- VIP Industries Ltd.

- Timberland LLC

- Johnston & Murphy

Recent Developments

-

In October 2022, Dior unveiled its Cruize 2023 collection, which comprised leather accessories and products restructuring the traditional Andalusian spirit paired with latest and chic designs by Dior.

-

In July 2022, Nike introduced five novel sneakers, which includes the Air Force 1 Low '07' 'Fresh, Air Max 97 Coconut Milk and Black, and Air Trainer 1 'Midnight Navy, which are manufactured from various kinds of leather such as premium leather.

-

In April 2021, Adidas Ag declared the introduction of its new shoes, Stan Smith sneakers, which are manufactured from vegan leather. A mushroom-based material was used to produce these shoes. This new unveiling is a crucial plan of the company’s wider sustainability objectives to fulfill the surging demand for sustainable items in the market.

U.S. Leather Goods Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 52.32 billion

Revenue forecast in 2030

USD 76.53 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, type by product, product

Country scope

U.S.

Key companies profiled

Adidas AG; Nike, Inc.; Puma SE; Fila, Inc.; New Balance Athletics, Inc.; Knoll, Inc.; Samsonite International S.A.; VIP Industries Ltd.; Timberland LLC; Johnston & Murphy;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Leather Goods Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the latest industry trends and opportunities in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. leather goods market report based on type, type by product, and product.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Genuine Leather

-

Synthetic Leather

-

Vegan Leather

-

-

Type By Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Genuine Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

Synthetic Leather

-

Polyurethane Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

PVC Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

-

Vegan Leather

-

Handbags

-

Small Leather Goods/ Accessories

-

Apparel

-

Footwear

-

Home Décor and Furnishing

-

Pet Accessories

-

Automotive Accessories

-

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Handbags

-

Tote Bag

-

Clutch

-

Satchel

-

Others

-

-

Small Leather Goods/ Accessories

-

Wallets

-

Pouches

-

Card Holders

-

Phone Covers/Cases

-

Watch Straps

-

Others (Luggage Tags, Pencil Cases, etc.)

-

-

Apparel

-

Men

-

Shirts

-

Pants

-

Suits, Coats & Jacket

-

Overalls

-

Others (Kilts, Vests, Chaps, etc.)

-

-

Women

-

Skirts

-

Coats & Jackets

-

Pants

-

Others (Vests, Chaps, etc.)

-

-

Children

-

Suits, Coats & Jackets

-

Vests

-

Pants

-

Skirts

-

Chaps

-

-

-

Footwear

-

Athletic

-

Men

-

Women

-

Children

-

-

Non-athletic

-

Men

-

Women

-

Children

-

-

-

Home Décor and Furnishing

-

Decorative Wall Hangings’

-

Tabletop decorative items

-

Hanging Storage

-

Leather Furniture

-

Other

-

-

Pet Accessories

-

Pet Collar and Leads

-

Leather Pet Toys

-

-

Automotive Accessories

-

Seating Systems

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. leather goods market size was estimated at USD 50.08 billion in 2023 and is expected to reach USD 52.32 billion in 2024.

b. The U.S. leather goods market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 76.53 billion by 2030.

b. Leather footwear dominated the U.S. leather goods market with a share of 40% in 2023. This is attributable to the growing demand for leather athletic footwear, and the resultant product launch initiatives by major companies in recent years.

b. Some key players operating in the U.S. leather goods market include Adidas AG, Nike, Inc., Puma SE, Fila, Inc., New Balance Athletics, Inc., Knoll, Inc., Samsonite International S.A., VIP Industries Ltd., Timberland LLC, and Johnston & Murphy.

b. Key factors that are driving the market growth include the surging disposable incomes of consumers, enhanced lifestyle standards, evolving fashion trends, and increasing domestic and international tourism.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.