- Home

- »

- Water & Sludge Treatment

- »

-

U.S. Liquid Waste Management Market, Industry Report, 2033GVR Report cover

![U.S. Liquid Waste Management Market Size, Share & Trends Report]()

U.S. Liquid Waste Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Category (CWT, Onsite Facilities), By Waste Type (Residential, Commercial), By Source (Municipal Textile), By Service (Collection, Transportation/Hauling), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-888-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

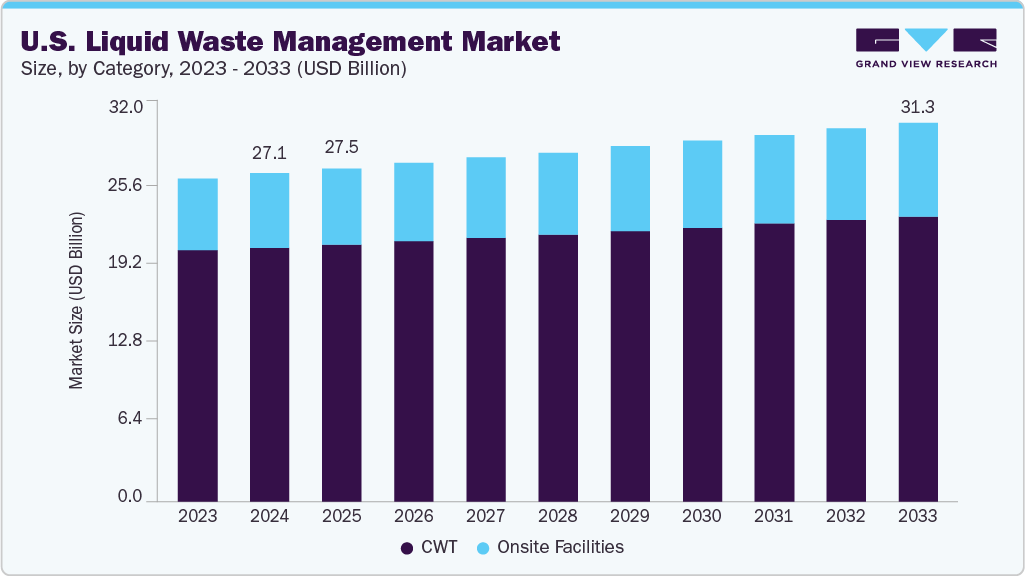

The U.S. liquid waste management market size was estimated at USD 27,088.6 million in 2024 and is projected to reach USD 31,340.5 million by 2033, growing at a CAGR of 1.9% from 2025 to 2033. The U.S. liquid waste management market is primarily driven by stringent environmental regulations imposed by agencies such as the EPA, pushing industries and municipalities to adopt safer waste handling and disposal practices.

Key Market Trends & Insights

- The liquid waste management market in the U.S. is expected to grow at a CAGR of 1.9% from 2025 to 2033.

- By category, onsite facilities segment is expected to grow at a considerable CAGR of 3.0% from 2025 to 2033 in terms of revenue.

- By waste type, commercial segment is expected to grow at a considerable CAGR of 2.3% from 2025 to 2033 in terms of revenue.

- By source, pharmaceutical segment is expected to grow at a considerable CAGR of 3.9% from 2025 to 2033 in terms of revenue.

- By service, treatment segment is expected to grow at a considerable CAGR of 2.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 27,088.6 Million

- 2033 Projected Market Size: USD 31,340.5 Million

- CAGR (2025-2033): 1.9%

Rapid urbanization and growing industrial output contribute to increased volumes of liquid waste, necessitating efficient management solutions.

Another key driver is the growing emphasis on sustainability and resource recovery from liquid waste streams. Advancements in treatment technologies enable the extraction of energy, nutrients, and clean water from waste, turning it into a resource. Federal and state-level funding for wastewater infrastructure upgrades is also fueling the adoption of modern liquid waste management systems. Moreover, the rise of circular economy practices is encouraging industries to minimize waste and maximize reuse, supporting market growth.

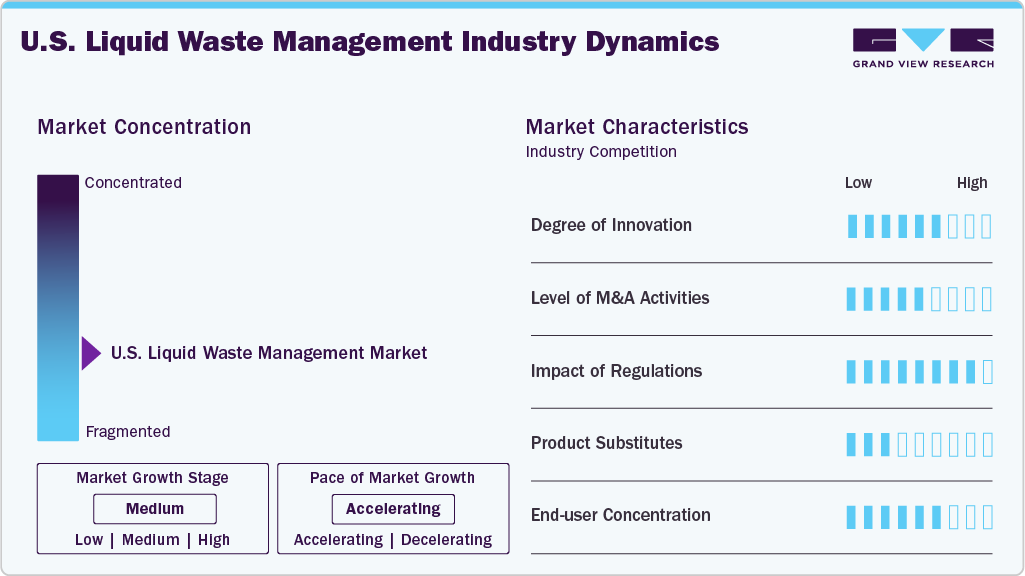

Market Concentration & Characteristics

The U.S. liquid waste management market is fragmented, with a mix of large national players and numerous regional and local service providers. While major companies hold notable market shares, a significant portion of the market is served by smaller firms offering specialized or localized services. This competitive structure limits dominance by any single entity. The fragmentation also encourages innovation and competitive pricing across different regions and service segments.

The U.S. liquid waste management industry shows moderate innovation, driven by the need for efficient, safe, and sustainable treatment technologies. New methods focus on resource recovery, automation, and real-time monitoring. Companies are adopting AI, IoT, and chemical-free treatment processes. Innovation is also targeting improved handling of hazardous and complex waste streams.

The industry experiences a steady level of mergers and acquisitions as larger firms acquire regional operators to expand their geographic reach and capabilities. M&A helps companies offer integrated services and enter new markets. Strategic partnerships are also common for accessing advanced technologies. This trend supports consolidation in certain service segments while maintaining overall market fragmentation.

Strict environmental and safety regulations significantly shape the liquid waste management industry in the U.S. Federal and state laws mandate proper disposal, treatment, and documentation of waste handling. Compliance drives investment in modern technologies and licensed facilities. Regulations also increase demand for professional waste management services across industries.

Drivers, Opportunities & Restraints

The U.S. liquid waste management market is driven by strict environmental regulations that mandate safe collection, treatment, and disposal of hazardous and non-hazardous liquid waste. Rising industrial activity across sectors such as chemicals, oil & gas, and healthcare contributes to increased waste generation. Urban population growth further adds pressure on municipal systems. In addition, growing awareness of health and environmental risks fuels demand for professional waste management solutions.

There is significant opportunity in developing advanced treatment technologies that enable resource recovery, such as water reuse and energy generation. Increasing adoption of circular economy principles encourages waste minimization and sustainable disposal practices. Growth in the pharmaceutical and biotech sectors also creates demand for specialized liquid waste services. Government infrastructure investments and public-private partnerships further support market expansion.

High operational and disposal costs can be a barrier for smaller waste generators and service providers. Regulatory complexity and frequent changes in environmental standards increase compliance burdens. Limited infrastructure in certain rural or underserved regions restricts service accessibility. In addition, improper segregation of liquid waste at the source can reduce treatment efficiency and increase environmental risks.

Category Insights

CWT segment dominated the market and accounted for a share of 77.4% in 2024, due to its ability to handle large volumes of complex industrial waste with standardized processes. These facilities are equipped with advanced technologies and permitted to treat a variety of hazardous and non-hazardous waste streams. CWTs are preferred by industries lacking in-house treatment infrastructure. Their regulatory compliance and economies of scale further strengthen their market position.

Onsite facilities are the fastest-growing category, driven by industries aiming to reduce transportation costs and increase control over waste handling. These systems offer real-time treatment at the source, improving efficiency and reducing environmental risk. Regulatory pressures and the need for immediate waste processing encourage adoption. Industries with high-volume or sensitive waste streams, such as pharmaceuticals and food processing, particularly benefit from this approach.

Waste Type Insights

Residential segment dominate the U.S. market and accounted for the share of 43.6%, due to the large volume of domestic wastewater generated from households. Municipal services manage sewage, greywater, and septic tank waste, making residential collection widespread and consistent. Public funding supports infrastructure development and upgrades in residential areas. Regular generation and predictable waste patterns ensure a steady demand for treatment services.

The commercial segment is the fastest growing due to rising waste volumes from sectors like hospitality, retail, offices, and healthcare facilities. Increasing regulatory scrutiny on proper disposal of fats, oils, greases, and medical liquid waste drives demand. Businesses are investing in contracted services and in-house systems for better compliance. Growing urban commercial developments further contribute to the segment’s rapid expansion.

Source Insights

Municipal segment accounted for a share of 70.9% in 2024 due to its responsibility for treating large-scale residential and community wastewater. Public utilities manage sewage and stormwater systems, ensuring broad coverage and consistent waste flow. Federal and state investments in municipal infrastructure support this dominance. The segment benefits from centralized treatment facilities with high processing capacity.

The pharmaceutical segment is the fastest growing due to the increasing volume of complex and hazardous liquid waste from drug manufacturing and research labs. Strict disposal regulations and the need for specialized treatment drive demand for advanced waste management services. Onsite and third-party treatment options are expanding to ensure safe, compliant handling. Growth in the life sciences sector further accelerates this trend.

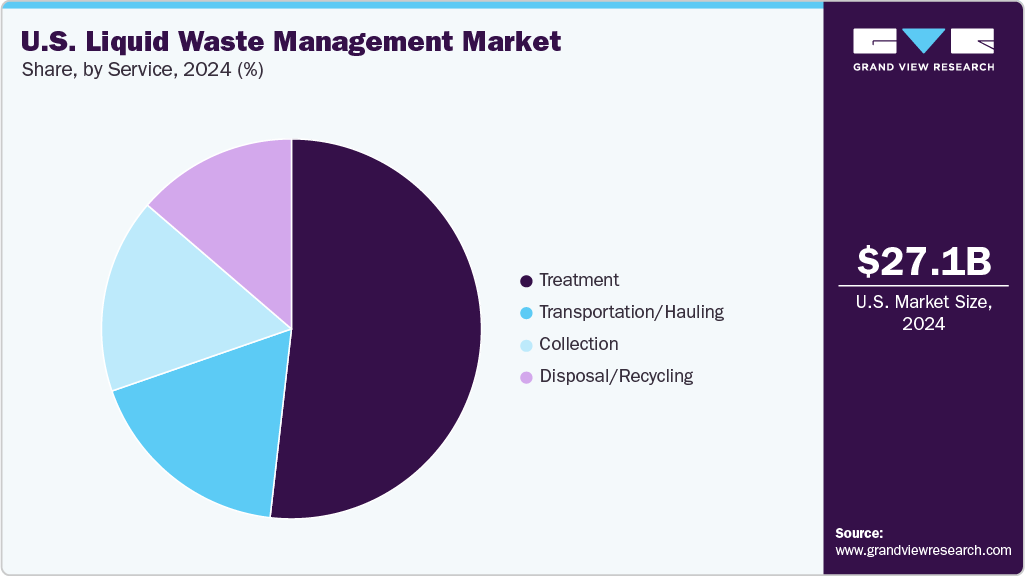

Service Insights

The treatment segment dominates the U.S. liquid waste management market and accounted for the 51.8% share, as it is essential for making waste safe for discharge or further processing. Municipal and industrial sectors rely heavily on physical, chemical, and biological methods to meet regulatory standards. High treatment volumes are driven by daily residential sewage and industrial effluents. Investment in advanced treatment technologies further supports this segment’s leading position.

The disposal and recycling segment is growing significantly due to rising focus on sustainability and resource recovery. Industries are increasingly adopting recycling solutions to reclaim water and recover valuable byproducts from waste streams. Regulatory incentives and environmental policies are promoting responsible disposal practices. This shift supports the development of circular economy models within waste management.

Key U.S. Liquid Waste Management Company Insights

Some of the key players operating in the market include Veolia, Waste Management Solutions, Clean Harbors

-

Veolia specializes in integrated liquid waste treatment solutions, offering advanced services tailored for industrial clients. The company focuses on managing hazardous and non-hazardous liquids through cutting-edge technologies, including chemical-neutralization and oil-water separation. Veolia’s operations emphasize circular economy principles by recovering resources like water and energy from waste. Its customized solutions help reduce environmental impact and ensure regulatory compliance for complex waste streams.

-

Waste Management Solutions delivers comprehensive liquid waste handling, from collection and transportation to treatment and final disposal. The company offers sector-specific services, particularly for automotive, manufacturing, and food processing industries. With a focus on safety and environmental responsibility, it ensures compliance with evolving state and federal regulations. Its scalable infrastructure allows it to manage both bulk and specialty waste efficiently.

Key U.S. Liquid Waste Management Companies:

- Veolia

- Waste Management Solutions

- Clean Harbors

- Clean Water Environmental

- DC Water

- Covanta Holding Corporation

- Stericycle, Inc.

- US Ecology, Inc.

- Republic Services, Inc.

- Hazardous Waste Experts

Recent Developments

-

In July 2024, Veolia Water Technologies Qatar, in collaboration with the Katara Project, inaugurated the country’s first large-scale treated wastewater reuse facility at Katara Cultural Village. The plant treats up to 15,000 m³ of wastewater daily, supplying high-quality water for irrigation and cooling. It significantly reduces freshwater consumption, saving between 5,000 and 15,000 m³ per day while lowering treatment costs.

-

March 25, 2024, Clean Harbors finalized the acquisition of HEPACO from Gryphon Investors in a $400 million cash deal. This move adds 40 locations across 17 U.S. states, along with 1,000 employees and 900 vehicles to its field services division. HEPACO, which earned $270 million in 2023 revenue, is projected to deliver around $30 million in EBITDA for 2024, with $20 million in expected annual cost synergies. The acquisition enhances Clean Harbors’ emergency response network and supports its Vision 2027 growth goals.

U.S. Liquid Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27,503.03 million

Revenue forecast in 2033

USD 31,340.55 million

Growth rate

CAGR of 1.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, waste type, source, services.

Country scope

U.S.

Key companies profiled

Veolia; Waste Management Solutions; Clean Harbors; Clean Water Environmental; DC Water; Covanta Holding Corporation; Stericycle, Inc.; US Ecology, Inc.; Republic Services, Inc.; Hazardous Waste Experts

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Liquid Waste Management Market Report Segmentation

This report forecasts revenue growth at U.S., and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. liquid waste management market report based on category, waste type, source, and services:

-

Category Outlook (Revenue, USD Billion, 2021 - 2033)

-

CWT

-

Onsite Facilities

-

-

Waste Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

Toxic & Hazardous Waste

-

Organic & Non-Hazardous Waste

-

-

Industrial

-

Toxic & Hazardous Waste

-

Organic & Non-Hazardous Waste

-

Chemical Waste

-

-

-

Source Outlook (Revenue, USD Billion, 2021 - 2033)

-

Municipal

-

Textile

-

Pulp & Paper

-

Iron & Steel

-

Automotive

-

Pharmaceutical

-

Oil & Gas

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2021 - 2033)

-

Collection

-

Transportation/Hauling

-

Treatment

-

Disposal/Recycling

-

Frequently Asked Questions About This Report

b. The U.S. liquid waste management market size was estimated at USD 27,088.6 million in 2024 and is expected to be USD 27,503.0 million in 2025.

b. The U.S. liquid waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 1.9% from 2025 to 2033 to reach USD 31,340.5 million by 2033.

b. Municipal segment accounted for a share of 70.9% in 2024 due to its responsibility for treating large-scale residential and community wastewater. Public utilities manage sewage and stormwater systems, ensuring broad coverage and consistent waste flow. Federal and state investments in municipal infrastructure support this dominance. The segment benefits from centralized treatment facilities with high processing capacity.

b. Some of the key players operating in the U.S. liquid waste management market include Veolia; Waste Management Solutions; Clean Harbors; Clean Water Environmental; DC Water; Covanta Holding Corporation; Stericycle, Inc.; US Ecology, Inc.; Republic Services, Inc.; Hazardous Waste Experts.

b. The U.S. liquid waste management market is driven by stringent environmental regulations and increasing industrial activity across sectors like healthcare, manufacturing, and oil & gas. Rapid urbanization and population growth add pressure on municipal waste systems. Additionally, growing awareness of public health and environmental safety fuels demand for effective waste handling solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.