- Home

- »

- HVAC & Construction

- »

-

U.S. Loader Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Loader Market Size, Share & Trends Report]()

U.S. Loader Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Backhoe, Skid Steer), By Engine Capacity (Up To 250 HP, 250-500 HP), By Propulsion Type, And Segment Forecasts

- Report ID: GVR-4-68040-252-1

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Loader Market Size & Trends

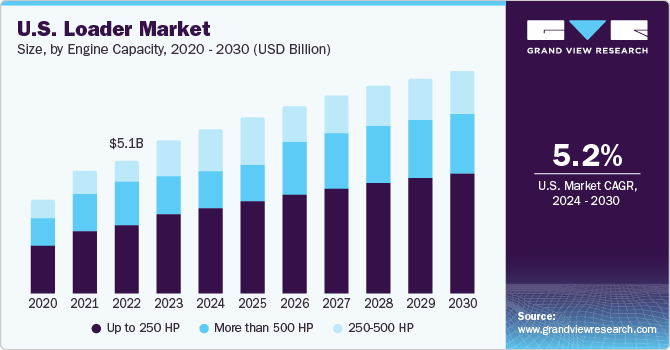

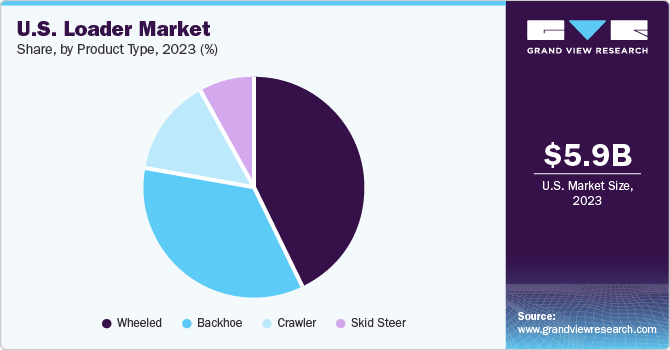

The U.S. loader market size was valued at USD 5.96 billion in 2023 and is anticipated to grow at a CAGR of 5.2% from 2024 to 2030. The loader demand in the country has risen significantly, owing to increasing investments in various infrastructure and construction projects. There has been an increased emphasis by the federal government on developing new infrastructure, including railroads, bridges, and tunnels, which is bolstering the need for loaders for earth moving and material handling purposes, among other applications that are commonly undertaken at construction sites. These investments are expected to grow further, in line with the rising demand for single-family housing redevelopment projects, which bodes well for the growth of the loader market over the forecast period.

The U.S. accounted for a revenue share of 18.41% in the global loader market in 2023. Technological concepts such as automation have resulted in several notable manufacturers in the country, such as John Deere, Caterpillar, and SANY upgrading their equipment to improve the performance of wheel loaders. Automation has become a necessity in construction operations, where several functions are of a repeatable nature. Trends such as automated loading that improves accessibility of loading operations and engine automation that reserves performance of heavy equipment by hibernating it during standby mode are expected to drive market expansion by encouraging manufacturers to launch advanced offerings. Moreover, major names are focusing on improving operator convenience by designing comfortable seating, extra high backrests, and windshield defrosters. For instance, Kubota’s R640 and R540 wheel loaders feature an enlarged front window and an all-glass full-sized window on the right side that provide a 360-degree operational view. Such initiatives are poised to boost demand for loaders across construction projects.

The positive outlook in the country’s construction sector is a major enabler for loader demand. According to a report published by the U.S. Census Bureau, in January 2024, the country’s expenditure on construction was valued at around USD 2.1 trillion. Factors such as population growth, urbanization, and shifts in regional demographics are influencing the demand for various types of construction projects, such as housing, schools, and healthcare facilities.There has been a surge in single-family homebuilding activities in the U.S., aided by declining mortgage rates, which have encouraged healthy sales for construction equipment. Loaders are required for quickly moving construction materials from one location to another; with housing construction generating a significant amount of debris, the need for loaders becomes paramount.

In the U.S., there has been a steady growth in the number of projects utilizing electric-powered construction equipment, with the aim to adhere to government regulations concerning sustainability in construction processes. Remarkable advancements in battery technology that have been witnessed in the past few years have transformed the performance and efficiency of loaders. The introduction of lithium-ion batteries, which offer higher energy density compared to conventional lead-acid batteries, has revolutionized the functionality of compact construction equipment. These batteries can also store more energy in a compact and lightweight form. Hence, machineries with lithium-ion batteries can operate on a single charge for an extended period without compromising performance. This increased energy density provides equipment such as loaders with greater power and enhanced lifting capacity.

Market Concentration & Characteristics

The market growth stage is moderate, and pace of market growth is accelerating. The growing focus on innovative technologies and their role in improving loader performance are expected to positively shape the industry. Ongoing developments in the field of advanced telematics systems are expected to transform the construction industry, allowing for seamless remote monitoring and control of construction equipment. For instance, in April 2023, Bobcat, a subsidiary of Doosan Corporation, launched its new Machine IQ telematics system, which enables customers to access machine data from any location and device at any time. The system allows continuous monitoring of machine health and remote tracking of essential information for improved maintenance, performance, and security, from remote computing devices.

The U.S. market for loaders includes a number of companies that have well-established operations, leading to increasing instances of mergers & acquisitions, as well as product launches. For instance, in March 2023, at the CONEXPO-CON/AGG trade show held in Las Vegas, Hyundai Construction Equipment Americas launched the HL985A, its largest-capacity wheel loader model. The HL985A wheel loader provides a standard bucket capacity of 7.0-m3 (9.1-yd3) for use in high-production works such as aggregates, quarrying, and large-volume material handling applications.

There is a significant weightage given by loader manufacturers to the adherence to regulatory policies and guidelines in the country. Currently, regulations have been put in place by various bodies such as the Occupational Safety and Health Administration (OSHA) concerning workplace safety and operator readiness; the U.S. Environmental Protection Agency for controlling emissions from heavy equipment; and standards developed by ANSI (American National Standards Institute) to ensure safety, reliability, and performance of the machinery. Stringent emission standards have compelled manufacturers to develop more electric- and battery-powered options, with ICE-based offerings expected to gradually become a less-preferred option.

Currently, there are hardly any direct substitutes for loaders. Manufacturers are striving to improve loader designs to make them smarter and more energy-efficient, leading to increased R&D investments. Innovations are focused on using lightweight but rigid raw materials as well as installing battery systems that can provide longer runtimes. Thus, the market is expected to face a low risk of substitutes in the coming years.

End-users in this market include major industries such as construction and mining, among others, which play a vital role in the loader value chain. Their involvement begins with identifying their specific operational needs and requirements, directly influencing the demand for loaders. End-users are responsible for properly utilizing, maintaining, and servicing loaders throughout their lifespan, ensuring optimal performance and durability. Manufacturers are witnessing an increased demand for ‘greener’ loader alternatives, which has accordingly developed their production processes.

Engine Capacity Insights

The up to 250 HP segment accounted for the largest revenue share of 51.86% in the U.S. market for loaders in 2023. This segment includes efficient and compact loaders, whose demand has increased greatly in recent years, as an increasing number of projects are focusing on using equipment that utilize lower power while also carrying out digging, earthmoving, and material handling tasks with greater reliability. Moreover, loaders with engine capacities less than 250 HP are perfect to use on delicate surfaces, as well as in tight spaces. Their lower maintenance requirements further add to their appeal. Consequently, the trend of compact loader launches has become more prevalent in recent years. For instance, Manitou has introduced the 1950 RT compact track loader with an output of 74 HP and a rated operating capacity of 1,950 lbs., with the aim to offer high performance and produce minimum emissions.

The more than 500 HP segment is expected to remain the second-biggest contributor to the U.S. market during the forecast period. The implementation and adoption of the Bipartisan Infrastructure Law (BIL) that aims to improve the road and rail infrastructure in the country has proven to be instrumental in boosting sales of high-engine capacity loaders. This capacity allows for increased productivity, enabling these machines to handle substantial loads and operate in demanding terrains with greater ease. The rapidly growing construction and mining activities in the country have driven the requirement for faster and more powerful equipment. Since loaders with more than 500 HP are capable of meeting these needs, they are widely deployed for large-scale construction projects, including the development of highways, bridges, and urban infrastructure.

Propulsion Type Insights

In terms of propulsion, the internal combustion engine (ICE) segment accounted for a dominant revenue share in the U.S. loader market in 2023. The widespread adoption of diesel loaders is attributed to their cost-effectiveness and fuel efficiency, addressing the economic considerations of industries engaged in material handling and construction tasks. Moreover, the robust and durable nature of diesel loaders increases their application in heavy-duty construction activities. Their versatility in navigating diverse terrains and efficiently handling heavy loads enhances their utility across various industries. The widespread availability of diesel fuel and ease of refueling are also contributing to ICE-powered loader demand in crucial applications.

Meanwhile, the electric segment is anticipated to advance at the fastest CAGR through 2030. An increasing interest in sustainable and eco-friendly solutions across industries in the United States has led to the growing demand for electric loaders. Currently, industries are focused on reducing their carbon footprint and minimizing their environmental impact, which aligns with the characteristics of electric loaders. Moreover, technological advancements in battery systems have enhanced the efficiency and performance of electric loaders, addressing concerns related to power and runtime. The decreasing costs of electric components and the availability of charging infrastructure are also supporting the growth of the electric loaders segment.

Many emerging companies are aiming to increase their footprint by launching electric offerings in the country. For instance, FIRSTGREEN Industries, which is the lone global manufacturer of commercial, electric, and zero-emission skid steer loader, announced its expansion in the U.S. in January 2024. The company stated that it had added dealerships in the states of Washington, Iowa, Illinois, Missouri, Maryland, and Ohio, and New York, bringing its count to around 20 dealerships in the country. The company’s products aim to significantly reduce emission levels due to their diesel-powered counterparts and reduce cost of ownership. These loaders are also 98% recyclable, which is expected to enhance their appeal among environment-conscious customers.

Product Type Insights

Based on product type, the wheeled loaders segment held the largest revenue share in the market in 2023. Wheeled loaders are widely in demand in construction and infrastructure projects owing to their versatility and mobility. The rising need for highly efficient material handling equipment from the agriculture and logistics sectors is also propelling their demand. The growing emphasis on technological advancements to increase operator comfort and machine performance has opened new avenues for wheeled loaders to meet evolving industry preferences. Besides, the shifting trend toward sustainability is encouraging the integration of eco-friendly technologies in wheeled loader designs, driving their demand. For instance, in March 2023, LiuGong North America announced the sale of its first battery EV, the 856H-E MAX Wheel Loader, to the Los Angeles County Sanitation Districts.

The skid steer loaders segment is projected to witness the fastest growth rate in the market during the assessment period. This segment is witnessing rapid growth owing to the compact size and improved maneuverability of these loaders. Their ability to navigate through confined spaces has also spurred their demand in construction and landscaping projects. Since these loaders are versatile and can handle various attachments, they have become a popular choice for diverse tasks. Moreover, their cost-effectiveness appeals to small and medium-sized businesses. The expansion of the U.S. construction industry has resulted in the need for efficient and versatile material handling and landscaping solutions, which are effectively addressed by skid steer loaders.

Key U.S. Loader Company Insights

There is significant competition in the U.S. market for loaders, owing to the availability of several established names aiming to attain a larger share of the countrywide revenue. The increasing number of construction projects in the country, coupled with focus on environment-friendly and low-emission solutions, has compelled manufacturers to improve their design and technology. New product launches, as well as mergers & acquisitions, are expected to remain major factors influencing company growth. Furthermore, global dealers of construction machinery are expanding their geographical footprints in the U.S., which is expected to result in substantial profits in the long term.

For instance, Ferronordic, a major European dealer of Volvo Construction Equipment, announced in December 2023 that it had acquired Rudd Equipment, marking the company’s entry in the U.S. market. The latter is the exclusive Volvo CE dealer in the entire states of Ohio, Indiana, and Kentucky, excluding two counties. Rudd Equipment’s territory further includes parts of Illinois, Missouri, West Virginia, Tennessee, Pennsylvania, and Maryland. This acquisition is expected to help Ferronordic drive its presence in developed markets.

Key U.S. Loader Companies:

- Caterpillar

- Komatsu

- CNH Industrial N.V.

- J C Bamford Loader Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery

- SANY Group

- Liebherr

- Deere & Company

- Manitou

Recent Developments

-

In January 2024, John Deere introduced the 444 G-Tier Wheel Loader, as part of the company’s shift towards performance tiering. The company states that this newly-launched wheel loader has a smaller size and lower operating weight in comparison to its 544 and 644 G-Tier range, while offering comparable durability and reliability. The machine offers additional features such as an optional high-lift to boost its reach and a debris package to reduce downtime and improve performance

-

In October 2023, CASE Construction Equipment, a brand of CNH Industrial N.V., introduced a line-up of small articulated loaders and mini track loaders, at the Equipment Expo held in Kentucky. This new range comprised the stand-on TL100 mini track loader and six small articulated loaders, which include a telescopic offering and an all-electric model to be launched in 2024. These solutions have been launched to help contractors finish more tasks while requiring less manual labor

-

In October 2023, JCB announced that it would start the construction of a new factory at a designated site in San Antonio, Texas for the company’s North American customers in early 2024. The 720,000 sq. ft. factory would become the company’s second facility dedicated to construction equipment in the region and would help the company in boosting its customer base and expanding its business operations

-

In June 2023, Caterpillar introduced the successor to its 994K wheel loader, the ‘Cat 995 Wheel Loader’, offering a higher payload and performance. The equipment provides up to 19% higher productivity and 6% greater hydraulic force, while also delivering close to 13% lower fuel consumption per hour. The loader has been designed to offer maximum operator comfort by increasing the legroom by 50% and reducing fatigue

U.S. Loader Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 8.67 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, propulsion type, engine capacity

Key companies profiled

Caterpillar; Komatsu; CNH Industrial N.V.; J C Bamford Loader Ltd.; Volvo Construction Equipment; Hitachi Construction Machinery; SANY Group; Liebherr; Deere & Company; Manitou

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Loader Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. loader market report based on product type, propulsion type, and engine capacity:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Backhoe

-

Skid Steer

-

Crawler

-

Wheeled

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Engine Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

Frequently Asked Questions About This Report

b. The U.S. loader market size was estimated at 5.96 billion in 2023 and is expected to reach 6.41 billion in 2024.

b. The U.S. loader market is expected to grow at an annual compound rate of 5.2% from 2024-2030 to reach 8.67 billion by 2030.

b. The up to 250 HP segment accounted for the largest revenue share of 51.86% in the U.S. market for loaders in 2023. This segment includes efficient and compact loaders, whose demand has increased greatly in recent years, as an increasing number of projects are focusing on using equipment that utilize lower power while also carrying out digging, earthmoving, and material handling tasks with greater reliability.

b. Some of the companies operating in the U.S. loader market include Caterpillar; Komatsu; CNH Industrial N.V.; J C Bamford Loader Ltd.; Volvo Construction Equipment; Hitachi Construction Machinery; SANY Group; Liebherr; Deere & Company; Manitou

b. Technological concepts such as automation have resulted in several notable manufacturers in the country, such as John Deere, Caterpillar, and SANY, upgrading their equipment to improve the performance of wheel loaders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.