U.S. Limestone Market Size & Trends

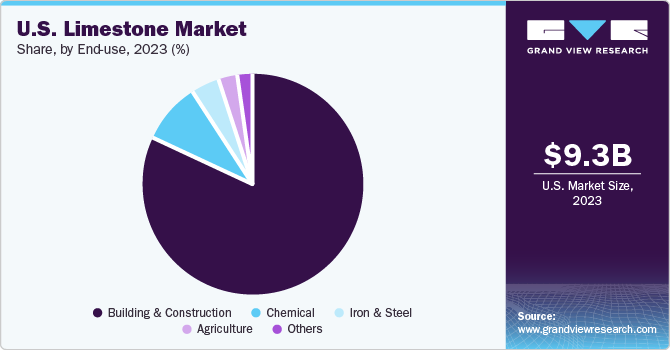

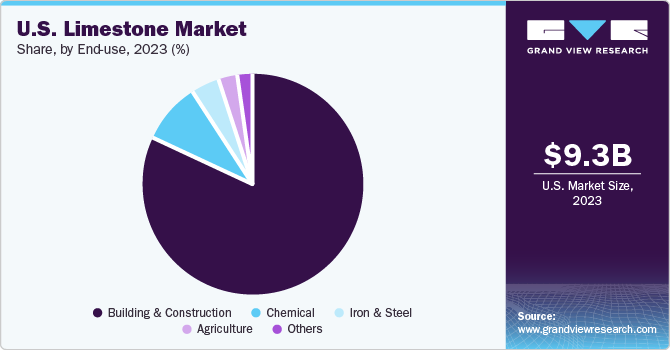

The U.S. limestone market was valued at USD 9.34 billion in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030. Increasing demand for limestone in various industries such as construction, agriculture, and water treatment is driving the market growth.

The construction industry uses limestone extensively owing to its unique properties, such as durability and resistance to weathering. Additionally, growth of the construction sector and infrastructural development in the U.S. are likely to further fuel the demand for limestone. The rising awareness about water safety has led to an increased use of limestone in water treatment plants for pH balancing and impurity removal. However, market growth is restrained by environmental regulations and availability of substitutes.

Environmental regulations related to mining and quarrying are becoming increasingly stringent, with an aim to minimize environmental impact. These regulations often require companies to invest in eco-friendly technologies and practices, which increases operational costs. Moreover, companies may face penalties for non-compliance, further affecting their profitability.

Market Concentration & Characteristics

The U.S. limestone market is moderately concentrated, with several key companies dominating the industry. These companies have a significant market share owing to their extensive product portfolio and services, strong brand recognition, and wide distribution networks.

The degree of innovation in the U.S. limestone market is moderate. Companies consistently invest in research and development (R&D) to enhance limestone quality and explore new applications. For example, the utilization of limestone in environmental applications such as water treatment and flue gas desulphurization stems from these innovative efforts.

The level of M&A activities in the U.S. limestone market is moderate. Companies often engage in M&A activities to expand their product portfolio, increase their market share, and strengthen their geographical presence. For instance, in September 2023, Graymont Limited acquired Compact Energy.

The limestone market is subject to various environmental regulations related to mining and quarrying, which can impact the market growth. Companies need to comply with these regulations to minimize the environmental impact of their operations.

There are substitutes available for limestone in certain applications. For example, in the construction industry, alternatives like crushed stone, sand, and gravel can be used. However, the unique properties of limestone make it irreplaceable in many applications.

The end-user concentration in the limestone market is high. The construction industry is the largest end-user of limestone, followed by the iron and steel, agriculture, and chemical industries.

End-use Insights

The building & construction segment dominated the U.S. market in 2023 with more than 81% revenue share. This dominance can be attributed to the extensive use of limestone in building & construction industry. Limestone’s unique properties such as durability, resistance to weathering, and versatility make it an ideal material for construction applications. It is commonly used in cement production, as a building stone, and even in the manufacturing of glass and ceramics.

The chemical segment is anticipated to register a CAGR of 6.1% from 2024 to 2030. As it is used as raw material across various chemical processes and products. Limestone is converted into calcium oxide (quicklime) and calcium hydroxide (hydrated lime), which are widely used in industries such as water treatment, metallurgy, paper & pulp, pharmaceuticals, and others.

Key U.S. Limestone Company Insights

The U.S. limestone market is concentrated with some of the key players like Minerals Technologies Inc., Imerys, CARMEUSE, Graymont Limited, and Omya AG dominating the market.

-

Minerals Technologies Inc. is a global specialty materials company that provides a wide range of products. Specialty Minerals, a division of Minerals Technologies Inc., manufactures fine industrial mineral products at its Adams, Massachusetts plant.

-

Imerys is a global leader in the production and distribution of high-quality limestone products. Limestone is extracted from quarries all around the world and processed into a wide range of products that are used in construction, paper, paint, plastics, rubber, adhesives, food and pharmaceuticals, agriculture and industry.

-

Carmeuse is a leading provider of lime and limestone, providing customers with specialty products that are less common in the industry and specific product mixes. Many of their products’ characteristics, including composition, particle sizing, and packaging, are customized based on the needs of the application.

Key U.S. Limestone Companies:

- CARMEUSE

- GLC Minerals LLC

- Graymont Limited

- Imerys

- Iowa Limestone Company

- Kerford Limestone

- Lafarge Holcim

- Minerals Technologies Inc.

- Omya AG

- United States Lime & Minerals Inc.

Recent Developments

-

In January 2024, Imerys reached a new milestone in the implementation of their lithium production project (The La Loue) for production of batteries. This is one step closer towards a bold aim of the creation of an integrated regional electrical vehicle value chain.

-

In September 2023, Graymont agreed to acquire Compact Energy, a significant lime processing facility strategically situated in Banting, in the state of Selangor, Malaysia.It will provide an additional390,000 tons of annual quicklime production capacity and 70,000 tons of hydrated lime production capacity that can cater to the demands of domestic and international markets.

-

In April 2023, Minerals Technologies announced three long-term precipitated calcium carbonate (PCC) supply agreements that will further expand the company’s Specialty Additives product line in China and India. This highlights the expanding penetration of the limestone market into other applications like paper and pulp.

U.S. Limestone Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 9.91 billion

|

|

Revenue forecast in 2030

|

USD 15.10 billion

|

|

Growth rate

|

CAGR of 7.3% from 2024 to 2030

|

|

Actual data

|

2018 - 2023

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

End-use

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Minerals Technologies Inc., Imerys, CARMEUSE, Graymont Limited, Omya AG, GLC Minerals LLC, Kerford Limestone, Lafarge Holcim, United States Lime & Minerals Inc., Iowa Limestone Company

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Limestone Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Limestone market report based on end-use: