- Home

- »

- Medical Devices

- »

-

U.S. Neuroscience Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Neuroscience Market Size, Share & Trends Report]()

U.S. Neuroscience Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Instruments, Consumables), By Technology (Brain Imaging, Neuro-Microscopy), By End-user (Hospitals, Diagnostic Laboratories), and Segment Forecasts

- Report ID: GVR-4-68040-283-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Neuroscience Market Size & Trends

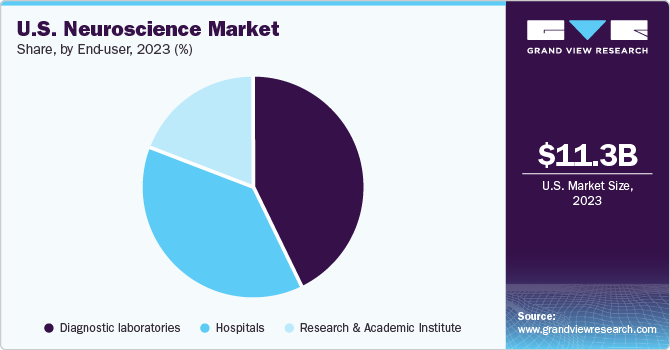

The U.S. neuroscience market was valued at USD 11.31 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. Factors including the surge in the prevalence of neurological health conditions, including Alzheimer's, epilepsy, traumatic brain injuries, brain cancer, and others, are driving the growth of the market. As per the Alzheimer's Association, over 6 million Americans live with Alzheimer's disease. This number is expected to increase to 13.0 million by 2050.

In 2023, the U.S. accounted for a market share of over 27.0% in the global neuroscience market. An increasing number of initiatives undertaken by various organizations is expected to fuel the market growth in the country. For instance, the Bee Foundation (TBF) is a nonprofit organization that emphasizes creating awareness and limiting the number of cerebral aneurysm deaths with the help of advanced research practices. The TBF invites research proposals for brain aneurysms, which is expected to support the organization in attaining its aim of reducing deaths due to brain aneurysms. These factors are expected to boost the market during the forecast period.

Furthermore, according to the Brain Aneurysm Foundation, more than 6.5 million people in the U.S. have an unruptured brain aneurysm. In addition, approximately 30,000 people suffer an intracranial aneurysm rupture annually. As per the National Institute of Health, U.S., every year, around 795,000 people in the country suffer a stroke, causing 137,000 deaths. Thus, increasing cases of neurological disorders are likely to drive the market in the country. Moreover, supporting reimbursement policies and increasing healthcare expenditure contribute to market growth.

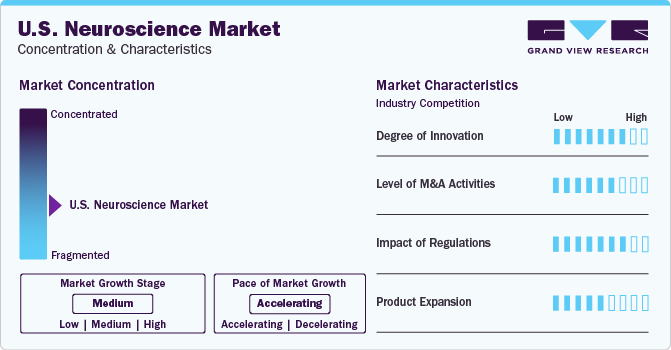

Market Concentration & Characteristics

The industry growth stage is medium (CAGR 5-10%), and the pace of the growth depicts an accelerating trend. The U.S. neuroscience industry is fragmented, marked by many companies competing for market share. The industry is in the moderate growth stage and will continue its trajectory in the coming 5 to 6 years.

The increasing incidence of brain aneurysms and stroke is boosting the launch of technologically advanced products. Endovascular coiling, surgical clipping, and flow diverters are notable treatment modalities for treating an intracranial aneurysm. Some key players operating in this segment are Johnson & Johnson, MicroPort Scientific Corporation, Medtronic, Integra LifeSciences, Terumo Corporation, and Penumbra, Inc. Industry players are constantly trying to introduce technologically advanced products. Many companies invest heavily in research and development to create new and improved minimally invasive surgical tools. Endovascular coiling is a minimally invasive procedure doctors often recommend for treating intracranial aneurysms. Numerous players are also making significant investments in R&D initiatives for introducing advanced minimally invasive surgical instruments. The endovascular coiling used to treat intracranial aneurysms is one of the minimally invasive procedures physicians widely recommend.

The U.S. neuroscience industry is characterized by substantial M&A and collaboration activities undertaken by key manufacturers. Numerous players in the country are collaborating with other relevant companies to strengthen their portfolios and expand their reach. For instance, in December 2023, AbbVie, Inc. announced plans to acquire Cerevel Therapeutics’ neuroscience pipeline of numerous preclinical and clinical-stage candidates with potential for diseases including Parkinson’s, schizophrenia, and mood disorders.

The approval process for neurological products is lengthy and time-consuming. For instance, distributing a new medical device or technology requires approval from the FDA and the Center for Devices and Radiological Health (CDRH), which can be received in two ways- premarket notification process and premarket approval. However, favorable initiatives undertaken by private and public organizations are likely to boost the demand. Favorable reimbursement policies by the Centers for Medicare and Medicaid Services (CMS) and Musculoskeletal Clinical Regulatory Advisors, LLC (MCRA) allow reimbursement of neurological devices when ordered by doctors or provided as part of a physician’s services.

Component Insights

Instrument segment dominated the market with a share of 65.1% in 2023. This dominance is attributable to introducing innovative diagnostic and treatment devices for neurological disorders. For instance, in May 2023, Koninklijke Philips N.V. unveiled the launch of Philips CT 3500, an AI-powered CT system. This system performs high-volume screening and routine radiology programs and can deliver high-quality images for precise diagnoses.

Moreover, the consumables segment is expected to witness significant growth during the forecast period. Consumables comprise patient monitors, ScalpFix clips, flat tabletops, cradle pads, injectors, head holder inserts, and others. Key market participants, including GE HealthCare and B. Braun SE, offer robust, easy-to-operate consumables for neurological instruments.

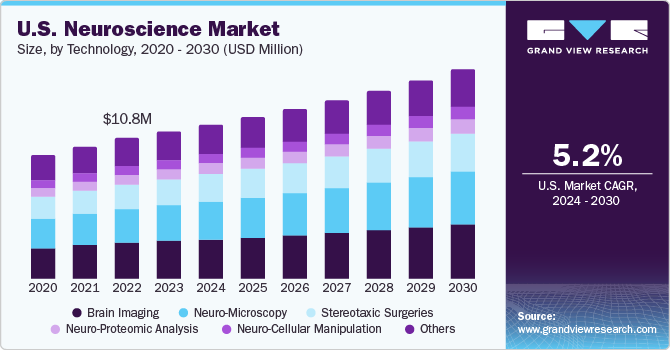

Technology Insights

The brain imaging segment accounted for the largest market share of 25.5% in 2023. This is attributable to using brain imaging devices, including CT scans, MRI, and EEG in hospitals, ambulatory surgical centers, and diagnostic centers to assess neurological conditions. MRI is being widely adopted for scanning and analyzing the brain & neurological conditions, including brain tumors.

The neuro-microscopy segment is expected to witness the fastest CAGR during the forecast period owing to technological innovations in neuro-microscopy. For instance, in May 2023, an MIT professor announced the creation of ultra-tiny, microscopic electronic machines that can penetrate the brain and determine & reverse neurological disorders. The presence of key market players, including Danaher Corporation and Carl Zeiss AG, is projected to fuel segment growth in the upcoming years.

End-user Insights

The diagnostic laboratories segment accounted for the largest revenue share of 42.7% in 2023. The increasing application areas of neurological devices in diagnostic laboratories, paired with the growing awareness about early diagnosis of diseases, is significantly driving segment growth. Some widely adopted neurological devices in diagnostic centers include MRIs, CT scans, electromyograms (EMG), electroencephalograms (EEG), and others.

The hospitals segment is expected to garner the fastest growth during the forecast period. This is attributable to the increasing patient pool suffering from neurological disorders, such as ischemic & hemorrhagic stroke, brain aneurysm, TBI, and AVM. Furthermore, the availability of technologically advanced neurological devices, coupled with favorable reimbursement policies is opportunistic for the segment growth. For instance, Medtronic offers all-inclusive services to deliver and maintain coverage & payment options for different neurological devices.

Key U.S. Neuroscience Company Insights

Key U.S. neuroscience companies include GE Healthcare, Danaher Corporation, and Carl Zeiss AG, among others. Major investments in R&D, strategic partnerships, and new product development are some of the key strategies adopted by market participants to gain a competitive edge in the market.

Key U.S. Neuroscience Companies:

- Carl Zeiss AG

- Danaher Corporation

- GE Healthcare

- Siemens Healthcare Private Limited

- Koninklijke Philips N.V.

- Canon Inc.

- B. Braun SE

- Medtronic

- Stryker

- Boston Scientific Corporation

- ABBOTT

- Terumo Corporation

Recent Developments

-

In March 2024, ProMIS Neurosciences, Inc. announced that the United States Patent and Trademark Office granted US Patent 11,905,317 to PMN310 for immunogenic compositions of matter under development for the treatment of Alzheimer’s disease. PMN310 is ProMIS’s innovative monoclonal antibody purposed to differentiate toxic oligomers of amyloid-beta (Aβ), which are a leading cause of Alzheimer’s disease.

-

In May 2023, Neurophet announced receiving the FDA approval for its AI software Neurophet AQUA. The software helps in enhancing the assessment of brain atrophy on MRI, thereby improving brain monitoring result outcomes.

U.S. Neuroscience Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.31 billion

Revenue forecast in 2030

USD 16.07 billion

Growth Rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end-user

Country scope

U.S.

Key companies profiled

Carl Zeiss AG; Danaher Corporation; GE Healthcare; Siemens Healthcare Private Limited; Koninklijke Philips N.V.; Canon Inc.; B. Braun SE; Medtronic; Stryker; Boston Scientific Corporation; ABBOTT; Terumo Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Neuroscience Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. neuroscience market report based on component, technology, and end-user:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables

-

Software & Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Brain Imaging

-

Neuro-Microscopy

-

Stereotaxic surgeries

-

Neuro-Proteomic Analysis

-

Neuro-Cellular Manipulation

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic laboratories

-

Research and Academic Institute

-

Frequently Asked Questions About This Report

b. The U.S. neuroscience market size was estimated at USD 11.31 billion in 2023 and is expected to reach USD 11.8 billion in 2024.

b. The U.S. neuroscience market is expected to grow at a compound annual growth rate of 5.15% from 2024 to 2030 to reach USD 16.07 billion by 2030.

b. The diagnostic laboratories segment accounted for the largest revenue share of 42.72% in 2023. This can be attributed to the wide application scope of neurological devices in diagnostic laboratories and increased awareness among the population about early disease diagnosis benefits.

b. Some key players operating in the U.S. neuroscience market Carl Zeiss AG; Danaher Corp.; GE Healthcare; Siemens Healthcare Private Limited; Koninklijke Philips N.V.; Canon Inc.; B. Braun SE; Medtronic; Stryker; Boston Scientific Corp.; ABBOTT; Terumo Corp.

b. The rising awareness among the global population about neurological disease diagnosis and their treatment options is expected to positively contribute to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.