- Home

- »

- Next Generation Technologies

- »

-

U.S. Metaverse Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Metaverse Market Size, Share & Trends Report]()

U.S. Metaverse Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Platform, By Technology (Blockchain, Virtual Reality (VR) & Augmented Reality (AR), Mixed Reality (MR)), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-187-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

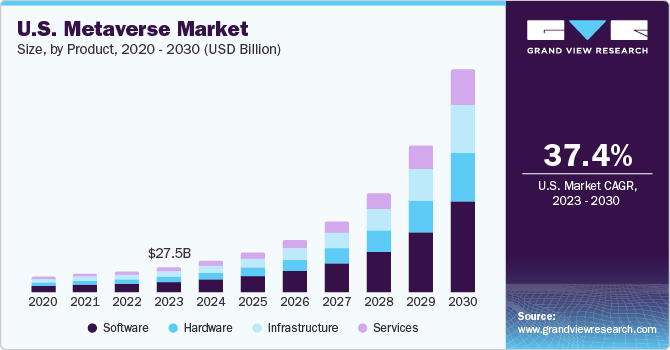

The U.S. metaverse market size was estimated at USD 27.50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 37.4% from 2023 to 2030. The increasing emphasis on conveying digital and real worlds through the internet is one of the major factors driving the market growth. In addition, the digital twins have become more powerful and complicated as their capabilities and complexity grow. However, system and data interaction across entire business ecosystems may be required to realize their full potential. The emergence of metaverse technology is expected to drive the digital revolution and affect every aspect of human life. The concept of an immersive internet as a massive, persistent, unified, and shared domain lies at the core of the metaverse. At the same time, the metaverse is advancing due to the increasing implementation of emerging technologies such as 5G, extended reality, and artificial intelligence.

With the rapidly increasing adoption of social media and the sturdy drive toward more social and complex gaming experiences, the metaverse has gained huge significance for leading companies. Most virtual environments or games being created in the metaverse are now selling their possessions, avatars, and all operational equipment as NFTs. The cost of digital belongings is increasing in comparison with their physical counterparts. For instance, Meta Mall is a metaverse platform that enables users to develop, own, stake, and real estate, virtual real estate in the form of non-fungible tokens (NFTs).

In addition, prominent companies are majorly investing in developing innovative metaverse and creating a competitive edge in the market. For instance, in June 2022, the U.S. division of electronic giant Samsung launched its official Discord server. The company continues to expand its presence in the Web3 sphere. Previously, it introduced “Samsung 837X”, an immersive metaverse experience within Decentraland, and “Samsung Superstar Galaxy” on Roblox.

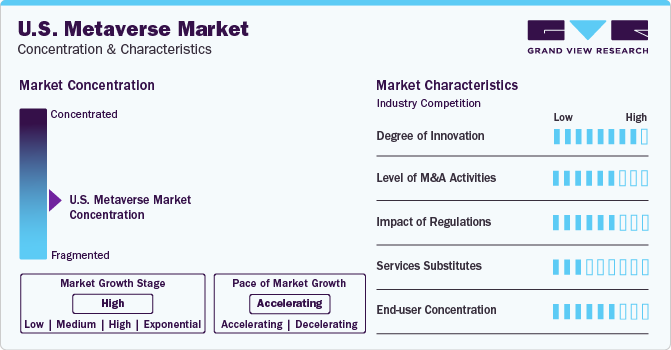

Market Concentration & Characteristics

The degree of innovation for the global metaverse market is observed to be on the higher side owing to the growing acceptance of mixed reality interfaces, which combine real and simulated worlds. Moreover, the growing interest of consumers in solutions backed by technologies such as blockchain is further anticipated to encourage solution providers to focus on innovative products in the coming years.

The metaverse market is characterized by a moderate level of merger and acquisition (M&A) activity, reflecting the industry's rapid evolution. Several key players are strategically acquiring startups to enhance their capabilities and gain a sizable market share in the U.S. market. Moreover, increasing geo-political concerns such as the U.S. - China trade war are encouraging key players to make strategic decisions on M&A activities in order to establish dominance in the U.S. market.

The growing focus of government authorities on ensuring data security owing to the rising number of cyber-attacks has enabled regulatory bodies to introduce regulations in the interest of personal data security. As a result, solution providers are focusing on opting for advanced technologies that ensure maximum data security. Thus, the impact of regulations is anticipated to moderately affect the metaverse market.

The metaverse technology is in the nascent stage of development. As a result, several companies are focusing on leveraging this technology to introduce advanced solutions, enhance the capabilities of existing solutions, and offer seamless customer experience. However, there is hardly any possibility of substitutes emerging and overpowering the metaverse in the coming years.

The end-user concentration is observed to be at a moderate level, considering the growing number of industry-specific use cases in the metaverse market. With the growing prevalence of metaverse in day-to-day business operations, the end-user concentration is expected to diversify across several industry verticals over the forecast period.

Product Insights

The software segment accounted for over 39% of the U.S. market in 2023 and is expected to expand significantly over the forecast period. Emerging demand for virtual communication in the entertainment and gaming industry is augmenting the software segment. An increase in investment in 3D avatar technology by leading technology companies and the implementation of virtual and augmented reality technology in various industries are also some emerging trends subsidizing market growth.

The services segment is expected to grow considerably over the forecast period. Numerous metaverse players are implementing digital world services to showcase the services and products in the virtual world to achieve real-world experience. Moreover, the increasing number of potential metaverse solution users and the rising need for companies to provide better customer experience is expected to drive the segment growth over the forecast period.

Platform Insights

Based on platform, the desktop segment accounted for the largest revenue share of over 41% in 2023. The increasing prominence of virtual desktops and the rising trend of PC games across the globe is fueling the growth of the desktop segment. A strong desktop computer with processing and graphics power to generate VR experiences that are currently only available on PCs in high resolutions (up to 4k) and at high framerates (up to 120 Hz) works well in conjunction with AR/VR headsets such as Oculus Quest, HTC Vive, and Valve Index Increasing developments in both consumer and business spaces is a major factor driving market revenue growth of this segment.

The headsets segment is expected to propel considerably over the forecast period. Market players are also developing advanced technology products in order to gain a competitive edge in the market. For instance, MR headsets introduced by Vuzix known as Blade, are powered by Amazon’s voice assistant- Alexa. The headset comes with a built-in camera, microphones, and a touchpad pairable by both iPhones and Android phones. This headset provides display notifications and videos from the paired device having a battery life of 2-12 hrs. For another instance, in February 2023, Google LLC launched a graphics rendering service based on the cloud named ‘XR Immersive Stream.’ The said service shall utilize the graphics processing unit of Google Cloud and deliver high-quality videos and images to any device.

Technology Insights

The virtual reality (VR) and augmented reality (AR) technology contributed to the largest revenue share of over 34% in 2023. Augmented Reality (AR) is a new age discovery and innovation apart from just depending on the smartphone or tablet, the technology is going to be used in wearable devices like smart glasses which will require a different kind of UX and designing process. With AI & AR Apple Inc. has already launched Animoji, animated emoji in their iOS which is implemented in their devices. This technology will hold a huge market share in the forecast period.

Mixed reality allows users to interact directly with a metaverse environment in a physical space. The growing usage of mixed reality in the medical field allows for surgical application as well as medical training, and it also aids in helping patients and clinicians grasp technical aspects of medicine. Nonetheless, mixed reality technology also plays a crucial role in the gaming sector where there are several games developed from first-person shooter to strategy games to roleplay adventures. Also, it is employed in the entertainment sector to deliver a distinctive movie-going and other entertainment experience.

Application Insights

The gaming segment held the leading revenue share of over 26% of the U.S. market in 2023, due to the growing focus of companies on developing games with realistic experiences by enabling immersive gaming experiences for the users. The emergence of the metaverse enabled gaming companies to introduce more features with ultra-high definition graphics and realistic experience thereby, propelling the industry growth.

The digital marketing segment is expected to grow significantly over the forecast period. Several established brands are expanding in the metaverse to expand their businesses around different platforms to achieve higher revenue than before. The creation of promotional materials and marketing plans for the metaverse requires originality, and brand-building experimentation is essential. The rapper Snoop Dogg, for example, created his own Snoopverse in The Sandbox, complete with an NFT collection dubbed "The Doggies," a selection of avatars, exclusive passes, a game, and even a music video that takes place in the universe.

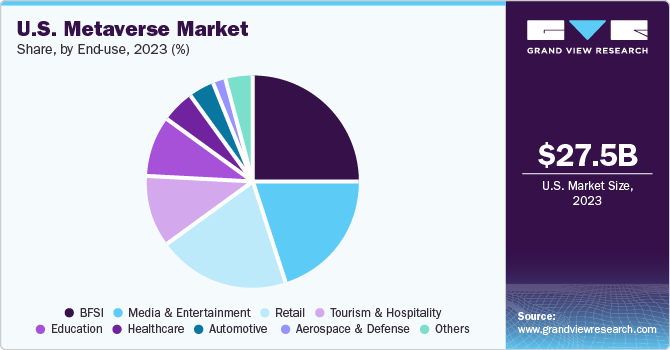

End-use Insights

Based on end-use, the BFSI industry is assessed to account for the largest revenue in 2023. The banking metaverse provides a comprehensive view of banks in the actual world from all perspectives. From the perspectives of blockchain, NFT marketplace, and the development of DeFi digital assets, metaverse technology is most advantageous for the banking sector. Metaverse’s impact on financial services results in the next development stage in the banking and finance industry. Customers can experience virtual banking using metaverse, which makes personalized banking possible with the use of virtual or augmented reality (AR/VR).

The tourism & hospitality industry is expected to offer numerous growth opportunities to the stakeholders over the forecast period. Virtual tourism is one of the most innovative metaverse use cases. The technology enables users to travel in a virtual world, which is helpful for users who are unable to travel long distances. Metaverse can also assist with the booking process; several hotels are also exploring ideas like creating Metaverse gathering spaces where guests from all around the world can attend events.

Key Companies & Market Share Insights

Some of the key players include Meta Platforms, Inc.; Epic Games, Inc.; NVIDIA Corporation; Unity Technologies, Inc.; and Roblox Corporations.

-

NVIDIA Corporation is a multinational technology corporation manufacturing computer graphics processors, chipsets, and related multimedia software. It specializes in designing and manufacturing GPUs (Graphical Processing Units) for professional and gaming markets and SoCs (Systems on a Chip) for automotive and mobile computing applications. In March 2023, NVIDIA Corporation, a technology company collaborated with Microsoft to develop and offer industrial metaverse solutions to customers via Azure cloud and artificial intelligence capabilities. Microsoft Azure is poised to host NVIDIA DGX Cloud and Omniverse cloud for operating and building 3D worlds

-

In May 2022, Epic Games, Inc. and WPP plc announced a partnership to build next-generation interactive experiences. The partnership is aimed at educating creators and brands to create custom brand experiences and execute the metaverse concepts using the former’s tools across Unreal Engine, Fortnite, and 3D marketplaces, such as Sketchfab and ArtStation

-

Roblox Corporation and Active Theory are some of the emerging players in the U.S. metaverse market.

-

Roblox Corporation is a technology company. The corporation is involved in operating the human co-experience platform “Roblox.” This platform allows users to explore and collaborate on user-generated 3D experiences. In January 2023, Roblox completed the rollout of its new hub that provides developers with more tools and a centralized process for documentation and developer forums. The hub is called Creator Hub

- Active Theory is a digital production studio focused on creativity. The company uses web technologies like UX and technical solutions to build websites, advertisements, apps, AR & VR experiences, and other application development services

Key U.S. Metaverse Companies:

- Meta Platforms, Inc.

- NVIDIA Corporation

- Epic Games, Inc.

- Roblox Corporation

- Unity Technologies, Inc.

- Active Theory

- Google LLC

- Microsoft Corporation

- Inoru

- Maticz Technologies Private Limited

Recent Developments

-

In December 2023, Reebok International Limited partnered with Futureverse, a technology company to provide a virtual experience to their customers with artificial intelligence (AI) and digital wearables. With this, Reebok is focusing on engaging its customers with the latest technology in order to gain customer insights and provide unique offerings to the customers

-

In February 2023, BMW AG, an automotive OEM, launched Supplierthon, an initiative aimed to bring together research organizations, metaverse technology experts & and enthusiasts, start-ups, and corporates to work on innovative ideas pertaining to metaverse technology.

U.S. Metaverse Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.28 billion

Revenue forecast in 2030

USD 253.77 billion

Growth rate

CAGR of 37.4% from 2023 to 2030

Historical Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Product, platform, technology, application, end-use

Key companies profiled

Meta Platforms, Inc.; NVIDIA Corporation; Epic Games, Inc.; Roblox Corporation; Unity Technologies, Inc.; Active Theory; Microsoft; Google LLC; Inoru; Maticz Technologies Private Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Metaverse Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. metaverse market report based on product, platform, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Infrastructure

-

Chips & Processors

-

Network Capabilities

-

Cloud & Edge Infrastructure

-

Cybersecurity

-

-

Hardware

-

Holographic Displays

-

eXtended Reality (XR) Hardware

-

Haptic Sensors & Devices

-

Smart Glasses

-

Omni Treadmills

-

-

AR/VR Devices

-

Others

-

-

Software

-

Asset Creation Tools

-

Programming Engines

-

Virtual Platforms

-

Avatar Development

-

-

Services

-

User Experiences (Events, Gaming, etc.)

-

Asset Marketplaces

-

Financial Services

-

-

-

Platform Outlook (Revenue, USD Billion, 2017 - 2030)

-

Desktop

-

Mobile

-

Headsets

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Blockchain

-

Virtual Reality (VR) & Augmented Reality (AR)

-

Mixed Reality (MR)

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Gaming

-

Online Shopping

-

Content Creation & Social Media

-

Events & Conference

-

Digital Marketing (Advertising)

-

Testing And Inspection

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Aerospace & Defense

-

Education

-

Healthcare

-

Tourism And Hospitality

-

BFSI

-

Retail

-

Media & Entertainment

-

Automotive

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. metaverse market size was estimated at USD 27.50 billion in 2023 and is expected to reach USD 34.28 billion in 2024

b. The U.S. metaverse market is expected to grow at a compound annual growth rate of 37.4% from 2023 to 2030 to reach USD 253.77 billion by 2030.

b. The software segment dominated the U.S. metaverse market with a share of 28.9% in 2023. This is attributable to the emerging demand for virtual communication in the entertainment and gaming industry is augmenting the software segment.

b. Some key players operating in the U.S. metaverse market include Meta Platforms, Inc.; NVIDIA Corporation; Epic Games, Inc.; Roblox Corporation; Unity Technologies, Inc.; Active Theory; Microsoft; Google LLC; Inoru; Maticz Technologies Private Limited

b. Key factors that are driving the market growth include the growing focus of enterprises to enhance customer experience, and increasing developments in the data science field.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.