- Home

- »

- Biotechnology

- »

-

U.S. Microbial Fermentation Technology Market, Industry Report, 2030GVR Report cover

![U.S. Microbial Fermentation Technology Market Size, Share & Trends Report]()

U.S. Microbial Fermentation Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Antibiotics, Probiotics Supplements), By End-user (Biopharmaceutical Companies, Contract Research Organizations), And Segment Forecasts

- Report ID: GVR-4-68040-246-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

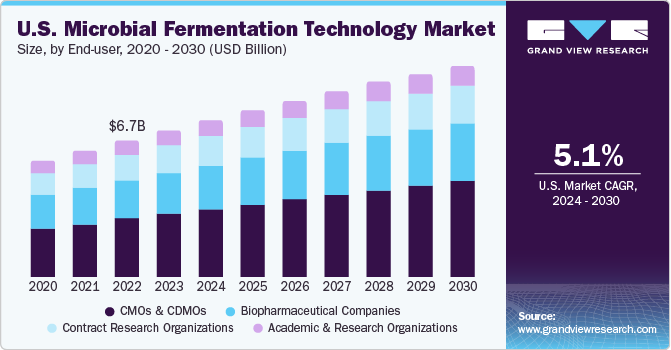

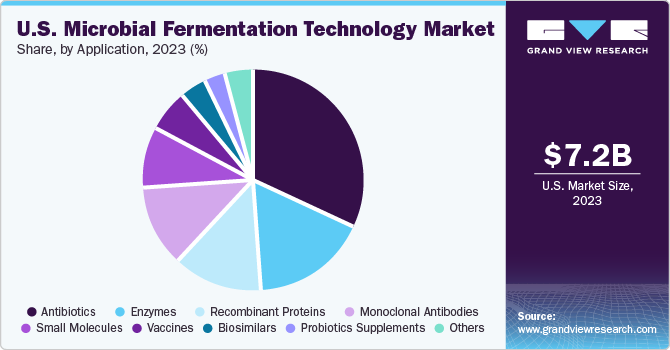

The U.S. microbial fermentation technology market size was estimated at USD 7.22 billion in 2023 and is expected to grow at a CAGR of 5.12% from 2024 to 2030. Microbial fermentation plays a vital role in bio-production, influencing cost and quality. The burgeoning biopharmaceutical sector, fueled by innovative therapeutics and biosimilars, propels market growth. Furthermore, research funding escalation due to the COVID-19 pandemic has expedited microbial fermentation adoption in therapeutic target and vaccine strategy discovery, contributing to market expansion.

The U.S. microbial fermentation technology market dominated the global microbial fermentation technology market, accounting for 21.67% of the total revenue share in 2023. This is primarily attributed to large-scale and well-established manufacturing facilities focused on biopharmaceuticals. In addition, according to the data published by the American Medical Association in March 2023, healthcare spending in the U.S. increased by 2.7% in 2021 to USD 4.3 trillion. This rise in spending and the introduction of various government initiatives are likely to create a conducive environment for the development of this market.

The market is poised for expansion as researchers and pharmaceutical companies invest in cutting-edge technologies and methods to improve antibiotic production. This includes utilizing advanced microbial fermentation processes that can enhance the efficiency, potency, and safety of antibiotics. Moreover, microbial fermentation has diverse applications, spanning biopharmaceuticals, probiotics, recombinant proteins and peptides, and other sectors. Thus, the technology’s adoption is expected to expand further due to the increasing use of next-generation molecules, such as antibody fragments and bioconjugates.

Microbial fermentation is preferred for producing smaller biologics, including cytokines, growth factors, nucleic acids, plasmid DNA, and nonglycosylated antibody fragments, due to shorter processing times and lower media costs than animal cell cultures. High capital requirements for API production lead to increased outsourcing of these activities, benefiting pharmaceutical companies by eliminating the need for expensive manufacturing units and labor forces. Outsourcing allows companies to focus on core competencies, resulting in increased productivity and, consequently, market growth.

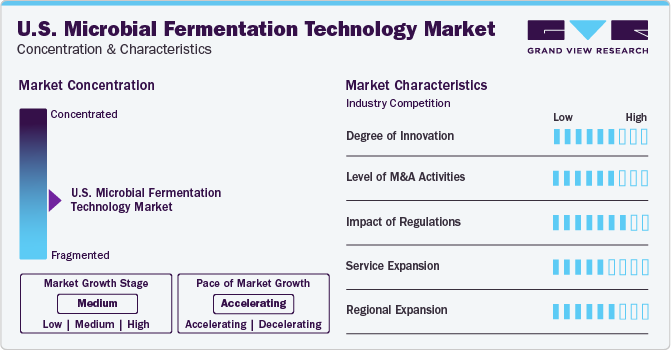

Market Concentration & Characteristics

The U.S. microbial fermentation technology industry is characterized by a high degree of innovation as the country supports a favorable regulatory environment and houses many prominent biopharmaceutical companies. Metabolic engineering has played a significant role in enhancing microorganism design and modification, leading to increased production of target compounds. The expiration of biologic patents and the subsequent rise in demand for biosimilars is anticipated to propel industry growth further.

Several industry players are acquiring smaller companies to strengthen their industry position. This strategy enables companies to increase their capabilities, expand product portfolios, and improve competencies. For instance, in December 2023, Roche acquired obesity drug developer Carmot Therapeutics for $2.7 billion, gaining access to the promising drug candidate CT-388.

The U.S. Food and Drug Administration (FDA) regulates fermentation technology processes, while the Environmental Protection Agency (EPA) ensures its environmental safety and sustainability. The American government’s dedication to enhancing healthcare and biotechnology sectors contributes to industry growth. For example, in September 2022, the U.S. government introduced a national biotechnology & biomanufacturing initiative and announced an investment of USD 2 billion in the sector, aiming at providing innovative solutions in health, food, climate change, & other sectors.

Key participants in the industry often adopt strategies to expand the reach of their products and ensure availability across diverse geographic regions, which aids a larger industry share and helps them cater to a wider customer base. Corbion’s algae-based novel ingredient, launched in 2023, serves as an excellent example of product expansion in the industry. This innovation addresses the growing demand for Omega 3 fatty acids in companion animal nutrition without relying on traditional marine-based sources.

Many companies are developing their manufacturing capabilities in the U.S. to support the increasing demand in the industry. For instance, in January 2021, Pall Corporation invested USD 114 million to expand their manufacturing capacity. The expansion was aimed at meeting the growing demand for COVID-19 vaccine manufacturing. Moreover, in June 2023, Enzene Biosciences, an India-based biotechnology company, announced an investment of USD 50 million to develop a new biopharmaceutical manufacturing plant in New Jersey, U.S.

Application Insights

The antibiotics segment dominated the application of microbial fermentation technology in 2023, generating nearly 32% of the total revenue share. Moreover, it is also anticipated to have the fastest CAGR over the forecast period owing to the high prevalence of infectious diseases, increased focus on antibiotics following the pandemic, and the segment’s profitability, which have contributed to this growth. According to the Centers for Disease Control and Prevention (CDC), approximately 1.3 million antibiotic-resistant infections occur annually, resulting in around 19,000 deaths. This highlights the urgent need for continued investment in antibiotic research and development to address the growing threat of antibiotic resistance.

Monoclonal Antibodies (mAbs) are witnessing a considerable rise in demand and are anticipated to witness lucrative growth from 2024 to 2030. Numerous manufacturers are successfully entering the market to cater to this increasing demand. To address the complex regulatory requirements associated with mAbs, these companies are partnering with Contract Development and Manufacturing Organizations (CDMOs) and Contract Manufacturing Organizations (CMOs).

End-user Insights

CMOs and CDMOs led the market in 2023 with over 42% of the revenue share generated and are anticipated to have the fastest segment growth during the forecast period. The rising demand for manufacturing biologics, driven by increased outsourcing to CMOs, has contributed to their growth. To enhance productivity, CMOs are adopting advanced technologies like microbial fermentation. They also employ various strategies, such as mergers and acquisitions, and collaborations, facilitating faster market approvals and rapid product launches for commercial use.

Biopharmaceutical companies occupied a significant market share in 2023 and are anticipated to have the second-fastest CAGR from 2024 to 2030. This growth can be attributed to strategic initiatives by these companies, such as product development, mergers and acquisitions, product approvals and launches, and expansion of their global presence. Furthermore, various players are collaborating to enhance their offerings in the microbial fermentation technology market. In March 2023, Cytovance Biologics partnered with Phenotypeca, combining Cytovance’s microbial fermentation capabilities with Phenotypeca’s yeast strain development technology, strengthening Cytovance Biologics’s leadership in microbial-derived APIs.

Key U.S. Microbial Fermentation Technology Company Insights

The market is fragmented, and companies in the U.S. microbial fermentation technology are adopting several growth strategies, such as, mergers & acquisitions and geographical expansion, to gain a higher market share. Some of the key players in the market are Biocon Ltd.; BioVectra Inc.; Danone; F. Hoffmann-La Roche AG; and Koninklijke DSM NV, among others.

The market also comprises other emerging players that impact the competitive landscape. For instance, in July 2021, Ginkgo Bioworks, a Boston-based biotech company, acquired Dutch DNA Biotech B.V., a company focused on producing organic acids and proteins through fermentation. This acquisition helped Ginkgo Bioworks expand its international operations.

Key U.S. Microbial Fermentation Technology Companies:

- Biocon Ltd.

- BioVectra Inc.

- Danone

- F. Hoffmann-La Roche AG

- Koninklijke DSM NV

- Lonza

- Novozymes A/S

- TerraVia Holdings, Inc. (Corbion)

- BIOZEEN

- Biovian Oy

Recent Developments

-

In March 2024, Lonza announced its plans to buy one of the world’s largest manufacturing sites in California, U.S., from Roche for $1.2 billion. The Vacaville facility, specializing in monoclonal antibodies production, significantly expanded Lonza’s capacity. The company also plans on investing an additional 500 million Swiss francs to upgrade the site.

-

In November 2023, Danone has collaborated with the Global Methane Hub to accelerate innovation in methane reduction. The partnership involves Danone’s participation in the Enteric Fermentation R&D initiative spearheaded by the Global Methane Hub.

-

In May 2023, DSM acquired Firmenich International SA, resulting in the formation of DSM-Firmenich AG. This merger strengthened the nutrition, health, and beauty sector, accelerating innovation for the companies.

-

In April 2022, Curia Global, Inc., a global CDMO specializing in biologics, enhanced its ability to scale up production by investing in two new Good Manufacturing Practice (GMP) standard suites, compliant with European Union (EU) Class C and featuring 200-L/100-L fixed reactor trains. This initiative expanded the capacity of their Albany site, positively impacting the market revenue.

-

In March 2022, BIO-CAT Microbials, LLC, a microbial solutions company, announced an investment of USD 35 million for the expansion of its Troy, Virginia, facility, aiming to include fermentation capabilities.

-

In February 2022, Thermo Fisher Scientific, Inc. opened a new single-use manufacturing facility in Millersburg, U.S., with an investment of USD 40 million. This expansion of the existing facility is aimed to cater to the growing demand for critical vaccines and biologics.

U.S. Microbial Fermentation Technology Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.43 billion

Growth rate

CAGR of 5.12% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, end-user

Country scope

U.S.

Key companies profiled

Biocon Ltd.; BioVectra Inc.; Danone; F. Hoffmann-La Roche AG; Koninklijke DSM NV; Lonza; Novozymes A/S; TerraVia Holdings, Inc. (Corbion); BIOZEEN; Biovian Oy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Microbial Fermentation Technology Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. microbial fermentation technology market report based on application and end-user:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibiotics

-

Probiotics Supplements

-

Monoclonal Antibodies

-

Recombinant Proteins

-

Biosimilars

-

Vaccines

-

Enzymes

-

Small Molecules

-

Other Applications

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Companies

-

Contract Research Organizations

-

CMOs & CDMOs

-

Academic & Research Organizations

-

Frequently Asked Questions About This Report

b. The U.S. microbial fermentation technology market was estimated at USD 7.22 billion in 2023.

b. The U.S. microbial fermentation technology market is expected to register a compound annual growth rate (CAGR) of 5.12% from 2024 to 2030 to reach around USD 10.43 billion by 2030.

b. The antibiotics segment dominated the application of microbial fermentation technology in 2023, generating nearly 32% of the total revenue share.

b. Some of the key players in the market are Biocon Ltd.; BioVectra Inc.; Danone; F. Hoffmann-La Roche AG; and Koninklijke DSM NV, among others.

b. Microbial fermentation plays a vital role in bio-production, influencing cost and quality. The burgeoning biopharmaceutical sector, fueled by innovative therapeutics and biosimilars, propels market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.