- Home

- »

- Medical Devices

- »

-

U.S. Medical Carts Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Medical Carts Market Size, Share & Trends Report]()

U.S. Medical Carts Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Product (Computer Workstations, Medication Carts), By Application (Medical Documentation, Medical Equipment), By Type, By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68039-546-6

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

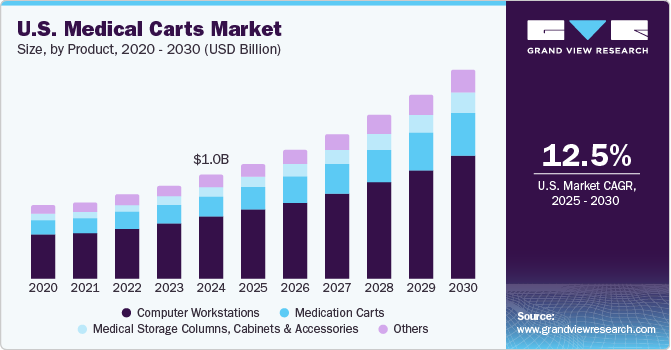

The U.S. medical carts market size was estimated at USD 1.01 billion in 2024 and is projected to expand at a CAGR of 12.54% from 2025 to 2030. Increasing adoption of Electronic Medical Records (EMR) in hospitals is a key factor driving the medical carts industry. The growing investments in healthcare by the government & private sector and the presence of key players in the U.S. are some of the key factors boosting the adoption of EMRs in hospitals.

According to statistics published on CMS.gov, in December 2024, U.S. healthcare expenditure increased in 2024. In 2023, healthcare spending grew by 7.5% to USD 4.9 trillion, or USD 14,570 per person. In 2024, the average annual health insurance premium increased by 6% for single coverage and 7% for family coverage. An increase in awareness among healthcare professionals and the adoption of patient engagement solutions in this country are key factors propelling the medical carts market growth. Medical errors are the 3rd leading cause of death, after heart disease and cancer. For instance, a Johns Hopkins study claims that above 250,000 people die annually from medical errors in the U.S. According to other research reports, the numbers are expected to be as high as 440,000. These estimates indicate that EMRs can help correct systemic errors.

In 90% of healthcare facilities, digital medical records are becoming the standard, necessitating a substantial need for medical laptop carts on wheels. These carts are getting more portable and advanced to better support doctors & nurses and meet the demands of the fast-paced healthcare industry. Moreover, the healthcare IT market in the U.S. is highly established compared to other countries. An increase in emphasis on efficient care delivery and adoption of healthcare IT solutions that assist in delivery are expected to boost the market in the coming decade.

The number of large hospitals in the U.S. is improving the demand for medical carts. According to the American Hospital Association, in 2024, there were around 6,120 total hospitals, including 20 Federal Government hospitals and 659 nonfederal psychiatric hospitals in the U.S. Similarly, as per the data published by the CDC, in 2021, there were around 139.8 million Emergency Department (ED) visits in the U.S. As per the same source, the number of ED visits resulting in hospital admission was around 18.3 million, and those resulting in admission to critical care units were around 2.8 million. Hence, the high number of emergency room visits, and the presence of several emergency care units are expected to boost the use of medical carts in these units.

Moreover, the rising prevalence of chronic diseases, such as cardiovascular disease, cancer, & diabetes, has led to an increase in the number of admitted patients. According to the American Heart Association, over 130 million adults, or 45.1% of the U.S. population, are projected to suffer from some form of CVD by 2035. Moreover, according to the CDC, about 655,000 Americans die from heart disease annually, one in every four deaths. In addition, the CDC states that six in 10 adults in the U.S. suffer from chronic disease, and four in 10 adults have two or more chronic diseases. Hence, the growing patient pool suffering from chronic diseases is increasing the overall number of hospital admissions. The significant increase in the number of hospitals and hospital admissions is boosting the demand for medical carts, propelling the market growth.

The physician-client relationship is becoming heavily reliant on technology. Using advanced equipment is essential whether a physician is documenting invasive surgery, biometrics, or gathering data. Robot-assisted surgery, simpler access to digital data, genome mapping, and assistive devices that may effortlessly raise bedridden patients are all instances of cutting-edge medical technology. As a result, these advancements may let physicians and nurses focus on diagnosing illnesses, provide better patient care, and remove monotonous duties from their workload.

Hence, these factors are expected to fuel the medical carts market growth. For instance, in July 2022, Holo Industries LLC launched a transformative HoloMed line of holographic inserts for medical carts, patient monitors, and other products that protect patients and hospital staff by virtually eliminating surface contact and touchpoints, thereby reducing the transmission of HAIs.

Furthermore, the adoption of mobile carts is increasing rapidly due to continuously evolving technology that offers better configuration, construction, options, and features to meet the requirements of consumers. To offer hassle-free caregiving to patients, the selection of an appropriate mobile cart is crucial. An increase in the demand for point-of-care diagnostic technology acts as a key driver for the medical carts market. For instance, in September 2020, Ergotron launched the StyleView pole Cart. The compact mobile cart is used to carry tablets & technological supplies to healthcare, industrial & educational environments. It also aids telehealth and remote learning.

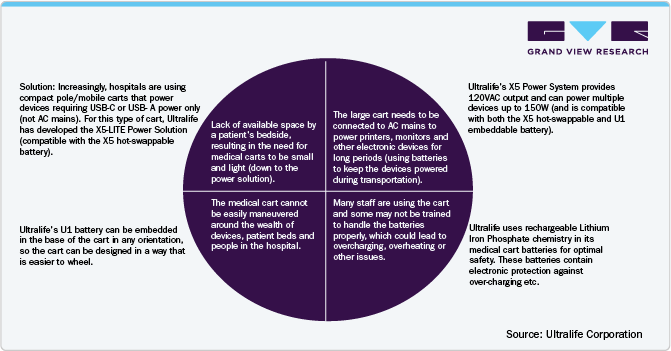

Ultralife a medical battery manufacturer, has been manufacturing medical cart-mountable power systems for more than a decade. The infographic below by the firm demonstrates the potential circumstances this equipment may encounter in the field and how to make sure the devices being transported are powered efficiently.

According to the firm’s officials, the infographic may be used by design engineers, electrical engineers, and original equipment manufacturers (OEMs) to gain additional insight into the significance of incorporating power solutions that tackle performance, reliability, and safety concerns. As an illustration: How does the power system enable the cart to properly power all of its electronic devices or fit into small spaces? What safeguards are built into the batteries to guard against misconduct?

Market Characteristics & Concentration

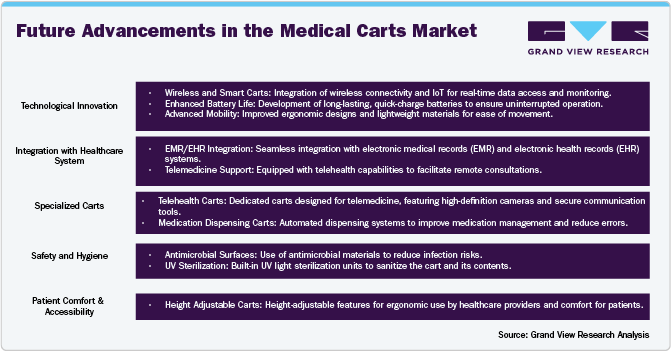

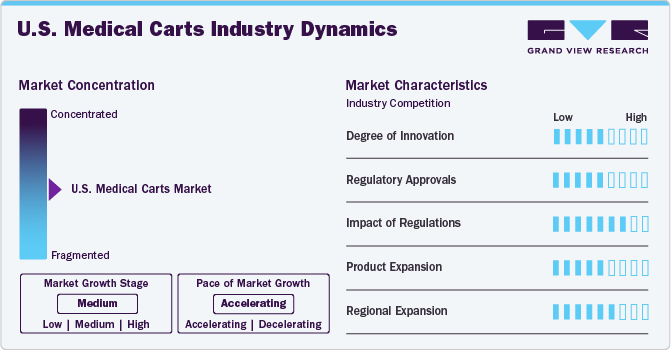

The market growth stage is moderate, and the pace of the market growth is accelerating. The medical carts market is characterized by a high degree of growth owing to rising chronic diseases, a surge in the geriatric population, a surge in the adoption of EMR, and technological advancements. In addition, the growth of telehealth services, the expansion of hospitals, clinics, and outpatient facilities and the need to reduce medication errors and improve patient care quality encourage the adoption of specialized medication dispensing carts and telehealth carts.

Key strategies implemented by players in the medical carts market are new product launches, expansion, acquisitions, partnerships, and other strategies. In January 2023, Capsa Healthcare announced the acquisition of Tryten Technologies Inc. Tryten is a designer and manufacturer of lightweight, easy to maneuver mobile cart solutions.Capsa Healthcare provides a wide range of mobile computer workstations, wall-mount arm platforms, and solutions for modern medication administration.

Capsa's product portfolio includes the Trio, M38e, MedLink, T7, and SlimCart mobile workstations, as well as the industry-leading V6 wall mount solution. The integration of Tryten's mobile carts complements Capsa's point-of-care solutions, providing a novel approach with the potential to develop both virtual and patient-centered healthcare delivery.

The U.S. market exhibits a high degree of innovation, driven by advancements in wireless connectivity, integration with Electronic Medical Records (EMR), and the development of ergonomic mobile designs. Innovations such as antimicrobial surfaces and automated medication dispensing systems are enhancing functionality and safety, meeting the evolving needs of healthcare providers and improving patient care. This continuous innovation ensures that medical carts remain a critical component of modern healthcare infrastructure.

Regulatory agencies, such as the U.S. Food and Drug Administration (FDA) in the U.S. establish stringent regulations governing the design, manufacturing, and marketing of medical devices, including medical carts. Compliance with regulatory standards is mandatory to ensure patient safety and product efficacy.In the U.S., medical carts may require pre-market approval (PMA) or 510(k) clearance from the FDA before they can be legally marketed and sold.

Regulations profoundly impact the medical carts market by shaping product development, manufacturing practices, market access, patient safety, and post-market surveillance. Compliance with regulatory requirements is essential for manufacturers to ensure the safety, efficacy, and quality of medical carts and maintain trust among healthcare providers, regulatory agencies, and patients.

Product expansion in the U.S. market is driven by the development of specialized carts tailored to diverse healthcare needs. Innovations include telehealth carts equipped with advanced communication tools, medication dispensing carts with automated systems for error reduction, and ergonomic designs for enhanced mobility and user comfort. This expansion is meeting the growing demand for versatile, technology-integrated solutions in modern healthcare environments.

The U.S. market is characterized by a blend of fragmentation and consolidation. While the market includes numerous small and medium-sized enterprises offering specialized products, recent trends show consolidation through mergers and acquisitions by larger players aiming to expand their product portfolios and market reach. Competitive analysis reveals that major companies like Midmark Corporation, Capsa Healthcare, and Ergotron lead the market with extensive distribution networks and continuous innovation, driving overall market growth.

The U.S. market is experiencing significant regional expansion, driven by the growth of healthcare facilities in both urban and rural areas. Increased investments in healthcare infrastructure, particularly in underserved regions, are boosting the demand for advanced medical carts. This expansion ensures better access to modern healthcare tools, enhancing the overall efficiency and quality of patient care across the country.

Product Insights

Computer Workstations dominated the market in 2024.Computer workstations integrated into medical carts facilitate healthcare providers access to Electronic Health Records (EHR) and patient data at the point of care. This integration enhances workflow efficiency, reduces documentation errors, and advances clinical decision-making, thereby driving demand for medical carts with integrated computer workstations. Moreover, it offers the flexibility to move seamlessly between patient rooms, clinics, and other care settings while maintaining access to digital health information.

Furthermore, these workstations feature advanced technology integration, including touchscreen displays, barcode scanners, and RFID readers. These technologies enable healthcare providers to perform tasks such as medication verification, specimen tracking, and inventory management more efficiently, thus fueling the segment growth. Moreover, a surge in telemedicine and remote work propels the market for medical carts integrated with computer workstations by providing a platform for virtual consultations, remote monitoring, & telepresence. Therefore, the aforementioned factors are expected to drive the segment growth in the coming years.

Medical storage columns, cabinets & accessories segment is expected to register the fastest CAGR during the forecast period, due to increased usage of these products in big hospitals, ambulatory care centers, clinics, and physician’s offices. The need for proper medication management and the associated benefits of using these products are likely to contribute to segment growth.

Healthcare providers seek efficient storage solutions to manage the growing volume of medical supplies, equipment, & inventory while maximizing space utilization and improving workflow efficiency. Medical storage columns, cabinets, & accessories offer customizable storage configurations, adjustable shelving, & modular designs that enable healthcare facilities to organize & access supplies easily, reducing clutter and enhancing inventory management processes.

Technological advancements in medical storage solutions are also driving market growth. Integrated Radio Frequency Identification (RFID) and barcode tracking systems provide real-time visibility into inventory levels, expiration dates, and usage patterns, enabling healthcare providers to optimize inventory levels, reduce stockouts, and minimize waste. Its automated dispensing and retrieval systems enhance efficiency by streamlining the storage & retrieval of medical supplies, enabling quick access to critical items when needed.

Application Insights

The medication delivery segment dominated the market in 2024.Medical carts play a crucial role in medication delivery within healthcare facilities, providing a versatile platform for safely storing, transporting, and administering medications to patients. Continuous development in the field of healthcare, and IT and the introduction of advanced products with more benefits can be attributed to segment growth. Manufacturers design innovative products with ergonomic solutions that help increase productivity, prevent musculoskeletal disorders, and help the nursing staff. These types of carts are in high demand in long-term care facilities and hospitals.

The Telehealth workstation segment is expected to register the fastest CAGR during the forecast period.The telehealth workstation is a key application within the medical carts market, driven by the increasing adoption of telemedicine practices. These workstations are designed to support remote consultations, diagnostics, and patient monitoring, enabling healthcare providers to deliver care efficiently across distances.

Key drivers include the rising demand for remote healthcare services, advancements in telecommunication technologies, and the need for efficient healthcare delivery in rural and underserved areas. The integration of high-resolution cameras, secure communication platforms, and user-friendly interfaces in these workstations enhances their functionality, making them essential tools in modern healthcare settings.

Medical carts promote patient safety by facilitating accurate medication administration and adherence to established protocols and guidelines. With built-in features such as barcode scanning, electronic Medication Administration Records (eMAR), & medication verification systems, medical carts help healthcare providers verify patient identities, check medication orders, ensure correct dosing & administration routes, reducing the risk of medication errors as well as adverse drug events.

In addition, growing awareness among healthcare professionals & patients, government initiatives to implement telehealth services, and an increase in the demand for expanded telehealth access through mobile solutions that help in combined video conferencing & onboard diagnostics are major factors anticipated to drive the segment in the coming years.

Type Insights

Emergency carts dominated the market in 2024. Emergency carts, often known as crash carts, are essential for delivering rapid and life-saving interventions during medical emergencies. These carts enable healthcare providers to respond quickly and effectively to medical emergencies, delivering essential medications, equipment, and supplies directly to the point of care. This rapid response capability is critical for stabilizing patients and initiating life-saving interventions, such as Cardiopulmonary Resuscitation (CPR), defibrillation, & emergency medication administration, in time-sensitive situations. Thereby, a surge in such situations leads to increasing adoption of these carts.

Procedure carts are expected to register the fastest CAGR during the forecast period. The procedure cart segment is expected to gain popularity in the coming years due to its consistent usage in several healthcare settings. Procedure carts improve clinical workflows by allowing healthcare providers convenient access to the supplies, medications, & equipment required to carry out procedures effectively and efficiently. These carts improve overall workflow efficiency in crowded healthcare facilities by combining everything required for particular procedures into a single, movable unit.

These products are especially helpful in operating procedures, such as cardiology & endoscopy, as well as providing access to essential therapeutics. There are various types of procedure carts, including portable, adjustable, and powered. They are sanitary and movable storage solutions that support surgical procedures in operating rooms. These carts help reduce the risk of cross-contamination by eliminating dust during the storage of supplies and instruments in small spaces. Thus, the aforementioned factors are expected to drive market growth.

End Use Insights

Hospitals dominated the market in 2024. Hospitals serve as the primary end users of medical carts, accounting for a significant portion of the overall market demand. The segment is expected to continue driving growth in the medical carts market, fueled by ongoing investments in healthcare infrastructure, technological advancements, and patient-centered care initiatives. For instance, as per the research article published in UC Regents, in August 2022, UC Davis Medical Center invested over USD 30,000 in donations to introduce CARE Carts, which was expected to make patients more comfortable and help them adjust to the hospital.

Moreover, hospitals encompass several departments, including emergency rooms, operating theaters, intensive care units, medical-surgical units, and outpatient clinics, each with distinct requirements for medical cart functionality & design. Hospital administrators and clinical staff rely on medical carts to support efficient patient care delivery, enhance workflow productivity, and maintain high standards of safety & infection control. Thus, the demand for innovative medical carts tailored to hospital workflows and clinical specialties is expected to increase, driving market expansion.

Physician offices/ clinics/office-based labs segment is expected to register the fastest CAGR of 14.2% during the forecast period.This can be attributed to an increase in awareness and demand for one-stop solutions that require less space & can be used for all medical requirements, as these carts include medicine, medical equipment, computers, storage cabinets and mobile. Physician offices, clinics, and office-based labs require versatile and mobile solutions to support diverse clinical activities and patient care needs. Hence, the rise in adoption of mobile workstations is expected to propel segment growth.

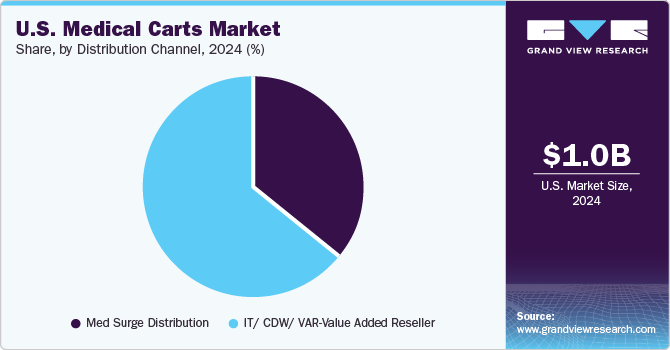

Distribution Channel Insights

IT/ CDW/ VAR-Value Added Reseller segment dominated the market in 2024 and is expected to witness growth at the fastest CAGR. These channels act as intermediaries between manufacturers and end users, offering expertise in technology integration, customization, & customer support. IT/CDW/VAR partners possess specialized knowledge & expertise in healthcare technology solutions, enabling them to understand the unique requirements and challenges of healthcare providers. They offer guidance and recommendations on selecting the most suitable medical cart solutions tailored to specific clinical workflows, environments, and integration needs.

Moreover, IT/CDW/VAR partners play a vital role in integrating medical cart solutions with existing IT infrastructure, EHR systems, and clinical software applications. They offer customization services to configure carts according to end-user preferences, ensuring seamless compatibility & functionality within healthcare environments.Thereby, due to the aforementioned factors, the segment is likely to witness considerable growth over the forecast period.

Medical surge distribution channels are expected to register a considerable CAGR during the forecast period.Medical surge distribution channels play a pivotal role in ensuring the efficient & timely delivery of essential medical supplies and equipment, including medical carts, during increased demand or emergencies such as pandemics or natural disasters. The distribution channels for medical carts typically involve a network of manufacturers, distributors, wholesalers, and healthcare providers working collaboratively to meet the urgent needs of healthcare facilities. By leveraging efficient distribution networks, supply chain resilience, collaboration, & technology integration, stakeholders can effectively address surge capacity needs, enhance patient care delivery, and mitigate the impact of emergencies on healthcare systems.

Key U.S. Medical Carts Company Insights

Capsa Healthcare, Ergotron, and Midmark Corporation are some of the major players in the U.S. market. The medical carts market has been witnessing notable trends that are impacting the activities of emerging players in the industry. Major manufacturers compete based on factors such as product quality, innovation, pricing, customization capabilities, and customer service.

Continuous technological advancements, regulatory compliance requirements, and changing buyer preferences contribute to intense competition, driving companies to differentiate their offerings and expand their market presence.

Key U.S. Medical Carts Companies:

- Medline Industries, Inc.

- Ergotron, Inc.

- Midmark Corporation

- The Harloff Company

- Waterloo Healthcare (Bergmann Group)

- AFC Industries, Inc.

- Capsa Healthcare

- Enovate Medical

- GCX Corporation (Jaco, Inc.)

- Altus, Inc.

- TouchPoint Medical

Recent Developments

-

In January 2025, MACHAN and its subsidiary brand, BAILIDA, will showcase their latest smart medical carts at HIMSS 2025, held from March 3 to 6 in Las Vegas. These innovative solutions integrate computer and medication carts with advanced electronic controls and management software to revolutionize healthcare workflows.

-

In November 2024, Advantech launched the AIM-68H medical tablet, which integrates into various clinical environments. It enhances healthcare delivery with real-time data monitoring, medical imaging, and equipment control.

-

In March 2024, GCX, launched its GCX Tablet Roll Stand to ensure safe, secure access to patient services and medical records from anywhere in the hospital. The carts are effortlessly maneuverable and include a fixed or adjustable height tablet arm for excellent viewing and access to video conferencing, electronic medical data, and patient care.

-

In October 2023, Ergotron acquired Enovate Medical, a manufacturer of nurse-ready workstation solutions and services that improve clinical workflows and facilitate real-time Electronic Health Record (EHR) charting at the point of care. Through this transaction, the merged firms might become the U.S. leader in offering ergonomic workflow solutions for healthcare.

-

In July 2023, Midmark Corp. announced its 2023 workstation promotion. The objective of the initiative is to guarantee that healthcare institutions have access to mobile workstations that are easy to use and ergonomic, which can enhance the experience between patients and caregivers.

U.S. Medical Carts Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.12 billion

Revenue forecast in 2030

USD 2.0 billion

Growth rate

CAGR of 12.54% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, application, type, end use, distribution channel

Country Scope

U.S.

Key companies profiled

Medline Industries, Inc.; Ergotron, Inc.; Midmark Corporation; The Harloff Company; Waterloo Healthcare (Bergmann Group); AFC Industries, Inc.; Capsa Healthcare; Enovate Medical; GCX Corporation (Jaco, Inc.); Altus, Inc.; TouchPoint Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Carts Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical carts market report based on product, application, type, end use and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Computer Workstations

-

Energy Source

-

Powered

-

Non-powered

-

-

Configuration

-

Wall-mounted

-

Mobile

-

-

Medication Carts

-

Medical Storage Columns, Cabinets & Accessories

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Documentation

-

Medical Equipment

-

Medication Delivery

-

Telehealth Workstation

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Anesthesia Carts

-

Emergency Carts

-

Procedure Carts

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Physician Offices/ Clinics/ Office Based Labs

-

Skilled Nursing Facilities

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Med Surge Distribution

-

IT/ CDW/ VAR-Value Added Reseller

-

Frequently Asked Questions About This Report

b. The U.S. medical cart market size was estimated at USD 1.01 billion in 2024 and is expected to reach USD 1.12 billion in 2025.

b. The U.S. medical cart market is expected to grow at a compound annual growth rate of 12.54% from 2025 to 2030 to reach USD 2.02 billion by 2030.

b. In 2024, the computer workstations segment dominated the U.S. medical cart market and accounted for the largest revenue share of 59.87%. The surge in telemedicine and remote work propels the demand for medical carts integrated with computer workstations, which provide a platform for virtual consultations, remote monitoring, and telepresence. The aforementioned factors are expected to drive the segment's growth in coming years.

b. Some of the key players operating in the U.S. medical cart market include Medline Industries, Inc., Ergotron, Inc., Midmark Corporation, The Harloff Company, Waterloo Healthcare (Bergmann Group), AFC Industries, Inc., Capsa Healthcare, Enovate Medical, GCX Corporation (Jaco, Inc.), Altus, Inc., TouchPoint Medical.

b. Key factors that are driving the U.S. medical cart market growth include increasing incidence of Musculoskeletal Injuries (MSI) among caregivers, growing demand for mobile computer carts in critical surgical procedures, rapid increase in the volume of hospitals & urgent care centers, and increase in adoption of the electronic medical records in hospitals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.