- Home

- »

- Paints, Coatings & Printing Inks

- »

-

U.S. Mirror Coatings Market Size, Industry Report, 2033GVR Report cover

![U.S. Mirror Coatings Market Size, Share & Trends Report]()

U.S. Mirror Coatings Market (2025 - 2033) Size, Share & Trends Analysis Report By Resin (Polyurethane, Epoxy), By Application (Water Based Coatings, Solvent Based Coatings), By End Use (Architectural, Automotive & Transportation), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-629-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mirror Coatings Market Summary

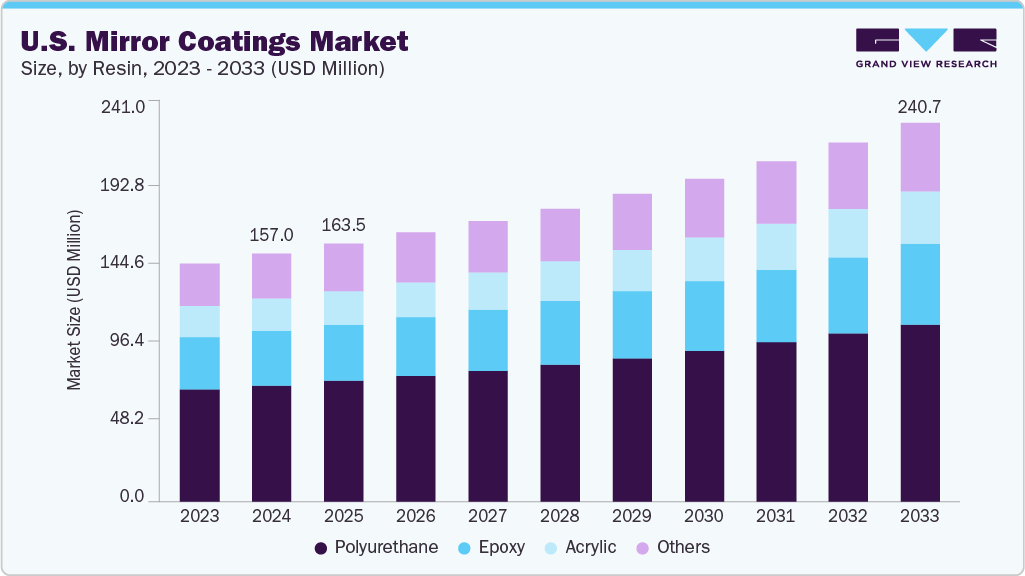

The U.S. mirror coatings market size was estimated at USD 157.03 million in 2024, and is projected to reach USD 240.73 million by 2033, growing at a CAGR of 5.0% from 2025 to 2033. The market growth is fueled by smart infrastructure growth, premium construction, and advanced automotive manufacturing.

Key Market Trends & Insights

- The mirror coatings market in the U.S. is expected to grow at a substantial CAGR of 5.0% from 2025 to 2033.

- By resin, the polyurethane segment led the market and accounted for the largest revenue share of 46.8% in 2024 in terms of revenue.

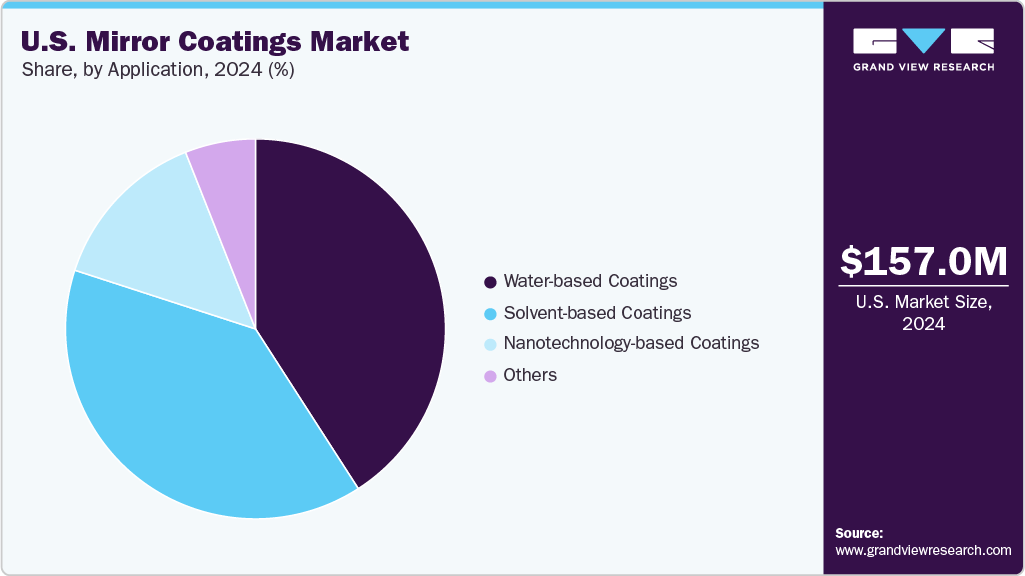

- By application, the water-based coatings segment led the market and accounted for the largest revenue share of 40.9% in 2024 in terms of revenue.

- By end use, the architectural segment led the market and accounted for the largest revenue share of 59.4% in 2024 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 157.03 Million

- 2033 Projected Market Size: USD 240.73 Million

- CAGR (2025-2033): 5.0%

Rising solar projects, especially CSP, boost demand for reflective coatings. Innovations like UV protection, anti-fog, and scratch resistance are driving adoption in sustainable, high-performance architectural and automotive applications. The U.S. mirror coatings market is driven by increasing investments in smart infrastructure, high-end residential and commercial construction, and advancements in automotive manufacturing. Coated mirrors are increasingly used for aesthetics, safety, and energy efficiency in electric and luxury vehicles. The rise in solar energy installations, particularly concentrated solar power (CSP) projects, fuels demand for reflective coatings. Innovations such as ultraviolet (UV) protection, anti-fog, and scratch resistance support growing consumer preference for sustainable and high-performance architectural and automotive mirror applications.High raw material costs, including silver, aluminum, and titanium dioxide, continue to challenge profitability in the U.S. mirror coatings market. Regulatory compliance with U.S. Environmental Protection Agency (EPA) restrictions on volatile organic compounds (VOCs) and hazardous solvents further increases formulation complexity and costs. The need for skilled labor and specialized application equipment adds to operational expenses. In addition, fluctuating input prices and supply chain disruptions have created uncertainty, particularly for small-scale manufacturers trying to adopt advanced coating technologies at scale.

The U.S. market is poised for growth through rising demand for smart coatings in healthcare, hospitality, and transport sectors. Innovations in anti-microbial, self-cleaning, and energy-efficient coatings align with green building certifications like LEED (Leadership in Energy and Environmental Design). Expanding solar energy initiatives supported by federal and state-level incentives are accelerating partnerships between coating manufacturers and renewable energy developers. E-commerce platforms and digital design tools offer increased access to custom and high-performance mirror products, enhancing distribution reach across commercial and consumer markets.

Market Concentration & Characteristics

The U.S. mirror coatings market is moderately concentrated, led by major players like SHERWIN-WILLIAMS, Diamon-Fusion International, Inc., and Guardian Industries. These firms leverage strong domestic supply chains, advanced research and development, and established commercial networks. While global leaders dominate premium segments, regional and niche manufacturers maintain a presence in specialized or cost-sensitive markets. Strategic partnerships, mergers, and acquisitions are frequently employed to strengthen technical capabilities and expand distribution, particularly as demand rises for performance coatings in architectural, automotive, and renewable energy sectors.

The U.S. mirror coatings market emphasizes high durability, optical clarity, and regulatory compliance, particularly under U.S. Environmental Protection Agency (EPA) and Leadership in Energy and Environmental Design (LEED) standards. Applications span construction, automotive, solar power, and electronics, requiring coatings that resist abrasion, ultraviolet (UV) exposure, and fogging. Advancements in nanotechnology and low-VOC (Volatile Organic Compounds) formulations are reshaping product development. Consumer demand for energy-efficient, eco-friendly, and customizable coatings continues to shape innovation, driven by smart infrastructure trends and evolving sustainability mandates nationwide.

Resin Insights

The polyurethane segment led the market and accounted for the largest revenue share of 46.8% in 2024. Owing to their superior abrasion resistance, elasticity, and high-gloss finish. These characteristics make them highly preferred in architectural and automotive mirror applications, especially where durability and visual clarity are crucial. U.S. demand is also driven by increased adoption in commercial interiors, elevator panels, and transportation mirrors. Furthermore, their compatibility with ultraviolet (UV)-resistant and anti-fog formulations makes them ideal for high-traffic and weather-exposed installations, aligning with domestic building codes and consumer quality expectations.

The epoxy segment accounted for the revenue share of 21.9% in 2024. This growth is driven by strong chemical resistance, adhesion properties, and affordability. These resins are favored for industrial and bathroom mirrors where humidity and chemical exposure are common. With increasing emphasis on low-VOC (Volatile Organic Compounds) and environmentally conscious solutions, epoxy coatings are gaining traction in decorative applications. Their adaptability across residential, healthcare, and manufacturing facilities aligns well with U.S. sustainability goals and the shift toward longer-lasting, cost-effective mirror solutions in both public and private infrastructure projects.

End Use Insights

The architectural segment dominated the market with a revenue share of 59.4% in 2024. This leadership is primarily driven by a construction surge in residential and commercial buildings. Emphasis on daylighting, spatial design, and energy efficiency has increased the use of coated mirrors in elevators, bathrooms, and open-plan layouts. Innovations in ultraviolet (UV)-resistant, anti-fog, and scratch-resistant coating meet the requirements of modern interiors and public infrastructure. In addition, U.S. adoption is fueled by green building standards and a strong remodeling trend in older urban areas focused on aesthetics and sustainable material use.

Mirror coatings are expanding in U.S. electric and autonomous vehicles, supporting visibility and sensor function while meeting aesthetic expectations. Demand is also rising in aviation and public transit. In solar energy, coated mirrors enhance reflectivity in Concentrated Solar Power (CSP) systems and are increasingly used in solar farms across the Southwest. Sustainability goals under federal programs, like the Inflation Reduction Act, and the growing adoption of renewable infrastructure, drive demand. High-performance coatings are critical for efficient energy use, safety, and compliance with evolving U.S. transportation and energy policies.

Application Insights

The water-based coatings segment led the market and accounted for the largest revenue share of 40.9% in 2024. This dominance is attributed to stringent regulations by the U.S. Environmental Protection Agency (EPA) limiting Volatile Organic Compound (VOC) emissions. These coatings emit fewer VOCs than solvent-based alternatives, supporting green building certifications such as LEED (Leadership in Energy and Environmental Design). Technological advances have significantly improved their durability, adhesion, and reflectivity, making them suitable for both commercial and residential applications. This aligns with U.S. sustainability goals and increasing demand for eco-friendly construction and remodeling materials in urban development.

The solvent-based coatings segment accounted for the second-largest revenue share of 39.1% in 2024. Solvent-based coatings maintained a strong 39.1% share in 2024 across the U.S., particularly in high-performance environments like transportation and industrial applications, due to superior weather resistance and durability. However, growing environmental restrictions are gradually shifting attention toward nanotechnology-based coatings. These advanced formulations offer premium features such as self-cleaning, ultraviolet (UV) protection, anti-fog, and anti-scratch properties. Adoption is rising in solar mirrors, smart buildings, and electric vehicles. The U.S. market benefits from innovation-driven demand, especially in sectors that prioritize performance, longevity, and cutting-edge aesthetics in mirrors.

Key U.S. Mirror Coating Company Insights

Some key players operating in the market include Edmund Optics Inc., SHERWIN-WILLIAMS, Diamon-Fusion International, Inc., Abrisa Technologies, and AccuCoat Inc.

-

Edmund Optics Inc. is a U.S.-based company headquartered in Barrington, New Jersey, specializing in the design and manufacture of precision optical components, assemblies, and imaging systems. Serving markets such as life sciences, industrial inspection, semiconductor, and defense, the company plays a pivotal role in supplying coated optical mirrors and lenses. With manufacturing facilities in the United States, Germany, Singapore, and China, Edmund Optics maintains a U.S. footprint and emphasizes innovation, optical performance, and advanced coating technologies across its product lines.

-

Diamon-Fusion International, Inc. is a California-based surface coating technology known for its proprietary chemical vapor deposition (CVD) process. The company specializes in hydrophobic and protective coatings for glass, mirrors, and other silica-based surfaces. DFI’s flagship product, Diamon-Fusion®, enhances durability, scratch resistance, and water repellency in architectural and automotive mirrors. With presence in over 30 countries, DFI partners with glass manufacturers, fabricators, and OEMs worldwide. The company focuses on sustainability and performance in high-end, functional glass and mirror coatings.

Key U.S. Mirror Coatings Companies:

- Abrisa Technologies

- AccuCoat Inc.

- Diamon-Fusion International, Inc.

- Dynasil Corporation

- Edmund Optics Inc.

- Guardian Industries

- North America Coating Laboratories

- SHERWIN-WILLIAMS

Recent Development

-

In April 2024, Guardian Glass introduced Guardian CrystalClear, a reduced-iron glass with 67% improved color neutrality and 90% visible light transmission. Compatible with SunGuard low-emissivity coatings, it’s offered in various thicknesses and jumbo formats for high-clarity architectural use.

-

In March 2024, Guardian Glass partnered with the VELUX Group to co-develop tempered vacuum-insulated glass (VIG). The collaboration aims to integrate VIG into VELUX roof windows, enhancing energy efficiency and sustainability.

U.S. Mirror Coatings Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 163.48 million

Revenue forecast in 2033

USD 240.73 million

Growth rate

CAGR of 5.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Resin, application, end use, region

Key companies profiled

Abrisa Technologies; AccuCoat Inc.; Diamon-Fusion International, Inc.; Dynasil Corporation; Edmund Optics Inc.; Guardian Industries; North America Coating Laboratories; SHERWIN-WILLIAMS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mirror Coatings Market Report Segmentation

This report forecasts volume & revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. mirror coatings market report based on resin, application, and end use:

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Polyurethane

-

Epoxy

-

Acrylic

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Water-based coatings

-

Solvent-based coatings

-

Nanotechnology-based coatings

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Architectural

-

Automotive & Transportation

-

Decorative

-

Solar power

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. mirror coatings market size was estimated at USD 157.03 million in 2024 and is expected to reach USD 163.48 million in 2025.

b. The U.S. mirror coatings market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2033 to reach USD 240.73 million in 2033.

b. Polyurethane resins led the U.S. mirror coatings market with a 46.8% share in 2024, driven by their durability, flexibility, and glossy finish. Widely used in architectural and automotive mirrors, they’re favored for high-traffic, weather-exposed areas. Their UV and anti-fog compatibility supports growing demand in commercial interiors and transportation, aligning with U.S. safety and performance standards.

b. Some key players operating in the mirror coatings market include Abrisa Technologies, AccuCoat inc., Diamon-Fusion International, Inc., Dynasil Corporation, Edmund Optics Inc., Guardian Industries, North America Coating Laboratories, SHERWIN-WILLIAMS.

b. The U.S. mirror coatings market is driven by smart infrastructure, luxury construction, EV growth, and CSP solar demand. Advanced coatings with UV, anti-fog, and scratch resistance support sustainable, high-performance applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.