- Home

- »

- Biotechnology

- »

-

U.S. Microcarrier Beads Market Size, Industry Report, 2030GVR Report cover

![U.S. Microcarrier Beads Market Size, Share & Trends Report]()

U.S. Microcarrier Beads Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Collagen Coated Beads, Cationic Beads) By Material (Natural, Synthetic), By Target Cell Type, By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-660-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Microcarrier Beads Market Summary

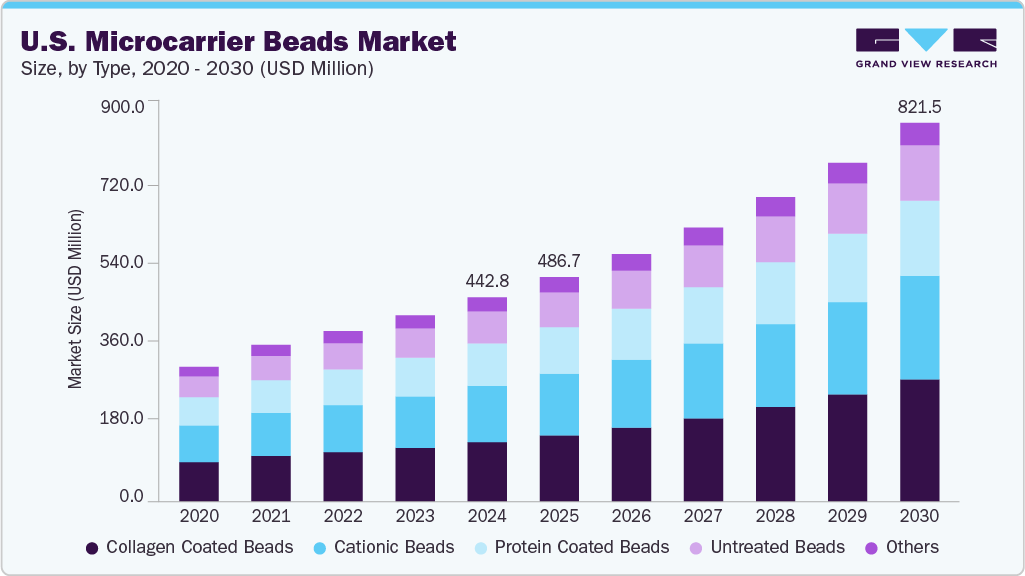

The U.S. microcarrier beads market size was estimated at USD 442.8 million in 2024 and is projected to reach USD 821.5 million by 2030, growing at a CAGR of 11.04% from 2025 to 2030. The market growth is driven by increasing demand for cell-based therapies, advancements in biopharmaceutical manufacturing, and the rising adoption of microcarrier-based culture systems for large-scale cell production.

Key Market Trends & Insights

- By type, the collagen coated beads segment held the highest market share of 29.13% in 2024.

- Based on material, the natural materials segment held the highest market share in 2024.

- Based on target cell type, the CHO segment held the highest market share in 2024.

- Based on application, the biopharmaceutical production segment held the highest market share in 2024.

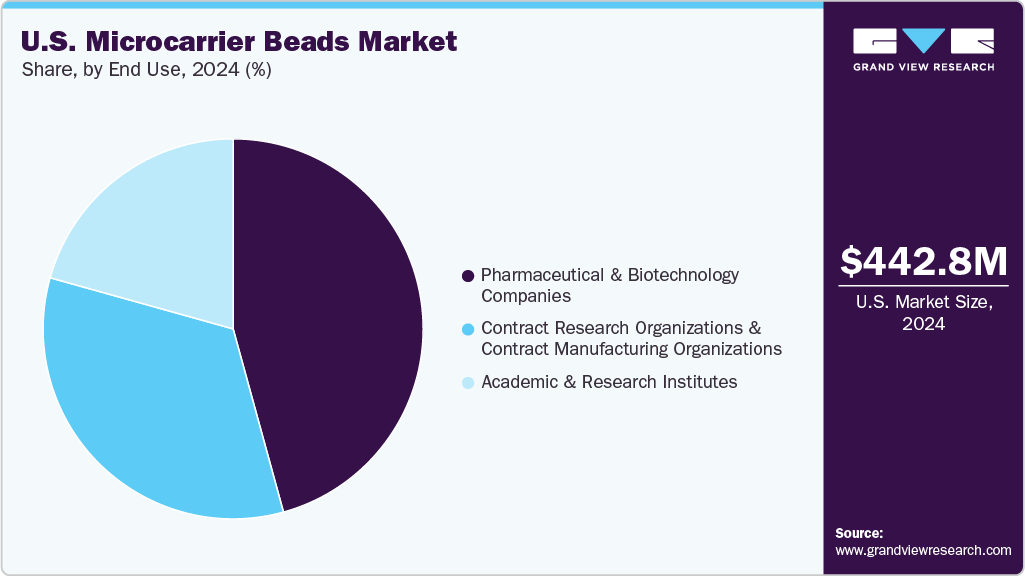

- By end use, the pharmaceutical & biotechnology companies segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 442.8 Million

- 2030 Projected Market Size: USD 821.5 Million

- CAGR (2025-2030): 11.04%

Moreover, growing investments in regenerative medicine and tissue engineering, along with technological innovations in microcarrier design and materials, are expected to drive market growth throughout the forecast period. The U.S. has seen a sharp increase in demand for microcarriers, largely driven by the expanding production of biologics and cell-based vaccines. Microcarrier beads allow for the efficient expansion of adherent cells, which are crucial in producing monoclonal antibodies, viral vectors, and vaccines. As the biologics segment continues to outpace traditional pharmaceuticals, microcarrier-based cell culture systems are increasingly being adopted to meet scalability requirements. Companies like Thermo Fisher Scientific and Corning Incorporated are investing in product enhancements to support high-throughput, scalable manufacturing processes. For instance, Thermo Fisher continues to expand its Gibco microcarrier product line to cater to high-density cell culture applications, particularly in vaccine production and viral vector manufacturing.

Microcarrier beads offer notable cost advantages over traditional planar culture methods, such as reduced labor, lower media usage, and smaller facility footprints. These economic benefits, combined with improved consistency and scalability, make microcarriers highly attractive for biomanufacturers. Moreover, microcarrier-based systems align well with the FDA’s cGMP standards, aiding in regulatory approval processes. Companies like Sartorius and Eppendorf are promoting closed-system bioreactor setups with pre-sterilized, ready-to-use microcarriers to facilitate cGMP-compliant cell culture. In May 2024, Eppendorf launched the BioBLU 5p High-Density Vessel designed for microcarrier applications in regulated production environments.

The U.S. microcarrier beads industry is also being propelled by innovation in microcarrier materials (e.g., biodegradable, macroporous, and serum-free options) and strategic collaborations. For example, in April 2024, Corning announced a partnership with a U.S.-based gene therapy firm to co-develop optimized microcarrier surfaces tailored for stem cell expansion. Additionally, Thermo Fisher and Lonza have both announced increased investments in microcarrier-compatible bioproduction facilities. These partnerships and technological advancements are improving cell yields, facilitating easier harvesting, and enhancing compatibility with automation and single-use systems. The growing ecosystem of support products and services around microcarriers-such as automated cell counters, perfusion systems, and real-time monitoring tools-is further reinforcing U.S. microcarrier beads industry growth.

Table 1 Microcarrier bead materials for specific cell types

Microcarrier Material

Common Cell Types Supported

Applications

Polystyrene (PS)

Fibroblasts, Mesenchymal Stem Cells (MSCs), CHO cells, Vero cells, HeLa cells, Primary human cells

Vaccine production, biopharmaceuticals, stem cell expansion

Dextran

Human Mesenchymal Stem Cells (hMSCs), Primary cells, Hybridoma cells, Suspension cell lines (e.g., CHO)

Regenerative medicine, therapeutic protein production

Polyvinyl Alcohol (PVOH)

Mesenchymal Stem Cells (MSCs), Endothelial cells, Neural stem cells, Primary human cells

3D cell culture, stem cell therapy, bioprocessing

Poly(lactic-co-glycolic acid) (PLGA)

Human Adipose-Derived Stem Cells, Human Umbilical Vein Endothelial Cells (HUVECs)

Controlled drug release, regenerative medicine, tissue engineering

Polyethylene Glycol (PEG)

Embryonic stem cells, Induced pluripotent stem cells (iPSCs), Sensitive primary cells

Sensitive cell culture, tissue engineering, immunotherapy

Polymethyl Methacrylate (PMMA)

Fibroblasts, Epithelial cells, Long-term adherent cells

Long-term cultures, biomanufacturing

Cellulose

Fibroblasts, Mesenchymal Stem Cells (MSCs), Primary cells

Tissue engineering, regenerative medicine

Collagen

Mesenchymal Stem Cells (MSCs), Chondrocytes, Fibroblasts

Wound healing, cartilage regeneration

Alginate

Hepatocytes, Chondrocytes, Mesenchymal Stem Cells (MSCs)

3D cell culture, drug screening, tissue repair

Other natural materials

Various primary cells, Stem cells, Endothelial cells

Regenerative medicine, cell therapy

Source: PMC Article, Journal of Biomedical Materials Research, Nature Reviews & Others.

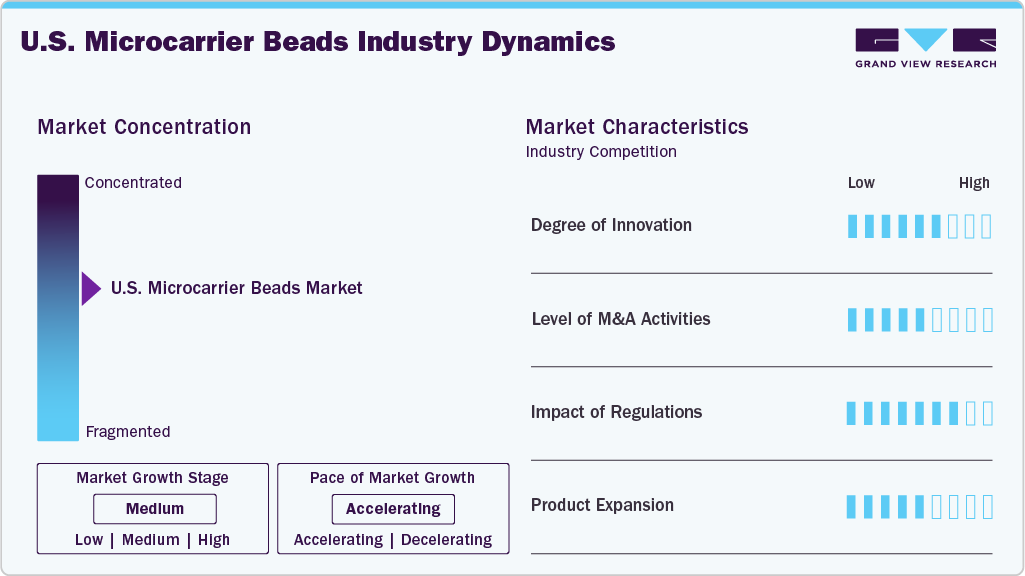

Market Concentration & Characteristics

Innovation in the microcarrier space is driven by the growing need for scalable, serum-free, and biodegradable solutions tailored to advanced therapies. Recent product launches focus on functionalized surfaces (e.g., ECM-coated beads), dissolvable carriers, and materials compatible with automated, closed-system bioreactors. Companies are also developing microcarriers optimized for specific cell types like stem cells, CHO cells, or HEK293. R&D efforts are increasingly aligned with the unique requirements of gene therapy, vaccine production, and personalized medicine, making innovation a key competitive differentiator in the U.S. microcarrier beads industry.

The microcarrier bead segment has seen moderate-to-high merger and acquisition (M&A) activity, mostly driven by broader consolidations in the bioprocessing sector. Strategic acquisitions by giants like Thermo Fisher (e.g., acquisition of Brammer Bio) and Danaher (e.g., Cytiva from GE) have allowed companies to integrate microcarrier capabilities into end-to-end cell therapy solutions. Smaller players or technology innovators are often targets for acquisition to gain proprietary microcarrier technology or access new customer segments. This M&A trend is expected to continue, particularly as biopharma outsourcing and cell therapy manufacturing grow more complex.

Regulations have a significant impact on the U.S. microcarrier beads market, especially in the U.S., where cGMP compliance, FDA oversight, and requirements for traceability and sterility govern biomanufacturing processes. Microcarrier products must meet stringent quality standards, particularly when used in therapeutic or clinical-grade cell expansion. As the FDA and EMA increase scrutiny on cell and gene therapies, companies are focusing on producing microcarriers that are sterile, animal-origin-free, and validated for clinical use, making regulatory compliance a key driver of product development and differentiation.

Product expansion in the U.S. microcarrier beads industry has been robust, with leading players launching a variety of microcarriers differentiated by size, surface chemistry, porosity, and degradability. Offerings now include microcarriers for single-use bioreactors, xeno-free culture systems, and those tailored to specific applications (e.g., stem cell expansion or virus production). Firms are also expanding their support products-such as cell detachment enzymes and harvesting systems-to provide comprehensive solutions. This diversification helps companies serve both academic and commercial users across R&D and GMP manufacturing.

Type Insights

The collagen-coated microcarrier beads segment dominates with the highest market share of29.13% in 2024, driven by their superior biocompatibility and ability to mimic the natural extracellular matrix (ECM), which enhances cell adhesion, proliferation, and differentiation. These properties make collagen-coated microcarriers beads particularly valuable in vaccine production, cell therapy, and regenerative medicine applications. Leading companies are actively investing in developing and expanding collagen-coated microcarrier types to meet the growing demand. For instance, Sartorius AG offers animal component-free and protein-coated microcarrier beads designed for adherent cell culturing, catering to various research and production needs. Such initiatives reflect the industry's commitment to advancing collagen-coated microcarrier technologies, thereby facilitating the growth of cell-based treatments and biopharmaceutical production and further boosting the U.S. microcarrier beads industry.

The cationic beads segment is expected to grow significantly during the forecast period, driven by their enhanced ability to support efficient cell attachment and growth, particularly for anchorage-dependent cells in serum-free or low-serum environments. Their positively charged surfaces facilitate strong electrostatic interactions with negatively charged cell membranes, making them ideal for expanding sensitive cell types such as stem cells, fibroblasts, and epithelial cells in bioreactors.

Material Insights

Natural materials dominated the microcarrier beads with the highest market share in 2024. The demand for natural material-based microcarrier beads is growing rapidly, driven by the increasing preference for biocompatible, biodegradable, and xeno-free solutions in cell therapy and vaccine production. Materials such as collagen, gelatin, alginate, and cellulose offer favorable biological properties that support cell adhesion, proliferation, and differentiation without introducing synthetic or animal-derived risks, making them especially attractive for clinical and regulatory-compliant applications.

The synthetic materials segment is expected to grow at a significant CAGR during the forecast period. U.S. demand for synthetic microcarrier beads, crafted from materials like polystyrene, dextran, acrylamide, PLGA, and glass, is strongly driven by their high reproducibility, mechanical robustness, and scalability for industrial use. These synthetic carriers offer predictable surface chemistry and size distribution, making them ideal for the large-scale production of vaccines, therapeutic proteins, and monoclonal antibodies in bioreactors.

Target Cell Type Insights

The CHO segment held the largest share of 32.55% in 2024. The U.S. microcarrier beads industry’s growth is propelled by the dominant role CHO cells play in the production of monoclonal antibodies, therapeutic proteins, and viral vectors. Manufacturers are increasingly turning to microcarrier-based bioprocessing to enable high-density CHO cell expansion in stirred bioreactors, enhancing yield, reducing footprint, and ensuring batch consistency critical for large-scale biopharmaceutical production.

Mesenchymal Stem Cells (MSCs) are anticipated to grow at the fastest CAGR during the forecast period. MSCs are a primary target cell type for microcarrier-based culture systems due to their significance in regenerative medicine, immunomodulation, and cell therapy. Microcarriers beads provide a three-dimensional surface that enhances MSC adhesion, proliferation, and differentiation while supporting large-scale, clinically relevant cell yields. For instance, in June 2020, an article published in Frontiers in Bioengineering and Biotechnology reviewed the microcarrier bioreactor culture of human mesenchymal stem cells, highlighting the impacts of bioprocessing parameters on therapeutic potency and scalability for clinical manufacturing. As clinical demand for MSC-based therapies increases, particularly in treating orthopedic disorders, cardiovascular diseases, and autoimmune conditions, microcarriers beads have become critical for Good Manufacturing Practice (GMP) compliant and cost-effective production processes.

Application Insights

The biopharmaceutical production segment held the highest share of the U.S. microcarrier beads market in 2024, driven by the growing demand for biologics and personalized medicines. Increasing investments in biopharmaceutical research and manufacturing, advancements in cell culture technologies, and stringent regulatory standards have fueled the need for high-quality purification and separation materials. This segment benefits from the expanding pipeline of biopharmaceutical types and the rising adoption of innovative production techniques, making it a key contributor to the U.S. industry growth.

The regenerative medicine segment is expected to witness the fastest CAGR over the forecast period, propelled by the rising prominence of stem cell- and cell-based therapies targeting chronic diseases, tissue repair, and personalized medicine. Robust funding from government agencies like the NIH and ARMI-totaling billions annually-has accelerated preclinical and clinical development, necessitating scalable platforms for cell expansion. Technological innovations such as fully biodegradable or surface-engineered microcarriers tailor-made for therapeutic cell lines are simplifying downstream processing and improving cell quality, making them a preferred choice for regenerative applications.

End Use Insights

The pharmaceutical & biotechnology companies segment accounted for the largest market share of 45.73% in 2024. The rise in cell-based vaccines, personalized treatments, and chronic disease therapeutics has created strong demand for adaptable cell expansion platforms. Additionally, continuous advancements in cell culture media, single-use bioreactors, and automation-concurrent with stricter regulatory standards-have reinforced the adoption of microcarrier systems that offer reproducible, GMP-compliant processes. Finally, robust R&D funding and innovation (from both government agencies like the NIH/ARMI and industry players) have accelerated the development of next-gen microcarriers, further propelling their market uptake.

The academic and research institutions segment is expected to grow significantly over the forecast period due to the increasing focus on advanced scientific research and innovation in biotechnology, pharmaceuticals, and regenerative medicine. Growing government funding, rising collaborations with industry players, and expanding research projects to develop novel therapies and technologies are driving demand. Moreover, the need for specialized materials and equipment in experimental and preclinical studies is fueling the growth of this segment.

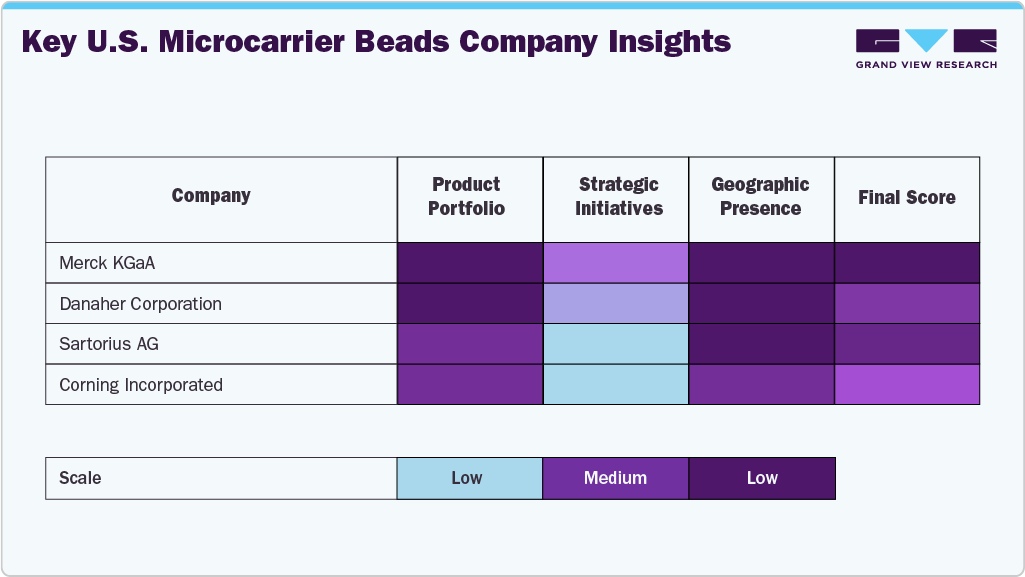

Key U.S. Microcarrier Beads Company Insights

The U.S. microcarrier beads market is led by a group of established bioprocessing and life sciences companies known for their strong R&D capabilities, broad product portfolios, and integration with bioreactor systems. Key players include Merck KGaA (MilliporeSigma), Danaher Corporation (Cytiva), Sartorius AG, and Corning Incorporated, all of which are actively expanding their microcarrier offerings to support growing demand in cell and gene therapy, vaccine production, and regenerative medicine.

Leading firms, including Corning Incorporated, Danaher Corporation (via Cytiva and Pall Life Sciences), Sartorius AG, and Corning, continue to play a pivotal role in shaping the U.S. microcarrier beads industry through innovations in surface chemistry, type scalability, and bioprocess optimization. Their solutions support high-yield cell expansion platforms used in regenerative medicine, cell therapy, and large-scale biologicals manufacturing, making them integral to modern bio-manufacturing ecosystems.

Companies such as Bio-Rad Laboratories, Inc., and Repligen Corporation (via Tantti Laboratory Inc.) are expanding their presence in the market through specialized offerings and technology integration. These firms are investing in new type development tailored for specific cell lines, including mesenchymal stem cells (MSCs) and induced pluripotent stem cells (iPSCs), while also enhancing the performance of microcarriers beads for use in serum-free and xeno-free environments, key for clinical and commercial cell therapy production.

The microcarrier beads market is gaining momentum due to heightened demand for efficient and scalable cell culture platforms. Strategic collaborations, facility expansions, and type innovations are intensifying competition. As the demand for cell-based treatments, vaccines, and biopharmaceuticals accelerates, companies that combine advanced bioprocessing technologies with flexibility, affordability, and regulatory alignment will be well-positioned to lead the next wave of growth in this evolving sector.

Key U.S. Microcarrier Beads Companies:

- Danaher Corporation

- Sartorius AG

- Corning Incorporated

- Merck KGaA

- Bio-Rad Laboratories, Inc.

- Repligen (Tantti)

- Darling Ingredients

- KURARAY CO., LTD.

- Creative BioMart

Recent Developments

-

In March 2025, Kuraray launched Scapova, a bead-shaped microcarrier scaffold made from polyvinyl alcohol (PVA), designed to support efficient cell proliferation in 3D cultures. These microcarriers are created by chemically modifying and crosslinking PVA into 200 μm beads, which are then coated with collagen to enhance cell adhesion.

-

In November 2024, Rousselot and IamFluidics Launch Revolutionary Dissolvable Microcarrier for Scalable Cell Culturing.

-

In November 2023, Kuraray Co., Ltd. developed PVA hydrogel microcarriers for cell culture applications in regenerative medicine. The product is launched in Japan and is expanding to international markets, including the United States.

U.S. Microcarrier Beads Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 486.7 million

Revenue forecast in 2030

USD 821.5 million

Growth rate

CAGR of 11.04% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, target cell type, application, and end use

Country scope

U.S.

Key companies profiled

Danaher Corporation; Sartorius AG; Corning Incorporated; Merck KGaA; Bio-Rad Laboratories, Inc.; Repligen (Tantti); Darling Ingredients; KURARAY CO., LTD.; Creative BioMart

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Microcarrier Beads Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. microcarrier beads market report based on type, material, target cell type, application, and end use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Collagen Coated Beads

-

Cationic Beads

-

Polystyrene

-

PVOH

-

Others

-

-

Protein Coated Beads

-

Collagen

-

Cellulose

-

Polystyrene

-

Others

-

-

Untreated Beads

-

Cellulose

-

Polystyrene

-

Dextran

-

Others

-

-

Others

-

Alginate

-

PVOH

-

Others

-

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Materials

-

Cellulose

-

Collagen

-

Alginate

-

Other Natural Materials

-

-

Synthetic Materials

-

Polystyrene

-

Dextran

-

PVOH

-

Other Synthetic Materials

-

-

-

Target Cell Type Outlook (Revenue, USD Million, 2018 - 2030)

-

CHO

-

HEK

-

Vero

-

MSCs

-

iPSCs

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Production

-

Vaccine Production

-

Therapeutic Production

-

-

Regenerative Medicine

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations & Contract Manufacturing Organizations

-

Academic & Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. microcarriers beads market size was estimated at USD 442.8 million in 2024 and is expected to reach USD 486.7 million in 2025.

b. The U.S. microcarriers beads market is expected to grow at a compound annual growth rate of 11.04% from 2025 to 2030 to reach USD 821.5 million by 2030.

b. The collagen-coated microcarrier beads segment dominates the industry with the highest market share of 29.13% in 2024, driven by their superior biocompatibility and ability to mimic the natural extracellular matrix (ECM), which enhances cell adhesion, proliferation, and differentiation.

b. Some key players operating in the U.S. microcarriers beads market include Sartorius AG; Corning Incorporated; Merck KGaA’ Bio-Rad Laboratories, Inc.; Creative BioMart; Repligen (Tantti); Darling Ingredients; KURARAY CO., LTD.

b. The market growth is driven by increasing demand for cell-based therapies, advancements in biopharmaceutical manufacturing, and the rising adoption of microcarrier-based culture systems for large-scale cell production.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.